Summary:

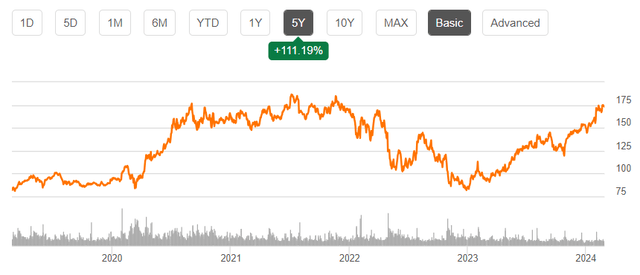

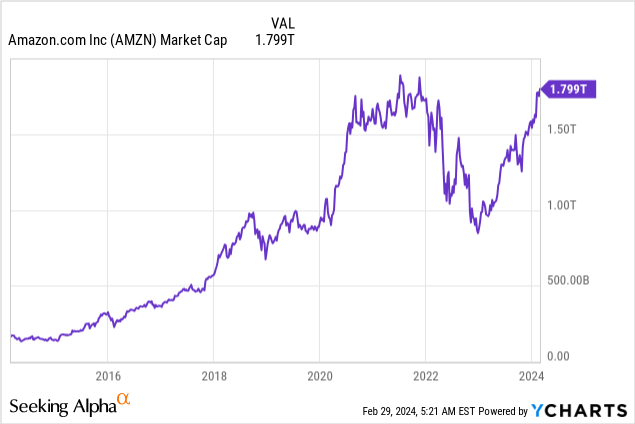

- Long-term investors of Amazon have seen significant returns, with the stock being a “10-bagger” since 2014.

- Amazon’s ongoing aggressive reinvestment strategy, supported by its financial resources and talent, suggests that the stock’s rally is far from over.

- Valuation analysis indicates that Amazon is currently undervalued by 20%, making it a “Strong Buy”.

Justin Sullivan

Introduction

Investors who started building up their positions in Amazon.com Inc.’s (NASDAQ:AMZN) stock during the pandemic rally partially fueled by the FOMO (fear of missing out) effect might not be very happy since the stock is currently still below its 2021 highs. However, I believe that long-term investors of Amazon, who have held their stocks for at least the last ten years, are very happy because the stock has been a “10-bagger” since 2014. This massive value for shareholders was created by successfully executing the company’s aggressive investing strategy. Since Amazon’s aggressive reinvestment strategy is ongoing and bolstered by its substantial financial resources and top-tier talent, I believe that AMZN’s rally is far from its conclusion. My bullish stance is also supported by the valuation attractiveness because my valuation analysis indicates a 20% undervaluation, which makes AMZN a “Strong Buy.”

Fundamental analysis

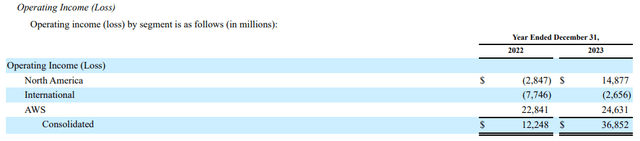

Amazon is the global cloud infrastructure leader and the world’s second-largest global e-commerce player based on gross merchandise value (“GMV”). The company’s e-commerce business generated almost half a trillion in revenue in 2023, but this is a business with thin margins. On the contrary, the company’s Amazon Web Services (“AWS”) cloud business is a profitability superstar with about 27% operating margin.

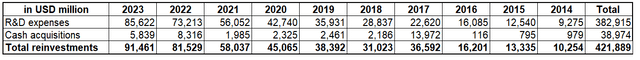

The company is heavily betting on growth as free cash flow is not distributed to shareholders as dividends but accumulated and reinvested in R&D and acquisitions, which are crucial for the company’s growth strategy. According to Wikipedia, since the company’s establishment in the mid-1990s, Amazon has acquired more than 100 companies and also bought stakes in dozens of other businesses.

Based on the data presented by Seeking Alpha in the company’s financial performance section, Amazon spent a total of $422 billion in cash acquisitions and R&D between 2014 and 2023. This equals around 34% of the cumulative gross profit generated by AMZN over the same period.

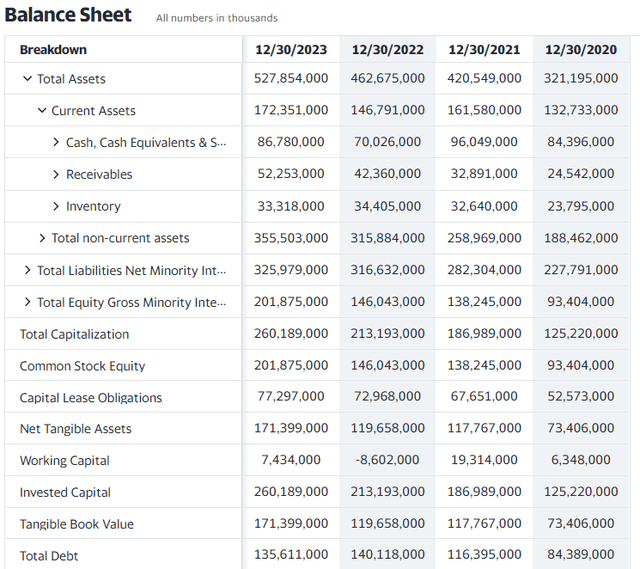

When I look at AMZN’s balance sheet, I understand that its aggressive reinvestments in business growth are likely to continue because the company had almost $87 billion in cash as of the FY 2023 year-end and total debt much lower than the company’s $1.8 trillion market capitalization.

There are numerous factors that evidence that Amazon’s growth strategy with aggressive reinvestments is working.

First, the company is leading in the two thriving industries and is expected to compound at double digits over the next several years. According to marketingreport.one, the global e-commerce industry will grow at a 12% CAGR over the next several years. Precedence research forecasts the same average annual growth rate for the cloud infrastructure market. Having leadership in two emerging industries indicates not only exceptional execution of the management but also unparalleled visionary talent.

Second, this massive business expansion and leadership created shareholder value over the last decade. Amazon ended 2014 with approximately $150 billion in market cap, and it is currently about 12 times higher, which means that the capitalization grew at a 28% CAGR, creating massive returns for long-term investors of AMZN.

Third, Amazon was named one of the top U.S. employers for several years in a row. This means the company is likely able to recruit top talents and professionals and create strong teams across different lines of business.

The great execution and visionary talent of the management, ample financial resources, and the ability to create great teams for each of the company’s ventures is an unbeatable mix that will highly likely help Amazon to sustain its leadership positions in e-commerce and cloud infrastructure.

The company is investing heavily in new hot industries, which are also poised to double and triple in size over the long run. Amazon’s interests are present in the emerging electric vehicles (“EV”) industry via its big bet on Rivian Automotive, Inc. (RIVN). Apart from EVs, Amazon also invests in video streaming and sports betting, among other emerging industries. Despite the video streaming business being very crowded with stars like Netflix, Inc. (NFLX) and The Walt Disney Company (DIS) leading the industry, I believe that Amazon has sufficient both financial and human capital to compete.

Valuation analysis

AMZN demonstrates strong momentum across different timeframes and rallied by 85% over the last 12 months. The stock almost doubled from the November 2022 bottom but still did not reach its historical heights achieved in 2021.

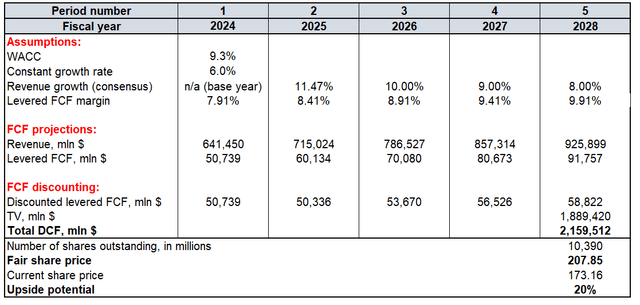

Amazon’s current market cap is $1.8 trillion, and to check whether it is fair, I will conduct the discounted cash flow (“DCF”) modeling. I will discount future cash flows with a 9.3% WACC. As I have mentioned in the fundamental analysis, Amazon invests substantial amounts into future growth and is a global leader in the two emerging industries. Therefore, I think that a 6% constant growth rate for the terminal value (“TV”) calculation is fair for AMZN. I rely on consensus estimates for my 2024-2025 revenue assumptions and expect a steady deceleration as the scale of the business expands. I use a 7.91% TTM levered FCF margin for the FY 2024 and expect a 50 basis points expansion each year. According to Seeking Alpha, there are around 10.4 billion AMZN shares outstanding.

My DCF model suggests that AMZN’s fair share price is about $208. This means the stock is around 20% undervalued compared to the last close.

Mitigating factors

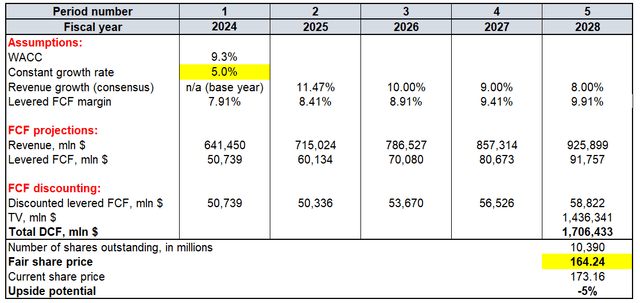

Around 90% of the stock’s fair price is represented by the terminal value, which is very sensitive to changes in the constant growth rate. Sustaining a CAGR of 6% is challenging and apparently not guaranteed. If a 5% constant growth rate is incorporated into the DCF model instead of 6%, the fair share price tumbles to $164. This is around 5% lower than the last close.

AWS’s leadership in the cloud seemed intact, but recent news suggests that the competition from Microsoft Corporation’s (MSFT) Azure is intensifying. According to crn.com, AWS lost two percentage points of cloud market share, while Azure gained the same portion. This means that Azure not only expanded its market share but also did so at the expense of AWS. Such a change is highly likely caused by the generative AI functionality developed by OpenAI, which is available to MSFT (because Microsoft is one of the largest investors in OpenAI) and not available to AMZN. To address this risk, in late September 2023, Amazon announced a $4 billion investment in another AI startup, Anthropic, which was a clear signal that the company was entering the AI battle. But I think that another quarter of giving up a portion of market share to the biggest rival will be absorbed by investors with considerable pessimism.

Conclusion

A company like AMZN, the global leader in two hot industries, traded with a 20% discount, is an apparent gift and a “Strong Buy”. As the company’s successful strategy in the past is supported by top talent and ample financial resources, I am confident that from the long-term perspective, the stock can repeat the massive bullish run delivered over the past decade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.