Summary:

- Today, I will explore a few topics with you, principal among which will be a comparison of the operating philosophies of AWS and Azure.

- We will explore the strategies that both businesses have employed and what their futures may look like based on the strategies they employ in the future.

- We will also discuss equity investing through the lens of risk = return, as well as Amazon’s ad businesses and the TAM thereof.

- In short, while I am not nearly as bullish on Amazon as I’ve been over the last year, I do believe it still represents a good value for investors at these levels.

HJBC

A Brief Introduction That Explores Nuance Of Risk = Return And Equity Investing

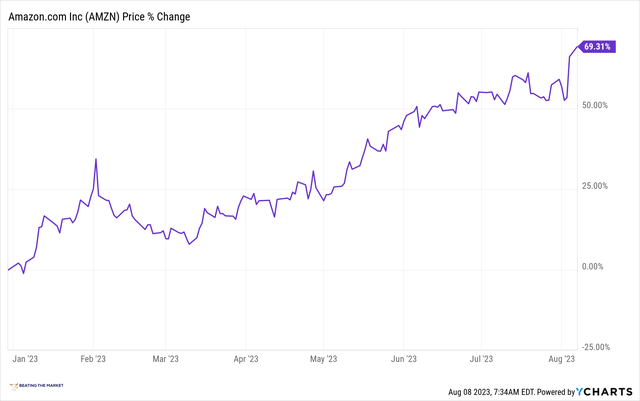

Over the last 9 months, I have been heavily focused on highlighting/accumulating Amazon (NASDAQ:AMZN) Stock. I began this focus specifically in late 2022 by placing my highest rating on the business that I’d ever placed in my investing service’s history: I rated it a very strong buy with a 12% weighting, suggesting that the risk = return equation was vastly out of balance.

Amazon’s YTD Return

That is, I contended that the risk we assumed in buying the business at ~$85/share in late 2022 was effectively 0% (there is nothing that has 0% risk, of course. Even the “risk-free rate,” i.e., U.S. Treasuries have yields that indicate there’s risk associated with purchasing them; however, I have recently argued that multi-national corporations like Microsoft (MSFT) or Amazon could actually outlast the American empire in its current form.

I reasoned that there was effectively 0% risk (again, I understand there is no such thing as no risk, but this was my perspective), and Amazon’s return equaled something on the order of 20%+ annualized returns for the next 10 years, so we had a risk = return equation that looked something like this:

- (Risk = return) : 0-5% = 20-30%

This asymmetry is principally what I work to find and share with you. It is why I study businesses (outside of the pure fun of doing so).

This is the central logic underpinning the companies I buy: I’m constantly searching for asymmetric risk = return equations such that I can assume relatively little risk relative to the prospective return I will receive. I’m constantly searching for asymmetric risk = return equations such that risk equals a percentage materially lower than the return percentage.

To this end, before we begin today’s discussion, if you’ve not already, I encourage you to read my most recent note on Amazon, which detailed my simplified thesis granularly over the last 9 or so months:

- Amazon Stock‘s Profligacy Is Destroying Shareholder Value

AWS Appears To Have Stabilized, And It Could Accelerate Growth From Here

As the economy has been uncertain over the last year, AWS customers have needed assistance cost optimizing to withstand this challenging time and reallocate spend to newer initiatives that better drive growth. We’ve proactively helped customers do this. And while customers have continued to optimize during the second quarter, we’ve started seeing more customers shift their focus towards driving innovation and bringing new workloads to the cloud. As a result, we’ve seen AWS’ revenue growth rate stabilize during Q2 where we reported 12% year-over-year growth.

Andy Jassy, CEO, Q2 2023 Amazon Earnings Call

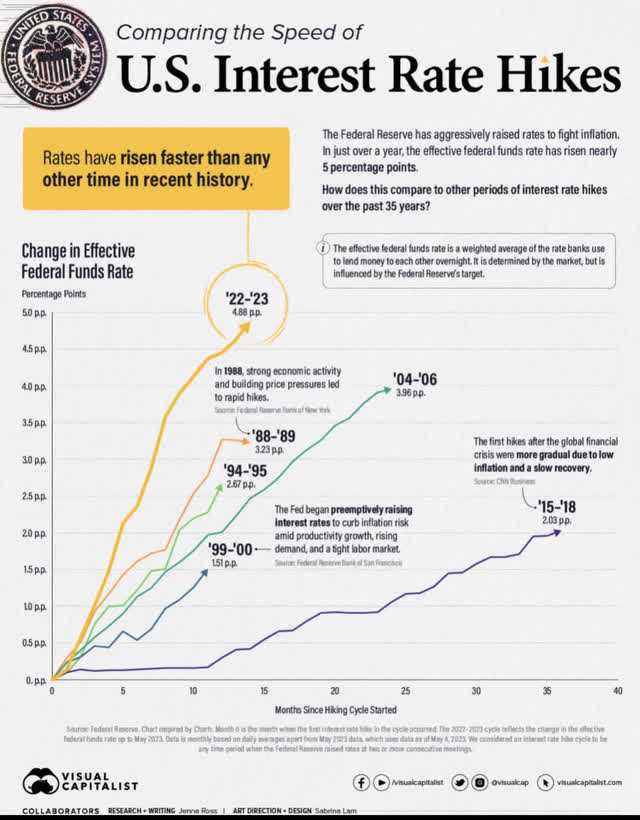

Throughout 2023, I have emphasized that software has been going through a downcycle. Software growth rates across the board have been in decline due to the fastest interest rate hiking cycle in American history. We can see this reality in data points such as the median growth rate for all publicly traded software companies:

Clouded Judgment By Jamin Ball

I believe we will see a sub-20% median growth rate in Q2 2023, as recent reports indicate that a rebound has not yet fully occurred, despite AWS ostensibly stabilizing in Q3 2023. More on this in a bit.

Importantly, this softness has given us the opportunity to buy many high-quality software names, and it will likely continue to open opportunities for us.

Late 2022 and much of 2023 have been the best time to buy software companies.

2020 and 2021 were arguably the worst times possibly in American history, hence we did not buy most of the popular software names (e.g., CrowdStrike (CRWD) or Snowflake (SNOW) during that period, and, instead, waited until late 2022/early 2023 to begin purchasing via our disciplined, long term oriented dollar cost average strategy).

The best time to buy quality businesses is when they go through a difficult period, as has been the case for many software businesses over the last 12 months or so.

The worst time to buy them is when everyone knows they are doing well, and, commensurately, everyone is buying their stock.

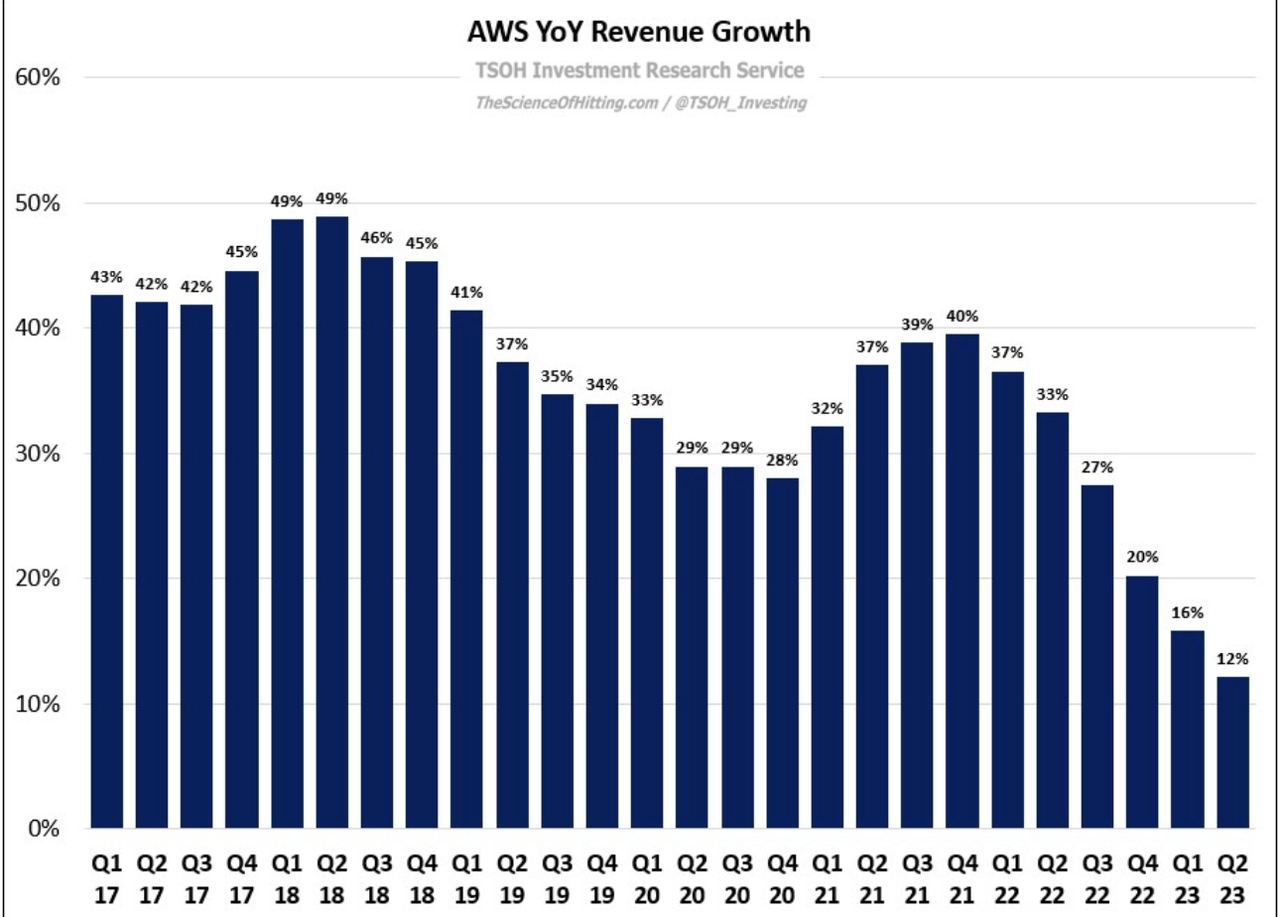

Turning to AWS, we can see the same deceleration, which software companies broadly have experienced, in AWS’s growth rates over the last year or so as well:

AWS’ Quite Legendary Growth Rate Deceleration

The Science Of Hitting By Alex Morris

AWS’ decelerating growth rate has been quite breathtaking, but we know that this is nothing out of the ordinary, nor idiosyncratic to AWS, when we consider the context I just shared with you.

As one more contextual piece of software growth data (to be sure, there are many such pieces of data out there), I’ve often shared that Snowflake did not grow for the entire month of April. 0%. Nothing. No growth. For such a young and dynamic business, with a desirable product and exceptional corporate execution, this was fairly incredible and indicative of the challenging times software businesses have faced as of late.

But it’s par for the course (it makes sense) when we consider that we just experienced the fastest rate hiking cycle in American history, which spawned the 2nd, 3rd, and 4th largest bank failures in American history in early 2023, all of which very likely has contributed to both the downcycle in software, and the downcycle in digital ads as an aside.

America Has Executed The Fastest Interest Rate Hiking Cycle In Its History, Which Has Slammed The Brakes On Growth In A Variety Of Sectors In The Economy

Why AWS Won & How The King Of Software Met Its Match

Next, a few words about AWS. AWS remains the clear cloud infrastructure leader with a significant leadership position with respect to number of customers, size of partner ecosystem, breadth of functionality and the strongest operational performance. These are important factors for why AWS has grown the way it has over the last several years and for why AWS has almost doubled the revenue of any other provider.

I’ve talked to many AWS customers over the years and continue to do so. And while all these factors I mentioned have been big drivers of the business’ success, AWS customers tell us that as importantly, they care about the very different customer focus and orientation in AWS may see elsewhere.

Andy Jassy, CEO, Q2 2023 Amazon Earnings Call

Over the last few weeks, I’ve been discussing the competitive positioning between AWS vs Azure. My central point has been that, for cloud infrastructure businesses like AWS, Azure, and GCP, creating an open ecosystem that emphasizes empowering small software businesses to bring their big visions to life over the course of a couple of decades will be seen as the long-term winning strategy.

I do not believe relentless vertical integration, alongside targeted replication of the best software businesses will yield the largest infrastructure ecosystem long term. Aggressively vertically integrating, aggressively replicating smaller software businesses’ winning ideas, aggressively creating a closed-vertically integrated ecosystem may yield decent results in the near term, but, ultimately, the largest public cloud infrastructure business will be built by way of an open, partner-centric, empowering orientation and mindset.

I have contended that Microsoft has been caught in something of an Innovator’s Dilemma where it’s serving two masters simultaneously:

- 1st Master: Focus on its legacy application software business and cause rapidly growing, smaller software businesses to not want to do their business with Microsoft, leading to lower long run TAM for Azure, or…

- 2nd Master: Focus on its IaaS/PaaS (Azure) business (via creating an open, partner-centric ecosystem) and risk growth stagnation for its legacy application software business.

In some sense, it cannot do both simultaneously, though it has tried, and, to be sure, it’s done a great job. I think Microsoft will continue doing so, but I also think there’s a reason AWS is nearly twice the size of Azure and its home to the most dynamic, rapidly growing software businesses on earth.

More than 90% of the startups on the Cloud 100 run their businesses on AWS … These leaders could choose any cloud provider, and they choose AWS.

AWS re:Invent in review: Highlights for customers in retail and CPG | Amazon Web Services

And it makes sense: AWS’ CEO does not often appear on CNBC vocally touting its software application business that competes with the young 30-something or 40-something-year-old’s software startup. AWS’ CEO is not vocally touting its new product that will kill that software startup’s growth.

Microsoft is publicly in direct, constant, and intense competition with what could be its best customers long term, who would serve to drive durable long-term growth for Azure in the decades ahead.

Here is the Cloud 100 referenced above:

To be sure, in recent years, AWS has begun vertically integrating more and more software products; however, there’s a decision that both AWS and Azure must make:

- Further vertically integrate software application businesses to create growth for their software application businesses, or focus on being a partner-centric, open ecosystem that welcomes and empowers the youngest and most innovative software companies to its platform.

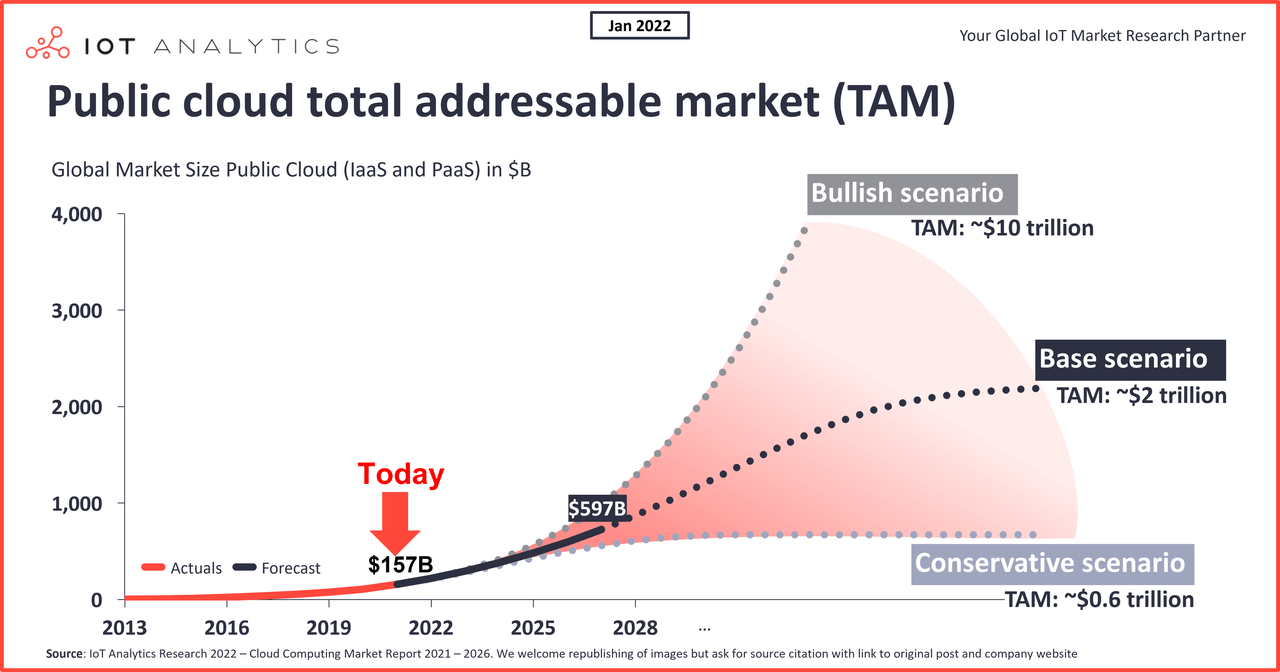

In my eyes, the latter orientation is the right path to take, though it requires a bit more of a long-term mindset, and the more open platform will likely capture the largest market share of a TAM that could be vastly larger than most appreciate today.

Cloud Infrastructure TAM Could Reach Trillions In The Next 10-20 Years

IoT Analytics

With all of these ideas in mind, I do not believe AWS has reached its terminal growth rate at 12%, and it’s quite possible that it reaccelerates growth into the second half of 2023, especially in light of some of the commentary we received on the Amazon Q2 2023 earnings call.

So again, if we rewind to our last conference call, we had seen 16% AWS revenue growth in Q1, and the growth rates have been dropping during the quarter. And what I mentioned was that April was running about 500 basis points lower than Q1. What we’ve seen in the quarter is stabilization and you see the final 12% growth.

I will stop for a moment and just put that in perspective. So again, last Q2 last year, we had close to $20 billion of revenue and we grew that $2.4 billion. So that’s — while that is 12%, there’s a lot of cost optimization dollars that came out and a lot of new workloads and new customers that went in. So there was — on our base, it’s very large numbers. And when customers start to — that cost optimization work, they can take some of their spend down for a while as they do that, and we help them do that and been part of our DNA ever since we started AWS. So that’s all good.

What we’re seeing in the quarter is that those cost optimizations, while still going on, are moderating and many maybe behind us in some of our large customers.

And now we’re seeing more progression into new workloads, new business. So those balanced out in Q2. We’re not going to give segment guidance for Q3. But what I would add is that we saw Q2 trends continue into July. So generally feel the business has stabilized, and we’re looking forward to the back end of the year.

Brian Olsavsky, CFO, Q2 2023 Amazon Earnings Call

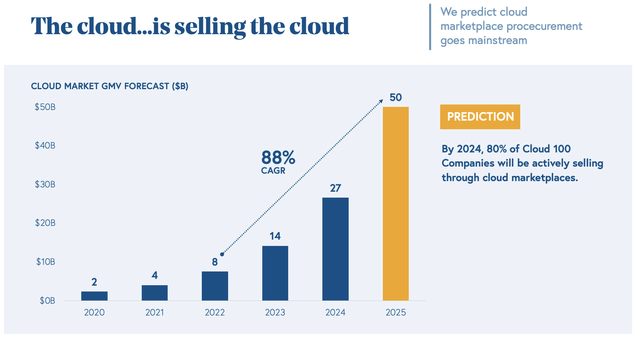

To close, I wanted to share a data point with you that I believe is worth monitoring.

Cloud software marketplaces on public clouds, such as AWS or Azure, have been growing rapidly. This will be a trend to monitor in the years and decade ahead:

GMV For 3rd Party Software Marketplaces On AWS, Azure, And GCP

Let’s now touch on the second primary pillar of Beating The Market’s thesis for Amazon.

Digital Ads

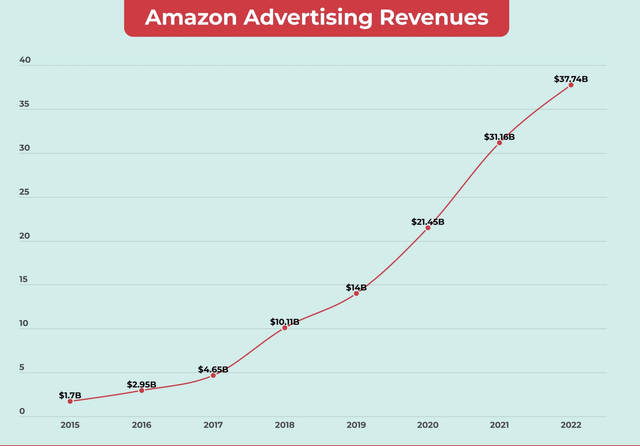

Incredibly, despite the digital ad market finding itself in something of a state of growth paralysis, Amazon’s digital ads business continues to produce 20%+ growth and has done so for the last 8 consecutive quarters through the fastest interest rate hiking cycle in American history.

Advertising revenue remained strong, up 22% year-over-year. Our performance-based advertising offerings continue to be the largest contributor to our growth.

Our teams worked to increase the relevancy of the ads we show to our customers by leveraging machine learning and improve our ability to measure the return on advertising spend for brands.

Brian Olsavsky, CFO, Q2 2023 Amazon Earnings Call

As I’ve often noted, digital ads are actually an AI revolution at its core. It is the application of machine learning and artificial intelligence to the traditional ads industry (what we’d called in Inverse Bubble within Beating The Market).

We recently discussed this attractive industry for investment in a note entitled, “Rapidly Growing Industries,” which you may read via the link below:

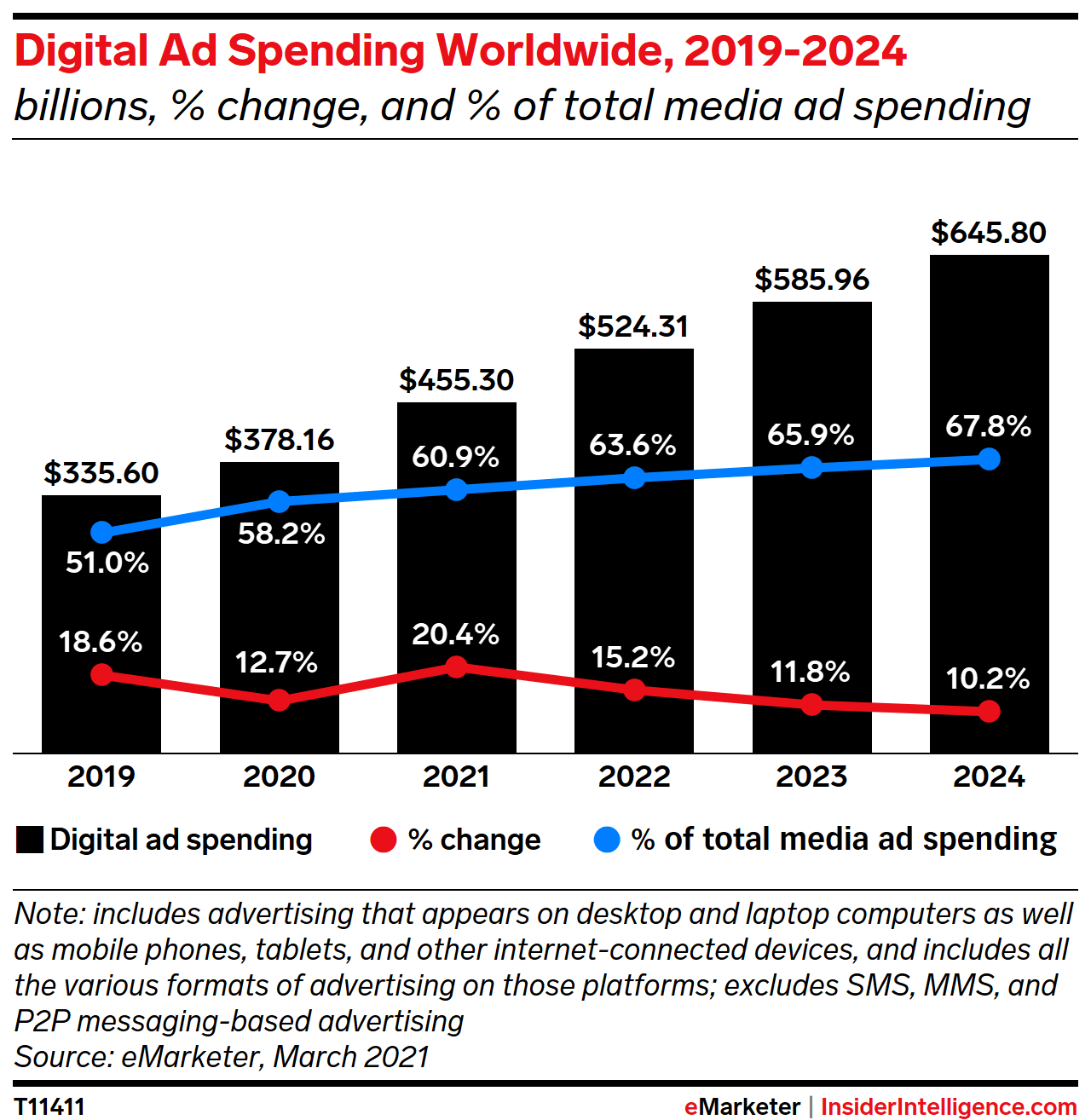

Within that note, I shared a few TAM charts for the digital ad industry:

eMarketer

As we see, the digital ad industry will continue to grow at healthy rates for the next couple of years, and I believe well into the future.

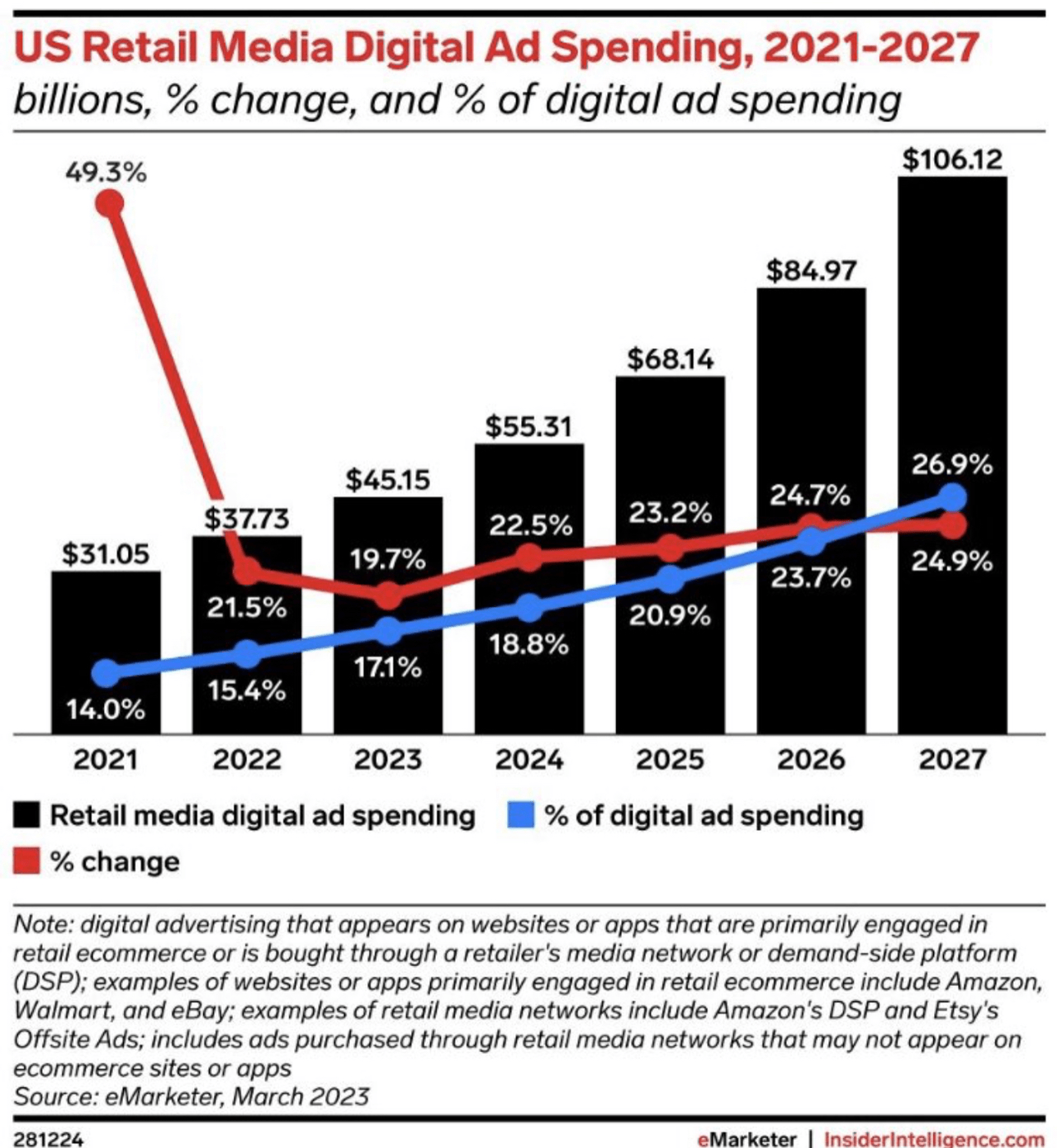

But, in “Rapidly Growing Industries,” I specifically highlighted that it’s not so much the digital ads industry that’s attractive as much as it is the subset of digital ad industries within the overall digital ad industry.

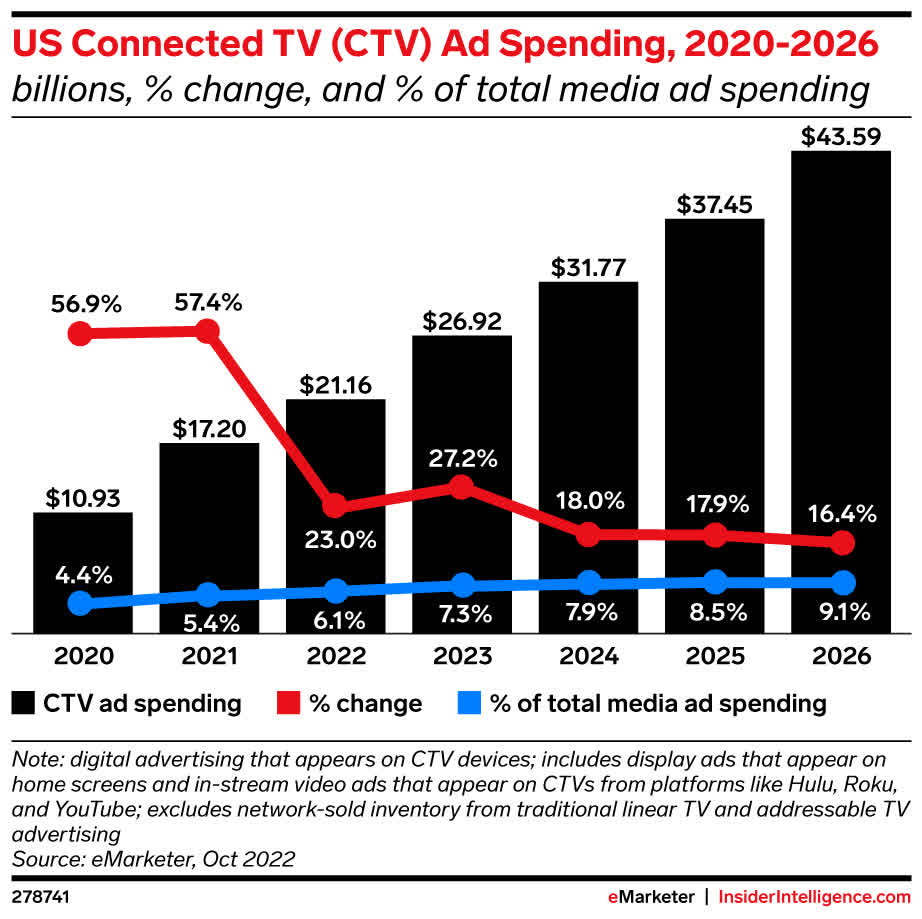

Amazon’s ads business is comprised principally of its ecommerce digital ads business (the TAM of which is depicted in the first chart just below) and its Connected TV ads business (the TAM of which is depicted in the second chart just below).

Both of these digital ads businesses are growing rapidly within digital ad subset TAMs, which are growing more rapidly than the overall digital ad TAM depicted above.

Ecommerce Digital Ad Spend (Read Description For Precise Definition)

eMarketer

I’ve not seen many folks discussing this TAM specifically, but I believe it will create a handful of 5x to 10x return businesses in Amazon, Coupang (CPNG), Sea (SE), and MercadoLibre (MELI) over the next 10 years or so.

We’ve dubbed this cohort “MACS,” as an aside.

eMarketer

Amazon’s ad business continues to defy the growth of the broader digital ad market because it is concentrated in these more rapidly growing subsets of the overall digital ad market.

We can see this growth graphically depicted below:

Concluding Thoughts: Andy Jassy At The Helm

While working through Amazon this time around, it dawned on me that there may be something symbolic about Mr. Jassy being appointed as CEO of Amazon.

As I wrote in our last consideration of Amazon,

In no uncertain terms, I believe Amazon has built the most important computing platform of the next 100 years.

The demand for compute and storage will only grow from here, and AWS will be at the center of this growth in demand.

To this end, I believe we should alter our thinking of Amazon:

It is not an ecommerce business.

That has become a sideshow at this point (note the ad sales however).

AWS is Amazon, and not the other way around.

The State of our Stocks 131 (AMZN)

I believe there’s a very long and evolving path ahead for AWS’ growth, and Mr. Jassy’s appointment as CEO is something of a testament to this reality:

Amazon did not select its ecommerce or advertising CEO to run Amazon.

It selected its AWS CEO. It selected the man who will steward the company into its next evolutionary stage of itself, as the foremost cloud computing business on earth; one that will provide large portions of necessary infrastructure compute for the world’s 4th industrial revolution, digital economy.

Mr. Jassy’s selection is not just a selection of merit, but also a symbol of the future of Amazon.

Thank you for reading, and have a great day.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.