Summary:

- Amazon’s advertising segment is becoming increasingly important for the stock performance, as can be seen after Q2 2024 earnings.

- Amazon has broken the digital advertising duopoly of Google and Meta, but it will need to sustain a good growth rate to improve the sentiment towards the stock.

- There has been a massive investment in AI chips, and good AI tools for advertisers is the quickest way to gain good returns from the investment in these expensive chips.

- Over the long term, Amazon is in an ideal spot to deliver margin expansion by using AI and robotics within its operation.

- Amazon’s consensus EPS estimate for fiscal year ending 2026 is $7.3 which gives the stock a forward P/E ratio of 25 making it reasonably priced compared to other big tech peers.

4kodiak/iStock Unreleased via Getty Images

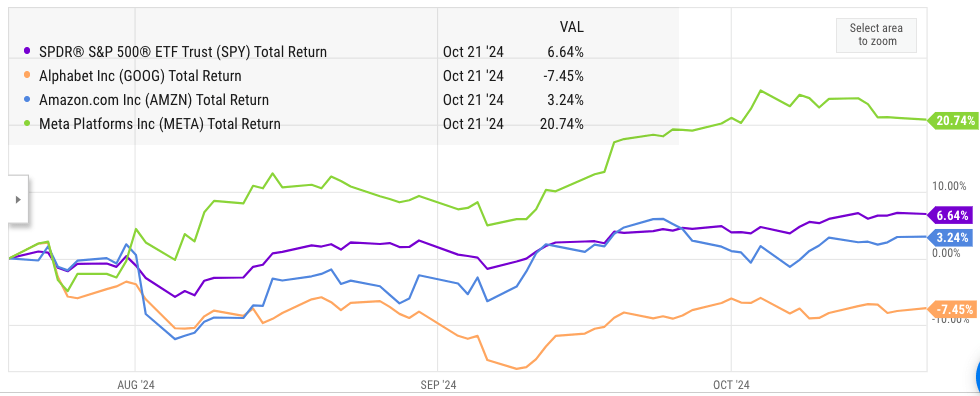

Amazon’s (NASDAQ:AMZN) most important metric for the upcoming quarter is likely going to be the YoY advertising growth rate. Wall Street is becoming increasingly concerned over the massive investments made in AI chips. The quickest way to show good returns on these investments is through better AI tools in advertising. Meta (META) reported 22% YoY growth in its advertising revenue in Q2 2024 which was higher than Google’s (GOOG) YoY advertising growth of 11% and higher than Amazon’s 20% growth in advertising business. This helped Meta stock deliver a strong bullish trajectory since the last earnings. Total returns in Meta stock since the last earnings is 21%, compared to 3% for Amazon stock and negative 7% for Alphabet stock. In the previous article, it was mentioned that Amazon could deliver margin expansion through AWS and cost-cutting measures.

The long-term growth story is important for Amazon, but it would need to show good results in key metrics in the short term to boost the stock sentiment. It should be noted that Amazon’s AWS has seen good growth and margin numbers in the last four quarters. The trailing twelve-month operating margin of AWS has increased from 25.8% in Q3 2023 to 33.4% in Q2 2024. Amazon is also investing heavily in automation and robotics within its warehouse and distribution network. This should help the company build a strong moat and gain good margin expansion over the next few quarters.

Amazon’s EPS estimate for the fiscal year ending 2026 is $7.3 which gives the stock a forward P/E ratio of 25 for fiscal year 2026. This is lower than Apple’s (AAPL) forward P/E ratio of 28 and close to Microsoft’s (MSFT) 24 for fiscal year 2026. We can see that Amazon stock is not very expensive when compared with other peers. It is possible to see EPS upward revisions if Amazon’s AI investment help improve the margins in AWS and advertising segment.

Focus on advertising growth rate

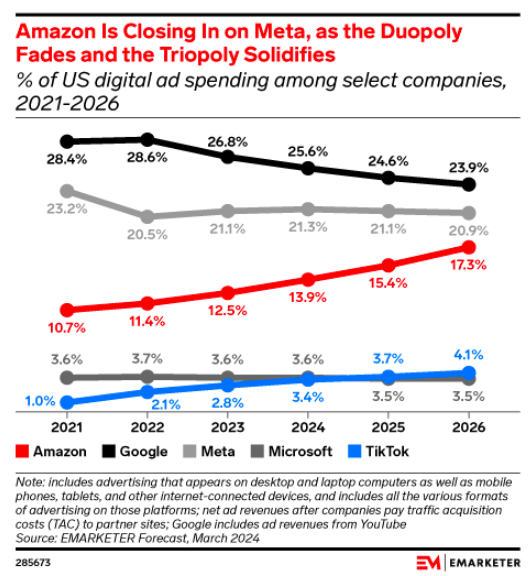

Amazon’s advertising segment has broken the digital advertising duopoly of Meta and Google. In a recent report, eMarketer mentioned that Amazon’s advertising market share could soon reach close to that of Meta and Google. This would be a great achievement for the company, which had very low revenue in this segment a few years back.

eMarketer

Figure: Amazon’s advertising market share growth. Source: eMarketer

Advertising is a high-margin business, and strong revenue growth in this segment could improve the overall margins for Amazon. Wall Street is also giving greater importance to margins and EPS among the big tech companies as the AI hype decreases. After the Q2 2024 results, Meta stock has been the best performing. A big reason is the strong 22% YoY growth in its advertising revenue. On the other hand, Alphabet reported only 11% YoY growth in its advertising revenue and Amazon reported 20% growth in advertising segment.

Ycharts

Figure: Meta’s outperformance compared to Amazon and Google. Source: Ycharts

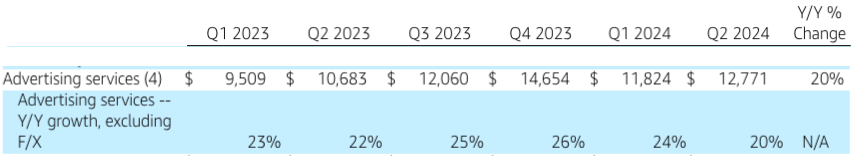

Amazon Filings

Figure: Decline in Amazon’s advertising growth rate in the last few quarters. Source: Amazon Filings

Over the last few quarters, Amazon’s advertising segment has seen a slight decrease in YoY growth rate, falling from 26% in Q4 2023 to 20% in Q2 2024. Amazon is building new AI-based tools for advertisers which should help in improving the YoY growth trajectory within the advertising business. Amazon will also be launching ads on Prime Video within important markets like Japan, Brazil and India in 2025. This should be another tailwind for the advertising business.

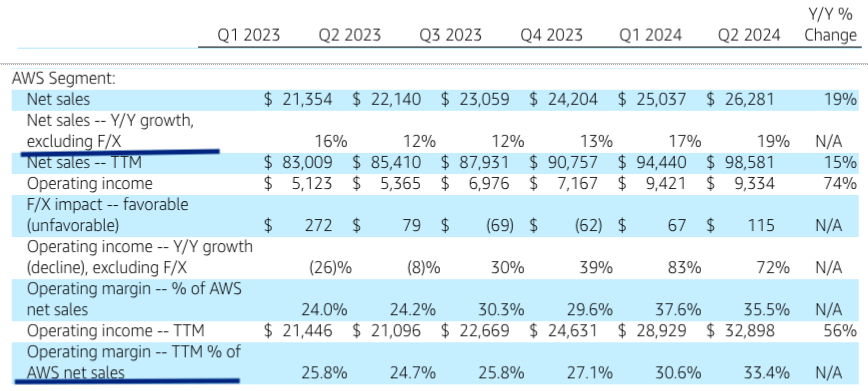

Good growth in AWS and automation

Amazon’s AWS is showing good growth inflection over the last few quarters. The YoY revenue growth in AWS increased from 12% in Q3 2023 to 19% in Q2 2024. There has also been a strong expansion in operating margin. The TTM operating margin in AWS has increased from 25.8% in Q3 2023 to 33.4% in Q2 2024. This has helped improve the company’s overall margins. AWS still contributes over 60% of the total operating margin for the company. If this growth trend continues, we could see better EPS numbers from the company in the near term.

Amazon Filings

Figure: Key metrics for AWS in the last few quarters. Source: Amazon Filings

Another major tailwind for Amazon will be the automation within its warehouses and shipping network. The company has invested heavily in robotics to reduce labor costs over the last few years. These investments will finally start showing results in the near term. The cost-cutting drive announced by the management should also help in improving the margins.

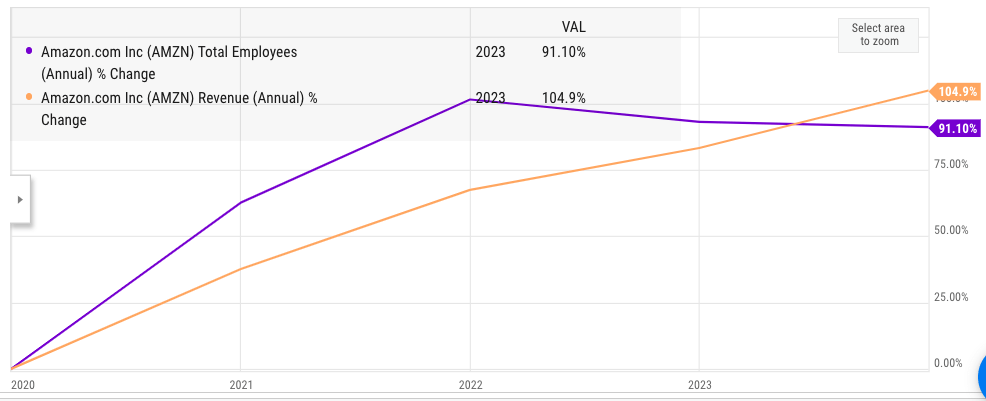

Ycharts

Figure: Growth in revenue and total employees of Amazon in last few years. Source: Ycharts

We can see in the above chart that Amazon’s headcount growth has reduced significantly in the last few quarters, while the revenue growth has been quite strong. This has helped improve the margins significantly.

Is the stock pricey?

Amazon’s market cap is close to $2 trillion, and any investment at the current price will need to closely look at the growth runway for the company. Unlike many other big tech companies, Amazon currently does not give dividends or invest in buybacks, which increases the importance of stock price growth. There was a small buyback program in 2022 but it was soon discontinued. The management is focusing on investing resources in new initiatives and logistics instead of having a big capital return program.

We can look at the improvement in valuation multiple over the last few quarters.

Figure: Amazon’s valuation multiple. Source: Ycharts

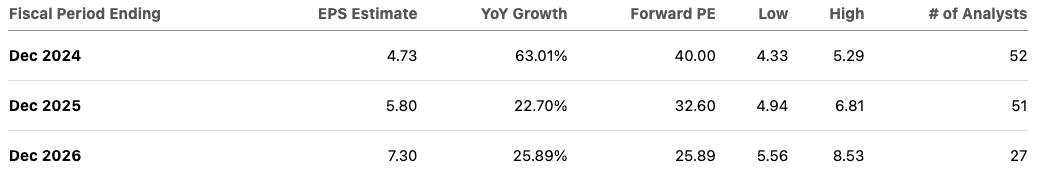

Amazon’s P/E ratio has come down sharply in the last few quarters due to rapid EPS growth. The 3-year median of P/E ratio for Amazon was 67 while the forward P/E ratio is 32. As shown below, there is a strong EPS growth projection for the next few quarters, which should further reduce the forward P/E ratio.

Seeking Alpha

Figure: Forward EPS projection of Amazon. Source: Seeking Alpha

Over the next few quarters, Amazon is projected to continue improving its EPS as more revenue comes from higher margin businesses like AWS and advertising compared to its e-commerce segment. For the fiscal year ending Dec 2026, Amazon’s EPS is estimated to be $7.3 and the forward P/E is expected to be 25.89. This is still quite reasonable compared to other tech peers.

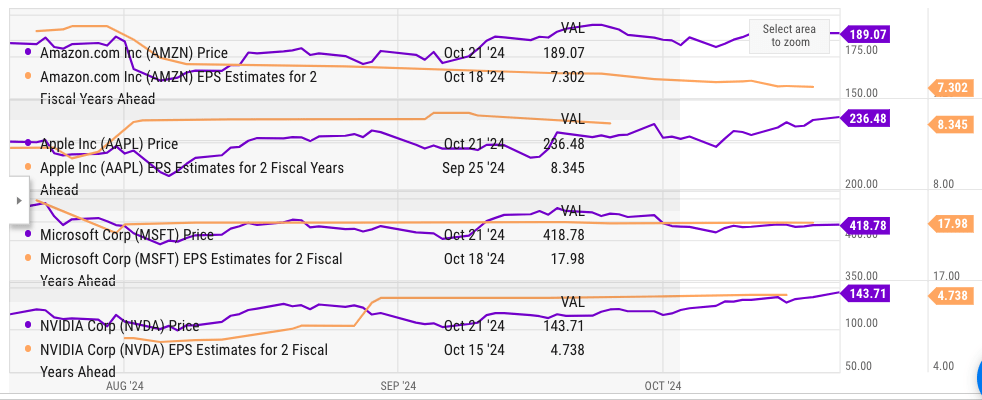

Ycharts

Figure: Comparison of forward EPS of Amazon and other big tech companies. Source: Ycharts

Apple’s forward P/E ratio for fiscal year 2026 is 28, Microsoft is 24, and Nvidia (NVDA) is 30. Compared to these big tech companies, Amazon’s forward P/E ratio of 25 for fiscal year 2026 looks quite reasonable. The YoY revenue growth projection of Amazon is also quite robust as the company continues to invest heavily in international operations and builds a more robust logistics network.

Amazon has a good moat and if the company delivers strong advertising growth in the upcoming earnings, we could see a bullish momentum for the stock.

Investor Takeaway

Amazon’s upcoming quarter and the near-term stock direction will be highly dependent on the performance of the advertising segment. We have already seen Meta outperform all other peers due to its strong advertising growth. The AWS segment continues to perform well and is showing margin expansion despite the massive revenue base.

Amazon stock does not seem to be very pricey compared to other big tech peers when we look at forward EPS growth estimates. Slower growth in the low-margin e-commerce segment will also help increase the revenue share of higher-margin segments. This should help in improving the EPS growth trajectory over the next few quarters. The management has taken a number of steps to reduce costs and optimize headcount. The upside potential for the stock is quite good, making it a Buy at the current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.