Summary:

- Amazon reported decent earnings results for Q1 last month.

- While the company’s guidance has been negatively affected by the turbulent macroeconomic environment, Amazon nevertheless has all the chances to continue to create additional shareholder value in the foreseeable future.

- At the same time, several growth catalysts could undermine the bearish arguments and help Amazon’s shares to appreciate further.

HJBC

Last month, Amazon (NASDAQ:AMZN) reported decent earnings results for Q1. Even though its guidance has been negatively affected by issues that are outside of its control, there are nevertheless reasons to be optimistic about Amazon’s potential to continue to create additional shareholder value over the following years.

Despite all the macroeconomic challenges, Amazon continues to hold a dominant position in the eCommerce market while its cloud, advertising, and other businesses expand and establish greater presence in their respective industries even in the current uncertain environment. Therefore, I still think that Amazon’s stock is a solid investment as the company’s growth story is far from over.

Amazon’s Growth Story Is Far From Over

In February, I wrote a bullish article on Amazon in which I argued that its stock is becoming a bear trap due to the fact that the upcoming improvement of the overall macroeconomic environment could improve the business’s overall performance and lift its shares higher. That’s exactly what has happened as Amazon’s shares have appreciated by over 20% since that time while the growth of the S&P 500 index was minimal. On top of that, there are now reasons to believe that the company’s growth story is far from over and the latest rally might not be over yet.

This is mostly because the announcement of earnings results for Q1 along with the reveal of an updated guidance for Q2 and beyond indicate that Amazon’s business is likely to continue to remain resilient in the current turbulent macroeconomic environment. Despite all the worries, Amazon managed to increase its revenues in Q1 by 9.5% Y/Y to $127.4 billion, above the expectations by nearly $3 billion, while its GAAP EPS during the period was $0.31, also above the forecasts by $0.11. In addition to that, Amazon also expects to generate sales in the range of $127 billion to $133 billion in Q2, up 5% to 10% Y/Y.

While such targets might look too ambitious at first, there are nevertheless several growth catalysts that should help Amazon achieve them. First of all, the beginning of the disinflationary process that started earlier this year along with better-than-expected growth of the American economy are likely to act as tailwinds in Amazon’s quest to achieve its quarterly targets. In addition, consumer confidence in the United States has been steadily improving in recent months which could indicate that the macroeconomic risks are about to subside in the following quarters. Amazon’s own North American sales increased by 11% Y/Y to $76.9 billion in Q1, which is a sign that things are improving back at home.

On top of all of that, the eCommerce market continues to grow at an aggressive rate in the current environment and is likely to increase in size even more in the following years, which would give Amazon even more opportunities to expand its business. The latest data shows that the eCommerce market in the United States alone is about to generate over $1.5 trillion in annual revenues in 2027, significantly above the annual revenue of over $850 billion that it achieved in 2022. Considering that Amazon is one of the biggest eCommerce companies in the world, it’s likely that it would become one of the biggest beneficiaries of such growth in the next half a decade.

In addition to Amazon’s core commerce business, there are also reasons to be optimistic about the company’s cloud business, which is also forecasted to increase in size in the foreseeable future. Despite the macroeconomic turbulence, the cloud market has now become a $237 billion opportunity thanks to the significant increase in cloud infrastructure spending in Q1, which increased by over $10 billion to $63.7 billion for the first three months of 2023. Thanks to this increase in spending, the sales of Amazon’s AWS segment increased in Q1 by 16% Y/Y to $21.4 billion as the company accounted for a 32% market share of the global cloud market at the end of March.

On top of that, the ongoing AI frenzy makes it possible for Amazon to capitalize on the growth of generative AI applications, which could drive a massive shift to the cloud and pave the path to $2.5 trillion worth of untapped opportunities for the company.

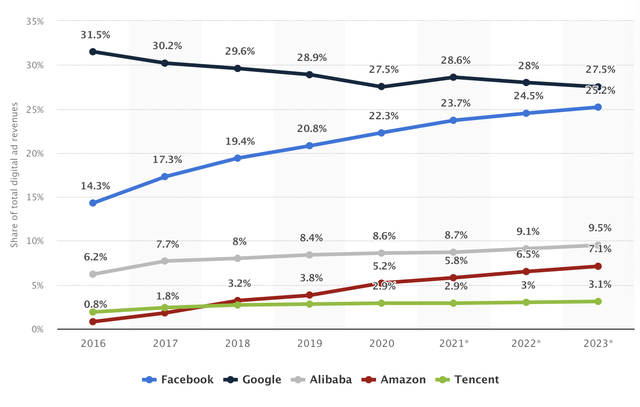

Add to this the fact that Amazon has also been actively increasing its market share in the digital advertising market and disrupting the Google-Meta (GOOG)(GOOGL)(META) duopoly, and it becomes obvious that the company has more than enough opportunities in various segments to scale its business. In Q1, Amazon’s advertising revenues already accounted for almost half of AWS sales and they’re likely to continue to increase in the following years as the company is forecasted to improve its share in the digital advertising market to 7.1% in 2023, up from 5.8% and 6.5% in 2021 and 2022, respectively.

Net digital advertising revenue share of major ad-selling online companies worldwide from 2016 to 2023 (Statista)

What’s Amazon’s Real Worth In The Current Environment?

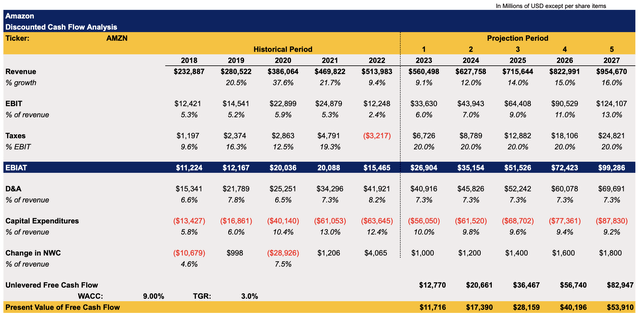

Considering all of those growth opportunities mentioned above, the main question now is whether it’s still safe to purchase Amazon’s stock after the latest rally. My previous DCF model that was published in February was showing that the company’s fair value is $96.64 per share, which is already below the current market price. However, I’ve recently updated the model due to the addition of Q1 numbers and the new assumptions could be seen in the table below.

The assumptions for top-line growth and earnings in the updated model are mostly in-line with the street expectations for the next couple of years after which the growth accelerates closer to the terminal year thanks to the potential greater monetization of opportunities that were mentioned earlier in this article. The model also includes a slow decrease of CapEx in relation to Amazon’s revenues in the next few years, while all the other assumptions in the model are mostly the same as before.

Amazon’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author )

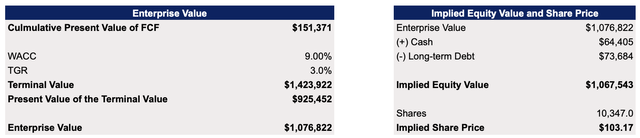

The updated model shows that Amazon’s fair value is $103.17 per share, above the previous estimates but also below the current market price after the recent rally.

Amazon’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author )

Despite this, there are nevertheless reasons to be bullish about Amazon even at the current market price of ~$120 per share. As a growth company, Amazon never truly traded close to its fair value during good times when the overall market was growing. If the macro environment continues to improve, then there’s a case to be made that Amazon’s stock would continue to appreciate and the rally won’t end anytime soon. At the same time, it’s also possible that once Amazon begins to capitalize on the untapped opportunities in AI, then its overall growth rate would be greater than it’s currently assumed. At the same time, there’s also a possibility that the Federal Reserve would begin to cut rates, which would lead to a decrease in WACC in the model as the capital would become cheaper to obtain. In all of those scenarios, the overall assumptions in the model would need to be revised, which would result in a greater fair value and a better upside.

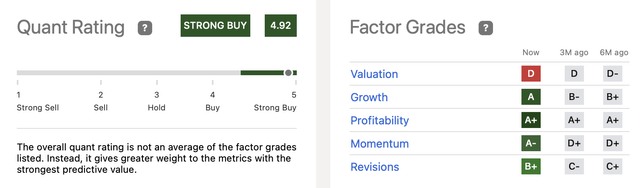

Considering that Seeking Alpha’s quant system recommends Amazon as a ‘Strong Buy’ despite giving it the rating of ‘D’ for valuation, it makes sense to believe that the valuation argument is not the most important when considering whether to buy the company’s stock in the current environment. This is because the upside could be greater than the numbers currently reveal.

Amazon’s Quant Rating (Seeking Alpha)

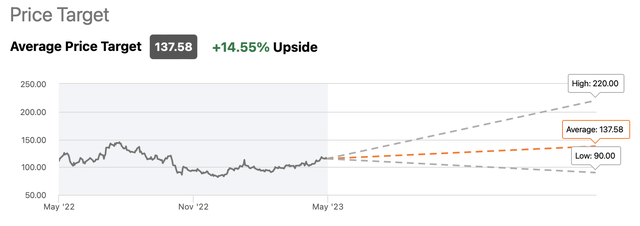

Add to this the fact that the consensus on the street is that Amazon’s stock represents an upside of nearly 15% from the current levels and it becomes obvious that the current rally in its stock might be far from over.

Amazon’s Consensus Price Target (Seeking Alpha)

Several Risks To Consider

While Amazon has numerous growth opportunities that could help it to continue to improve its overall performance and create additional shareholder value along the way, there are nevertheless several risks that investors need to consider. First of all, even though the annual inflation is cooling off, it’s still far away from the Federal Reserve target. As such, the Federal Reserve might continue to increase rates, which could result in a hard landing for the economy and a slower growth rate for most of Amazon’s businesses. In such a scenario, the company’s stock would likely lose its momentum as fundamentals would start to outweigh growth opportunities.

At the same time, there’s a possibility that Amazon’s international business would continue to lag behind even if things will be better back at home. In Q1, Amazon has already been negatively affected by foreign exchange rates which resulted only in a 1% Y/Y growth of revenues for its international segment. In constant currency, the international segment would’ve grown by 9% Y/Y. Since the management expects an unfavorable impact on sales in Q2 of around 30 basis points, it would be safe to assume that the global macroeconomic uncertainty would continue to haunt Amazon’s business in the following months.

On top of all of this, there’s also a risk that the competition in the cloud business would intensify and hurt Amazon’s leadership position there. The company is already feeling pressure there as its global market share decreased from 34% in Q3’22 to 32% in Q1’23. Add to this the fact that the management expects its customers to further optimize their cloud spending in Q2 and it becomes obvious that even though the company’s growth story is far from over, there are still reasons to be cautious when deciding whether to buy Amazon’s shares at the current levels.

The Bottom Line

While there are macro risks that are associated with Amazon, there are nevertheless reasons to be optimistic about the company’s performance in the foreseeable future. Even in the current environment, Amazon is able to grow at a decent rate and it’s unlikely that it’ll lose significant competitive advantages in the eCommerce or cloud businesses anytime soon. At the same time, the growth of the advertising business along with the potential improvement of the economy in the future could give an even greater boost to Amazon’s share price and create additional shareholder value along the way. Therefore, it’s safe to assume that Amazon’s stock remains a solid investment as the company’s growth story is far from over.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!