Summary:

- It may be surprising, but Amazon now trades at some discount to mega-cap tech peers.

- Once a tech darling, Amazon now trades at around half the market value of Microsoft.

- Investors seem to be only ascribing value to AWS due to the low profitability of the e-commerce operations.

- But one mustn’t underestimate the long-term margin expansion potential of the e-commerce operations, as Amazon has earned valuable competitive advantages.

- I outline the path for 50% or more potential upside.

FinkAvenue

My top picks this year have been in the tech sector, with a strong focus on profitable growth. Thus, it may be surprising to note that Amazon (NASDAQ:AMZN) has suddenly become my top overall pick and the largest holding in my portfolio. AMZN has seen its stock struggle relative to some mega-cap tech peers as investors were disappointed in the decelerating growth rates of AWS. Investors are not appreciating the monopolistic position of the company’s online e-commerce platform, which is arguably worth the current market cap by itself. AMZN might not look as profitable as mega-cap tech peers and the stock is being punished for it, but this is a company that has invested most aggressively into long-term investments. This is a case of a company choosing to keep margins down through aggressive investment, creating an attractive investment opportunity for investors willing to forego current earnings in favor of greater long-term rewards. I reiterate my strong buy rating for the stock.

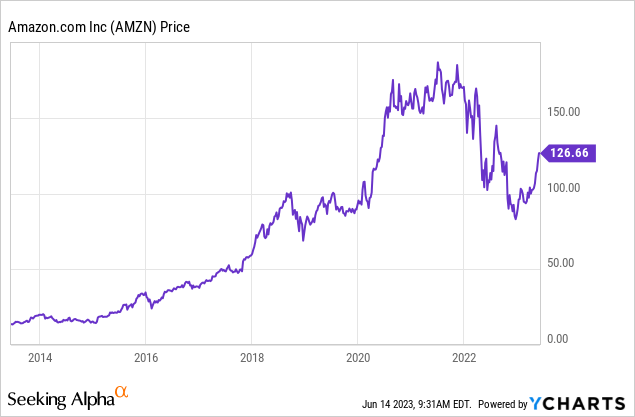

AMZN Stock Price

The tech crash has affected almost all tech companies, profitable or unprofitable, and AMZN was not excluded. As of recent trading, the stock price was barely higher than five years ago.

I last covered AMZN in March, where I rated the stock a buy on account of projected margin expansion. While the company did end up delivering a strong profit number, I remain of the view that margin expansion has only just begun.

AMZN Stock Key Metrics

In the most recent quarter, revenue grew 9% to $127.4 billion, comfortably beating the higher end of the guidance range at $126 billion. That was an impressive result considering the tough macro environment.

The more impressive result was arguably that of operating income, which came in at $4.8 billion. Management had previously been guiding for operating income between $0 and $4 billion.

The strong results were driven in large part due to the e-commerce segments, with North America showing strong double-digit sales growth and a return to profitability and the international segment also showing solid sales growth with better-than-expected operating losses.

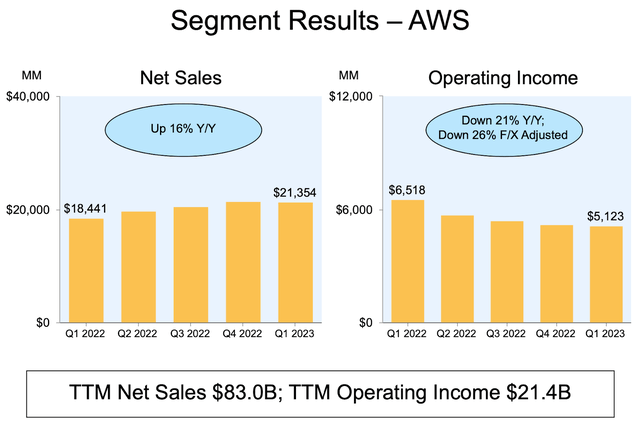

AWS delivered solid results as well, with revenue growing 16% YOY.

With profit margins beginning to stabilize, AMZN was able to improve upon its trailing twelve months free cash flow burn.

AMZN ended the quarter with $64 billion of cash versus $67.1 billion of debt, representing a strong balance sheet position. I note that the company did not repurchase any stock in the quarter.

Looking ahead, management guided for up to 10% sales growth to $133 billion in the next quarter, with operating income expected to remain robust at between $2 billion and $5.5 billion. These results – and guidance – appear very strong.

Why did the stock lag peers following the report? That has to do with comments that management made on the conference call with regard to AWS. Management noted that the cloud optimization headwinds have intensified, with revenue growth in April being “about 500 basis points lower” than this past quarter, implying an 11% growth rate in April. Investors may have been hoping for a quick end to these cloud optimization headwinds, and such a data point does not imply any such result. Management reminded investors that “90-plus percent of global IT spend is still on-premises.” The idea is that the long-term investment thesis remains intact, even if the tough macro puts a damper on growth rates in the near term. I expect many investors may be simply tolerating the loss-generating e-commerce business, with the impression that all of the stock value centers around AWS. With that kind of mindset, it makes sense why investors may have sold off the stock given the continued disappointing results at the segment.

Is AMZN Stock A Buy, Sell, or Hold?

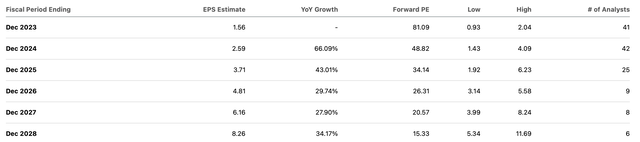

At recent prices, AMZN was trading at around 81x this year’s earnings estimates. While that looks expensive, it is important to note that earnings are expected to grow very rapidly in the coming years.

AMZN was recently trading at around a $1.3 trillion market cap. By comparison, Microsoft (MSFT) was trading hands at a $2.5 trillion market cap. The discrepancy looks misplaced.

Assuming that AWS can accelerate to just 15% growth, generate 40% net margins over the long term, and trades at a 1.5x price to earnings growth ratio (‘PEG ratio’), I can see AWS being valued at 9x sales or $800 billion in market value. I understand that many readers may have lost enthusiasm for the e-commerce segment on account of the elusive profits, but I wonder how many readers are frequent customers of the platform? It is important to not mistake lack of profits due to investments for a lack of profits due to bad business models. On that point, consider that AMZN’s ability to invest almost infinite amounts of capital at high ROI into its e-commerce operations is a clear positive, as most growth companies eventually come to a point in which they are unable to reinvest incrementally more capital and are instead forced to show growing profit margins. I acknowledge that this kind of perspective might not be so popular in an environment that is currently focused on near-term profits.

Let’s stop to think about what AMZN has accomplished in e-commerce. It has built out an unrivaled logistics network enabling it to deliver packages, sometimes with same-day delivery. It has earned a favorable reputation among consumers, in part due to the ease of return and the aforementioned speed of delivery. It offers an attractive marketplace for sellers due to the large number of consumers. This is a powerful network effect, in which it is not clear how a competitor can simultaneously compete on all 3 fronts. AMZN took many decades to build out these advantages, making it a very costly struggle for any potential competition. While Wall Street has seemingly given up on the long-term profitability of this segment, I remain optimistic given that the company continues to further its advantages here. AMZN was generating 4% to 6% margins in its North America segment pre-pandemic, far higher than the 1.2% margin posted this past quarter. Its international segment includes many countries still in the early stages of growth in which heavy investment is required to build out the infrastructure. Assuming just a 5% long-term net margin for e-commerce operations and a 20x earnings multiple, we can value the e-commerce segment at a $440 billion market value. Summing these two parts already yields a market value around the current stock price, in spite of the conservative assumptions. If we instead assume 18% growth and a 2.0x PEG ratio for AWS, and 7% long-term net margins and a 25x earnings multiple for e-commerce, then we instead arrive at $1.2 trillion in value for AWS and $770 billion in value for e-commerce for a total value of around $2 trillion. That latter estimate looks more reasonable, if not still conservative, given the company’s ability to drive margin expansion for as long as the eye can see. Somewhere in between these two estimates yields around 50% potential upside over the next 12 months.

What are the key risks? I believe my assumed PEG ratios are quite conservative, but there remains risk to the growth and margin assumptions. It is possible that AWS growth never returns to even the 15% estimate that I viewed to be conservative. It is possible that AMZN is unable to drive margin expansion in its e-commerce operations, perhaps due to inflation or delivery speed being an insignificant consumer desire. If AWS instead grows at just 10% with a 30% long-term net margin assumption, and the e-commerce operations have a 3% long-term net margin and trade at just 15x earnings, then the estimated value drops to $583 billion, implying considerable downside. That exercise makes something clear: AMZN is not “deep value,” not quite how Meta Platforms (META) were trading in late 2022. I am however of the view that the stock is too cheap relative to its high quality, as this is the kind of stock that can drive margin expansion long-term and deserving of premium valuations like typical consumer staple stocks (which, I should add, trade at PEG ratios in the 3x to 4x range). AMZN is now my largest position, and I reiterate my strong buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!