Summary:

- Amazon and Walmart are the two largest retailers in the world.

- Walmart has better financial metrics than Amazon.

- Amazon makes very little profit on its e-commerce sales.

- Neither company has done well in the last year.

- Walmart has repurchased 18% of its shares over the last 10 years.

Daria Nipot

Overview:

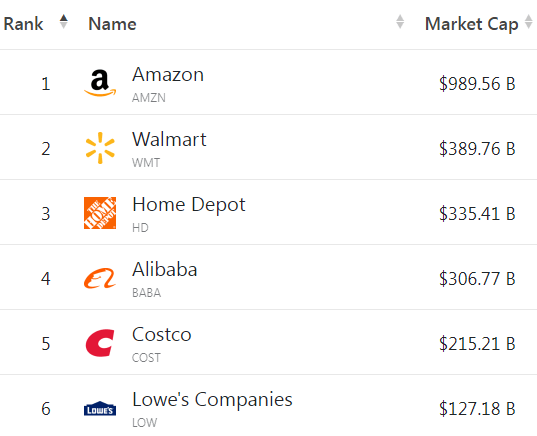

Amazon.com, Inc. (NASDAQ:AMZN) and Walmart Inc. (NYSE:WMT) are the two largest retailers in the world by Market Cap.

companiesmarketcap.com

Source: companiesmarketcap.com

On a strictly retail revenue basis, Walmart is much bigger than Amazon with retail revenue of $600 billion versus AMZN’s $280 billion. Including Amazon’s non-retail business, Walmart is still the larger of the two in revenue $600 billion to Amazon’s $502 billion.

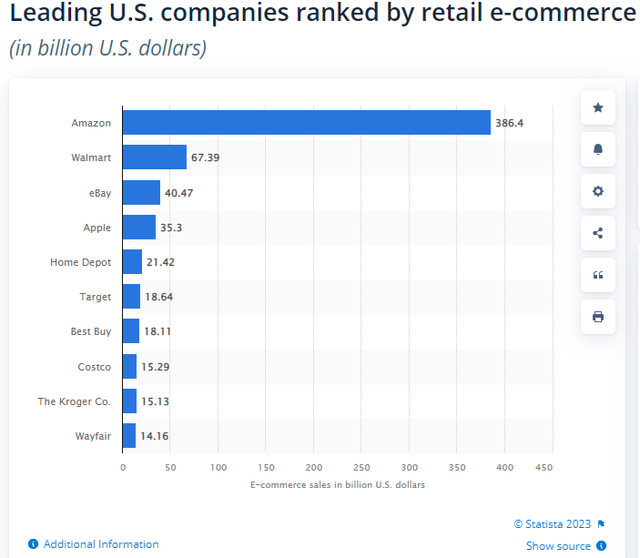

In terms of online sales, Amazon is much larger, but Walmart is second. Note that WMT’s total online sales are greater than Home Depot, Target and Costco combined.

Statista

Of course, Amazon generates most of its profits from its cloud service entity AWS and we will break down Amazon’s revenue between retail and cloud services later in this article.

In this article, I will compare AMZN to WMT to see which is the better long-term buy.

Amazon and Walmart’s Stock Key Metrics

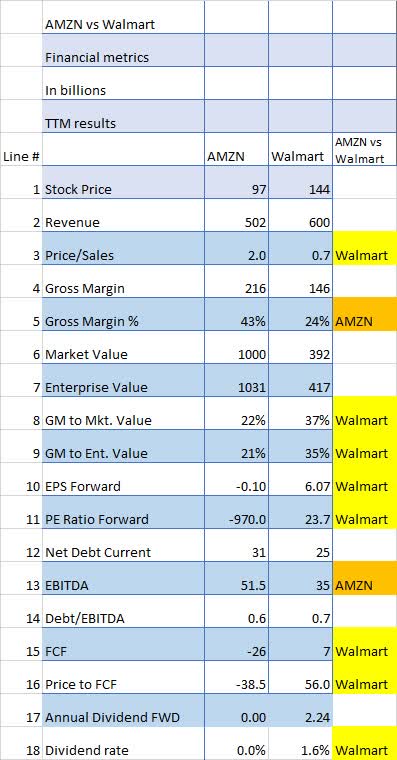

As you can easily see in the table below, Walmart is a larger company based on revenue (Line 2). And when it comes to Price/Sales (Line 3) Walmart appears to be a much better value with a ratio of 0.7x versus AMZN’s 2.0x.

Gross Margins (Lines 5, 8 and 9) are also interesting with AMZN and WMT having very different gross margin overall (Line 5) 43% to 24%, but Walmart has a higher GM percentage (37%) than Amazon’s 22% when compared to Market Value (Line 8).

This could imply that Walmart is relatively underpriced compared to Amazon.

The PE Ratio (Line 11) is another metric where Walmart’s PE of 27.3x appears to be undervalued compared to Amazon’s negative 970x.

Price to FCF (Free cash flow) is an area where Walmart once again clearly outperforms AMZN. That puts the Price/FCF ratio strongly in Walmart’s favor with a much lower ratio of 56x compared to AMZN’s negative -38.5x.

Walmart’s dividend rate of 1.6% (line 18) is higher than Amazon’s since it doesn’t pay a dividend.

Seeking Alpha and author

Based on current financial metrics, Walmart has better numbers than Amazon.

Is Amazon A Direct Competitor To Walmart?

Amazon and Walmart compete in the online world but Walmart’s largest revenue source is groceries and Amazon is only a minor competitor there with Whole Foods.

In the online world, Amazon sells virtually everything whereas Walmart’s selections are more limited.

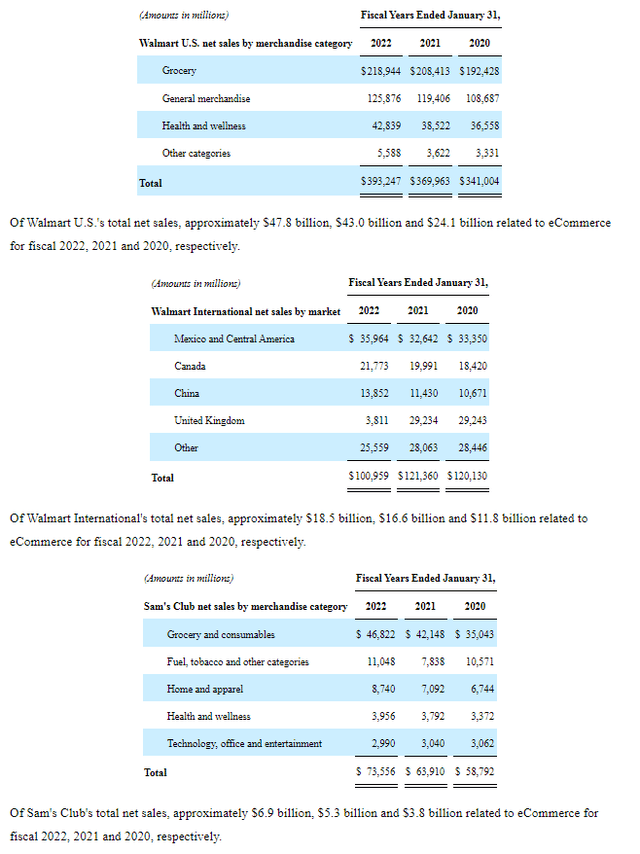

A breakdown of Walmart’s revenue from the most recent 10K gives you a better idea of their sales by source with grocery being the dominant one.

Walmart 10K

How Are Amazon And Walmart Stocks Different?

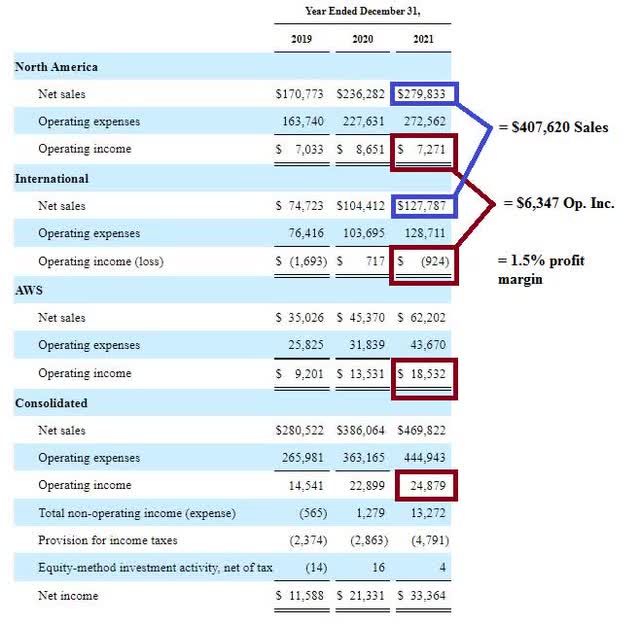

A big difference between the two companies is the huge effect AWS has on the profits of Amazon. Note the minuscule profit margin of 1.5% from e-commerce compared to AWS’s margin of 28%. Basically, Amazon is a cloud service provider with a huge e-commerce division attached.

Walmart on the other hand is a retailer.

Amazon 10K

Are These Stocks Fairly Valued?

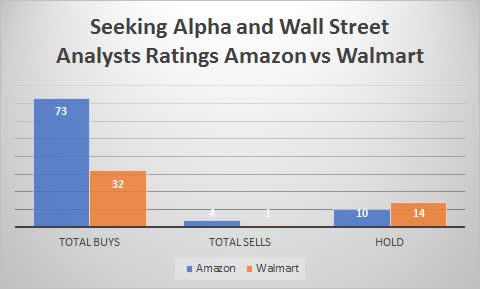

If we look at analysts’ ratings for both stocks we see that Amazon and Walmart are both rated highly by analysts. Amazon has 73 Buy recommendations and four Sell recommendations.

Walmart on the other hand has 32 Buys but only one Sell.

Seeking Alpha and author

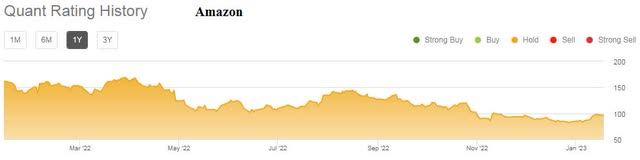

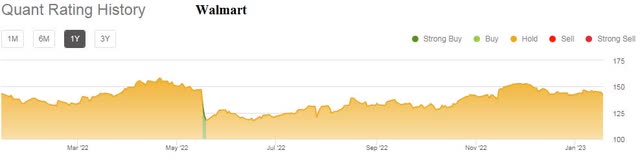

Quants, on the other hand, seem not to be enamored with either, ranking both Amazon and Walmart with a solid Hold rating.

Do the quants know something about Amazon and Walmart that the analysts don’t?

Seeking Alpha

Seeking Alpha

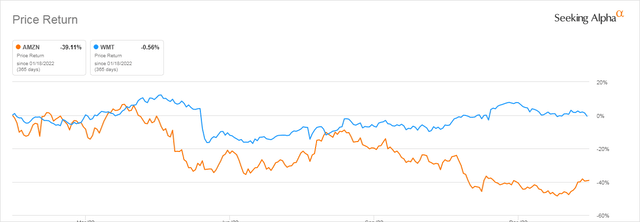

Over the last year neither has done well on a Price Return basis with Amazon down a breathtaking 39% versus Walmart‘s drop of only 1%.

Seeking Alpha

Both these stocks are more fairly valued now than they were one year ago. Still, are they reasonable enough for investment in 2023 considering the risks for the world economy, rising interest rates, and customer hesitation?

Is Amazon Or Walmart’s Stock A Better Buy?

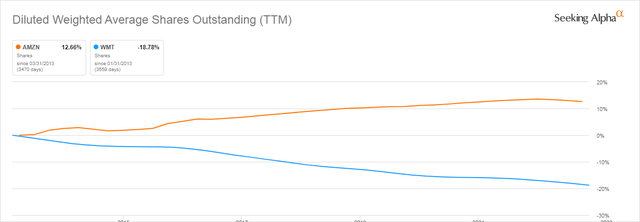

One of the advantages Walmart has over Amazon is the consistent share buyback plan that has been in place for years. Looking at the share comparison between the two companies we can see that Walmart’s share count has dropped by 19% over the last 10 years while Amazon’s has increased by 13%.

Seeking Alpha

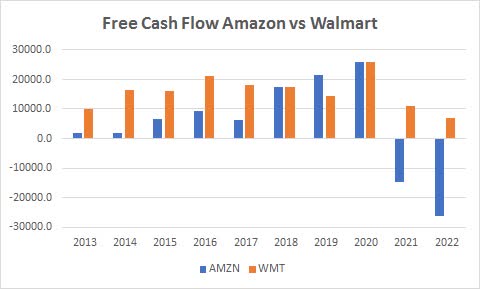

The one area of concern regarding Amazon is the huge negative FCF (Free Cash Flow) over the last two years. On a TTM (Trailing Twelve Month) basis, it was a negative $26 billion. Over the last two years, the total is over $40 billion.

Walmart’s FCF is nothing to brag about but at least it is positive.

Seeking Alpha and author

Amazon has also recently announced 18,0000 layoffs, about 6% of its workforce. That does not sound like Amazon is expecting a pick-up in revenues any time soon.

Generally speaking, neither company has had a good year, so any investment decision would have to be based upon significant improvement going forward.

I think Walmart has better and more conservative financial metrics and a more stable economic value proposition selling mainly groceries. Walmart is also buying back shares.

Amazon still has severe margin problems with the large e-commerce portion of its business and the profitable AWS portion of the business may struggle to keep Amazon’s historical price elevated. Amazon’s price-to-sales ratio may struggle to reach previous highs thereby limiting future gains.

Seeking Alpha

I rate Walmart a Buy and Amazon a Hold.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.