Summary:

- Amazon’s 2Q24 results beat expectations, with retail coming in mixed while AWS exceeded expectations.

- AWS saw acceleration for the third straight quarter, with management commentary skewing positive.

- Cost optimizations are likely a thing of the past and customers are now looking to add new projects and spend more on cloud migration and AI.

- Retail was mixed as Amazon continued to grow faster than the industry, but customers are reducing discretionary spend and trading down.

- There were also some encouraging announcements for Project Kuiper.

Anderson Coelho

While Amazon.com, Inc. (NASDAQ:AMZN) has fallen almost 20% from the peak to the trough, I am not worried about the company.

In fact, I have a buy investment rating for Amazon and remain positive about the long-term opportunity for the company.

In this article, I will elaborate more about my buy investment rating based on the company’s fundamentals, recent earnings, financials, and valuation setup.

I have written extensively about Amazon on Seeking Alpha, which can be found here.

2Q24

Firstly, I have a buy investment rating for Amazon because its recent 2Q24 results suggest that the fundamentals of its all-important AWS segment were solid, despite mixed retail business performance.

Overall, the positive trends in AWS were somewhat offset by a mixed retail business.

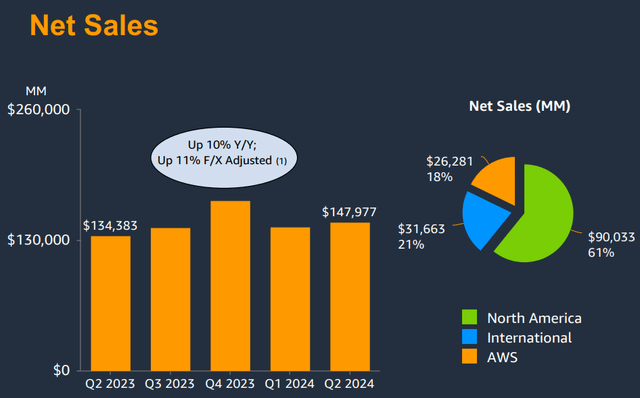

Revenue for 2Q24 came in at $148 billion, up 11% on a constant currency basis. This came in at the high end of guidance and in line with consensus expectations.

Operating income came in at $14.7 billion, or 9.9% margin, above the high end of the guidance of $14 billion and 7% ahead of consensus.

EPS came in at $1.26, 22% ahead of consensus.

AWS re-accelerated in the quarter and showed strong momentum, with more commentary below pointing to positive trends.

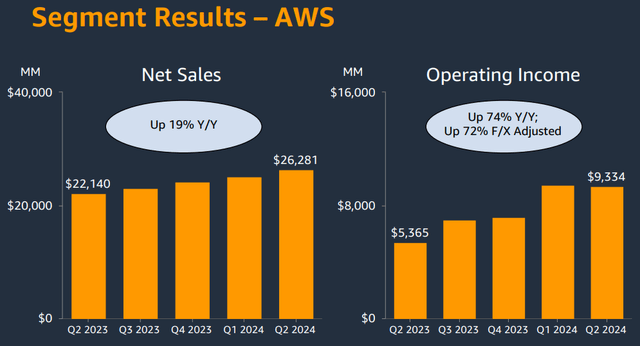

AWS segment came in at $26.3 billion and re-accelerated to 19% growth in the quarter, beating consensus by 1%.

AWS operating margin came in at 35.5%, which was also ahead of consensus expectations of 31.5%.

The retail segment was somewhat mixed relative to expectations.

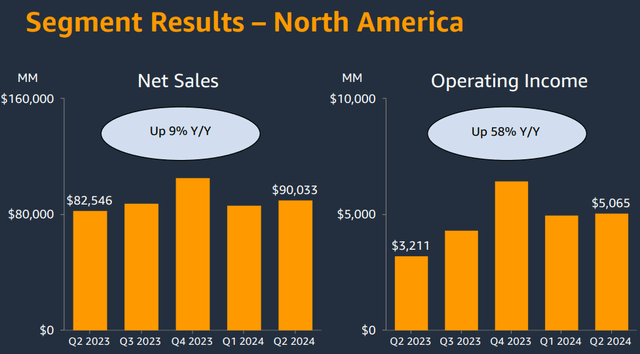

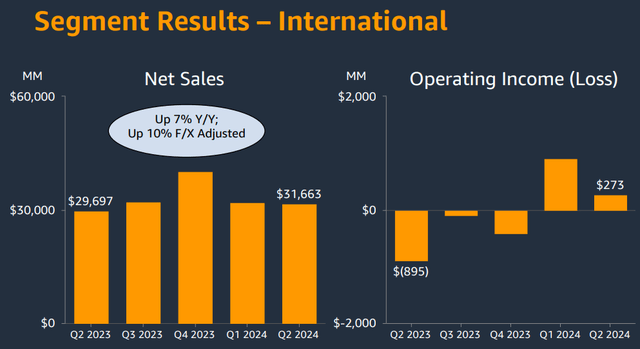

North America revenue came in at $90 billion, growing 9% on a constant currency basis, while international retail revenue came in at $31.7 billion, growing 10% on a constant currency basis.

North America segment (Amazon)

North America revenue was in line with consensus, but international retail revenues were 3% below consensus.

North America operating income grew 170 basis points from the prior year to $5.1 billion or 5.6% operating margin.

International operating income grew 1,100 basis points from the prior year to come in at a positive $273 million, or 0.9% margin.

International segment (Amazon)

In terms of Amazon’s outlook, the third quarter revenue guidance was somewhat in line with expectations, while operating income guidance was weaker than expected, as a result of increased investments into its business.

The 3Q24 guidance for revenue came in the range of $154 billion to $158.5 billion, somewhat in line with consensus expectations

The 3Q24 operating income guidance came in the range of between $11.5 billion to $15 billion compared to the consensus of $15.3 billion. At the midpoint, this missed consensus by 13%.

AWS acceleration

A key part of the thesis for the buy investment rating for Amazon is the acceleration of AWS.

To me, I am watching AWS for sustainable reacceleration signs and in this quarter, I think AWS showed us that it is indeed seeing solid momentum.

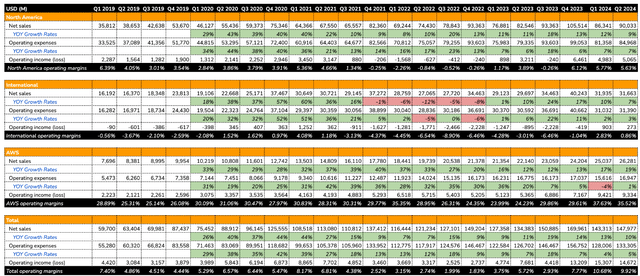

As can be seen below, AWS’s 19% revenue growth in 2Q24 is the third consecutive quarter of acceleration we have seen. Since AWS growth rates bottomed in 3Q23 with 12% revenue growth, the acceleration of AWS has been quite impressive.

Subsequently, in 4Q23, AWS accelerated 1 percentage point, in 1Q24, it accelerated 4 percentage points and in 2Q24, it accelerated 2 percentage points.

While probably still early days, this trend of the growth rates reaccelerating is certainly an encouraging one that seems to be sustainable.

Amazon segment breakdown (Amazon)

This AWS acceleration seems sustainable due to 3 main big trends that are driving AWS growth.

The first one is that CEO Andy Jassy highlighted that he sees that its customers have completed the significant majority of their cost optimization efforts and are once again focused on new projects and initiatives. This is highly positive because the deceleration in AWS growth rates from 4Q21 to 3Q23 was due to cost optimization efforts by its customers, causing a headwind to the AWS business. With a significant majority of that now completed, it implies that cost optimization will no longer be a significant headwind to growth, and in fact, with new projects and initiatives, this can even drive acceleration in revenue growth.

The second one is that the trend of migrating from on-premises infrastructure to the cloud to save money and improve productivity. AWS is once again seeing companies starting to want to modernize their infrastructure and ignite conversations about this migration once again. As a result, the migration to the cloud should provide another tailwind for AWS, which has the broadest functionality, strong security, and operational performance and thus a key choice amongst cloud service providers.

Lastly, the topic that every investor is so focused on today, where AWS is seeing companies looking to leverage on AI. AWS currently has an AI business that continues to grow very quickly and it is already at a multi-billion dollar revenue run rate despite it being early days.

Another key part of the investment thesis for Amazon is AWS’s exposure to the AI trend.

AWS is not only ensuring that they have the broadest selection of Nvidia instances available, but also offering better price performance through its own custom silicon for training, Trainium, and inference, Inferentia.

The second version of Trainium is ramping up in 2H24, and management suggested that they are seeing “significant demand” for this.

Management also said they are seeing model builders increasingly standardize on SageMaker, while Bedrock is focused on having the largest selection of models, recently adding Anthropic’s Claude 3.5 models, Meta’s new Llama 3.1 models, and Mistral’s new Large two models.

On the application layer, AWS continues to see strong adoption of Amazon Q, its generative AI-powered assistant for software development.

In fact, AWS saw that with Amazon Q’s code transformation capabilities, Amazon has migrated more than 30k Java JDK applications in just a few months, which saved $260 million and 4,500 developer years compared to what it would have otherwise cost.

AWS launched more than twice as many machine learning and generative AI features into general availability in the last 18 months than all the other major cloud service providers combined.

This highlights the commitment of AWS to be at the frontier of AI, ensuring that customers get the broadest functionalities on its platform and continuing to innovate on its AWS offerings.

Amazon is very bullish about the medium to long-term impact of AI not just for its own businesses, but also the businesses of its customers.

On the topic of AI capex.

I think CEO Andy Jassy gave some interesting color about what the AI capital expenditures entail for a large, global cloud provider like AWS.

The logistical challenge of AWS is that it has 35 regions in which it operates, where each region has a cluster of multiple data centers, and 110 availability zones, which is equivalent to a data center.

The challenge is then to have sufficient capacity in the respective availability zones so that you are able to meet the demand. The potential downside is that if AWS has too little capacity, and this leads to the inability for customers to scale their applications or even experience service disruptions.

At the same time, AWS is mindful of not having too much capacity so that it does not hurt the returns on investment.

To do that, AWS built models and systems to manage this capacity to meet demand, and they have done this well so far in a way that enables the company to land the right amount of capacity.

For AI, AWS has a very significant advanced signal from customers that want to take up a decent amount of capacity. The emphasis here is that AWS gets lots of signals from customers about what they need, and the investments they are making today are to meet the significant demand it is seeing within AI.

In fact, AWS wants to have more capacity right now, which really goes to show the very strong demand signals that they are seeing.

Lastly, AWS mentioned that AI will be a very, very large business” for AWS, which again shows the strong demand that AWS is seeing in the business.

Project Kuiper

While still in the early stages, in the long term, Project Kuiper is like a nice call option for the Amazon investment thesis, given the huge business opportunity and high barriers to entry into this business.

I think we are starting to see things getting kicked off with Project Kuiper, which is Amazon’s low-Earth orbit satellite constellation.

Amazon is currently accelerating satellite manufacturing at its facility and has announced a distribution agreement with Vrio to offer Project Kuiper’s satellite broadband network to residential customers in seven countries in South America.

Project Kuiper will be shipping production satellites later in 2024 and management said that they continue to see significant demand for the services from Project Kuiper from enterprise and government entities.

I continue to see Project Kuiper as a budding business for Amazon which has the potential to be a very large revenue contributor in the future.

Retail business

Another key part of the investment thesis is the retail business of Amazon, where it remains a leader, and while the trends were mixed in the quarter as mentioned above, Amazon’s retail business has held up better than many other competitors.

Management is citing that a lot of the consumer trends that they have been talking about in the last year continue to be present, which includes customers being careful with their spending, and trading down to look for lower ASP products.

This trend was present in 2Q24, and management expects that to continue into 3Q24.

Amazon has been very successful in helping customers trade down. Instead of spending on discretionary items, customers are buying lower-priced items, which plays into the hands of Amazon’s everyday essentials business.

At the same time, within the discretionary higher ticket items like electronics and computers, Amazon continues to grow faster than the industry, but this remains at a growth rate lower than what we would have seen in a more robust economy.

All in all, Amazon’s ability to offer what the customer wants has helped its retail business remain strong relative to the overall consumer industry.

Valuation

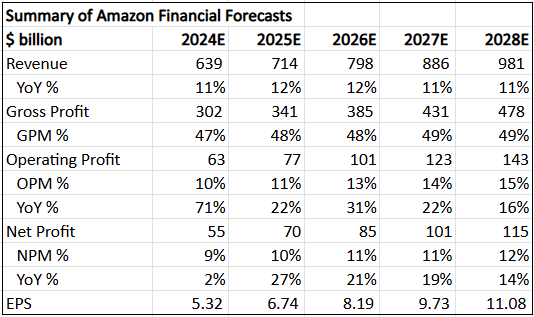

I am reiterating my 5-year forecast for Amazon given no material changes this quarter. Top-line revenue growth CAGR is about 11% in the 5-year period, with EPS CAGR at 17%. This skews conservative as we could see a further acceleration in AWS or the weakness in retail could dissipate sooner than expected.

Summary of 5-year financial forecasts (Author generated)

My intrinsic value for Amazon is $200, based on a lowered terminal multiple of 30x which is more reasonable for 2028 P/E, while the cost of equity remains at 12%.

The 1-year and 3-year price targets are $236 and $292 respectively, based on 2025 35x P/E and 30x 2027 P/E.

Conclusion

I think this is an excellent opportunity to invest in Amazon today, hence the buy investment rating for the company.

Across the board, Amazon’s businesses continue to be solid.

AWS is now pivoting to a position of strength, and the acceleration in growth of AWS is a key part of the investment thesis. There are three clear and major trends that will continue to drive the AWS business in the long term.

AI will no doubt be a key driver for the business and one that will be a significant contributor in the long term.

While we are seeing some softness in retail, this is perfectly normal for the business and does not reflect any deteriorating fundamentals. In fact, Amazon’s retail business is faring better than competitors and remains a clear leader in the space.

Lastly, with all that in mind, the valuation for Amazon remains attractive, with the risk-reward skewed to the upside.

While there are some concerns out there in the market, I am not worried about the future of Amazon.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, the AI deep dive report, and access to The Barbell Portfolio.

The Barbell Portfolio outperformed the S&P 500 by 50% in the past year through owning high conviction growth and contrarian stocks.

Apart from providing bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join Outperforming the Market before the 20% price hike next month.