Summary:

- AI-as-a-Service (AIaaS) and Machine Learning-as-a-Service (MLaaS) are growing trends in the AI industry, offering on-demand cloud-based AI capabilities.

- Amazon’s AWS AI offerings, along with Microsoft’s Azure AI, IBM’s Watsonx, and Google’s Vertex AI, are leading the competition in the AIaaS/MLaaS market.

- AWS AI has the potential to capture a larger market share due to its dominance in cloud services, extensive customer base and integration, developer-friendly ecosystem, and synergy with Amazon’s retail and e-commerce presence.

Just_Super

Thesis

In the rapidly growing landscape of artificial intelligence (AI), providing AI capabilities through on-demand cloud services is a growing trend. This approach is commonly known as AI-as-a-Service (AIaaS). Machine learning (ML), a subset of AI, is also now offered as a cloud-based service, and the term Machine Learning-as-a-Service (MLaaS) is the umbrella term used in describing this concept.

This article explores AIaaS/MLaaS, focusing on Amazon’s (NASDAQ:AMZN) AWS AI offerings, and how the cloud-based platform empowers businesses to harness the true potential of AI via cloud computing. By examining AWS’ versatile suite of AI products and services, and their seamless integration into Amazon’s expansive ecosystem, this analysis reveals how AWS uses AIaaS/MLaaS to democratize access to advanced machine learning tools, data analytics, and natural language processing (NLP); thereby, revolutionizing industries and fueling the growth of AI-driven solutions worldwide.

Through a comparative analysis of Amazon’s past successes with other “as-a-service” models, like SaaS, IaaS, and PaaS, and the standout AI features of AWS, this analysis presents a case for AIaaS/MLaaS and their pivotal role in shaping the future of AI adoption and empowering enterprises to thrive in an increasingly AI-driven world. Additionally, I explore the future of Amazon and how the success of its AI offerings could enhance the company’s sustained profitability and valuation in the long term.

While most AI-related analyses focus on leading chip and GPU manufacturers, like NVIDIA (NVDA) and Taiwan Semiconductor (TSM), and their competition for AI semiconductor market dominance, this analysis focuses on the grassroots adoption of AI, its ease of integration into everyday business applications, and the platforms or tech companies that are making this ease of integration possible. I believe mass AI adoption will only happen when the barrier to entry becomes low and small and medium enterprises (SMEs) can easily integrate AI into their business applications, regardless of budget and expertise. Thanks to AIaaS/MLaaS and the cloud platforms offering these services, the ease of AI and ML integration is already becoming a reality for most businesses.

AIaaS/MLaaS: Transforming Business Dynamics

Similar to how the SaaS model and its sub-varieties have revolutionized businesses by reducing costs, fostering collaboration, enabling agile development and deployment, and offering scalability and flexibility in software and hardware setups, AIaaS/MLaaS present similar advantages for companies looking to integrate AI and machine learning into their core operations. These innovative models empower businesses to incorporate advanced AI capabilities without needing extensive expertise or costly infrastructure investments. A B2C sales company, for example, can quickly deploy AI chatbots that use an NLP model provided by an AIaaS/MLaaS provider, without needing to jump through hoops to build and maintain a functioning NLP system. After deployment, the NLP system is maintained by the AIaaS/MLaaS provider, and the B2C business can scale its usage of the NLP model as it deems fit.

AWS brings its vetted expertise in cloud computing to AI. Other cloud giants, including Microsoft (MSFT), IBM (IBM), and Alphabet Inc. (GOOG) (GOOGL), are actively deploying AI tools within their cloud computing environments, sparking healthy competition for the market share of AIaaS/MLaaS provisioning.

Amazon provides businesses with several managed services and products, like Amazon SageMaker, Amazon Bedrock, and Amazon Rekognition, for AI-powered application development. AWS AI features a wide selection of AI foundation models, like the Amazon Titan large language model (LLM), that businesses can customize and train with their data to meet their specific use cases. Businesses and enterprises building on AWS AI can leverage the same security and scalability features that AWS is widely known for.

Microsoft’s AI cloud platform, Azure AI, provides businesses with enterprise-grade software development kits (SDKs) and application programming interfaces (APIs), like Azure ML Package for Python. Businesses also have access to Machine Learning Operations (MLOps) tools and pre-trained AI models to easily build and deploy AI-powered intelligent applications. Microsoft recently introduced a new coding LLM called Phi-1. Early this year, Microsoft made a substantial $10 billion investment in OpenAI. Some of Azure AI products include Azure Cognitive Services (a set of APIs that allows developers and data scientists to embed AI capabilities in their applications quickly), Azure Cognitive Search (an AIaaS that helps developers build rich AI-powered search experiences for applications), and Azure Machine Learning (a suite of MLaaS products that helps data scientists and developers to build, deploy, and manage high-quality AI models faster).

IBM, a pioneer in the field of AI, isn’t sleeping on AIaaS. IBM Watsonx is IBM’s AIaaS framework that focuses on offering enterprise AI solutions. Watsonx features feature-rich products that enable developers and data analysts to build and run AI models with ease. Watsonx provides developers and data analysts with thousands of ready-made AI models from IBM’s Foundation Library and the Hugging Face Library. Watsonx comes in three parts – watson.ai (a studio for AI builders), watson.data (a next-generation data lake), and watson.governance (a toolkit for AI governance).

Google Cloud offers its cloud customers an integrated data platform, an AI platform, and intuitive tools that empower developers and data analysts to swiftly create generative AI applications. Central to this offering is Google Cloud’s unified AI platform, Vertex AI. Within Vertex AI, developers can access pre-trained APIs. The AutoML capability in Vertex AI allows developers, even those with limited machine learning expertise, to train precise AI models tailored to their business requirements. Google’s PaLM 2 LLM is one of the leading models in the AI industry. Much like IBM’s Watsonx, developers can also explore an extensive array of readily available AI foundation models and pre-trained APIs within the Vertex AI ecosystem.

These cloud giants offer advanced on-demand AiaaS/MLaaS solutions tailored to their client’s specific needs. The extensive range of products and ongoing substantial investments dedicated to AI/ML cloud services by these industry leaders underscore one reality: AI is far from a passing trend; it is here to stay, and it has solidified its position as a transformative and disruptive technology.

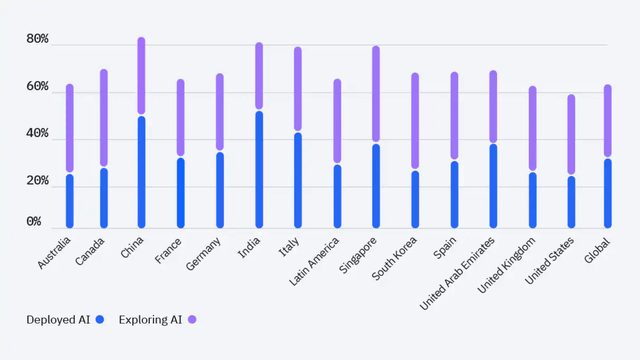

IBM Global AI Adoption Index 2022 (IBM)

The above infographic from last year is from IBM’s Global AI Adoption Index research. Data at the time the research was published (in May 2022) reveal that 35% of polled businesses have integrated AI into their operations, while an additional 42% are actively exploring the implementation of AI.

Why I Believe AWS is Poised to Lead the AIaaS/MLaaS Markets – A Qualitative Perspective

As each cloud infrastructure giant unveils cutting-edge AIaaS/MLaaS offerings and effectively entices businesses, developers, and data analysts, I’d like to highlight why I think AWS has the potential for a more significant AIaaS/MLaaS market share compared to Microsoft’s Azure AI, Google Cloud AI, and IBM’s Watsonx based on the following key factors:

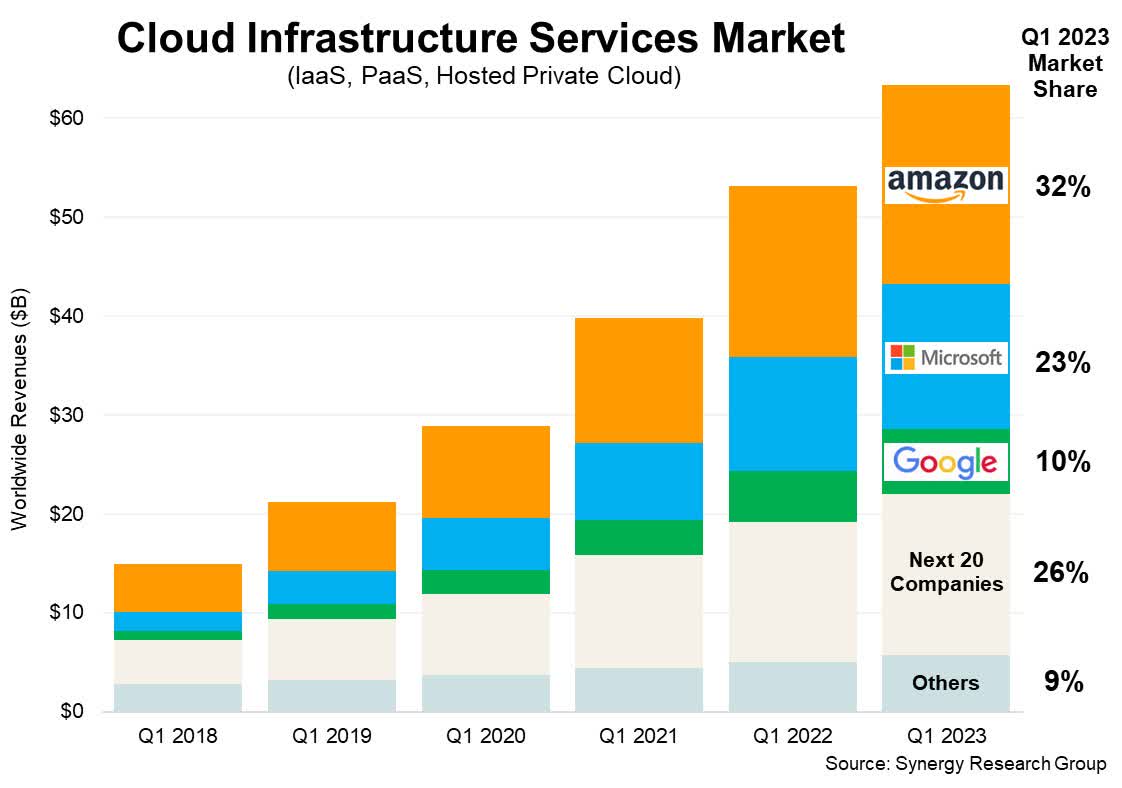

Synergy Research Group

- Dominance in Cloud Services: AWS already holds a dominant position in the global cloud computing market and has a substantial global market share. This established presence provides AWS with a strong foundation and wide reach to introduce and promote AI services. Data from research conducted by Synergy Research Group, in Q1 this year, shows Amazon leading the pack of cloud giants with a 32% market share.

-

Customer Base and Integration: Amazon’s extensive existing customer base using AWS for various cloud services gives it an edge in AI offerings. The seamless integration of AI capabilities into existing AWS infrastructure attracts businesses already reliant on Amazon’s ecosystem. As more businesses integrate AI into their applications, I believe AWS will retain a majority of existing customers.

-

Developer-Friendly Ecosystem: AWS is known for its user-friendly interface and developer tools that simplify the process of application development and deployment. This ease of use can attract a broader audience, including businesses with limited AI expertise. Several independent research has shown that AWS is the top choice for cloud application developers.

-

Ecosystem Synergy: Amazon’s strong retail and e-commerce presence, coupled with AWS, enables AWS to offer easy-to-integrate automated AI capabilities tailored for retail, logistics, and more. This synergy can attract businesses seeking ready-made, industry-specific AI solutions.

-

Innovation and Continuous Development: Amazon’s focus on innovation and continuous development aligns with the evolving AI landscape. The company’s track record of launching new services and features could keep AWS at the forefront of AIaaS/MLaaS offerings. Currently, there are reportedly thousands of customers actively trying out AWS’ new AI service called Amazon Bedrock.

While Microsoft’s Azure AI, IBM’s Watsonx, and Google’s Vertex AI also have their strengths and user bases, Amazon’s existing cloud market dominance and developer-friendly ecosystem collectively position AWS to potentially capture a larger market share. It is, however, essential to monitor competitive dynamics and evolving AIaaS/MLaaS market trends to assess the ongoing competition among these top platforms.

Overall, Amazon is taking its AI/ML cloud business seriously. A recent news report revealed AWS’ substantial investment of $100 million to establish a Generative AI Innovation Center, where businesses and organizations seeking directions on AI/ML integration will engage with AWS science and strategy experts, harnessing their expertise in AI/ML and generative AI.

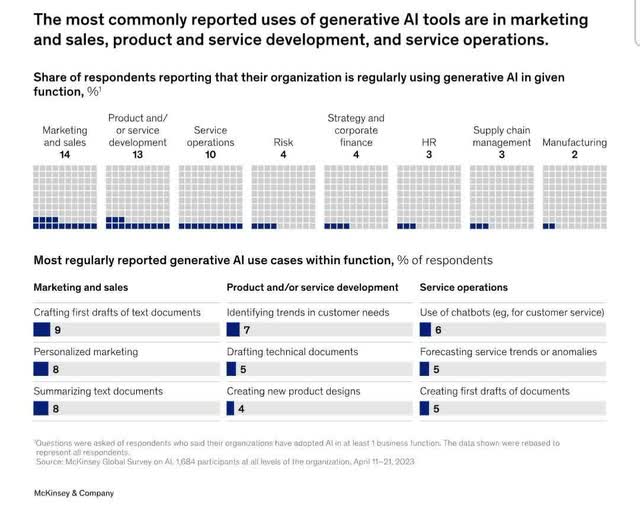

Growth Projection For The AIaaS/MLaaS Markets and How AWS (and Amazon) Could Benefit

Market research predicts that the generative AI market will grow from $43.87 billion (in 2023) to $667.96 billion by 2030. This growth will be driven by the demand to create virtual worlds and AI-powered marketing and sale, led by the marketing and advertising industry and its quest for better customer experience. Obviously, with this projected growth of the generative AI market, the demand for AIaaS/MLaaS tools and services will grow at a similar fast pace, as most generative AI applications will be built using foundation models provided by AIaaS/MLaaS providers.

Related, several research and reports have predicted substantial growth for the AIaaS/MLaaS markets. A June 2023 report by SkyQuest says the global AIaaS market will reach $187.98 billion by 2030, exhibiting a CAGR of 48.2% between 2023 and 2030, and the demand for MLaaS is expected to grow substantially in the same forecast period.

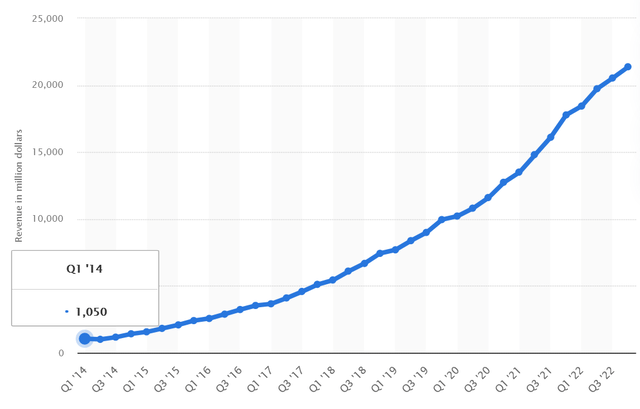

AWS Quarterly Revenue from Q1 2014 to Q4 2022 (statista.com)

AWS quarterly revenue has risen steadily in the past decade. Q1 2014 revenue was $1.05 billion; growing at a ~34% CAGR, AWS revenue reached $21.4 billion by Q4 2022, before experiencing a slowdown in Q1 this year. Amazon acknowledged the slowdown of AWS growth in its Q1 earnings call and attributed the slow growth to macroeconomic uncertainties which led businesses and enterprises to curb their cloud spending.

Amazon’s Q2 2023 report shows stability in AWS growth rate – a better outcome than the anticipated decline in Q1. AWS Q2 revenue sits at $22.1 billion with an operating income of $5.4 billion. Despite being considered more of a retail giant, 70% percent of Amazon’s $7.7 billion total operating income for Q2 came from AWS.

…what we’re doing is democratizing access to generative AI, lowering the cost of training and running models, enabling access to large language models of choice instead of there only being one option, making it simpler for companies of all sizes and technical acumen to customize their own large language model and build generative AI applications in a secure and enterprise-grade fashion.

Source: Amazon Q2 2023 Earnings Call Transcript

The recent uptick in the demand for AWS cloud services has been attributed to the increasing demand for AI cloud services. Amazon unveiled its goals for the AI landscape in the Q2 2023 earnings call.

We think of the middle layer as being large language models as a service. Stepping back for a second, to develop these large language models, it takes billions of dollars and multiple years to develop. Most companies tell us that they don’t want to consume that resource building themselves. Rather, they want access to those large language models, want to customize them with their own data without leaking their proprietary data into the general model, have all the security, privacy and platform features in AWS work with this new enhanced model and then have it all wrapped in a managed service.

Source: Amazon Q2 2023 Earnings Call Transcript

In the last earnings conference call, Amazon’s management reiterated its commitment to developing and democratizing access to large language models, which typically take an enormous amount of resources and time to build, by offering these models as-a-service. Amazon incorporates foundation models developed by other AI labs such as A121 Labs, Anthropic, Cohere, and Stability AI into Amazon Bedrock, demonstrating a strategic approach to expand its presence as an all-inclusive AI service provider.

Data Points from the Fiscal Quarter Reports Ending June 30 |

AWS |

Azure* |

Google Cloud |

|

Revenue |

$22.1 billion |

$24 billion |

$8.03 billion |

|

YoY Growth in Sales |

12% |

15% |

$28% |

|

Operating Income |

$5.4 billion |

$10.5 billion |

$395 million |

|

Market Share |

32% |

22% |

11% |

Data points from Amazon, Microsoft, and Google reports for their fiscal quarters ending June 30 show how the big three cloud segments stack up. *Note that Microsoft does not provide sales figures specific to Azure but combines Azure, other server software products, and enterprise products and services in its Intelligent Cloud segment. Therefore, I consider AWS the true winner in the cloud sector top-line, bottom-line, and market share ranking.

Quick Quantitative Analysis

Sell-side analysts are bullish on AMZN after a Q2 EPS surprise of 89.54%. The stock has seen 100% up revisions and 0% down revisions in the last 90 days. Q2 results showed a 133.3% YoY growth in operating income and 74% YoY growth in operating cash flow. Q3 EPS estimates are $0.56 or a 180% YoY increase, and $2.13 for EPS (TTM) by the end of the fiscal year 2023. I think the outlook for AMZN is positive and bullish due to strong revenue and earnings projections for the coming months, and optimistic guidance for Q3.

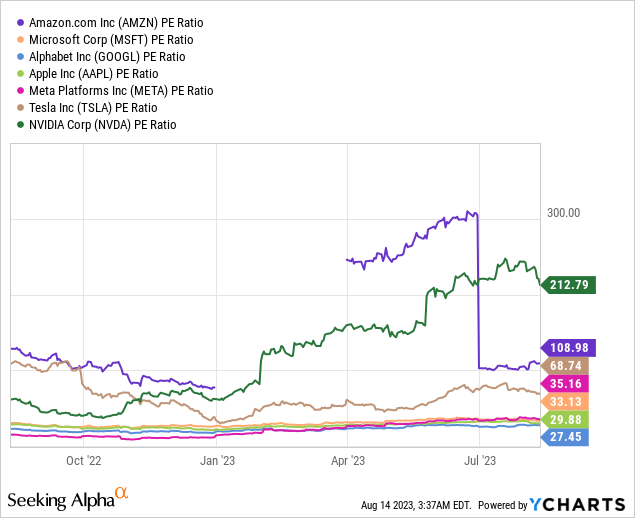

For most of the last ten years, AMZN has had a higher P/E multiple in comparison to the other stocks in the mega-cap tech peer group. AMZN has also had a P/E above its sector median, suggesting that investors have been willing to pay a premium for Amazon’s earnings relative to its peers. AMZN’s current P/E GAAP (TTM) is 108.98x. The historic median P/E multiple for the last decade is 149.23x. Based on the historic median value, I believe AMZN is currently trading at a relatively fair valuation in comparison to its historical P/E trend. I choose to go with the historical median P/E multiple instead of the more common historical average P/E calculation because of the potential for distortion. Given the high disparity in AMZN P/E multiples over the years, with a high of over 1000x and current P/E of 108.9x, a calculation of the mean value will be affected by outliers.

AMZN’s Forward P/E GAAP is 64.17; this expected decrease in P/E multiple shows an anticipated earnings growth, and I expect this to be priced into the stock in the future, with all other factors being equal.

Risks

While the coast seems clear for a massive AI adoption and AWS’ reign over the AIaaS/MLaaS markets, some factors could still slow the growth and profitability of AWS in its AI foray.

Economic Uncertainty

Macroeconomic uncertainties remain a challenge to the fast adoption of on-demand AI and the growth of the AIaaS/MLaaS industry. As mentioned earlier in this analysis, economic uncertainties prompt CIOs to cut costs by reducing investments in technological integration.

Privacy Concerns

With data breaches and privacy violations becoming a growing concern, privacy concerns might be another impediment to the adoption of AI. When AI models are trained using sensitive or personal data, there is a legitimate concern that the model might inadvertently misuse or expose that data, leading to potential breaches of confidentiality. The unpredictable outcomes of AI interactions with sensitive data underscore the need for rigorous testing, monitoring, and continuous refinement of these models.

Competitive Landscape

A potential risk also lies in the intensifying competitive landscape, which could potentially slow down AWS’ journey toward AI dominance. As big cloud players like Microsoft and IBM also vie for AIaaS dominance, Amazon must continuously innovate and offer unique value propositions to maintain its market edge.

High Capital Expenditure

Another pertinent risk is the substantial CaPex required to establish and maintain AI data centers, which are typically run on AI-specific hardware known as AI accelerators. This huge financial commitment could potentially impede profitability. As adoption expands, the investment needed for infrastructure, hardware, and ongoing maintenance would also increase, and that can strain financial resources and delay achieving desired returns.

AWS runs its proprietary AI accelerators designed to optimize performance for its next-gen AI-capable data infrastructure. The chips are designed and produced by its subsidiary Annapurna Labs. The production of specialized accelerators, like AWS Trainium and AWS Inferentia, involves significant investments in research, development, design, facilities, and production equipment.

Talking about AI chips, Google and Microsoft are actively developing their proprietary AI accelerators. Google is in the AI drag race with its AI chip known as Tensor Processing Units (TPUs); its exascale AI supercomputer called TPUv4 is powered by its TPU chips. Microsoft has also been reportedly working on its AI chip, code-named Athena, since 2019. The active investments in and development of these proprietary AI accelerators underscore how the leading cloud computing providers are fiercely competing to push the boundaries of AI innovation and secure their foothold in the AI domain.

Takeaway

As AI adoption expands, AWS could play a pivotal role in enhancing enterprise capabilities through AI. The growth trajectory of generative AI and the demand for AIaaS/MLaaS tools aligns well with Amazon’s ambitions, potentially driving substantial top-line growth. While there are challenges like economic uncertainties, privacy concerns, competition, and high CaPex, Amazon’s investment in innovation and its commitment to democratizing AI access, positions it favorably to navigate these challenges and maintain market lead.

Generative AI will be majorly served through AIaaS/MLaaS, allowing developers and businesses to access and utilize generative models for various applications without needing to build and maintain the models themselves. Researchers predict a strong impact of generative AI on the global economy. Goldman Sachs believes generative AI could disrupt and raise global GDP by 7%. CIOs of top firms are bullish on the potential of generative AI. Generative AI, served through AIaaS/MLaaS, is an untapped market, and I believe AWS is rightly positioned with a strong foothold.

Since 2014, at least 50% of Amazon’s operating profit has been from AWS. That figure just went up to 70% for Amazon’s Q2 operating income. Since the release of Amazon’s Q2 report, the spotlight has been on AWS – for all the good reasons. AWS is considered the bedrock of Amazon’s bottom line. I believe that Amazon will strategically invest in what has become its most important segment and cash cow, to ensure sustained growth and profitability.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best AI Ideas investment competition, which runs through August 15. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.