Summary:

- Amazon’s advertising business is growing to become a formidable competitor to rivals like Google and Meta.

- Amazon offers a range of advertising options, leveraging its e-commerce platform and extensive customer data for targeted ads.

- Amazon’s advertising business is growing rapidly, with revenue reaching $10.7 billion in Q2 2023, surpassing Google’s retail advertising business.

- I rate Amazon a buy: I value the stock at an EV/Sales multiple of 3.5x, which suggest a ~$175 target price by 2024.

hapabapa

Amazon’s (NASDAQ:AMZN) advertising strategy has evolved into a robust and competitive force in the digital advertising landscape. While Google (GOOG) (GOOGL) and Meta Platforms (META) continue to be major players with their own strengths, Amazon’s unique blend of e-commerce integration, purchase intent, data, and performance-based advertising has positioned it as a strong rival, particularly for businesses with a focus on e-commerce and product sales. As the digital advertising industry continues to evolve, Amazon’s ability to combine shopping and advertising seamlessly may give it a significant edge in the competition for advertising dollars.

Amazon’s Advertising Ecosystem Is Enormous

A Multi-faceted Advertising Approach …

Amazon’s advertising strategy is a multi-faceted, offering a broad range of advertising options, products, and channels. To give some examples of how Amazon’s advertising business works, let me draft a quick overview of the key offerings.

First, it is important to understand that the majority of Amazon’s advertising sales is generated through the company’s e-commerce shopping platform. In that context, Amazon offers sponsored products, which are ads that appear within search results and on product detail pages, helping sellers promote their products to a relevant audience.

Relatedly, sellers can also buy sponsored display ads, as well as create custom brand experiences with the “sponsored brands” offering.

Amazon’s extensive customer data is very precious here — over the years Amazon has collected enormous amounts of data on customer behavior, their purchase history, search queries, and more. With advertising, this data is used to create detailed customer profiles and allows advertisers to target their ads with remarkable precision. Accordingly, advertisers can select specific demographics, interests, and even target shoppers who have viewed or purchased similar products.

In recent years, Amazon has also expanded its advertising offerings beyond its own, core platform, allowing brands to advertise on third-party sites and apps via the Amazon Advertising network. Specifically, through Amazon DSP, which enables advertisers to programmatically buy display and video ads across the web and on Amazon-owned platforms, Amazon has expanded its advertising reach to an “omnichannel” approach. In that context, the acquisition of companies like Twitch certainly helped to build a network.

Finally, Amazon has started to incorporate advertising into its other products and services, such as its Prime Video streaming service, which will soon include “limited” ads to help fund the creation of new content. In fact, according to a recent press release, Amazon Prime will be introducing “limited” advertising on its Prime Video content from early next year.

What all of Amazon’s advertising offerings have in common, however, is the leveraging vast customer data to offer targeted advertising to brands and sellers on its platform — just like Google and Meta.

… Complemented By Tools And Technology

Amazon provides robust tools for advertisers to measure the impact of their campaigns. This includes conversion tracking, sales attribution, and reporting dashboards. Advertisers can see how their ad spend directly influences sales and adjust their strategies accordingly. In that context, the AWS’s cloud computing power certainly helps to process and analyze vast amounts of data, enabling real-time optimization of advertising campaigns.

Amazon’s advertising model is largely performance-based, meaning advertisers pay when customers take specific actions, such as clicking on an ad or making a purchase. This ensures that advertisers can measure the effectiveness of their campaigns and optimize their ad spend for better ROI. Moreover, Amazon seamlessly integrates ads into the shopping experience. This means that ads often look like organic search results or product listings, making them more appealing and less intrusive to customers.

An example of how this is done can be considered very similar to the Google strategy: Amazon allows advertisers to bid on keywords relevant to their products. Accordingly, when customers search for these keywords, the sponsored products or brands appear in the search results. Amazon’s search algorithm also considers relevance and bid amount when determining which ads to display. Like with everything Amazon does, the e-commerce giant prioritizes the customer experience in its advertising strategy.

In that context, advertisers must adhere to strict guidelines to ensure that ads are relevant and valuable to customers, as low-quality or irrelevant ads can negatively impact an advertiser’s performance on the platform. Amazon’s advertising platform uses algorithms to dynamically generate ads based on a user’s behavior and preferences. This results in highly personalized ad experiences, increasing the likelihood of engagement and conversion.

Ad Dollars Are Shifting To Amazon

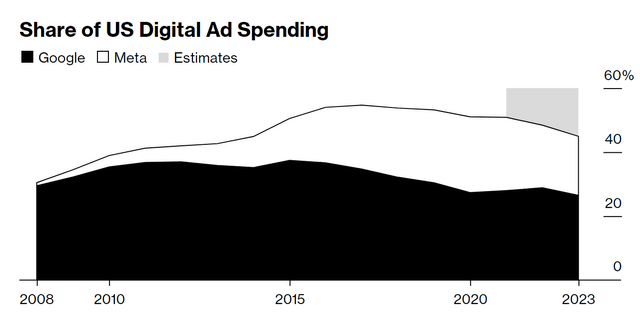

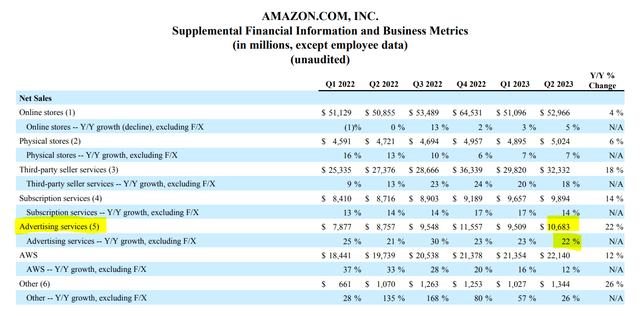

Google is currently on trial vs the DoJ for allegedly discriminatory TAC agreements with phone OEMs, rendering Google the default search engine on billions of handsets. The trial is insofar relevant for the Amazon discussion, as there have recently been disclosed some interesting insights. In a testimony about Google’s advertising strategy Jerry Dischler, vice president for advertising products at Google, commented that “[Amazon] is able to get better data than we are on the effectiveness of their advertising … [which] has caused budgets to shift”. Moreover, Discher also added that Amazon’s retail advertising business is now bigger than Google’s. In that context, estimates by Bloomberg reveal that the combined digital advertising market share for Meta and Google has likely peaked in late 2016, with “alternative” advertisers like Amazon and TikTok consistently gaining share since then.

Analysing Amazon’s quarterly reports confirms that Amazon’s advertising business is big, and growing fast. In fact, Amazon’s advertising business is growing faster than AWS!

In the quarter ended June, 2023, Amazon’s revenue from advertising services jumped 22% year over year, up to $10.7 billion. In Q1 2022, this revenue was only $7.9 billion, and growing only about 3 percentage points faster. Unfortunately, operating income for the advertising business is not disclosed. But investors should consider the business to be high-margin, likely competitive with the profitability achieved by Google.

Conclusion

Amazon’s advertising strategy is a complex and dynamic ecosystem designed to maximize revenue while delivering value to customers and advertisers. It leverages the company’s vast e-commerce platform, data-driven targeting, and innovative ad formats to create a seamless advertising experience. This strategy has made Amazon a formidable player in the digital advertising space, challenging industry giants like Google and Facebook. Personally, I would not be surprised if Amazon’s advertising business continues to grow at a greater than 20% CAGAR throughout the next five years, taking additional market share from the two incumbents Google and Meta. If my argument is correct, then Amazon’s advertising business would generate more than $100 billion of sales by 2028.

Overall, I rate Amazon a buy: I value the stock at an EV/Sales multiple of 3.5x, which is approximately in line with the company’s average multiple for the past 3-years, and would suggest a ~$175 per share target price by end of 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.