Summary:

- Amazon and Google both have attractive valuations, but Amazon’s AWS is currently the better cloud investment due to its market leadership and profitability.

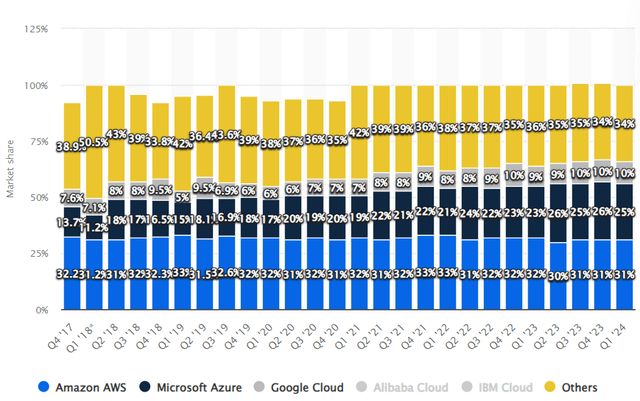

- The cloud market is rapidly expanding, with AWS holding a 31% share and GCP growing from 7.6% to 12% since 2017.

- AWS is expected to grow at 15% annually, while GCP is projected to grow at 25% due to increasing market share.

I Like That One

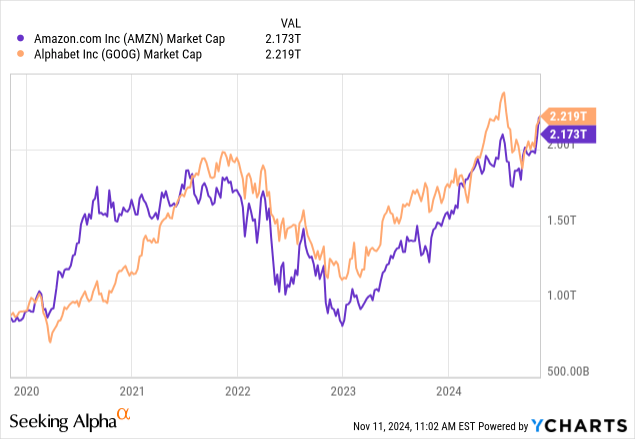

Amazon (NASDAQ:AMZN) and Google (NASDAQ:GOOG, NASDAQ:GOOGL) are currently both trading at a similar market cap of ~$2.2 trillion.

According to my latest Amazon and Google articles, both companies are currently valued attractively to enter a position. In this article, we will delve a bit deeper into the cloud segment of both companies and answer the question of which of the two is currently the better stock to profit from the spectacular growth that the cloud market offers.

Market Situation

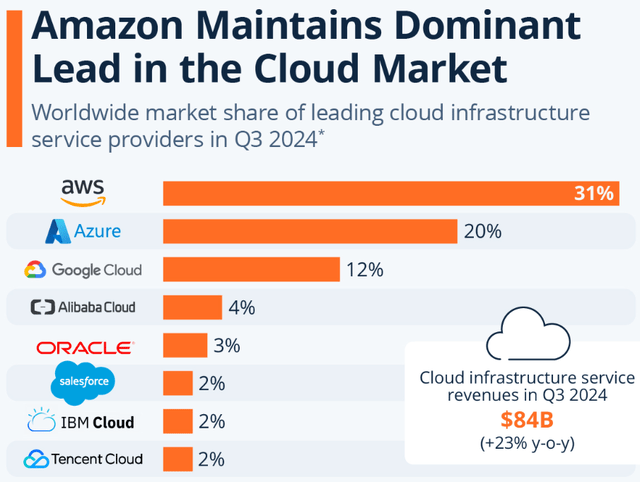

In 2024, the market for cloud computing is still expanding quickly (+23% YoY) due to technology breakthroughs, strategic partnerships, and substantial expansion. Dominant positions are maintained by major industry leaders such as Google’s Cloud Platform (GCP), Microsoft (MSFT) Azure, and Amazon Web Services (AWS). With 31% of the market, AWS continues to lead, while Azure has 20% thanks to its high appeal in the corporate sector and interoperability with current Microsoft services. Other significant participants include Salesforce (CRM) in the SaaS market and Alibaba (BABA) Cloud, which is especially significant in the Asia-Pacific area.

Cloud Market Share by Provider Q3/24 (statista.com)

The amount spent on cloud computing worldwide is expected to increase to almost $678.8 billion by 2024. This rise is a reflection of the high demand for cloud solutions, which is mostly due to companies’ continuous attempts to adapt digitally. According to experts, 45% of companies have adopted the cloud-native development strategy, which prioritizes apps and software that are optimized for cloud settings, and another 32% have plans to do so in the near future.

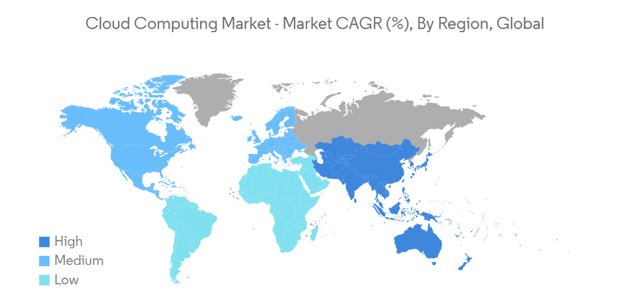

With most of the worldwide cloud sales and the majority of the major cloud providers based there, North America continues to lead in this segment. High adoption rates of cutting-edge technologies like edge computing, AI, and ML are advantageous to the market. The highest growth from here however is expected to be achieved in the Asia-Pacific region.

Cloud Market CAGR by Region (mordorintelligence.com)

As can be seen below, Amazon is currently holding its market share at ~31%, while Google is increasingly gaining market share with expanding it from 7.6% in Q4/17 to 12% in Q3/24, as mentioned above.

Cloud Infrastructure Market Share per Quarter (statista.com)

Growth Prospects

There are currently several expectations for the cloud market growth over the next few years:

| Research Firm | Expectation p.a. | Time Frame |

| Mordor Intelligence | 16.4% | 2024 – 2029 |

| Grand View Research | 21.2% | 2024 – 2030 |

| Markets and Markets | 15.1% | 2024 – 2028 |

| Fortune Business Insights | 16.5% | 2024 – 2032 |

| Acumen Research | 17.8% | 2023 – 2032 |

| Statista | 18.5% | 2024 – 2029 |

The average of these assumptions is a cloud market CAGR of 17.6% p.a., considering that Google is currently increasing their market share we should assume a higher growth rate for GCP than for AWS. To adjust for this, I assumed the following growth rates for the two cloud companies:

Google: 25% p.a. – 17.5% market growth + 7.5% from market share growth

Amazon: 15% p.a. – 17.5% market growth – 2.5% from market share decline

Profitability

The EBIT margins of Google’s cloud were negative over the last few years but are improving rapidly:

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| EBIT Margin | -52% | -43% | -16% | -11% | 5% |

In the latest quarterly earnings the margins were even better at 9.4% in Q1, 11.3% in Q2 and 17% in Q3. With these spectacular quarterly growth rates, it is reasonable to assume that Google will continue to improve their profitability in the cloud segment. With this in mind and considering the EBIT margins of ~30% at AWS and Azure’s 45% the following margin development for the two companies seem very achievable:

| EBIT Margin | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 |

| AWS | 30% | 35% | 35% | 35% | 35% | 35% | 35% | 35% |

| GCP | 15% | 25% | 30% | 35% | 35% | 35% | 35% | 35% |

Risks to Consider

Aggressive pricing tactics, however, could be used to draw in and keep customers as a result of the growing rivalry between the major companies. As vendors strive to undercut one another while offering creative and customized solutions, this pricing war could overall reduce achievable margins in this market.

Furthermore, profitability could be severely hampered by the enormous capital expenditure (CAPEX) required to build and operate massive data centers and state-of-the-art technological infrastructure. In order to meet both technical needs and environmental norms, providers are making significant investments in cutting-edge technology, sophisticated AI capabilities, and sustainable, energy-efficient data centers. The economy of scale could however (partly) offset these costs, further solidifying Microsoft’s, Amazon’s and Google’s dominant market position.

Valuation

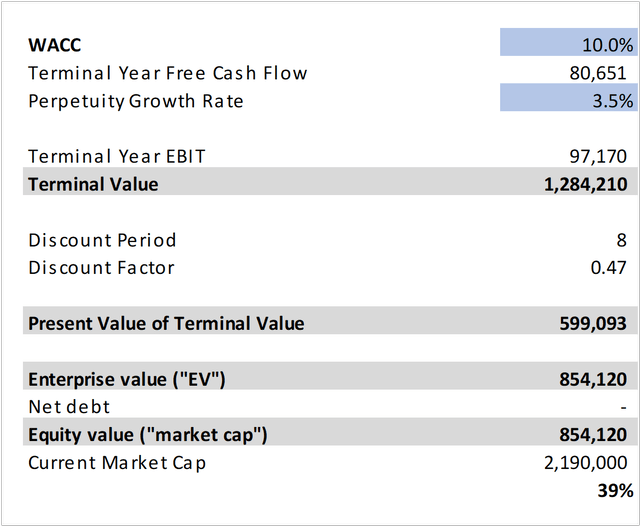

For our valuation, we need a few additional assumptions:

- EBIT to FCF: For the EBIT to FCF conversion, I looked at Google’s whole business and averaged out the last three years. I think with Google Search and YouTube, Google is currently having a similar FCF rate than a potential pure play on cloud might have. This, however, doesn’t impact our comparison, as I used the conversion rate of -17% for both companies.

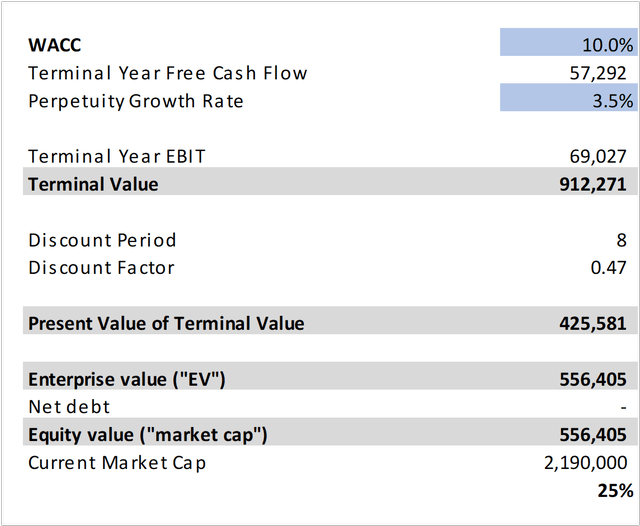

- WACC: Here I used 10%.

- Perpetuity Growth Rate: For the perpetuity growth rate, I assumed a conservative 3.5%.

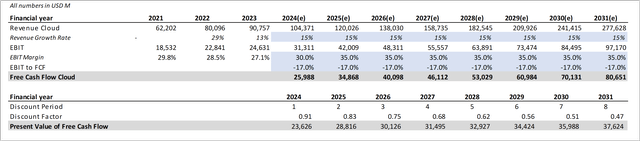

Amazon – AWS

AWS Free Cash Flow Analysis (I) (own assumptions ) AWS Free Cash Flow Analysis (II) (own assumptions)

For Amazon, we get an enterprise value of $854 billion alone for the AWS segment of the company, which is currently almost 40% of the market cap of Amazon.

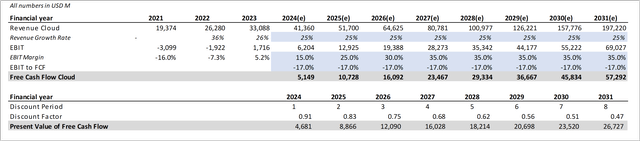

Google – GCP

GCP Free Cash Flow Analysis (I) (own assumptions) GCP Free Cash Flow Analysis (II) (own assumptions)

For GCP, on the other hand, we get an enterprise value of $556 billion, which is 25% of the current market cap.

Conclusion

Both companies are very high quality and currently undervalued in my opinion, which can also be seen in the price targets of my latest articles on Amazon and Google. Even with these pretty conservative assumptions for Amazon, the company, however, seems to be the better cloud play right now. If I had to choose one company to benefit from the increasingly high cloud adaption, I would currently choose Amazon over Google.

What’s Your Perspective? Let’s Discuss!

Thank you for reading my analysis! I’d love to hear your ideas and points of view – whether you agree, disagree, or have your own take on the stock. Let’s start a discussion in the comments! I welcome any helpful arguments and ideas that can help us better comprehend this topic. Thanks!

~ Fabian – FF

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, AMZN, CRM, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.