Summary:

- Amazon’s revenue streams have diversified beyond traditional retail, with advertising, third-party seller services, and AWS driving future growth.

- The company has shown resilience in challenging economic conditions, with North American sales growing by double digits.

- While facing competition from emerging e-commerce platforms, Amazon’s understanding of consumer preferences and track record of innovation position it well for sustained growth.

400tmax

Amazon (NASDAQ:AMZN) is known as one of the largest retailers in the world. However, in recent years, the company has diversified its revenue streams far beyond traditional retail, with segments like advertising, third-party seller services, and Amazon Web Services poised to be strong drivers of future revenue growth. Additionally, Amazon’s ability to adapt to economic challenges and its initiatives to attract and retain customers indicate resilience and potential for further expansion.

The continued improvement in operating margins, particularly in key segments like North American retail and AWS, signal increasing efficiency and profitability. Despite emerging competition from newer e-commerce platforms, Amazon’s deep understanding of consumer preferences and its track record of innovation position it well for sustained growth in the future. These factors combined make Amazon an attractive company for growth oriented investors to consider.

The sales and revenue picture

Retail sales growth in North America proved to be lackluster throughout large parts of 2023. Yet, Amazon continued to perform well even in this challenging environment with its North American sales growing by 11.5% quarter-over-quarter (QoQ) in the third-quarter of 2023. This led Global Data to observe that Amazon’s resilience in the face of more challenging economic conditions can be attributed to its role as a dependable and significant collaborator for numerous entities in the consumer sector. Global Data notes that with reaching customers becoming harder and consumer spending being cautious, companies turn to Amazon for help. Amazon offers these small businesses various solutions like advertising and seller services, which help businesses improve their performance even when times are more challenging. Amazon has achieved this important role thanks to its large audience and its knack for connecting other companies with their target customers in innovative and valuable ways.

This has allowed Amazon to perform well even at times when the retail sector as a whole is experiencing a bit of a drawback. In my view, these changes to Amazon’s business model in recent years has made it a good stock to hold even during cyclical downturns in the broader retail sector. Furthermore, broader US retail sales have shown positive signs of improvement in recent months as retail sales rose unexpectedly in November and by more than expected in December. This broader recovery in US retail sales should benefit Amazon’s North American sales outlook as well, which is a particularly important market for Amazon. Its fourth quarter earnings already showcased a 13% increase in sales for its North American business. Sales on a company-wide basis increased by 14% QoQ.

The company also continued to see particularly strong growth in other business units such as its third-party selling services where revenue grew by 19.9% and advertising where revenue grew by 26.8%. These businesses are likely to be strong revenue growth drivers for Amazon in the near future. Amazon Web Services [AWS] has also continued to witness strong growth and is expected to see significant growth in its generative AI business in the coming years. Management has noted that –

And then on the Gen AI side, it’s — if you look at the Gen AI revenue we have, in absolute numbers, it’s a pretty big number, but in the scheme of a $100 billion annual revenue run rate business, it’s still relatively small, much smaller than what it will be in the future, where we really believe we’re going to drive tens of billions of dollars of revenue over the next several years. But it’s encouraging how fast it’s growing and our offering is really resonating with customers.”

Despite these positive growth channels, there has been growing concern among some market participants that newer e-commerce platforms such as Shein and Temu could pose a competitive threat to Amazon’s traditional retail segment and its third-party sales. According to CE Insights, there is a growing interest among Amazon shoppers in the platforms Temu and Shein, highlighting a potential competitive challenge. The data indicates an increasing overlap of customers between Amazon and these emerging players, particularly among loyal Amazon shoppers who are more inclined to explore these new sites.

CE Insights highlights a rising interest among Amazon shoppers in Temu and Shein, suggesting potential competition. Their data shows more customers are overlapping between Amazon and these new platforms, especially loyal Amazon shoppers who are keen to explore them. CE data reveals a steady increase in cross-shopping at Temu among both Amazon.com and Amazon Marketplace customers over the year, matching Temu’s growing presence in the U.S. since its launch in September 2022. In August 2023, nearly 3% of Amazon shoppers also shopped at Temu, a notable jump from about 1% in March. Furthermore, in the past three months, approximately 5% of Amazon shoppers purchased from Temu, while 4% bought from Shein. Customers who shop frequently on Amazon are more likely to explore these new platforms, indicating a general openness to emerging sites among online shoppers.

In my view, these emerging players are likely to increasingly compete with Amazon but do not pose an existential threat to it. It was recently reported that while Shein and Temu attracted a large number of “window-shoppers” in the US during the crucial holiday sales period, these platforms were far less effective at turning those views into actual sales. I believe this lower conversion ratio likely arises from a lack of consumer confidence in the quality of the products from these players as well as a lack of consumer confidence in returns policies with these online retailers.

Amazon has also proven to be an industry leader in understanding what its consumers actually want. This is clearly demonstrated by the strong early holiday shopping events announced by the company and which ultimately boosted its sales substantially. Management noted in this respect that –

We kicked off the holiday season with Prime Big Deal Days, an exclusive event for Prime members to provide an early start on holiday shopping. This was followed by our extended Black Friday and Cyber Monday holiday shopping event, which was open to all customers and ended up being our largest event ever. These events also helped attract new customers and Prime members.”

Importantly, these events were not only popular among existing customers but contributed to expanding Prime members and building greater customer loyalty among a larger audience.

Improving margins

The other key-driver of shareholder value in Amazon is the strong improvement in operating margins. In the fourth quarter the operating margin of its North American retail business reached 6.1% representing a 120-basis point increase QoQ. This was also the company’s seventh consecutive quarter of growth in the operating margin of its North American retail business. This growth in the operating margins has been driven to a large extent by the success Amazon has realized in regionalizing its fulfilment centers.

Its international business has still seen operating losses albeit that these operating losses have declined substantially in recent quarters. Here the improvements were again driven by more effective cost management from Amazon with the cost to serve being on a continued downwards trajectory. The international segment could offer further opportunities for improvement in the overall operating margin of Amazon’s retail business in the years ahead. Investors should closely monitor developments within this segment.

While Amazon Web Services [AWS] operating margin has effectively remained flat on a QoQ basis, it too has expanded substantially in the past year. AWS now has an operating margin of almost 30% which represents a 5% increase from its operating margin a year ago. In my view, this segment likely has less room for further improvement in its already high operating margin. To be clear, the segment still seems to have quite a bit of room for further revenue growth and an increase in operating profit, just not much growth in the segments operating margin. This is because the growth in AWS’s operating margin was driven primarily by cost reductions and the scope for further cost reductions is just not there to the same degree. Something which management also pointed out in the earnings call by saying that –

I think that the lion’s share of cost optimization [at AWS] has happened. It’s not that there won’t be any more or that we don’t see anymore, but it’s just attenuated very significantly.”

Valuation

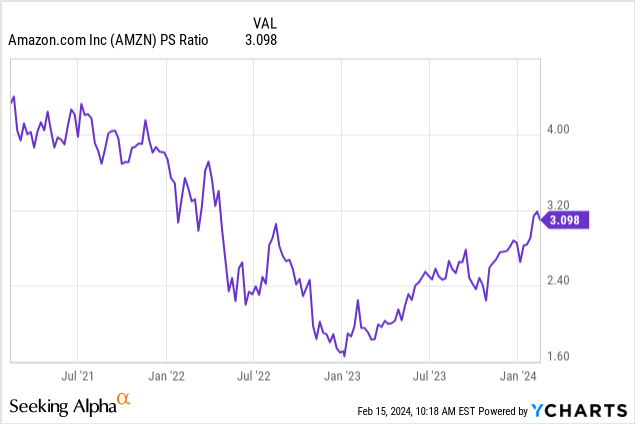

Amazon is currently trading at a price-to-sales ratio of around 3.121 and while the PS ratio has been on a steady upward trend since 2023, it remains below Amazon’s 5-year average PS ratio of around 3.4. This discounted PS ratio is particularly significant when taking into account the strong sales growth in recent quarters as well as the continued improvement in operating margins. These improvements together with the discounted price to sales ratio makes Amazon appear relatively attractive from a valuation perspective.

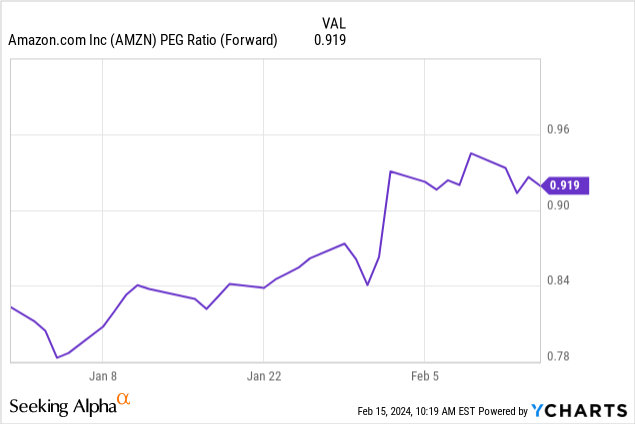

Amazon is currently trading at a forward price-to-earnings growth ratio of 0.922 as depicted in the chart below. This forward PEG ratio suggests that even with strong earnings growth, the stock is trading near fair value. This then leads me to conclude that Amazon can still be a buy from a valuation perspective albeit that the stock is not trading at a substantial discount.

Conclusion

Amazon demonstrates substantial growth prospects as it continues to evolve beyond traditional retail and expands its revenue streams into segments such as advertising, third-party seller services, and Amazon Web Services. While it remains one of the largest retailers globally, recent years have seen Amazon undergo significant transformation, with these new revenue sources emerging as key drivers of its future growth.

Despite facing a challenging retail sales environment, particularly during the first part of the second half of 2023, Amazon has continued to see double digit sales growth. This resilience can be attributed to Amazon’s role as a dependable collaborator for numerous entities in the consumer sector. Furthermore, Amazon’s sales growth does not only rely on traditional retail channels. Revenue from other business units, such as third-party seller services and advertising, has shown particularly strong growth rates. These segments are expected to continue driving revenue growth for Amazon in the near future. Additionally, AWS, Amazon’s cloud computing division, has witnessed significant growth and is expected to see further expansion, particularly in its generative AI business.

From a financial standpoint, Amazon has shown consistent improvement in operating margins, particularly in its North American retail and AWS segments. The company’s ability to regionalize its fulfilment centres has contributed to these improvements. The International unit now offers great opportunities for further improvements in operating margins as costs in this division are also increasingly reduced. This poses a significant opportunity for unlocking further shareholder value in Amazon in the quarters ahead.

Lastly, while Amazon faces growing competition from emerging e-commerce platforms like Shein and Temu, these players are unlikely to represent a substantial threat to Amazon. Reports indicate that although Shein and Temu attracted significant interest from “window-shoppers” during the holiday sales period, their conversion rates into actual sales were comparatively lower. This suggests that Amazon’s established reputation for quality and customer service provides it with a competitive advantage.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.