Summary:

- Ambarella projects over 25% y/y revenue growth for fiscal 2026, driven by strong product momentum in automotive and IoT sectors.

- The company is debt-free with $230 million in cash, but its free cash flow is largely offset by stock-based compensation.

- Valued at 11x forward sales, Ambarella offers a compelling entry point for long-term investors despite competitive pressures and market volatility.

- Risks include potential inventory corrections and market downturns, which could impact investor willingness to pay the current valuation.

amgun

Investment Thesis

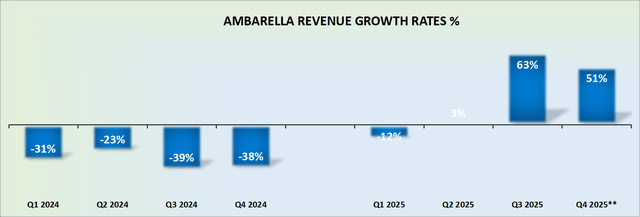

Ambarella (NASDAQ:AMBA) delivers very strong guidance for fiscal Q4 2025. More specifically, it now appears that investors can count on 50% y/y revenue growth rates for the next quarter.

Consequently, I now expect to see more than 25% y/y revenue growth rates in fiscal 2026 (starting February 2025).

Even though this investment thesis is not blemish-free, I believe that there’s a lot to like in this name and that over the next several months, investors will look back to $86 per share as a cheap price to get involved with this stock.

Ambarella’s Near-Term Prospects

Ambarella is a semiconductor company specializing in advanced processors for edge applications in the automotive and IoT sectors. Its value proposition lies in its innovative System-on-Chips that provide high-performance computing with power efficiency.

These processors enable intelligent features like advanced driver-assistance systems in vehicles and AI-driven video analytics in IoT devices, making them critical to next-generation technologies across auto and IoT sectors.

Ambarella’s product momentum is driven by its CV family of processors, including the high-value CV5 and upcoming CV7 chips. These chips are gaining traction due to their performance in automotive and enterprise IoT applications.

Ambarella operates in a highly competitive semiconductor industry, contending with giants like NVIDIA (NVDA) as well as smaller peers like Semtech (SMTC), as well as many others, which also develop AI processors for automotive and IoT markets.

On top of that, the slow adoption of Level 2+ autonomy and broader market weaknesses could be a source of headwinds to sustaining growth in this competitive landscape.

Given this balanced backdrop, let’s now delve into its fundamentals.

Ambarella’s Fiscal 2026 Could Deliver +25% CAGR

Before we go further, note that Ambarella is now in fiscal 2025 (not to be confused with calendar year).

During the earnings call, management noted that new product adoption was driving its strong outlook for fiscal Q4 2025.

Further, given its newly found momentum, Ambarella now projects fiscal 2025 (ending soon, in January 2025) revenue growth of approximately 23% y/y, up from the midteens it guided for last year.

What’s more, management nevertheless notes that there’s still some seasonality in its outlook.

And although management doesn’t provide any sort of tangible guidance for more than the quarter ahead, I believe that there’s a distinct possibility that Ambarella will grow at more than 30% CAGR next fiscal year.

Here’s my reasoning. Firstly, we know that between fiscal Q3 and fiscal Q4, Ambarella is delivering about $78 million to $83 million in revenues, albeit moving from higher revenues to slightly lower revenues, given the natural seasonality.

Nevertheless, I believe that expecting around $80 million in revenues in fiscal H1 2026 seems like a reasonable assessment.

Consequently, for fiscal H1 2026, even without much growth from fiscal Q3 2025, there’s a path here for Ambarella to deliver about +25% y/y growth rates with ease. Possibly more.

This would make AMBA look like a very different sort of company than investors have become accustomed to in the past several years. Indeed, it’s been more than 8 consecutive quarters since Ambarella has delivered +25% y/y revenue growth rates. This could be a new dawn.

With that in mind, let’s discuss its valuation.

AMBA Stock Valuation — 11x Forward Sales

What I like about Ambarella is that it is a debt-free business, with roughly $230 million of cash and marketable securities. This means that just over 6% of its market cap is made up of cash. Clearly something that is enticing for an Inflection investor, such as myself.

But where I struggle to get overly comfortable is that the business’ free cash flow profile leaves a lot to be desired. Case in point, for the first 9 months of fiscal 2025, Ambarella delivered $2.2 million of free cash flow.

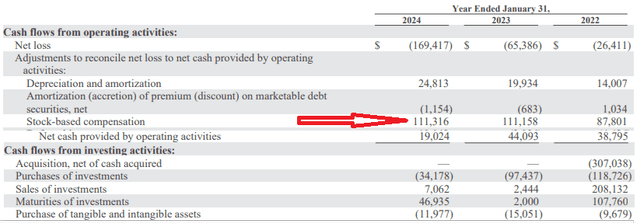

And then, keep in mind that for fiscal 2024, Ambarella’s stock-based compensation was more than $100 million, see below.

AMBA fiscal 2024 annual report

So yes, Ambarella can proudly state that it has delivered 15 consecutive years of positive free cash flow. But if the vast majority of its free cash flow is going out the door as stock-based compensation, what’s left for shareholders? On the other hand, I ponder, does it matter? Am I overthinking matters?

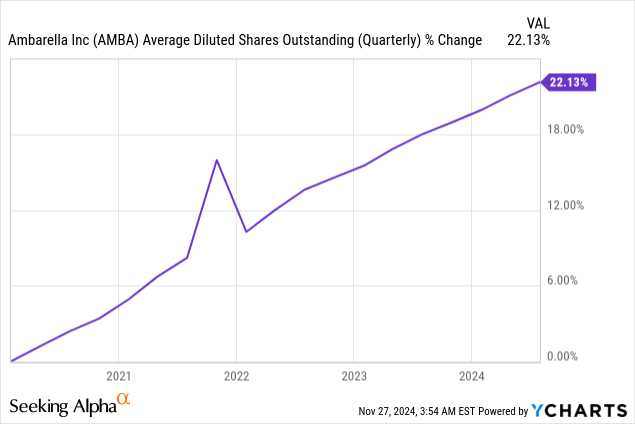

Allow me to throw in a different reference point. In the most recent quarter, fiscal Q3 2025, Ambarella’s shares outstanding increased by slightly over 3% y/y. This continues its 3-year trend of diluting shareholders, see below.

As you can see above, in the past 3 years, the share count is up more than 20%. So, yes, Ambarella can highlight consistent free cash flow, but is there any excess free cash flow for me?

On yet the other hand, everything we’ve discussed in this section is already old news. It’s already in the price. What the future investor will care about is where the business is heading. Not where it’s been.

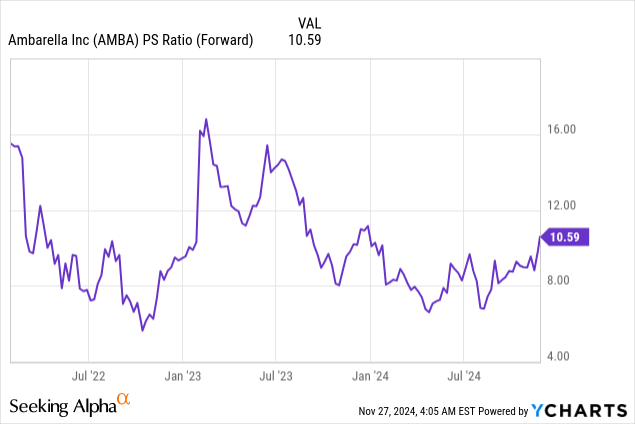

As you can see above, investors have been willing to pay approximately 11x forward sales for Ambarella. Sometimes slightly more and sometimes slightly less.

But for all intents and purposes, it appears that now investors are still willing to pay around 11x forward sales, including the after-hours jump, the only difference being that right now, they are getting a company that is demonstrably growing at more than 25% CAGR.

Important Risk Factors

Here’s the main bearish aspect. How many times over the past 5 years has Ambarella seemed to be Inflecting higher, only to disappoint investors? Inventory corrections have happened in the past. And they will also happen again in the future.

Hence, my question is this, how sustainable are these revenue growth rates?

The other consideration in my mind is that for now, investors are not too perturbed by paying around 11x forward sales for AMBA. But at the same time, the market right now is really hot.

If the market slows down, investors may be less inclined to pay 11x forward sales, and it’s not implausible for AMBA to return to around 8x forward sales.

The Bottom Line

As I reflect on Ambarella’s current positioning, I find the valuation of 11x forward sales compelling.

This pricing offers a unique opportunity to invest in a company poised to deliver over 25% y/y revenue growth for fiscal 2026. On the other hand, challenges such as competitive pressures remain, but I believe these are already in the price.

Moreover, with a strong debt-free balance sheet, and a clear growth trajectory, Ambarella’s potential to redefine itself as a high-growth story makes the current entry point attractive for long-term investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.