Summary:

- I had rated Amazon a ‘Neutral/Hold’ last June but upgraded it to a ‘Buy’ at the end of Jan this year, capturing +3.96% in active return.

- Now, I’m revising that to a ‘Neutral/Hold’ again as I note merely adequate growth in its E-commerce segment and reasons to be cautious given the proximity to 4-monthly resistance levels.

- This is balanced by my bullish outlook on AWS, which I think is well-poised for growth reacceleration as enterprises increase their tech spend allocations.

- I also think we will see further margin expansion in the stock as the company implements a host of improvements in logistics and advertising, benefiting e-commerce EBIT margins.

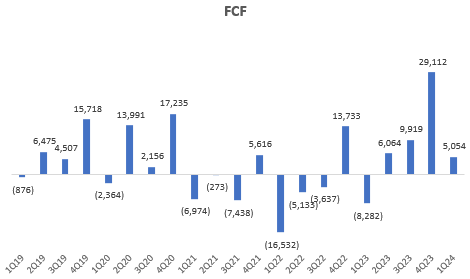

- On the risks side, higher capex and equipment lease expenses are expected to generate AWS growth. I am watching the AWS margin and overall FCF figures for signs of downside surprises.

stefanamer/iStock via Getty Images

Performance Assessment

My last article update on Amazon.com, Inc. (NASDAQ:AMZN) was a year ago. I had held a ‘Neutral/Hold’ stance as I was concerned about the growth prospects. However, 6 months later, just before Q4 FY23 earnings, I changed my stance to a ‘Buy’:

Communication of Author’s Change in Stance (Author’s Last Article on Amazon, Seeking Alpha)

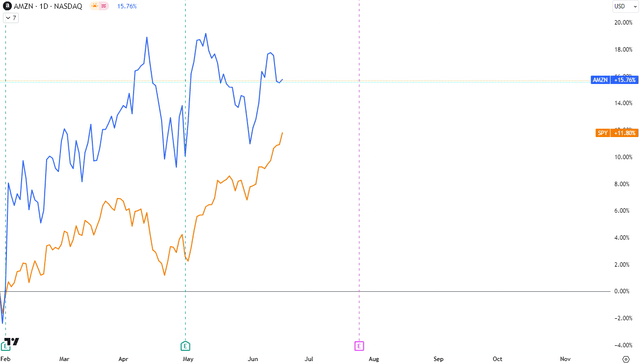

This revision has worked out well as AMZN has generated +15.76% in total shareholder return vs the S&P500’s +11.80% since that ‘Buy’ upgrade, leading to +3.96% in active return:

AMZN vs SPY Total Shareholder Return Since ‘Buy’ Update (TradingView, Author’s Analysis)

Thesis

Compared to last year, there are still some growth concerns in the e-commerce part of the business, but this is offset by an exciting outlook ahead for AWS and an impressive evolution of the company’s profitability. Altogether, I am adopting a ‘Neutral/Hold’ stance again on the stock based on these key thesis points:

- Overall Commerce segment revenue growth is at adequate levels.

- AWS is at an inflection point; poised well for a sharp growth revival.

- There is a clear track for continued increases in profitability in the ex-AWS businesses.

- There is scope for multiple expansion following earnings-driven growth.

- Technicals give some reason for caution.

Overall and Commerce segment revenue growth is at adequate levels

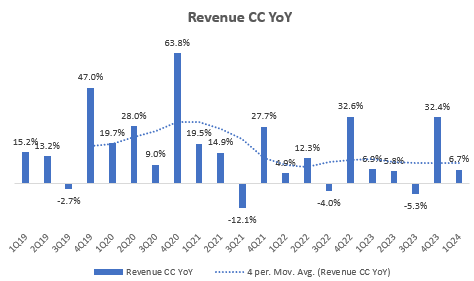

Amazon’s overall revenue growth on a constant currency (CC) basis is ticking in the high-single digits YoY. Look at the 4-period moving average levels in the chart below as that normalizes for Q4 seasonality:

Revenue Constant Currency (CC) YoY (Company Filings, Author’s Analysis)

I would characterize this as not stellar but merely adequate. This is because a high-single digits overall revenue growth profile is below levels seen by the rest of the Magnificent 7 stocks.

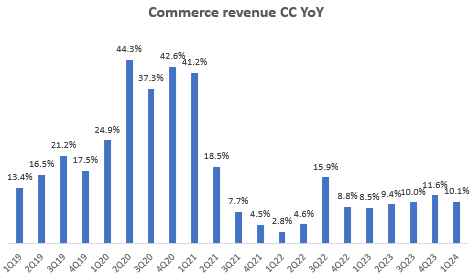

Amazon’s Commerce Revenues, which are defined as the total of 1P and 3P marketplace revenues, make up 65.9% of the sales mix as of Q1 FY24. The merely adequate revenue growth for the overall company is due to the performance in this segment, which is also ticking along around 10% YoY:

Commerce (1P, 3P Marketplace) Revenue Constant Currency (CC) YoY (Company Filings, Author’s Analysis)

Notice that this is moderately below pre-pandemic growth levels of mid-teens YoY growth. Now, I do recognize that it is operating at nearly double the base base of pre-pandemic sales. However, given the unsaturated growth potential particularly in international markets, I believe the days of mid-teens % growth is still possible in Amazon’s e-commerce business.

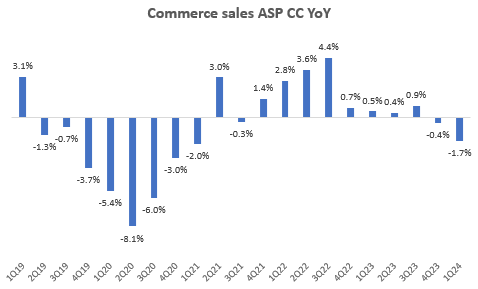

Whilst volume growth has been ticking along around 10%, a key drag in the e-commerce growth business has been tepid to declining average sale prices as customers look for value in their purchasing patterns:

Commerce (1P, 3P Marketplace) Average Sales Price (ASP) Constant Currency (CC) YoY (Company Filings, Author’s Analysis)

Customers are shopping but remain cautious, trading down on price when they can and seeking out deals.

– CEO Andrew Jassy in the Q1 FY24 earnings call

I don’t see any meaningful signs of a growth acceleration here yet based on macro indicators such as the US Retail Sales growth (as North America makes up 73% of non-AWS revenues and the US is the biggest piece out of this), which printed lower than expected in May 2024.

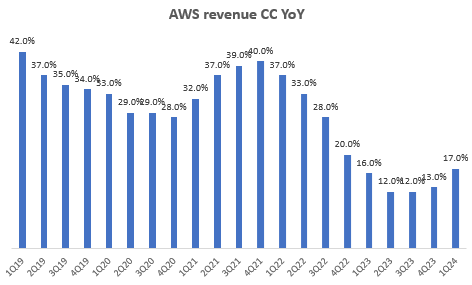

AWS is at an inflection point; poised well for a sharp growth revival

On the other hand, the growth of AWS seems to be a much more vibrant one. From the numbers, we can see a bit of an acceleration over the last couple of quarters:

AWS Revenue CC YoY (Company Filings, Author’s Analysis)

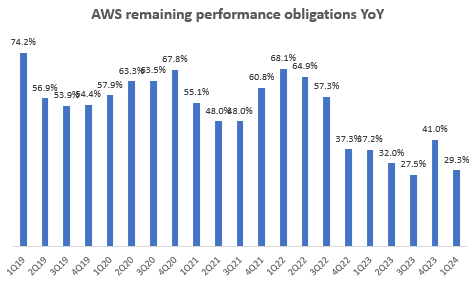

Leading indicators of future revenues as measured by remaining performance obligations are also posting strong 30%+ YoY growth:

AWS Remaining Performance Obligations YoY (Company Filings, Author’s Analysis)

The narrative behind these numbers and what fuels my confidence in the AWS growth revival trends continuing is based on the dual effects of:

1. Enterprises’ increased propensity to spend on new projects, marking a shift from earlier behavior involving cost optimizations and reprioritizations of cloud spends (corporate speak for spending less, deferring and cancelling projects).

Companies have largely completed the lion’s share of their cost optimization and turned their attention to newer initiatives…

– CEO Andrew Jassy in the Q1 FY24 earnings call.

2. Customers are racing to spend more on generative AI tools and features.

…we’re seeing very significant momentum in people trying to figure out how to run their generative AI on top of AWS.

– CEO Andrew Jassy in the Q1 FY24 earnings call.

Zooming out a bit, it is worthwhile noting that although AWS is at a $100bn+ annualized revenue run-rate, the vast majority (~85%) of global IT spend remains on-premise. The gradual shift of IT infrastructures moving onto the cloud and increased investments in AI-driven productivity provide a very long runway for further growth.

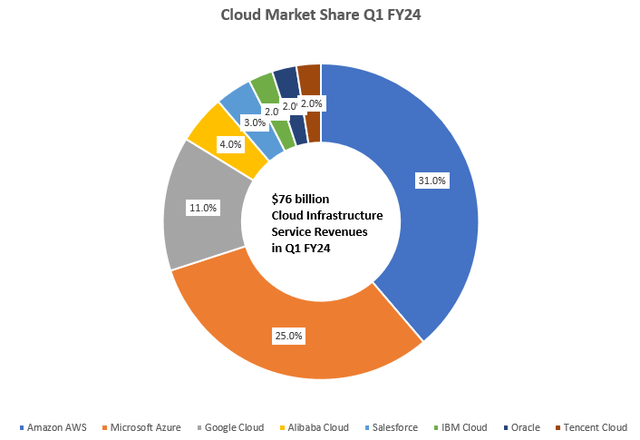

And as the market-leading cloud vendor with a 31% share, Amazon is extremely well positioned in this regard:

Cloud Market Shares Q1 FY24 (Synergy Research Group, Statista, Author’s Analysis)

So overall, I am quite bullish on the AWS growth opportunity. Currently, AWS makes up 17.5% of Amazon’s revenue mix, up from 13% 5 years ago. I anticipate AWS to continue growing to around a 25% mix of overall revenues in the next 5 years.

There is a clear track for improved profitability in the ex-AWS businesses

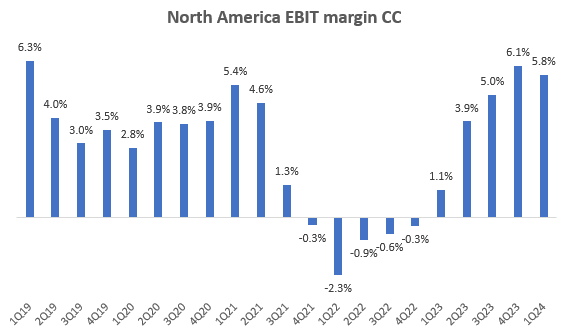

Amazon’s profitability in businesses not including AWS is now ticking above pre-pandemic levels in both North America (73% of ex-AWS revenues):

North America EBIT Margin CC (Company Filings, Author’s Analysis)

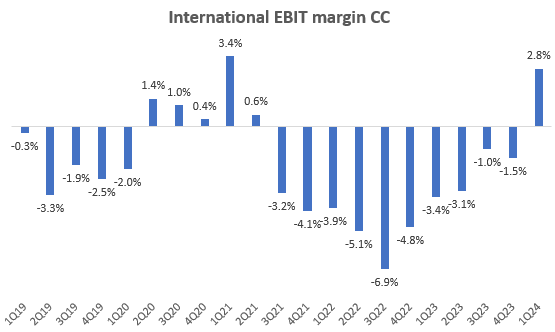

And internationally:

International EBIT Margin CC (Company Filings, Author’s Analysis)

CFO Brian Olsavksy noted that they have many most margin levers from better logistics improvements through things like regionalization of delivery models in international markets, ROI increases from advertising efforts from initiatives such as an increase in 3rd party sponsored products and ads from Prime Video and more.

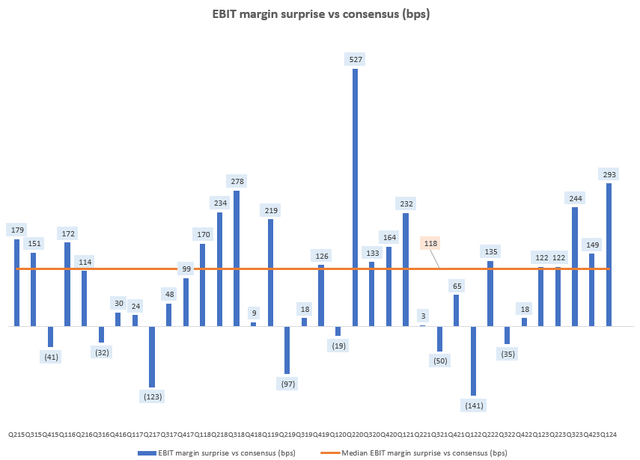

I am inclined to believe this narrative as the general track record of margin beats is positive, with a median EBIT margin beat vs consensus of 118bps since Q2 FY15 (Brian Olsavsky became Amazon’s CFO in June 2015):

EBIT Margin Surprise vs Consensus (bps) (Capital IQ, Author’s Analysis)

There is scope for multiples expansion following earnings-driven growth

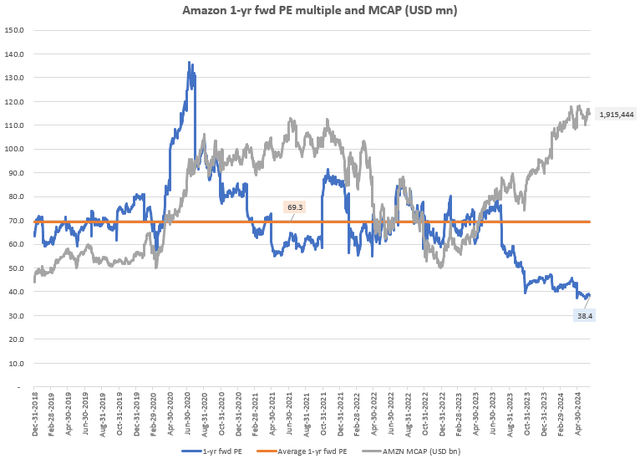

Amazon’s market capitalization has increased over the last year, yet its 1-yr fwd P/E multiple has decreased, suggesting genuine earnings-driven growth in the company. This is unsurprising given the superior profitability profile for the company.

Amazon 1-yr fwd P/E and MCAP (USD mn) (Capital IQ, Author’s Analysis)

From its current 1-yr fwd multiple of 38.4x, I believe there is scope for multiple expansion, particularly as the company delivers on continued margin improvements and hopefully an eventual growth acceleration in the e-commerce business. When this happens, I anticipate another leg up in the market capitalization of Amazon. Indeed, this is what happened to NVIDIA Corporation (NVDA) earlier this year.

Technicals signal give some reason for caution

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

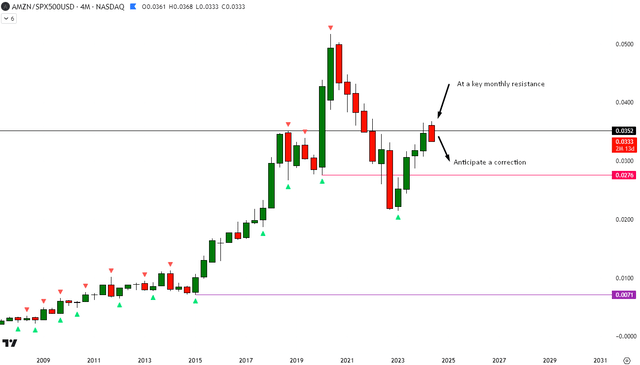

Relative Read of AMZN vs SPX500

AMZN vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

On the relative 4-monthly chart of Amazon vs the S&P500 (SPY) (SPX), I see the ratio prices near a key monthly resistance level, which may correspond to the right shoulder of a bearish head and shoulders classical chart pattern.

Hence, I am getting cautious on incremental buys at these levels as I believe a small correction is likely.

Key Monitorable

For upside risk monitorables, I will be tracking retail sales data, inflation, and general consumer sentiment numbers to get leading clues on a growth acceleration in Amazon’s e-commerce business.

For downside risk monitorables, I believe increased investments in capex, which won’t flow through the P&L, but affects free cash flows (FCF) and equipment lease costs (which does flow through the P&L) to enable AWS-driven growth can lead to a drag on margins and free cash flows. Currently, consensus estimates are not pricing in any period of negative free cash flows. However, I am still keeping a track on FCF, recognizing that investor flows may shift out of Amazon if it undergoes an extended period of investment with low FCF generation:

Amazon FCF (USD mn) (Company Filings, Author’s Analysis)

Takeaway

Overall, I think Amazon’s overall growth track is merely adequate so far, dragged down a bit by some more cautious, value-spending activity by customers on the e-commerce side of things. However, I am rather bullish on AWS and I believe it is at a rising growth inflection driven by enterprises becoming more ready to spend on technology upgrade projects and on AI productivity. I also believe in management’s narrative about there being further margin expansion levers because the track record of EBIT margin beats proves to me that execution follows the CFO’s commentary.

I suspect that multiple expansion may play out as the company demonstrates continued increases in profitability and hopefully a reacceleration in the e-commerce business growth.

Overall, I lean bullish but due to a cautious technical outlook of AMZN relative to the S&P500, I am inclined to rate the stock a ‘Neutral/Hold’ for now as I’d rather hold off on incremental buys for now.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.