Summary:

- Amazon leverages size effectively in e-commerce, Prime Video and advertising, showcasing scale and reach.

- An 11-year basketball deal with Prime Video is a key example showing how sports leagues want to work with Amazon given their distribution footprint.

- Valuation analysis suggests a hold for long-term investors.

4kodiak/iStock Unreleased via Getty Images

Introduction

Per my May article, Amazon’s (NASDAQ:AMZN) AWS keeps growing with generative AI. Since that time, the 2Q24 earnings have come out, along with a July 24 Prime Video announcement about an 11-year basketball deal. My thesis is that Amazon uses their size effectively. The basketball deal is a sharp example of Amazon using their scale and reach, but we also see them using these attributes effectively in other areas.

2Q24 Numbers

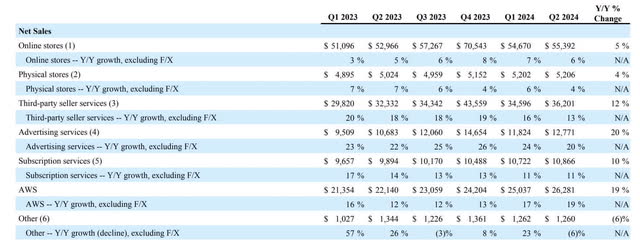

Looking at the 2Q24 earnings release, we see advertising was up 20% Y/Y and AWS had a 19% gain:

2Q24 Sales (2Q24 release)

Commerce

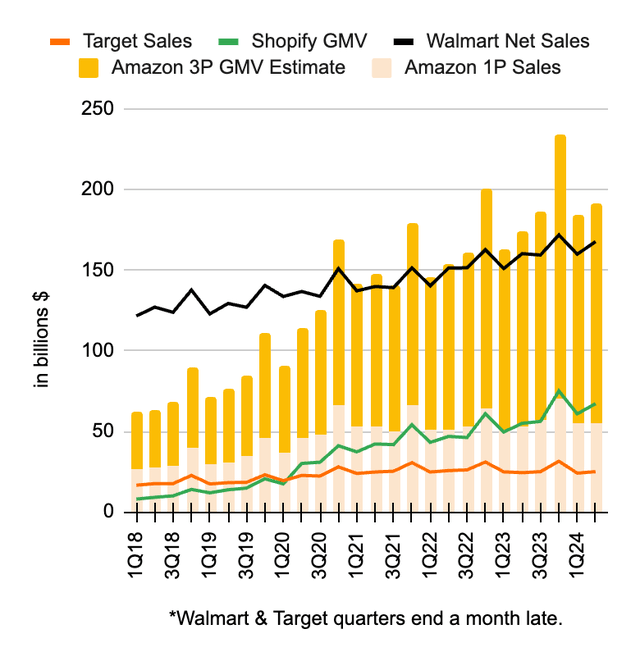

For decades, Amazon has been one of the biggest e-commerce destinations outside China, and they’ve continually used their size to their advantage. Customers can be wary about using their credit cards online, but they’ve tended to be more comfortable with Amazon because of their size and their trusted brand. Another benefit of Amazon’s size is selection – customers have a plethora of product choices. Amazon is always increasing the dollar amount of goods moving through their ecosystem, especially in the 3P segment. I like to make comparisons to Walmart (WMT) and Target (TGT) where growth is more tepid. Shopify (SHOP) is a completely different business model, but I like making comparisons with their ecosystem as well:

1P Sales & 3P GMV (Author’s spreadsheet)

It would be nice to include Costco (COST) in the graph above, but their quarterly fiscal calendar is confusing, having 12 weeks for the first three periods and 16 or 17 weeks for the final period (their fiscal year ends on the Sunday closest to August 31). In the fiscal year through September 3, 2023, Costco had operating income of $8.1 billion on revenue of $242.3 billion, which was composed of $237.7 billion in net sales plus $4.6 billion in membership fees. Unlike Walmart and Target, Costco is known for making much of their operating income from membership fees.

Prime Video

A July 31 Fast Company article says the NBA wanted to do a recent 11-year deal with Amazon, because of the reach and infrastructure that Amazon possesses (emphasis added):

According to The Athletic, the gist of the NBA’s legal argument is that even if Turner matches the dollar figure of Amazon’s offer, it hasn’t – more importantly, it can’t – match Amazon’s offer in terms of reach. Turner primarily broadcasts games on basic cable, whereas Amazon is an “over the top” distributor that bypasses traditional distribution channels (like cable and satellite providers) and streams directly to consumers. In the NBA’s view, Amazon’s infrastructure makes it simpler for more people to find and consume its product, and thus renders Turner’s bid legally insufficient.

Regarding the above deal, TNT Analyst Charles Barkley is quoted by The Athletic, saying only large-sized streamers like Amazon and Netflix will be able to afford sports rights in the future:

“It’s going to all go to streaming in 11 years,” Barkley told The Athletic. “I think this is just a cash grab, but they needed streaming because in 11 years nobody’s going to be able to afford these rights but streaming.”

Advertising

AI feeds on data, and no e-commerce destination outside China collects more customer data than Amazon. They continue to improve their advertising system while making AI investments and leveraging their data. Per an August 2023 Yahoo Finance article, Amazon has a bright future with advertising because they have vast amounts of data and they’ve taken their time to make the right types of investments (emphasis added):

” Hands down, data is the North Star and the core strength of Amazon’s ad business,” Friedland told Yahoo Finance. “They took the time to invest in robust closed-loop-reporting technology and that pays in spades.”

AWS

AWS, Microsoft Azure (MSFT) and Google Cloud are the only cloud companies outside of China with enough size to make the massive capex investments required to compete on a global scale. Answering a Mark Mahaney question in the 2Q24 call, CEO Andy Jassy said 90% of global IT spend is still on premises, so we have tremendous growth ahead with conventional computing. Additionally, the AI growth should be prodigious (emphasis added):

I think that – the one other thing I would say about that, too, Mark, is that – the business today, as I mentioned, it’s a $105 billion revenue run rate business, about 90% of the global IT spend is still on premises. And if you believe that equation is going to flip, which I do, there’s a lot of growth ahead of us in AWS as the leader in all those dimensions I mentioned. But I also think that generative AI itself and AI as a whole – it’s going to be really large. I mean it is not something that we originally factored when we were thinking about how large AWS could be.

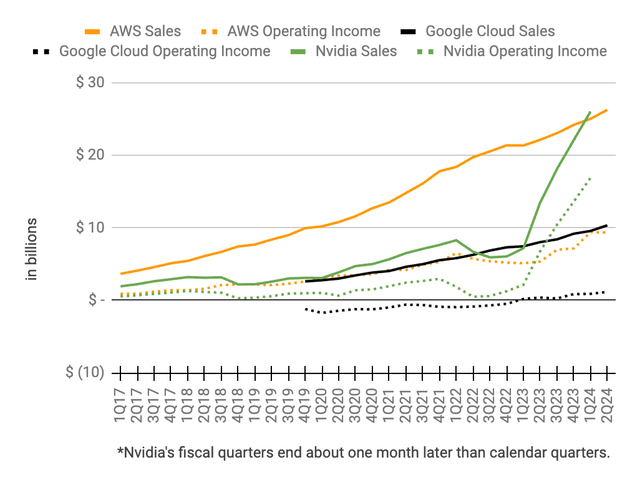

The economics for Microsoft Azure are somewhat obfuscated, but Google Cloud discloses their operating income and AWS has much better margins today. AWS also had significantly better margins than Google in the past, when AWS revenue was at the level we see from Google Cloud today:

AWS operating income & sales (Author’s spreadsheet)

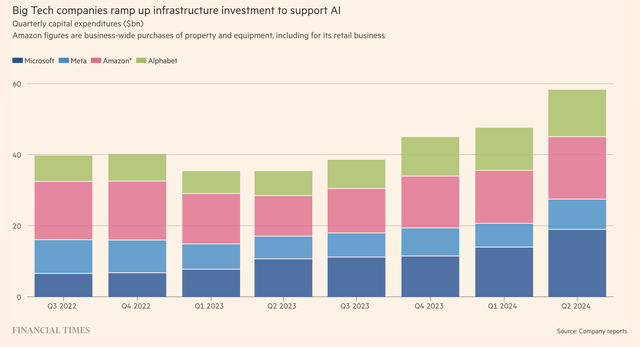

The FT shows the enormous capex requirements mentioned above for the hyperscale cloud companies:

Big Tech Capex (FT)

Valuation

Per the points made above, Amazon’s size makes their ad business extremely valuable because they collect massive amounts of data, and they have the ability to make meaningful investments. Additionally, they are in the right type of advertising market which is low in the funnel where purchases can be measured as opposed to just clicks. In February 2022, Amazon Director of Software Development Mike James testified in the Google (GOOG) (GOOGL) case, saying shopping ads are lower in the funnel than text ads. Obviously, shopping ads are Amazon’s bread and butter, so they can compete well against companies like Google and Meta (META) who are bigger overall with respect to digital advertising. The August 5, 2024, Memorandum Opinion court document for the Google case recognizes this fact, noting Google estimates that as of 2023, Amazon’s ad revenues are larger than Google’s in retail advertising. The document goes on to say Amazon was growing twice as fast as Google in this area as of 2021 (emphasis added):

These “product page” ads likely generate substantial revenue for Amazon, whose ad business is growing rapidly. ( Google record from January 2021 estimating that Amazon’s “US ads business is nearly the size of Google’s US retail ads business today, and is growing at over twice Google’s rate.”).

Outside of the AWS segment, we need to look at the North America segment and the International segment differently. In the 1Q24 call, CFO Brian Olsavsky talks about the way emerging countries bring down the overall margins for the International segment:

I would say the established countries of Europe, Japan, as well as the U.K. are following a lot of the same trajectory as in the United States. They are profitable in their own right. They are adding selection, they’re adding new features like grocery there, adding to their Prime benefits, and a lot of the work that we do in the United States carries over there. The second group is the emerging countries. And of course, we’ve launched 10 new countries in the last 7 years.

Later in the 1Q24 call, CEO Andy Jassy talks about the way the International cost structure will improve in the future as it starts to catch up to the US in terms of inexpensive same-day facilities:

And our same-day facilities are our least expensive facilities in the network. We still have a fraction of the number of those that we will have in the U.S. that we’ll have in other parts of the world, which will, again, both change our cost structure while increasing speed.

Looking at 2Q24, the North America segment had operating income of $5,065 million on sales of $90,033 million while the International segment had operating income of just $273 million on sales of $31,663 million. On a trailing twelve month (“TTM”) basis, the North America segment had operating income of $20,816 million or $10,048 million + $14,877 million – $4,109 million on sales of $369,775 million or $176,374 million + $352,828 million – $159,427 million. Meanwhile, the International segment had TTM operating income of $662 million or $1,176 million + $(2,656) million – $(2,142) million on sales of $135,978 million or $63,598 million + $131,200 million – $58,820 million. Through July 31, Walmart had TTM operating income of $28,237 million or $14,781 million + $27,012 million – $13,556 million on revenue of $665,035 million or $330,843 million + $648,125 million – $313,933 million for an operating margin of about 4.25%.

Outside of AWS, I’m optimistic that Amazon can eventually have a steady-state operating margin of at least 5%. If we apply this to $505.8 billion, which is the sum of the $369.8 billion TTM North America sales plus the $136 billion TTM International sales, then it implies a steady-state TTM operating income of over $25 billion. I think the non-AWS business is worth 40 times this amount +/- 5% implying a range of $950 to $1,050 billion.

The AWS operating income run rate is $37,336 million, based on the 2Q24 figure of $9,334 million. I think the segment is worth 20 to 30x this run rate, which gives us a range of $745 to $1,120 billion when rounding to the nearest $5 billion. One of the reasons I give the non-AWS segment a higher accrual multiple than the AWS segment is because the capex economics of the AWS segment might end up being more like a railroad, where depreciation and amortization never match maintenance capex.

My sum of the parts valuation is as follows:

$950 to $1,050 billion non-AWS

$745 to $1,120 billion AWS

—————————————–

$1,695 to $2,170 billion total

The 2Q24 10-Q shows 10,495,566,881 shares as of July 24 such that the market cap is $1,890 billion based on the August 21 share price of $180.11. The stock is in my valuation range and I think it is a hold for long-term investors.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, AAPL, ASML, BABA, GOOG, GOOGL, META, MSFT, NVDA, TCEHY, TSLA, TSM, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.