Summary:

- Amazon reported better-than-expected earnings for Q2, driven by a strong performance in the North American e-Commerce segment.

- Operating income for Amazon’s NA e-Commerce segment improved drastically which is good news for Amazon. NA e-Commerce grew almost as quickly as AWS in Q2’23.

- Amazon issued a strong outlook for Q3, implying the possibility of a consecutive revenue acceleration.

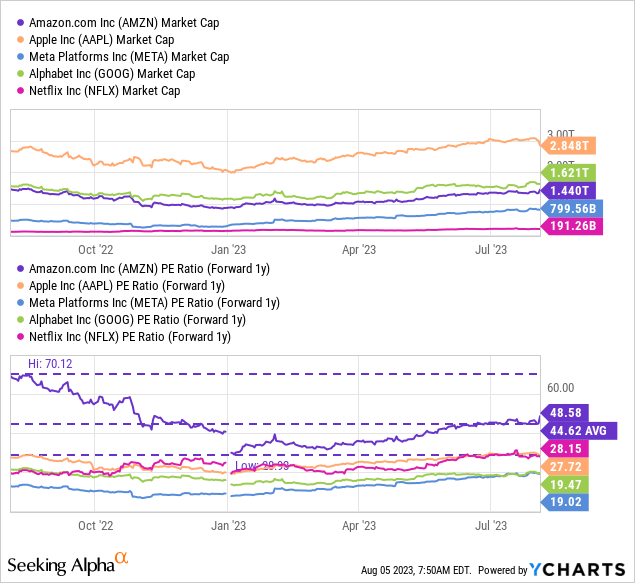

- While the firm’s operating income picture has improved as well, I see limited upside as AMZN trades at a near-50X P/E ratio.

HJBC

Amazon (NASDAQ:AMZN) reported much better than expected earnings for its second fiscal quarter than expected on Thursday: Amazon not only saw a re-acceleration of its top line growth in Q2’23, driven by a strong performance in the North American e-Commerce segment, but NA e-Commerce almost grew as quickly as the company’s Cloud business. The e-Commerce segment also saw a massive improvement in its operating income picture which is the key reason behind my rating upgrade to hold. Amazon issued a strong outlook for the third-quarter as well and includes a consecutive revenue acceleration. Because of a continual slowdown in its Amazon Web Services business, however, there are headwinds to Amazon’s valuation that investors should take seriously!

Previous rating and reasons for rating change

I rated Amazon as a sell in May due to the company’s slowing top line growth. Previously, I highlighted a weak operating income trend as a reason to avoid shares of Amazon. Since Amazon is seeing a significantly improved operating income situation, driven by e-Commerce, I believe shares of Amazon have a better risk profile than I initially thought. However, they are not a buy, in my opinion, due to persistent headwinds in AWS as well as a high valuation based off of P/E.

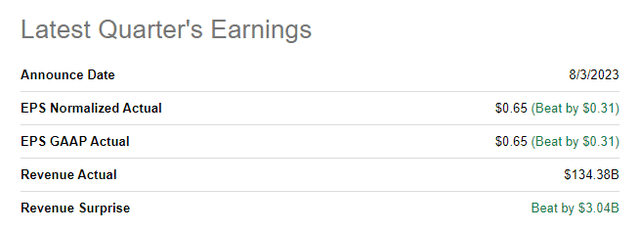

Amazon beats revenue and earnings

Amazon reported a solid earnings sheet for the second-quarter that saw the e-Commerce company beat top line and bottom line estimates by considerable margins: Amazon reported revenues of $134.4B, beating the average estimate by more than $3B. Amazon further generated adjusted earnings of $0.65 per-share, beating the consensus estimate by $0.31 per-share.

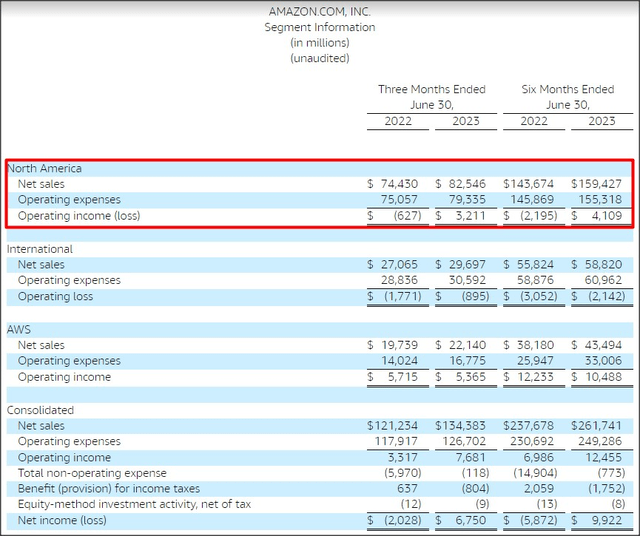

Drastic improvement in e-Commerce performance

In the past I have seen two major problems with Amazon which were: (1) The lack of profitability in the North American e-Commerce segment and (2) Moderating growth for Amazon Web Services.

As to the first point, e-Commerce.

Amazon saw a strong performance in its North American e-Commerce segment in the second-quarter, with revenues growing 11% year over year to $82.5B. Amazon saw a sequential acceleration of its net sales as well, driven by e-Commerce: Amazon’s top line grew 2 PP quicker than in Q1’23 and the company also beat its own top line guidance which called for up to 10% Y/Y revenue growth in Q2’23.

There has been by one major factor that drove Amazon’s results in the second-quarter: The U.S. economy performed well, growing 2.4% on an annualized basis in Q2, and consumers continued to spend money. With the economy given tailwinds to a company like Amazon, it could be in a strong position to expand on recent gains in the North American e-Commerce business in the second half of the year.

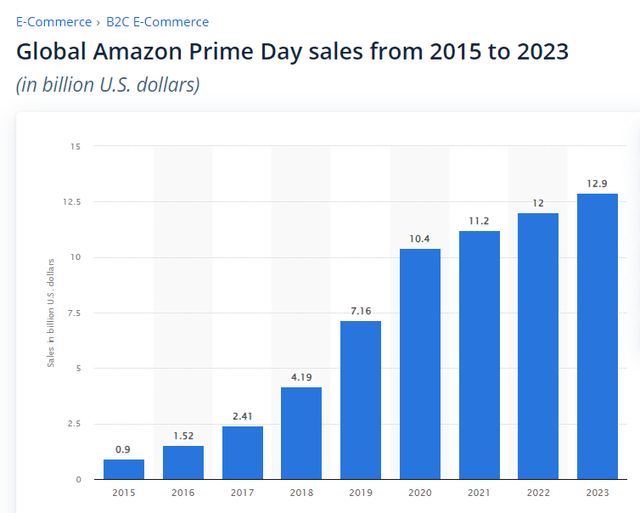

Amazon recently recorded yet another record Prime Day that saw the shipment of 375M items. Total 2023 Prime Day sales totaled $12.9B, showing 7% growth over last year’s sales event. Consumer spending is strong and benefits large retailers like Amazon and the record Prime Day suggests that consumers don’t yet feel that they need to cut back on spending.

Turning to profitability.

In the past, I have mentioned Amazon’s unprofitable e-Commerce business as a reason to not buy Amazon’s shares, but cost saving initiatives and a strong economy have improved Amazon’s earnings picture greatly in the second-quarter.

Amazon’s North American e-Commerce business posted operating income of $3.2B in Q2’23 compared to a loss of $627M in the year-earlier period. It was the second quarter of positive operating income in the North America business. In total, Amazon generated $7.7B in operating income and two out of three segments were operating income positive (international e-Commerce was not). Amazon’s massively improved operating income picture is the main reason for my rating upgrade.

|

Operating Income (in $billion) |

Q3’22 |

Q4’22 |

Q1’23 |

Q2’23 |

|

North America e-Commerce |

-$0.4 |

-$0.2 |

$0.9 |

$3.2 |

|

International e-Commerce |

-$2.5 |

-$2.2 |

-$1.2 |

-$0.9 |

|

AWS |

$5.4 |

$5.2 |

$5.1 |

$5.4 |

|

Total |

$2.5 |

$2.8 |

$4.8 |

$7.7 |

(Source: Author)

AWS continued to slow down in Q2’23

Amazon Web Services has been a key driver of Amazon’s growth in the past, but it looks like e-Commerce could be taken over now. The most interesting take-away from Amazon’s Q2’23 earnings report was that the growth of its Cloud unit was just 1 PP below Amazon’s North American e-Commerce segment top line growth rate: AWS saw 12% year over year top line growth compared to 11% growth in NA e-Commerce.

Quarter over quarter, Amazon Web Services’ revenue growth rate slowed 4 PP which should not have surprised investors. As I indicated in my work — Amazon Q1: The Big AWS Reset — slowing segment growth should have been expected as the corporate scaled back IT spending and the trend in AWS growth points downward. Until AWS returns to stronger growth, I see limited upside for Amazon’s shares.

Nonetheless, the Amazon Web Services business remained solidly profitable and contributed 70% of Amazon’s consolidated operating income in Q2’23.

Amazon’s guidance for Q3’23

Amazon has guided for third-quarter revenues of $138.0-143.0B, which translates to up to 13% top line growth year over year. At the same time, Amazon said that it expects $5.5-8.5B in operating income in Q3’23. Strong Prime Day sales in July likely supported Amazon’s optimistic guidance for the third-quarter.

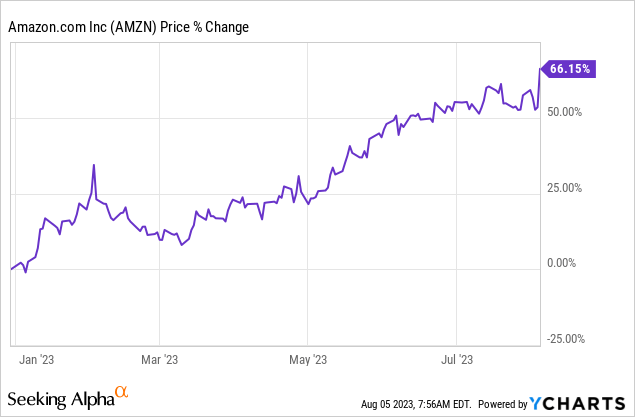

Amazon is still valued highly

Amazon is still priced as a growth stock, although the company’s top line growth has seen a sharp post-pandemic correction. Amazon is currently valued at 48.6X forward earnings which is about 9% above the company’s 1-year average P/E ratio. Amazon is also by far the most expensive FAANG stock and the third-largest FAANG company regarding market value. Given the sharp rise in Amazon’s valuation, and recognizing the company’s improved operating income picture, I am upgrading Amazon to hold.

Risks with Amazon

One key risk factor that I see with Amazon is the continued growth slowdown in Amazon Web Services which has not eased in the second-quarter: Q2’23 was the second consecutive quarter in which the AWS segment has seen a 4 PP slowdown in its top line growth. I would only be willing to upgrade Amazon to buy if the company managed to return AWS to higher growth.

Closing thoughts

I was wrong doubting Amazon’s operating income potential, especially in the North American e-Commerce business. The massively improved operating income picture in the second-quarter and strong guidance for Q3’23 are two reasons for me to change my rating to hold.

Overall, Amazon delivered an impressive earnings sheet for the second-quarter, with the exception of Amazon Web Services. However, the North American e-Commerce came to the rescue and impressed with both top line growth and operating income improvements. I believe Amazon’s risk profile has improved after its second-quarter earnings report, but headwinds remain, especially regarding AWS. Amazon’s valuation is also not too attractive and with a P/E ratio of almost 50X, I believe shares are at best a hold!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.