Summary:

- Key economic data points strongly imply the potential for a cyclical correction in FY 2023.

- With an e-Commerce revenue share of 84%, Amazon.com, Inc. will remain vulnerable to economic contractions and weakness in consumer spending.

- In the longer term, two businesses within Amazon could help the company reduce its exposure to the economic cycle.

HJBC

Shares of Amazon.com, Inc. (NASDAQ:AMZN) are facing potentially more downside as the FED continues to hike interest rates rapidly and risks to the global economy are growing. The Fed raised interest rates yet another 0.5% on Wednesday, bringing interest rates to the highest level since 2006. Additionally, economic news out of China further indicate that the Chinese economy is doing more poorly than expected. While two businesses within Amazon promise an offset to a potentially contracting economy, I believe Amazon’s share price weakness is going to extend into 2023 and the company appears set to retest its recent lows!

E-commerce-dependent businesses face headwinds

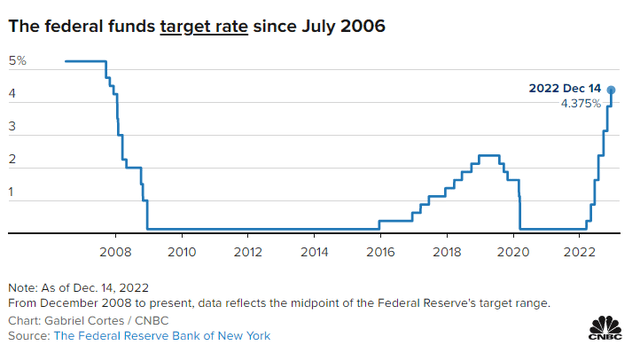

This week had a lot of bad news in store for investors. First, the FED raised its federal funds target rate by yet another 0.5% which lifted the benchmark interest rate to its highest level in 15 years. The key interest rate hasn’t been this high, at 4.375%, since just before the Global Financial Crisis.

High interest rates, while required to fight inflation, also risk pushing the U.S. economy into a recession, and high interest rates are often considered to be a warning sign indicating a cyclical correction. The FED also managed expectations this week by saying that it will have to raise interest rates to an even higher level in 2023.

At the same time, the National Bureau of Statistics released a batch of data that showed slowing consumer spending and industrial output growth in China. Consumer spending, as measured by retail sales, dropped 5.9% year-over-year in November, showing a sharp slowdown from the prior month which is when retail sales skidded only 0.5% year over year. Industrial output figures were also hardly encouraging: output of China’s industrial base grew just 2.2%, down from 5.0% in October. With both consumer spending and industrial output showing strong signs of a slowdown, risks to the global economy are clearly increasing.

Two businesses that could outperform for Amazon going forward

Higher interest rates and weakening economic growth not only cloud investor sentiment, but also put the valuations of companies at risk that depend primarily on consumer spending, like Amazon.

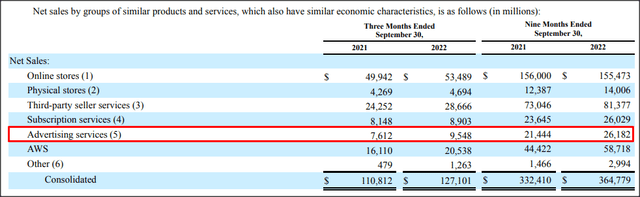

Amazon remains highly dependent on the e-Commerce business, which represented 84% of consolidated revenues in Q3’22. Amazon is already failing to deliver consistent profitability in the e-Commerce business. However, the business mix within Amazon is shifting, and two businesses especially have the potential to push Amazon’s entire business model into a new direction long term. One is Amazon Web Services, or AWS — Amazon’s Cloud business — which currently captures about 34% of the Cloud market and has a considerable lead over its rivals. The second-largest rival in the Cloud market is Microsoft’s (MSFT) Azure, with a market share of 21%.

But there is yet another business which doesn’t get all that much attention, and it has a lot of potential for Amazon going forward: digital advertising.

At its core, Amazon collects a lot of data from its customers, leaving the company with a highly valuable data treasure trove that the company can exploit in two distinct ways: (1) It can better market its products and services (thorough up-sells, for example) to customers and thereby increase its conversions (and ultimately profit margins); and (2) It can also sell access to these data pools to advertisers that are willing to pay good money to advertise their own products on Amazon’s shopping platform.

Amazon monetizes its data through sponsored ads, display, and video advertising and ad services is turning into a really serious business for the company. In Q3’22, advertising services grew its revenues 25.4% year-over-year to $9.5B, and the segment grew almost as fast as AWS, which saw a top line growth rate of 27.5%. Given the current growth rate of about 25% annually, I believe digital advertising could be a $70B annual revenue business by FY 2025, while AWS could grow into a $160B per-year top line business in three years.

The faster AWS and digital advertising grow, the less dependent Amazon is going to be on its loss-making, cyclically-exposed e-Commerce business.

Amazon’s valuation and potential to retest recent lows

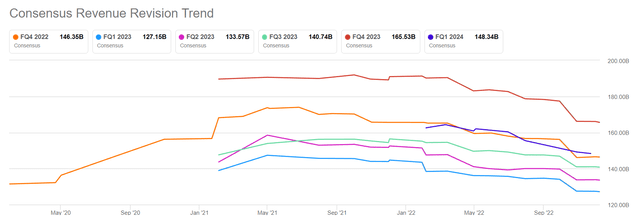

Amazon skidded to a 1-year low of $85.87 in November, but the stock has only mildly recovered from its low. Amazon is currently trading at $91.58 and it wouldn’t take much for Amazon to retest its low. Given the increasing likelihood of a recession in 2023, I believe Amazon’s top line forecast for Q4’22 will be very weak… and it seems the market is already agreeing with this as well: in the last 90 days, downward revenue revisions for Amazon’s fourth-quarter have outnumbered up-ward revisions by a ratio of 34:1, and pressure is clearly growing. Expectations are now for $146.35B for Amazon’s Q4’22, implying just 6% year-over-year growth. There is a good chance, I believe, that Amazon’s revenue growth will continue to skid into the low single digits in Q1’23, and it might even go negative.

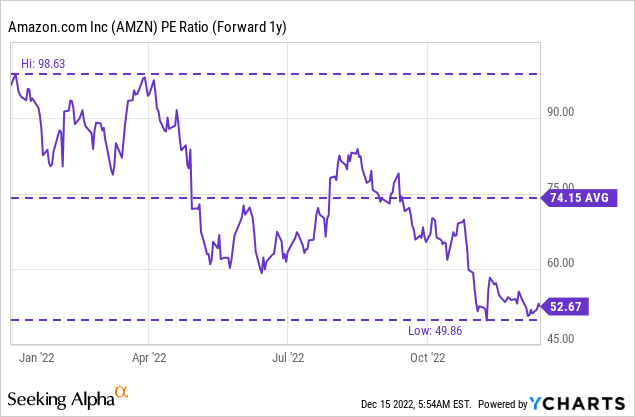

Shares of Amazon are currently trading well below their 1-year P/E average, but the valuation is still high at a P/E ratio of 52.6 X. Given the increasingly chilly headwinds for the economy and e-Commerce revenue risks, I believe that Amazon is going to retest its lows.

Risks with Amazon

The biggest risk for Amazon is obviously the near-term outlook for top line growth. Specifically, I see risks regarding the e-Commerce business which not only is cyclically vulnerable and driven chiefly by consumer spending, but also not profitable. On the other hand, advertising services and AWS are set to take on a more dominant role within Amazon’s increasingly diversified operating portfolio of businesses going forward, but in the short term, Amazon will remain vulnerable to consumer spending. Given the near-term uncertainty about Amazon’s growth curve, there is even a risk that e-Commerce revenue growth goes negative.

Final thoughts

I believe that the global economic climate is deteriorating and that investors are underestimating the risks to consumer spending which is what Amazon is still highly dependent on. Rate increases and disappointing data coming out of China — regarding industrial output and retail strength — indicate that the global economy is cooling off and vulnerable heading into 2023.

A cyclical correction in GDP growth is set to especially hurt a retail company like Amazon, whose revenues still largely come from e-Commerce transactions. While Amazon has two businesses in its portfolio that could provide an offset longer term — AWS and advertising — these businesses are not big enough yet to make a difference regarding Amazon’s commercial performance in the short term. For those reasons, I believe investor sentiment will continue to deteriorate and shares of Amazon will retest their lows!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.