Summary:

- We’re upgrading Amazon.com, Inc. to a buy as we now expect the stock to outperform the peer group into 2024.

- We think Amazon can remain relatively resilient in spite of the macro uncertainty in 2H23.

- We believe management’s focus on cost control and operational efficiencies will make the company more competitive and battle through the near-term softness in its e-commerce and AWS businesses.

- Additionally, we expect advertising revenue will rebound in 2H23 and improve further into2024.

- We see an improving risk-reward profile for Amazon stock and recommend investors explore entry points at current levels.

FG Trade

We’re upgrading Amazon.com, Inc. (NASDAQ:AMZN) to a buy; we expect the stock to outperform the peer group in 2H23 and 2024. In spite of continued macro uncertainty in 2H23, we think Amazon will be relatively resilient due to the company’s vast economies of scale and financial leverage; the company’s materially reduced cost to serve, making deliveries for its retail sales faster and less expensive. The reduced cost to serve combined with cost-cut measures over the past year, including downsizing layoffs of 27,000+ jobs, arm Amazon with financial leverage to weather the macro headwinds and grow through 2H23.

Currently, Amazon’s shipment costs and fulfillment costs continue to grow at a slower pace than unit growth; this quarter, the company reported revenue up 11% Y/Y and 5.2% sequentially and operating income of $7.7B versus $3.3B in 2Q22. Amazon’s main revenue stream, retail sales, reported higher Y/Y and QoQ growth this quarter despite the macro headwinds, up 11% Y/Y and 10% Y/Y versus an increase of 11% Y/Y and 1% Y/Y in 1Q23.

We think Amazon’s regionalization strategy that lowers costs to serve in stores’ fulfillment network, transitioning stores’ fulfillment and transportation network from one national network inside the U.S. to eight separate regions, helped improve International segment sales. To be specific, the result of management’s regionalization strategy has reduced the number of touches of the delivery package by 20%, reduced miles traveled by 19%, and increased deliveries fulfilled by 1,000 basis points.

Reduced cost to serve also reflected positively on operating income in North America and International segments, reporting improved Y/Y operating income at $3.2B and ($0.9B), respectively, this quarter versus a loss of $0.6B and $1.8B in a year ago quarter. Both segments also reported better operating income sequentially; North America’s operating income was $0.9B last quarter, while the International segment’s operating loss was $1.2B. We see operating income and sales in Amazon’s retail segments improve both Y/Y and sequentially in the back end of the year and in 2024 once consumer spending rebounds more meaningfully.

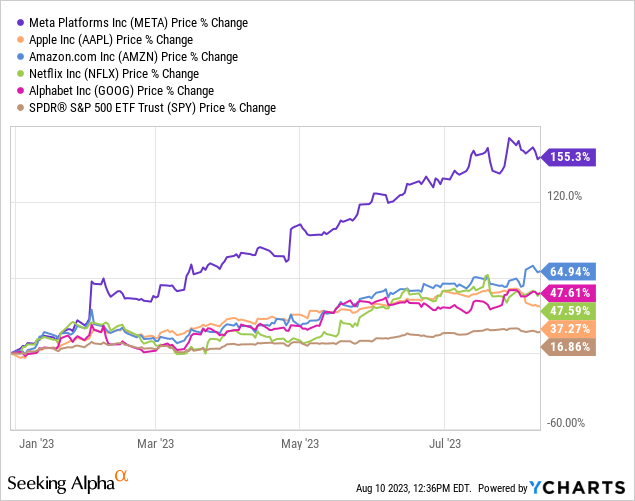

We expect management’s focus on cost controls and operational efficiencies will improve Amazon’s competitive edge and provide an advantage to battle through near-term headwinds in its e-commerce and AWS businesses. The stock is up 65% YTD, outperforming the S&P 500 (SP500) by roughly 48%. Amazon now joins Meta Platforms (META) as one of our favorite stocks in the FAANG group; we expect the stock to continue outperforming into 2024 and recommend investors explore favorable entry points into the stock at current levels.

The following graph outlines the stock performance of the FAANG group against the S&P 500 YTD.

YCharts

Resilient Cloud growth in a cost-cut environment

AWS sales grew 12% Y/Y and 3% sequentially to $22.1B this quarter; we’re constructive on AWS continuing to grow Y/Y and sequentially into 2024, although we expect to see a slower growth rate due to the softer cloud/enterprise spending environment. We’ve seen the softer spending impact Microsoft (MSFT), with management forecasting a continued slowdown in its Azure cloud service business earlier this quarter. Management touched on this concern during the earnings call, noting:

“If we rewind to our last conference call, we had seen 16% AWS revenue growth in Q1, and the growth rates have been dropping during the quarter.”

While we’re more constructive on AWS growth stabilizing this quarter and expect growth to continue in 2H23, we remain less optimistic about AWS experiencing higher double-digit growth in the near term.

Valuation

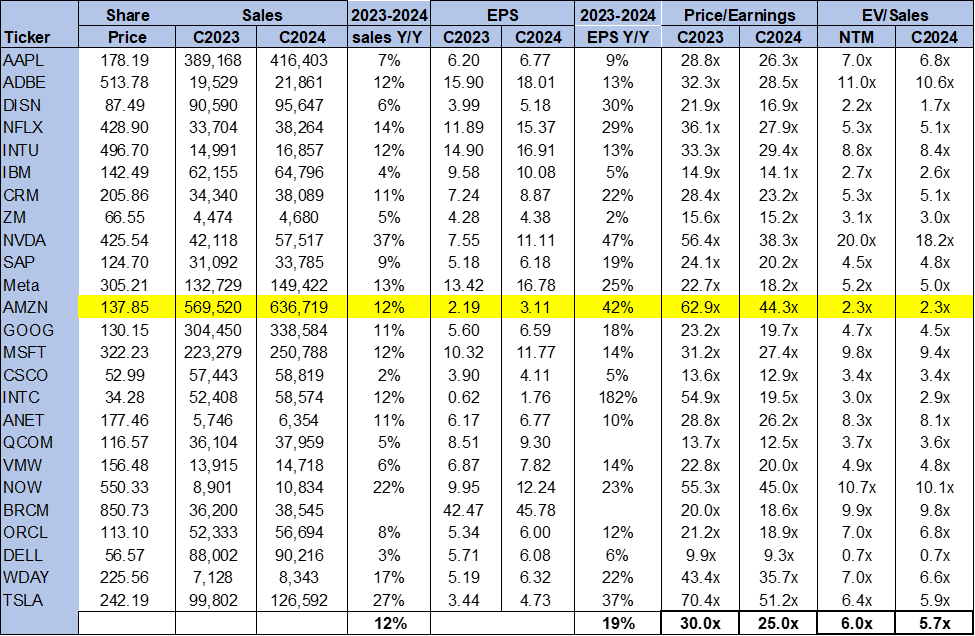

We think Amazon is fairly priced. On a P/E basis, the stock is trading well above the peer group average at 44.3x C2024 EPS $3.11 compared to the peer group average of 25x. The stock is trading below the group average at 2.3x EV/C2024 Sales versus the peer group average of 5.7x. We see favorable entry points into the stock at current levels.

The following chart outlines Amazon’s valuation against the peer group.

TSP

Word on Wall Street

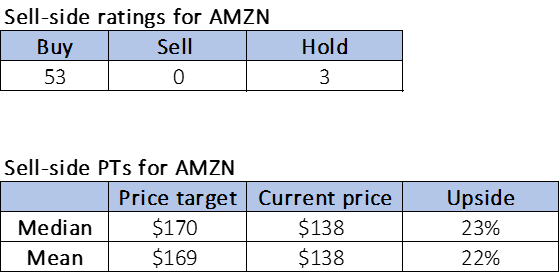

Wall Street shares our bullish sentiment on the stock. Of the 56 analysts covering the stock, 53 are buy-rated, and the remaining are hold-rated. The stock is currently priced at $138 per share. The median sell-side price target is $170, while the mean is $169, with a potential 22-23%.

The following charts outline Amazon’s sell-side ratings and price targets.

TSP

What to do with the stock

We’re upgrading Amazon to a buy, as we now expect the company’s financial leverage and vast economies of scale after continuing to reduce the cost to serve, among other cost-cut measures, to drive resilience through macro uncertainty in 2H23. We expect the cost-cutting measures will further improve Amazon’s financial leverage to be able to spend toward new functionality, specifically involving generative A.I., large language models, and machine learning. We see Amazon outperforming into 2024 and recommend investors explore favorable entry points into the stock at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2 week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2 week free trial so we hope to see you in our group soon.