Summary:

- Amazon.com, Inc. is a dominant company with strong positions in various industries and a well-diversified revenue stream.

- The company has done a brilliant job at monetizing its customer base through subscriptions, ads, and more.

- Amazon’s dominant position within the cloud industry and competitive pricing in advertising should fuel growth for year to come.

- My 10-year DCF indicates Amazon is still undervalued by 16%, making this a buy.

FinkAvenue

Investment Thesis

I believe Amazon.com, Inc. (NASDAQ:AMZN) offers a very attractive opportunity due to its dominant position across different sectors, diversification, and financial strength. AMZN is the leading e-commerce brand in the world with over 300 million customers; a lot of that success has to be attributed to prime membership (90 million members) and one-day shipping. The average Prime member spends $110 on Amazon every month; on the other hand, the average non-member spends just $38. Amazon Prime not only increases customer retention but also provides the company with a recurring revenue stream.

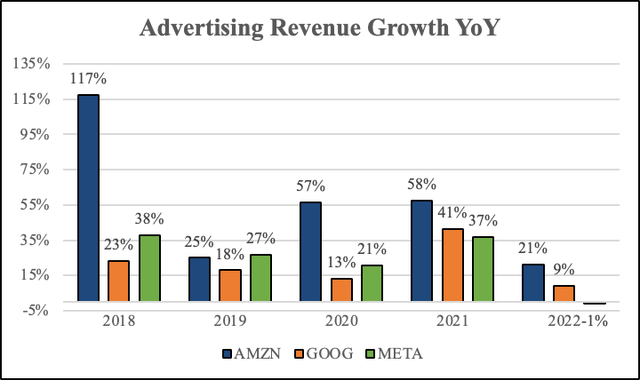

AWS is the leading global cloud provider, holding about 32% of the market share. Despite generating more than $80 billion in revenue in 2022, I believe there is still more growth to be realized in the segment as more enterprises realize the cloud’s potential. Speaking of growth, AMZN’s advertising business has been experiencing a serious boom over the past few years. Even outpacing Meta Platforms (META) and Alphabet (GOOG) advertising revenue growth.

AMZN sells ads through its e-commerce website, twitch, Prime Video, and more. I believe advertising and AWS have a long runway for growth. This segment has grown rapidly because it offers competitive pricing. According to Sellics, AMZN ads cost 68% less than Google ads and 44% less than Facebook ads when comparing the average cost-per-click on those platforms.

I believe Amazon enjoys a position of strong financial strength arising from its growing revenue, expanding margins, and sound balance sheet. The firm ended Q3 with $64.17 billion in cash and $137 billion in debt, an interest coverage ratio of 8.78x, and net debt to EBITDA ratio of 1.38x. My only concern is liquidity; the company ended the quarter with a current ratio below one (0.8x). However, this is not a recurring theme with the company. Liquidity has been strong in the previous quarters, with the exception of this one, but I thought I should mention it.

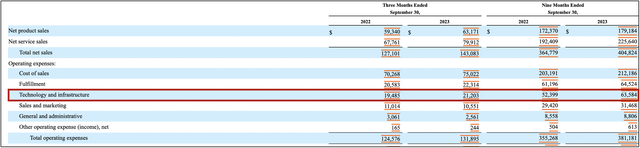

Gross margin has risen in the past few years, and I believe incremental growth drivers such as AWS and advertising will push margins even higher. Additionally, AMZN has decreased its total headcount by 67 thousand in 2022 to keep costs under control. The company has also cut its R&D spending, down by 8% year over year on a Q3 basis and down 17% year over year on a 9 months basis.

Valuation

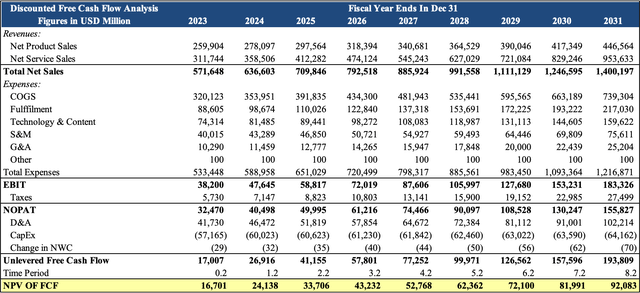

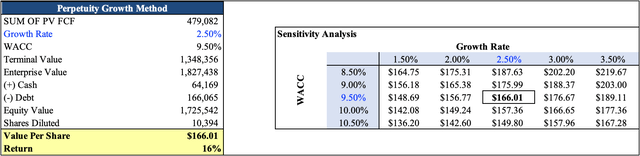

As I’m writing this, the stock is sitting at $143. AMZN is trading at a forward P/E of 53.52x the FY23 consensus of $2.67 and 41.63x the FY2024 consensus of $3.43. I used the discounted cash flow (“DCF”) method to value AMZN.

I estimate product sales to compound at a rate of 7%, driven by the continuing shift to online shopping; as for service revenue, I estimate revenue will grow by 15% annually, driven by the adoption of cloud services by businesses, subscription growth, and advertising. I estimate service revenue will outtake product revenue in 2023.

I assumed the COGS margin would diminish by 23 bps annually; AMZN has controlled costs over the past few years as they focused more on profits. As for the other assumptions, which include a fulfillment margin of 15.50%, a T&C margin of 12.20%, a S&M margin of 6.20%, and a G&A margin of 1.80%, These four assumptions are based on historical figures.

Using these assumptions, I arrived at a value per share of $166 per share, translating into a 16% return from the price of this writing. I used a WACC of 9.50% and a growth rate of 2.50% aligned with GDP’s.

Mitigates

My biggest concern regarding AMZN is regulation; given its size, AMZN will have difficulty making big acquisitions or entering other markets. Another risk is competition. The company competes with conglomerates in almost every segment: AWS competes with Microsoft’s (MSFT) cloud segment Azure, Google, and more.

Prime videos and music compete with Netflix, Spotify, Apple TV, Apple Music, and more. AMZN’s online store has a strong footing in the U.S. but is a different story internationally. AliExpress (owned by Alibaba) recently overtook Amazon to become the largest online marketplace in Europe. Lastly, there is exposure to consumer spending.

Final Thoughts

Overall, I’m very bullish on Amazon and believe it is a dominant company with very good prospects. The firm has done a brilliant job at monetizing its customers, and the diversification across different sectors minimizes risk. All of that, coupled with an attractive valuation, makes Amazon.com, Inc. stock a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not a qualified financial advisor or investing professional. My content and analysis are based on my opinion and are intended to be used and must be used for educational purposes only. No content or analysis constitutes or should be understood as constituting a recommendation to enter into any securities transactions or to engage in any investment strategy. It is very important to do your own analysis before making any investment based on your own personal circumstances. Readers should always seek the advice of a qualified professional before making any investment decision. Past performance is not indicative of future performance. A reader should not make personal financial or investment decisions based solely upon this analysis

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.