Summary:

- The stock was rallying on hopes for a turnaround at AMBA, but it got derailed after several recent developments.

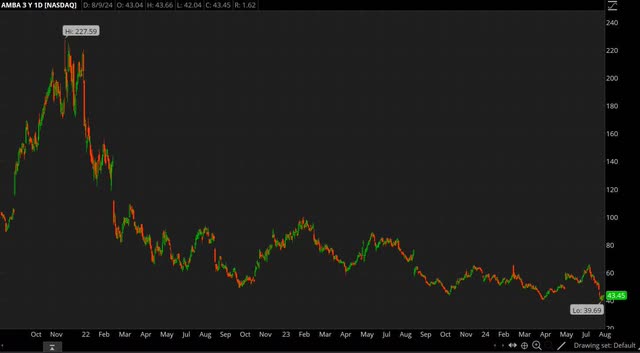

- Ambarella has seen sales shrink and losses mount, and the stock has done just as badly in the last three years, but better times may be within reach.

- The Company is counting on the market in China to enable a return to growth, but that foray is fraught with risk due to the tussle surrounding AI.

- U.S. government policy is a wildcard that could shape the road ahead for AMBA, but it is not easy to tell what will happen on that front.

J Studios

Ambarella (NASDAQ:AMBA), a supplier of low-power, system-on-chips or SoCs, has given back everything it gained after the last earnings report raised the value of the stock, based on the belief AMBA is set to return to growth after an extended period of contraction. The recent decline was caused by several contributing factors from different corners, which have yet to go away, but with AMBA scheduled to release its next report on August 27, an argument could be made that the recent drop in the stock presents an opportunity. However, the bull case for AMBA is not as obvious as it probably needs to be to get everyone on board. Why will be covered next.

AMBA Has Struggled For The Last Three Years

A past article from almost three years ago or September 2021 looked at the strengths and weaknesses of AMBA. On the one hand, the stock was in the midst of a powerful rally. In fact, the whole semiconductor sector was rallying at that time, all of which provided the incentive to get in on AMBA. On the other hand, AMBA traded at lofty valuations since a lot was expected from AMBA in terms of growth. AMBA, for instance, had a P/E ratio in the triple digits, which not everyone would be comfortable with. AMBA was thus rated a hold.

Being wary of paying a very high multiple for AMBA turned out to be warranted, as can be seen in the chart above. Instead of living up to the lofty growth expectations, AMBA has seen sales collapse, starting in the second half of 2021. In turn, AMBA racked up losses. In the last fiscal year, for instance, AMBA posted a GAAP loss of $169.4M or a record $4.25 a share in FY2024. The stock fell as the numbers from AMBA got worse.

AMBA hit a new 52-weeks and multi-year low of $39.69 as recently as August 7, 2024. The last time the stock went any lower was in March 2020. However, prior to this, the stock managed to put together a strong rally. This included a 20.6% gain in the stock after the release of the most recent or Q1 FY2025 report, before the stock collapsed in mid-July to new lows as shown in the chart above.

What Caused The Stock To Collapse In July

It’s no coincidence the decline started on July 17 with a drop of 8.4% on that day. On July 17, reports surfaced that the U.S. government was considering new restrictions on semiconductor companies doing business with China. This development affected the whole sector, but AMBA was particularly hard hit because the company has been counting on China to power a turnaround, as we will later see.

The decline continued in August as a result of a selloff in the stock market as a whole. A bunch of factors played a role here. This included geopolitical ones, including rising tensions in the Middle East, but also others like the unwinding of carry trades in financial markets. All this led to the drop in the stock from a high of $65.88 on July 16 to a low of $39.69 three weeks later on August 7.

However, the stock has rebounded in the last couple of days to close to $43.45 on August 9 for a market cap of $1.78B. AMBA is also set to announce its latest results on August 27 after the last report triggered a 20+% gain in the value of the stock. Some may be betting that could happen again, since nothing much has changed at AMBA itself since the last report. An argument can be made that if AMBA is set for an encore on August 27, then now is the time to get in on AMBA after the recent decline in the price of the stock.

Why There Is Reason To Be Upbeat About AMBA

As mentioned earlier, AMBA saw the top and the bottom-line shrink due to a drop in demand in the past few years. However, AMBA has responded by shifting away from its traditional business and moving towards new products with the intent to reignite growth. AMBA has placed particular focus on the application of artificial intelligence or AI at the edge through inference.

The last report showed that AMBA is making progress in making the transition towards become an inference AI play. In Q1 FY2025, AI-related revenue accounted for two-thirds of revenue. The FY2025 outlook sees AMBA returning to growth after contracting in FY2024. From the Q1 earnings call:

As expected, both auto and IoT revenue increased sequentially, and the AI products were about two-thirds of our total revenue. As previously discussed, our customers are in the midst of recovering from a cyclical inventory correction, and the favorable impact from this is expected to carry into the second quarter.

We continue to expect our fiscal ’25 revenue to grow year-over-year, driven by both the cyclical tailwinds and the secular growth in our AI portfolio. The combination of this cyclical and the secular forces is expected to enable our AI inference revenue to grow more than 30% in fiscal 2025.”

Source: AMBA earnings call

The consensus is that AMBA will report a non-GAAP loss of $0.19 a share on revenue of $62M when it releases its Q2 FY2025 report on August 27, based on AMBA’s guidance as shown below. Keep in mind that revenue has fallen YoY for 7 consecutive quarters. So for Q2 FY2025 revenue to come in flattish is significant progress, a sign AMBA is turning it around and putting the recent downturn in the rearview.

|

(Non-GAAP) |

Q2 FY2025 (guidance) |

Q2 FY2024 |

YoY (midpoint) |

|

Revenue |

$60-64M |

$62.1M |

(0.16%) |

|

Gross margin |

62.5-64.0% |

64.6% |

(135bps) |

Source: AMBA Form 8-K

The numbers for Q2 FY2025 are expected to improve upon Q1 FY2025 as shown below. In Q1 FY2025, AMBA lost $10.47M or $0.26 a share on revenue of $54.48M, both down YoY. In terms of GAAP, AMBA lost $0.93 a share. The main difference between the GAAP and non-GAAP number is that the latter excludes $0.64 of stock-based compensation expense. AMBA finished the quarter with cash, cash equivalents and marketable securities totaling $203.3M, partially offset by $3.39M of total debt.

|

(Unit: $1000, except EPS) |

|||||

|

(GAAP) |

Q1 FY2025 |

Q4 FY2024 |

Q1 FY2024 |

QoQ |

YoY |

|

Revenue |

54,473 |

51,616 |

62,142 |

5.54% |

(12.34%) |

|

Gross margin |

60.9% |

59.8% |

60.4% |

110bps |

50bps |

|

Income (loss) from operations |

(39,445) |

(41,714) |

(35,542) |

– |

– |

|

Net income (loss) |

(37,932) |

(60,607) |

(35,902) |

– |

– |

|

EPS |

(0.93) |

(1.50) |

(0.91) |

– |

– |

|

Weighted-average shares outstanding |

40,774K |

40,384K |

39,340K |

0.97% |

3.65% |

|

(Non-GAAP) |

|||||

|

Gross margin |

63.4% |

62.5% |

63.1% |

90bps |

30bps |

|

Net income |

(10,467) |

(9,825) |

(6,027) |

– |

– |

|

EPS |

(0.26) |

(0.24) |

(0.15) |

– |

– |

Source: AMBA Form 8-K

Why The Market Gave AMBA A Thumbs Up After The Q1 FY2025 Report

The value of the stock did not increase by over 20% after the Q1 FY2025 report for no reason. AMBA accomplished significant goals, which suggests AMBA is getting back to being a high-growth stock. AMBA, for example, scored its first design win for AMBA’s CV3-AD AI domain controller with a top five EV passenger vehicle company in China. AMBA believes this win alone could boost revenue by more than $100M.

Keep in mind FY2024 revenue came in at just $226.47M, so this is something that has the potential to really move the needle. AMBA scored another design win for its CV3-AD in China, with SANY in the market for commercial vehicles. AMBA also announced partnerships with other Chinese companies in the area of AI, particularly when it comes to autonomous driving. AMBA showed there is reason to believe a turnaround driven by the growing adoption of AI is starting to bear fruit.

Why There Are Grounds For Skepticism

This brings us to why the recent moves by the U.S. government could potentially spell trouble for AMBA. China played a prominent role at the Q1 FY205 earnings call since AMBA is counting on demand in China to power the turnaround, but AMBA is at risk of being denied full access to the market in China, depending on how new export restrictions are framed by the U.S. government.

Many of the previous export restrictions imposed on China by the U.S. government centered around AI. For instance, the U.S. restricted the supply of high-end GPUs from Nvidia (NVDA) that are needed for AI. So in theory, AMBA could stand to be affected since it too is trying to supply China with products that are centered on AI.

As previously shown, recent wins by AMBA came in China. If AMBA is denied access, whether in part or in full, then AMBA’s turnaround effort could be on shaky ground. It is too early to say, but those recent design wins in China may not benefit AMBA as much as previously thought. AMBA could still put together a turnaround, but it may have to do it without China.

If the turnaround is delayed because of intervention by the U.S. government, then AMBA could see its streak of annual losses extend. In terms of GAAP, which takes into account AMBA’s heavy use of stock-compensation expense, AMBA last finished with a net profit in FY2018. A look at the balance sheet shows an accumulated deficit of $172.86M, which shows that AMBA has lost more than it has made over the years. AMBA’s ability to generate a profit is shaky.

Nor has the top line grown much. Revenue grew at a CAGR of just 2.89% in the last 10 years. Yet, even though it has not really delivered in terms of growth, AMBA trades like a high-growth stock. AMBA, for instance, is valued at about 8 times sales with a market cap of $1.78B and TTM sales of 218.8M. In comparison, the median in the sector is 2.8x. Put all the above together, and you can see why long AMBA, despite its potential, is not as clear-cut as it needs to be.

Investor Takeaways

AMBA is scheduled to release its Q2 FY2025 report on August 27. The upcoming report is likely to build on the one that preceded it and one that helped trigger a major boost in the value of the stock. Some may want to get in on AMBA for this reason. AMBA will still end up in the red once again, but the numbers should be consistent with a company that is getting out of a deep downturn.

Furthermore, investor interest in potential AI plays remains as high as ever in the market and AMBA could be regarded as an AI play, although at the edge. Recent design wins in China show that AMBA has great growth potential. There is a reason after all why AMBA is assigned a relatively high valuation with multiples much higher than most.

However, potential export restrictions by the U.S. government could upend AMBA’s plan for a turnaround. That plan seemed to rely heavily on demand in China, and AMBA has had success there, but it is possible AMBA may have to go for a plan B, one that does not include China, or not as much. AMBA has to show it can duplicate its recent designs wins in China in other markets, but it has yet to do so. That could be a problem.

I am neutral on AMBA. It is possible there may no trade restrictions imposed on AMBA in China. If this happens, the stock has a chance to go higher on the back of growing demand for AI in China. At the same time, anyone who goes long AMBA needs to understand the risk associated with being long a stock that is exposed to potential trade restrictions on China, a market AMBA is counting on heavily.

If China is not an option for AMBA, bulls will have to wait longer for a turnaround, assuming there is one. New export rules can also be imposed at any point, so the stock could potentially be subject to a selloff when it is least expected. AMBA is a potential high-growth stock, which offers exposure to the AI market, but it is also a stock with a lot of risk attached to it.

Bottom line, if one wants to bet that there will be no restrictions on trading with China due to the U.S. government, than long AMBA could be worth considering. On the other hand, if one is not sure what will happen when it comes to trade restrictions on AMBA, then it may be better to not place bets that risk a sizable haircut in the event restrictions are imposed on AMBA.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.