Summary:

- Record consumer spending during this shopping season will benefit Amazon more than other retailers.

- Amazon, in fact, is focused on creating value for its customers while finding ways to receive more value for itself from each customer.

- Amazon’s operational improvements and investments in infrastructure enhance efficiency and reduce costs, leading to increased profitability.

Daria Nipot

Introduction

Black Friday and Cyber Monday are over. Yet, shopping season is only half way through and many retailers are extending their deals throughout the season. In this article, I want to show why Amazon (NASDAQ:AMZN) leverages its dominance in e-commerce, making it the best pick I see to take durable advantage of strong consumer spending.

Thanksgiving Holiday Weekend

This year, there was particular interest in spending data during the holidays because many were waiting for a sign of exhaustion in the consumer. Well, bears have been silenced by early data already expecting Black Friday and Cyber Monday spending to hit new records.

Now, we have more available data, with the National Retail Federation (NRF) stating “a record 200.4 million consumers shopped over the five-day holiday weekend from Thanksgiving Day through Cyber Monday, surpassing last year’s record of 196.7 million.” Since initial expectations were of 182 million, the reported figures were beyond any forecast.

However, while volumes could still be expected to be rather high, there were fears of too much discounting to clear inventories. It seems now as if the level of discounting has not been that bad.

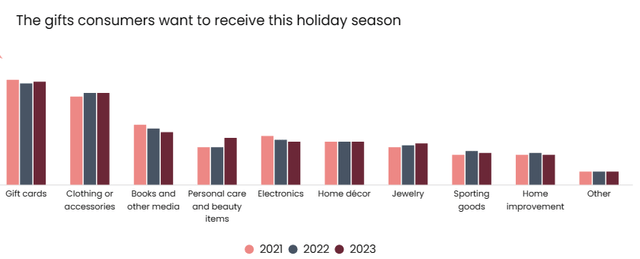

Thanks to the National Retail Federation, we also have a survey on this year’s most wanted gifts, where we find gift cards, clothing and accessories, and books ranking as the top three categories. These are products consumers are accustomed to buying on Amazon.

National Retail Federation – Holiday By The Numbers Slideshow

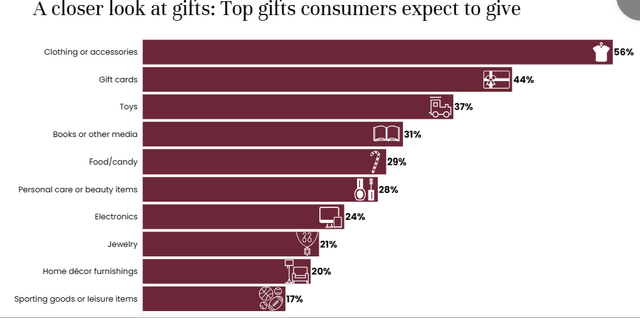

A closer look at gifts shows us also the top gifts consumers are expected to give. While most consumers would like to receive gift cards, when we look at it from the side of those who give, we find clothing or accessories being on top of gift cards, at 56%. In second place we have gift cards with a 44% preference and toys come up in third place, above books and other media. Once again, these choices are favorable for Amazon.

National Retail Federation – Holiday By The Numbers Slideshow

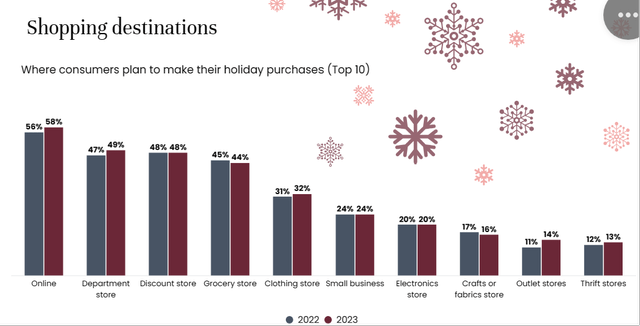

But what traces a true favorable trend for Amazon is this last piece of data. The NRF, in fact, shared its research on consumers’ favorite shopping destinations. As we can see, consumers have by now made it clear that online shopping is here to stay, taking market share from brick-and-mortar retailers.

National Retail Federation – Holiday By The Numbers Slideshow

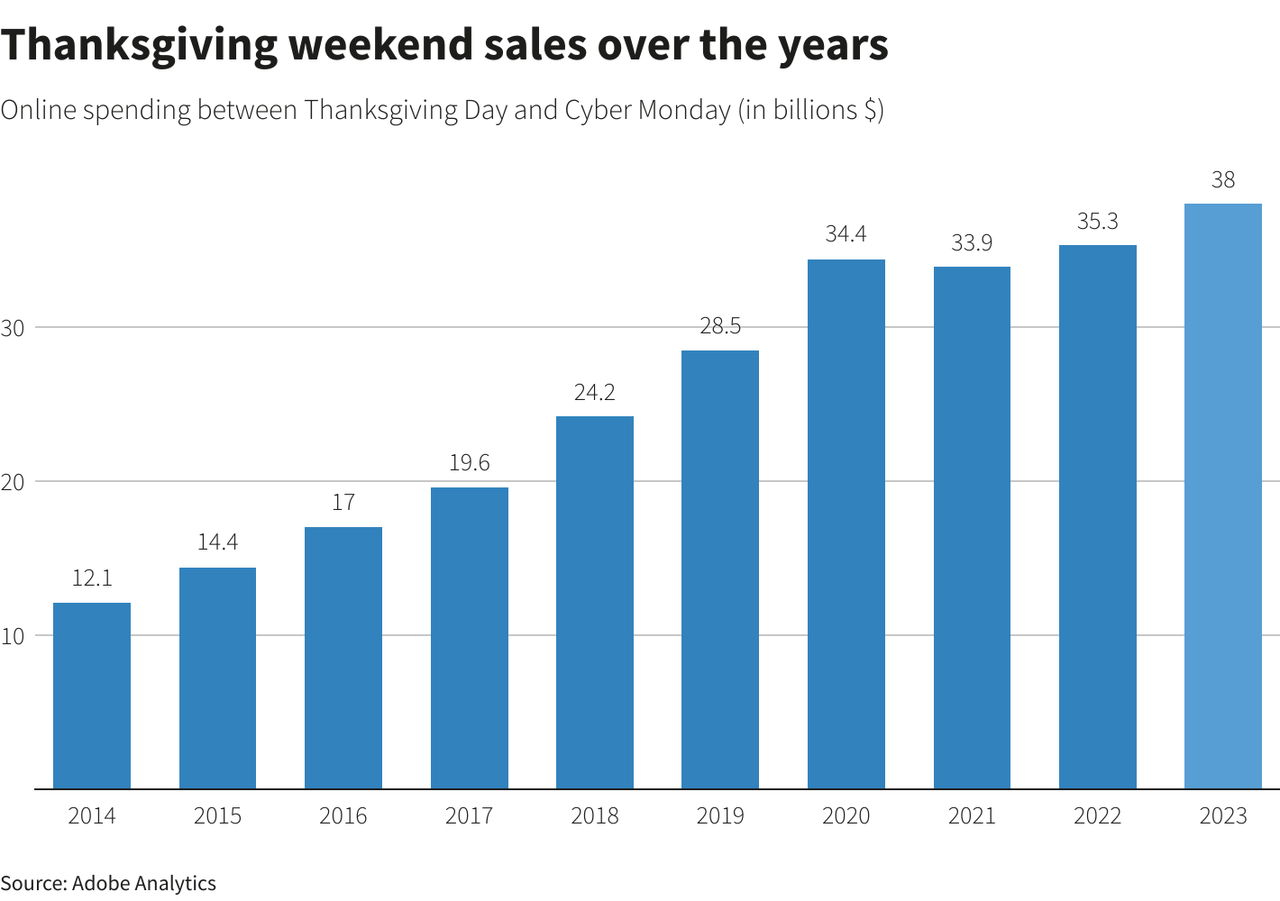

Well, after Black Friday was over, Adobe Analytics confirmed this survey, reporting shoppers spent a record $9.8 billion online (+7.5% YoY) in the U.S against any lackluster sales forecast for the shopping season. According to Adobe (ADBE), electronics, smartwatches, TVs, and audio equipment sold particularly well. Mastercard (MA) had a similar analysis, with online sales seen 8% up YoY. Another $10 billion should have been spent over the weekend and for Cyber Monday estimates are around $12 billion.

As we can see, online spending on Thanksgiving weekend has picked up speed once again after three years of almost no growth linked to the COVID-related pull-forward effect.

Reuters

So, with gas and food prices lower compared to last year, it seems consumers are more willing to spend. But according to Adobe, $79 million of the sales came from consumers using “buy now, pay later” methods, enabling them to stretch their wallets. Though the total amount is miniscule compared to the overall spending, it’s still a 47% increase YoY, showing a trend I believe is here to stay.

Amazon’s e-commerce business model

At the end of Cyber Monday, Amazon issued a final press release about the 11-day event on the platform. Amazon announced the event was the biggest ever, with customers around the world purchasing more than 1 billion items, with more than 500 million items being sold by third-party sellers.

But, most importantly, Amazon reported that “millions of customers signed up for a Prime membership during this most recent holiday shopping event, thanks to many invite-only deals for members.” Moreover, “for the first time, Prime members purchased great deals directly from Buy with Prime merchants during the Black Friday and Cyber Monday holiday shopping event.”

Considering at the end of Q3 Amazon already reported 18% growth YoY in third-party sales and a 25% ads revenue growth YoY, we can reasonably assume that the impact of Black Friday Week spending will boost these metrics even more at the end of Q4.

Without a doubt, more than the number of items sold, the most important piece of news has to do with new Prime memberships.

In fact, there’s a secret behind Prime which not every investor is aware of. In fact, it is an ecosystem built upon a key concept: Value creation. In fact, if we look at Amazon Prime as a standalone business, its income statement would not make much sense because it would seem it’s burning cash. However, as Jeff Bezos wrote in his last shareholder letter, Prime is part of how Amazon creates value for its customers. Bezos explained this with these words:

We offer low prices, vast selection, and fast delivery, but imagine we ignore all of that for the purpose of this estimate and value only one thing: We save customers time.

Customers complete 28% of purchases on Amazon in three minutes or less, and half of all purchases are finished in less than 15 minutes. Compare that to the typical shopping trip to a physical store – driving, parking, searching store aisles, waiting in the checkout line, finding your car, and driving home. Research suggests the typical physical store trip takes about an hour. If you assume that a typical Amazon purchase takes 15 minutes and that it saves you a couple of trips to a physical store a week, that’s more than 75 hours a year saved. That’s important. We’re all busy in the early 21st Century.

So that we can get a dollar figure, let’s value the time savings at $10 per hour, which is conservative. Seventy-five hours multiplied by $10 an hour and subtracting the cost of Prime gives you value creation for each Prime member of about $630. We have 200 million Prime members, for a total in 2020 of $126 billion of value creation.

Value creation means Prime customers are receiving a greater value than what they spend for their membership. In 2020, the value creation Mr. Bezos estimated was $630 per member. Now, we can fairly assume it’s higher (shipping has become faster, Prime has added more features to its ecosystem, while fees have indeed increased, but not at the same pace of the value created).

However, back in 2020 Amazon spent $58.52 billion on fulfillment, while earning only $25.2 billion from subscriptions. Of course, fulfillment expense covers both Prime and non-Prime members’ orders. However, Prime members order more than non-Prime members. So, here we are with the “Prime income-statement” disproportion, which seems to make Prime unsustainable for Amazon.

At the end of FY2022, things didn’t change much. In fact, we find fulfillment expenses far greater than subscription revenue.

Subscription revenue: $35.3 billion.

Fulfillment expenses: $84.3 billion.

If we consider Prime also has to spend for all the additional features (Prime Video and new content creation, broadcasting rights, Prime Music, and so on) it seems Amazon is just going to ruin itself.

So, why has Amazon not run out of business? Some may answer: It has AWS which is the true cash cow. Some may add: It’s the ad business that’s supporting all of this. This is true. But what sometimes we fail to consider is that the Prime ecosystem is indeed sustainable. In fact, while Amazon creates value for its customers and its members, it is creating a lot of value for itself, too.

Jeff Bezos, in the same letter, points out what this means:

Value creation is not a zero-sum game. It is not just moving money from one pocket to another. Draw the box big around all of society, and you’ll find that invention is the root of all real value creation. And value created is best thought of as a metric for innovation.

Of course, our relationship with these constituencies and the value we create isn’t exclusively dollars and cents. Money doesn’t tell the whole story.

These are inspiring words. But, at the end of the day, we need to know where the money is. In other words, where does Amazon earn its profits as the reward for the value it creates?

We need to introduce another concept: Customer lifetime value (CLV). Amazon creates an ecosystem customers are locked in. Most Prime members renew their membership, just as most of Costco’s (COST) members do. The result is that a Prime member has great lifetime value for Amazon.

If we read the transcript of the Q4 2022 earnings call, we see how Brian Olsavsky, CFO at Amazon, explained a bit of what the company aims at while creating value for its members:

In general, if you step back, we had some very large video properties that we had launched last year, Thursday Night Football and Lord of the Rings: Rings of Power. Both of them had record sign-ups for Prime membership. And we know that, again, investments like that will help with not only a new member or new Prime member acquisition, but also retention. And we see a direct link between that type of engagement and higher purchases of everyday products on our Amazon website.

In other words, as Amazon Prime members grow and are more engaged so does the retention rate grow as well. And this generates higher spending within the ecosystem.

Andrew Jassy seems to be truly inspired by Jeff Bezos’ lesson about value creation. In fact, in the same earnings call, he added a few thoughts to what Mr. Olsavsky said:

Just to add really one piece here, which is just, if you step back and think about a lot of subscription programs, there are a number of them that are $14, $15 a month really for entertainment content, which is more than what Prime is today. If you think about the value of Prime, which is less than what I just mentioned, where you get the entertainment content on the Prime Video side and you get the shipping benefit, the fast shipping benefit you can’t find elsewhere and you get the music benefit, you get the Prime Gaming benefit and you get the photos benefit and you get the Buy with Prime capability, use your Prime subscription on websites beyond just Amazon and some of the grocery benefits that we provide, and RxPass like we just launched to get a number of medications people take regularly for $5 a month unlimited, that is remarkable value that you just don’t find elsewhere. And we will continue to add things to Prime and continue to experiment with lots of different features and benefits.

That Amazon creates value for its customer is crystal clear. But how do we know the value each Prime member has for Amazon?

This is more difficult to know, since Amazon is quite jealous of many of its metrics and numbers and it discloses only what is really necessary according to the law. Therefore, we don’t even know the exact number of Prime members. We know there were 200 million in 2020. Current estimates see at least 220 million members worldwide, 175 million of which are in the U.S.

Last year, a survey reported that in 2021 a Prime member spent on average $1,400 on Amazon, vs. the $700 spent by non-Prime members. Let’s assume that by now these numbers have increased both because of inflation and because of the strong consumer spending we have talked about at the beginning of the article. We could make ad educated guess considering a Prime member spends now around $1,600 a year. At the same time, the average spending of a non-Prime should be around $750 a year.

The math is easy: The difference between the two customers is $850 per year. So, for every Prime member, Amazon earns its annual fee plus $850 in additional revenue. Since the membership program is sticky, most of its members will be part of the ecosystem for a long time. According to Statista, Amazon’s Prime member retention rate after one year is 93%. On year two, retention rate is 98% of the members who renewed after the first year. This means that, for every 100 new members, Amazon will still have 91 subscriptions after two years. It also shows how, after one year, there’s almost no churn, showing customers have become loyal.

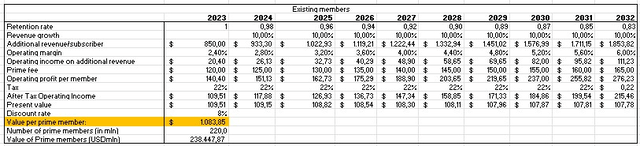

I have gone over all of this in a past article on the value of the Lord of the Rings series for Amazon. Here, we can update those data with what we know from this year. To understand how much a present member of Amazon is currently worth considering the next 10 years of the whole ecosystem, I calculated the present value of the operating profit per existing member, using the operating margin of 2,38% available from the 2022 Annual report and expecting a 40 bps increase YoY as the business scales more and more.

Author estimates

The Prime fee is a little bit lower than the $139 paid in the U.S. because worldwide Amazon has lower fees. I also assumed a membership survival rate of 98% and a spending growth of 10%. The result is that the present value of the profits Amazon will receive from each Prime member is around $1,083. Considering 220 million Prime members, we’re talking about a current value of $238.5 billion.

But we have to consider how Prime will grow in the next decade.

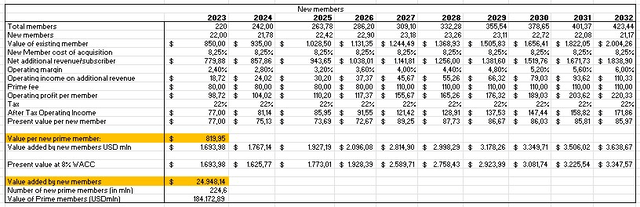

Let’s consider Prime will grow by around 22 million users per year.

Author estimates

We also know most of the new subscribers will come from outside the U.S. and so the annual fee for Prime starts at around $80 to then increase to $110.

Considering the same operating margin as before and a tax rate of 22%, we have a present value per new member of $77 in 2023. As this progress unfolds for the next year we can estimate a present value of the future operating profit per added member to be around $820. If we multiply it by the 224 million members Amazon could add during the next decade, we have a value of $184 billion.

In other words, it’s fair to assume that the Amazon Prime ecosystem currently has a value around $420 billion, considering its present size and a reasonable forecast of achievable growth. A market cap of $1.5 trillion for a company that, in addition to Amazon Prime, has higher margin businesses such as advertising and AWS, is to me still quite low, showing Amazon is still undervalued.

So, what does all this long reasoning lead to? It simply shows how, every time Amazon sells an item and, in particularly, adds a Prime member because of free shipping or Prime deals, it’s winning more than any other e-commerce retailer. The reason is simple: Amazon has an incredible ecosystem where customers stay for a long time and, while receiving value they also make Amazon earn and eat its chunk of the pie.

Operating leverage

Now, one last step. In recent years, one of the concerns around Amazon was that it had become free cash flow negative. This was somewhat contradicting what Amazon has always stated all throughout its annual reports: “Our financial focus is on long-term, sustainable growth in free cash flows.” To do the goal has always been to increase its operating leverage.

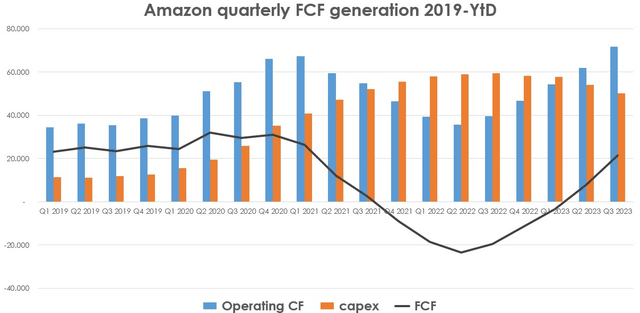

However, if we look at the quarterly free cash flow generation from Q1 2019 up until now, we see how, starting in Q1 2021, FCF plummeted and stayed negative for more than a year. But over the TTM, FCF has improved very quickly: We’re seeing around $10 billion quarterly improvements!

The main drivers Amazon talked about during the last earnings call were an increase in operating income, ads growth and improved operating leverage.

Capex also has gone down by about $10 billion year-over-year and the company keeps on expecting fulfillment and transportation capex to be down year-over-year.

Author, with data from AMZN quarterly reports

So, what was Amazon doing to deteriorate so quickly FCF generation? We see how capex increased rapidly, while operating cash flow went down until Q3 of last year. As we read in Amazon’s FY 2022 Annual Report, the company was primarily investing “in technology infrastructure (the majority of which is to support AWS business growth) and in additional capacity to support our fulfillment network.”

This year, during the last earnings call, Andy Jassy was finally able to explain better how the company moved from a single national fulfillment network in the U.S. to eight different regions. This was “one of the most significant changes to our fulfillment network in our history.”

This change has required a lot of investments. But it seems Amazon has now switched back to profitability mode, taking full advantage of an increase in its operating leverage. In fact, as Mr. Jassy explained:

Shorter travel distances and fewer touches mean lower cost to serve. But perhaps most importantly, shorter distances and fewer touches mean that customers are getting their shipments faster. […] we know how important speed of delivery is to customer satisfaction and buying behavior. A good example is the significant growth we’re seeing in consumables and everyday essentials. When customers are getting items as quickly and conveniently as they are now from Amazon, they’re going to consider us more frequently for more of their shopping needs.

This matters to us because quicker service means more sales. We can expect this year’s Black Friday may have seen a big boost thanks to the new fulfillment network which enables Amazon to ship quicker than ever many items consumers need right away.

Now, Amazon runs a logistics business that has overtaken delivery giants such UPS (UPS) and FedEx (FDX), something that was even unthinkable of a few years ago. Think about it: To become a delivery giant means huge capex. In a sort of way, it is as if Amazon successfully built a railroad of its own. Very few companies in the world have the finances to fund such investments. Amazon not only can, but did and now we can expect years of increasing profits thanks to better scale and operating leverage.

Now, nothing convinces to sign up for Prime Amazon customers more than fast shipping. The second largest driver of subscriptions is Prime Video. In a certain way, Amazon runs its business with the astuteness of the Greek hero Odysseus. He was the one coming up with the idea of the Trojan horse to finally conquer Troy from within. Amazon needs to do the same: It needs to enter within a consumer’s defensive walls and then “conquer” it from within. Its e-commerce platform is this: An easy place for shopping where items are delivered quicker than most competitors. Once consumers “taste” this convenience, they sign up for Prime and become engaged for enough time to pay back Amazon for the value it creates.

Valuation and Conclusion

Amazon is a difficult business to value because it holds several great businesses all bundled together. Moreover, its recent investment cycle made some of its metrics unusual high. For example, the company still trades at a 16.7 fwd P/FCF, but just last year this ratio went all the way up to 90. If Amazon switches into profit mode, I wouldn’t be surprised to see it able to generate quickly $150 billion in FCF per year, which would lead to a 10 P/FCF ratio.

More helpful if a sum-of-the-parts valuation. In this article I tried to show how the Prime ecosystem alone is worth a little less than half a trillion. Considering the other great businesses Amazon owns and operates, it would seem rather cheap to buy all of them apart from Prime for just $1 trillion. As far as I see it, Amazon will probably be the next company to hit $2 trillion in market cap and this is why I keep on rating it as a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.