Summary:

- Oracle has enjoyed upbeat growth thanks to the Cerner acquisition and aggressive price cutting for its core business.

- On the other hand, AWS, which accounted for 74% of Amazon’s profits in 2022, relies more on a vertically integrated cloud infrastructure and product strength.

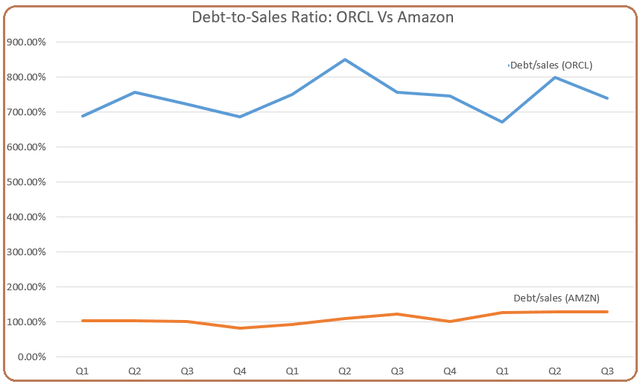

- Also, when considering the debt-to-sales ratio and profitability, Oracle’s growth strategy probably cannot be sustained.

- To moderate my bullish stance on Amazon, please note that volatility should persist.

- As for Oracle, it is important to have a management update as to how exactly it will promote profitable growth.

TU IS

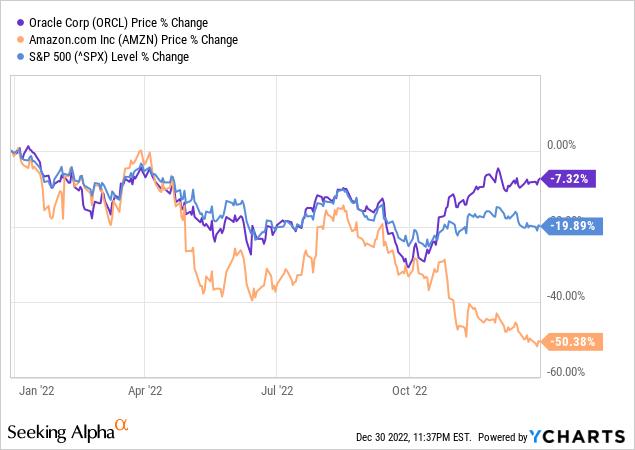

Oracle’s (NYSE:ORCL) share price has outperformed the S&P 500 in the last year as shown in the deep blue chart below after the company has grown its cloud business by the high double digits in its last reported quarter. In contrast, the stock of Amazon (NASDAQ:NASDAQ:AMZN) which owns AWS is more than 50% down.

Using a comparative approach, I assess the sustainability of their growth strategies in a macroeconomic environment where together with high inflation, there are now recession risks. For this purpose, I focus on AWS EC2 (Elastic Compute) cloud and database components, to show that it is Amazon that is emerging as the strongest contender in what was previously regarded as one of Oracle’s key strengths.

I start by dissecting the revenue growth of Oracle.

Oracle’s Growth Strategy Relies on Price Cutting

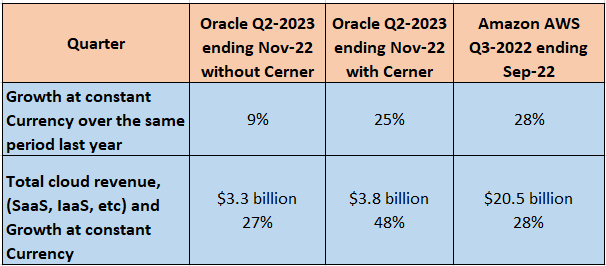

As shown in the table below, Oracle’s growth including Cerner was 25% in constant currency or excluding currency headwinds due to a strong dollar which has been impacting U.S exporters of software in 2022. In contrast, its organic growth was only 9% which is four times lower than AWS’s 28%.

Table built using data from (www.seekingalpha.com)

Going into details, at the intersection of healthcare and information technology and with a lot of data, Cerner contributed 21% to Oracle’s SaaS and IaaS revenues of $3.8 billion. Now, with merger synergies kicking in, there should be some margin gains for the merged entity, but this could be jeopardized by Oracle’s growth strategy.

In this respect, the statement by Safra Catz, the CEO, that the company “continues to benefit from economies of scale in the cloud, it will not only continue to grow operating income but will also grow the operating margin percentage” does not seem appropriate. The reason is that Oracle is having to resort to an aggressive pricing strategy, and according to Leo Leung, vice president of products and strategy, its prices are lower, and “there are a lot of services that we don’t charge for at all. They’re just included.”

To further illustrate my point that scaling further will be detrimental to profitability, I look at the hybrid cloud, an area witnessing high market growth. Here, Oracle has the OCI Dedicated Region, which is a hybrid cloud solution that provides customers with a cloud-like experience within their own data centers, but, such projects can entail big IT budgets costing at least $4 million for a minimum of four-year engagement. Now, this is the price after Oracle has cut prices.

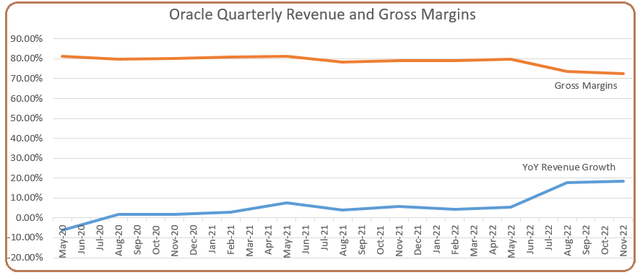

Therefore, providing heavy discounts may continue to help revenue growth as per the blue chart below, but, Oracle’s gross margins which are on a downtrend should continue to suffer.

Table built using data from (www.seekingalpha.com)

Moreover, with a hybrid infrastructure, there are more complexities as there are more IT environments to manage including the private clouds and public multi-clouds. This calls for more of a consultancy approach as International Business Machines (IBM) has opted for especially with a lot of uncertainty as to whether corporations will sustain the amount they spend on IT. Just offering large product discounts does not work when the future is uncertain.

Now, with debt ballooning at $83.6 billion and the current federal funds rate at 4.25%-4.5% and likely to reach 5.1% next year, borrowing costs remain elevated. In these circumstances, the question is how long a price-cutting-driven growth strategy can last till the effects start to be felt on the free cash flow which appears to have reached a tipping point when looking at quarterly figures.

AWS Relies on Lower TCO and Product Strength

On the other hand, while not having Oracle’s huge on-prem customer base, AWS has been active in hybrid cloud mainly thanks to its long-standing agreement with VMware (VMW), towards whom Oracle showed hostility for a long time. Also, instead of price cuts, the cloud hyperscaler’s strategy seems more oriented at driving down the TCO or total cost of ownership for its customers. This is where AWS-designed ARM-based processors which are more energy efficient than x86-based processors are able to offer customers up to a 40% lower TCO. Now, 48 of the top 50 EC2 customers use it for a variety of use cases including databases and data big data/analytics.

In this respect, having its origins (in 2006) as a provider of elastic or expandable storage, virtual servers, and messaging, Amazon now offers more than 200 services covering databases and analytics including Amazon Aurora, Amazon Redshift, and Amazon DynamoDB.

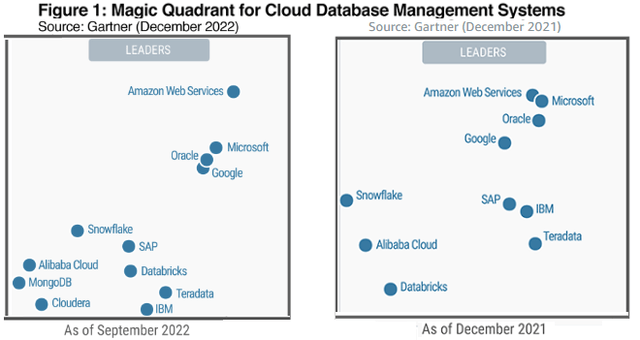

These database management systems may be less known to the investing community but have certainly been getting traction from users and have been recognized for years by Gartner which allocated AWS a leadership role for the last 8 consecutive years alongside Oracle, Microsoft (MSFT), Google (GOOGL) (GOOG), Snowflake (SNOW) and others. Now, Gartner classifies companies as leaders, challengers, visionaries, or niche players.

Focusing on the leader’s quadrant, investors will note the difference between December 2021 (right picture below) and 2022 (left one) shows that AWS has now been promoted to the pole position, well ahead of the Microsoft-Oracle-Google trio. This is thanks to Gartner naming it the highest in execution and furthest in vision among the 12 vendors evaluated.

Gartner Magic Leaders Quadrant – Difference between 2021 and 2022 (aws.amazon.com)

While this change does not augur well for AWS’s competitors in general, it is especially difficult to digest for Oracle which has been quite vocal about the superiority of its autonomous databases compared to AWS Openshift since last year. Now, with AWS having both a superior product and offering a lower TCO because of its Graviton processors for its public cloud, it does not necessarily need to provide the same level of discounts as Oracle in the cloud price war.

Thus Amazon should continue to play a leading role in the cloud market.

Debt-to-Sales Ratio and Valuations

According to Gartner, the public cloud services Market will reach a record of $592 billion in 2023. However, as a cautionary note, it adds that due to inflationary pressures and given that the cloud constitutes the largest chunk of IT spending, the outlook could darken in case IT budgets shrink.

This could indeed be the case given that recession risks have gone higher and it is precisely here that vertically integrated cloud computing offerings like AWS can help organizations opt for elastic and scalable solutions or a more sustainable alternative than Oracle’s relatively temporary product discounts. The reason is simply that CFOs cannot do long-term budgeting based on discounts.

At the same time, aggressive pricing translates into lower profit margins for service providers especially in a highly competitive environment as evidenced by the number of contenders in the above leader’s quadrant increasing by two in a matter of only one year. This is the reason why analysts may be wrong when they expect Oracle’s earnings per share to grow in the years to come and even with a forward PE of 16.69x, the stock is not a buy.

Pursuing further, in addition to profitability, Oracle’s growth comes at the expense of debt. In this respect, the above 700% debt-to-sales ratio as per the blue chart below shows that it relies on $7 of debt for every $1 of sales made. Moreover, the trajectory of the chart shows no sign of debt going down anytime soon. This strategy was attractive at a time when credit was cheap, but, not anymore and Oracle’s interest expenses have grown by 26% to $856 million in the last reported quarter.

Table built using data from (www.seekingalpha.com)

Now, Amazon is also reliant on debt to finance its sales, but, it has a much lower debt-to-sales ratio. Moreover, AWS generates higher-margin sales compared to Amazon’s retail business. As such, it accounts for about 74% of Amazon’s profit. Technologically speaking, it also enables the online retailer to expand its logistics ecosystem with the latest AI in a more effective way as it is able to extract more returns out of investments, which are both for EC2 customers and its internal use.

As for valuations, analysts are also optimistic for AWS to grow its EPS in the coming years. For this purpose, with product superiority in the $4.4 trillion database market, it certainly has the means to grow its global cloud market share beyond the current 33% (end of 2021 figures) while not having to provide steep discounts to lure in customers, which augurs well for profitability. This is why even with a forward PE of 50.46x, the company is not overvalued and after a 50% one-year drop, the stock could limp back to the $100 level based on an 18% appreciation of its $84 share price.

Conclusion

This thesis has shown that AWS’s organic growth strategy is more sustainable, both as a first mover with a sizeable market share and superior database products. On top of this, with a more vertically integrated cloud model, it is able to offer better TCO to customers at a time of economic uncertainty.

On a cautionary tone, while aggressive interest rate hikes have had an impact on inflation, it remains at elevated levels and the Fed continues to be hawkish which normally does not bode well for tech. Thus, expect further volatility till there is a clear announcement of a change in policy in view of deteriorating financial conditions.

As for Oracle, I have a hold position instead of being bearish, till the management clarifies its position on how exactly it intends to pursue profitable growth and manage debt. Furthermore, this is not only a database company but has a wide portfolio of products including managed versions of its ERP (Enterprise Resource Planning), supply chain, and logistics applications. With Cerner, it has access to a $3.8 trillion market in the United States alone and can benefit from health providers relying more heavily on technology to promote efficiencies, but, to be realistic, this is a sector that has been significantly impacted by high inflation. Finally, the strategy Oracle has adopted to scale rapidly is detrimental to profitability.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.