Summary:

- Ambarella Inc. has experienced a decrease in share price due to a difficult economic environment in the semiconductor industry.

- The company focuses on creating system-on-a-chip designs for HD video processing, AI computer vision algorithms, and more.

- Ambarella is targeting the automotive industry and IoT for future growth, but profitability and R&D expenses remain concerns.

sankai

Investment Rundown

The share price has been volatile for Ambarella Inc (NASDAQ:AMBA) as the semiconductor industry is facing a difficult economic environment, not as enriched with demand as it previously was. As companies are managing to stock up inventories more efficiently, the sudden demand and shortages for some products in the industry seem to have mellowed out demand. This has been visible in the earnings report for AMBA as their revenues shrunk YoY drastically, causing investors to abandon the stock and the share price to decrease.

The share price is lower than where it was back in late May, but unfortunately, I don’t think it yet constitutes a buy. We need catalysts and even though we have the next report right around the corner, I think investors are faced with too much risk buying ahead of it. Instead, a more neutral view seems appropriate, and I am rating AMBA a hold for now.

Company Segments

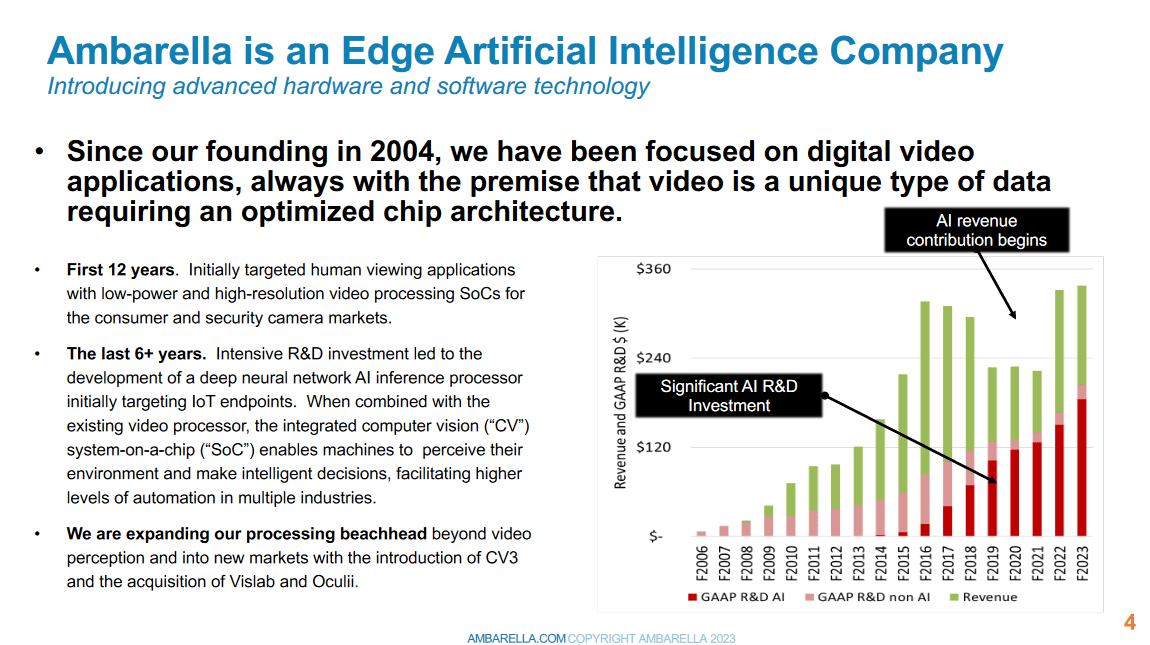

AMBA is a leading developer of cutting-edge semiconductor solutions that power high-definition (HD) and ultra-HD compression, image processing, and deep neural network processing on a global scale. The company is focusing on creating various system-on-a-chip designs that seamlessly combine HD video processing, image processing, advanced artificial intelligence computer vision algorithms, audio processing, and comprehensive system functions all within a single chip. The broad nature of the business is what seems to have lent them the solid growth they have had and why they boast such a dominant position.

Overview (Investor Presentation)

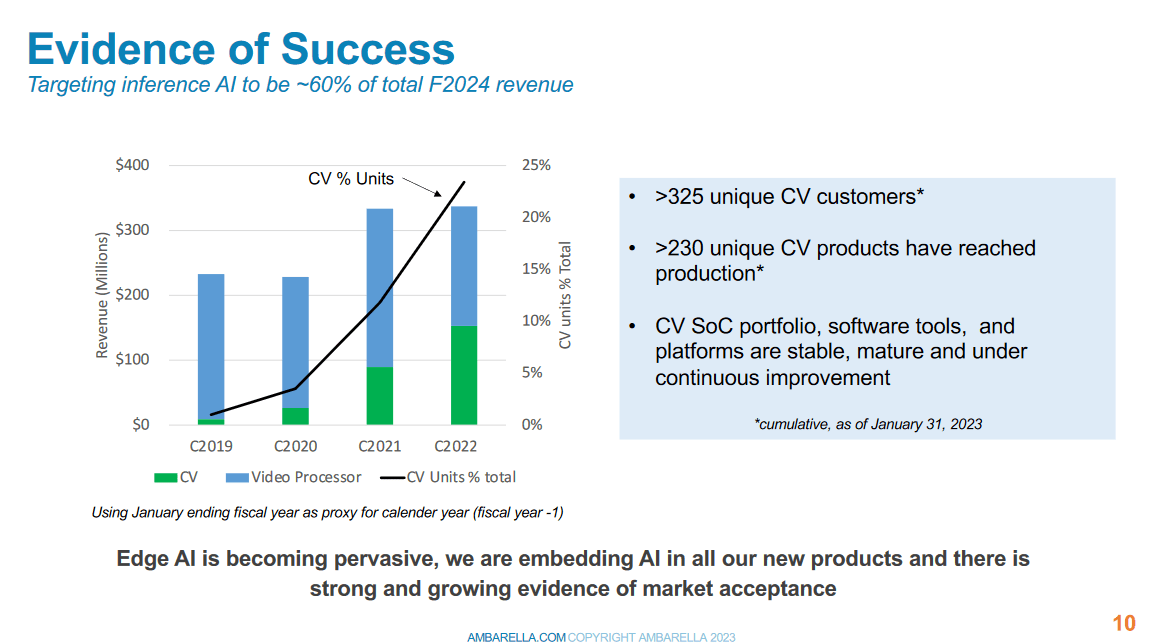

We are at the beginning of the AI revolution and companies like AMBA seem like fantastic bets and ways to gain exposure to these trends. The company is yet to post a positive EPS though, but projections are that it will happen by 2026 at least. This would make AMBA far more attractive for a buy case.

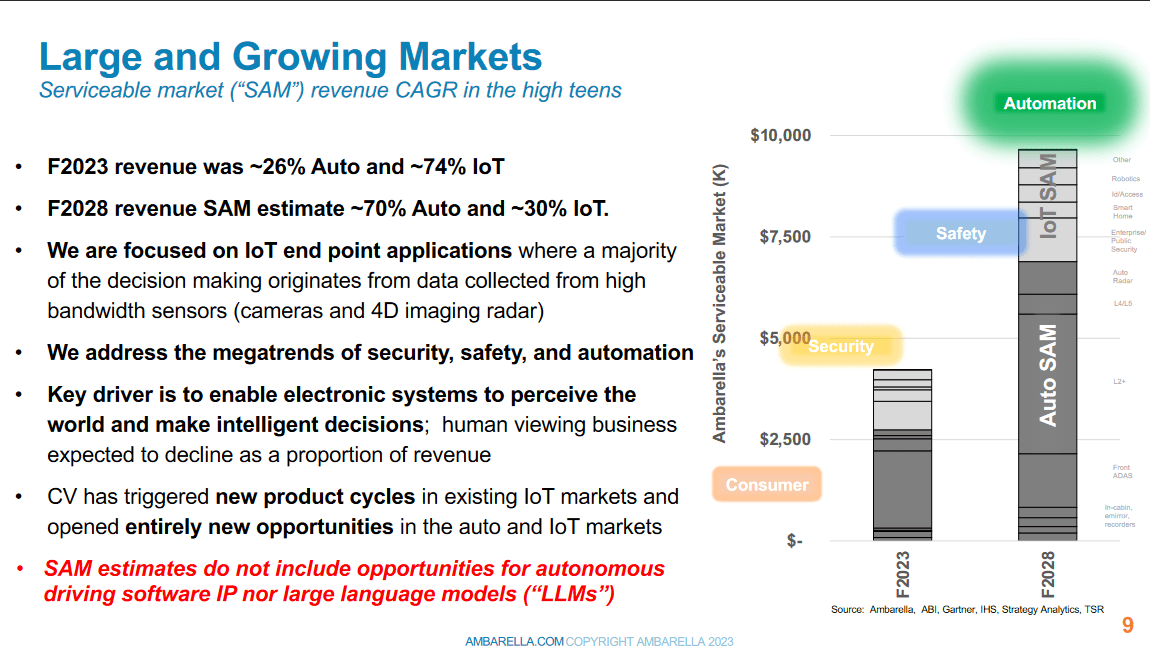

Markets (Investor Presentation)

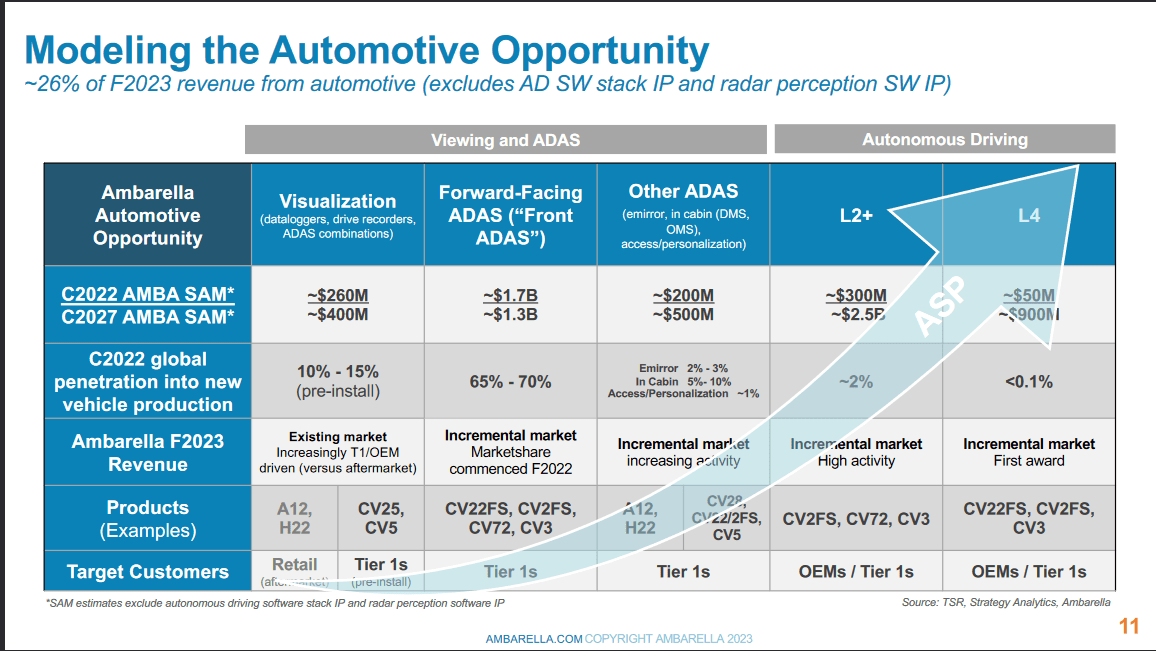

The primary markets that AMBA is looking at are the Auto industry and IoT. Going into 2028 the company forecasts that the Auto industry is going to make up around 70% of the total revenues for the company, which would be quite a major shift from today’s levels when it’s just 26% instead. The company is likely to grow impressively over the coming years and anticipating a 10 – 15% YoY growth for the bottom line is not out of the picture I think. But as I am a rather skeptical investor, I want to see some more progress on profitability before jumping in. The coming report I don’t think will show enough of an improvement as R&D expenses continue to make up a large portion of operating expenses, over 60% in the last 12 months. Until AMBA can scale up further, I think these expenses will continue to weigh on margins and introduce risk to investors that I am not willing to take on.

End Markets (Investor Presentation)

Diving deeper into the automotive market for AMBA there are ample amounts of opportunities. The company is more or less a service company that derives value from helping industries and companies be able to better automize their processes and operations. For the viewing and ADAS, SAM AMBA sees a $2.2 billion opportunity. But a lot of the potential also comes from autonomous driving, which is valued at $3.4 billion by 2027 in SAM. The company is primarily targeting Tier 1s and OEMs for their services and so far AMBA has been successful in its growth, as they have gathered up over 325 unique CV customers. Going into the Q2 FY2024 report by the company, seeing customer growth beat estimates, then the share price might jump as both momentum appears once again and profitability might be closer than previously thought. I am willing to take the risk that substantial customer growth won’t have happened as many companies are still worried about overspending as interest rates remain high.

Risks

The trajectory of the company’s forthcoming revenue growth hinges significantly on its capacity to expand its market share, particularly within the rapidly evolving domains of IoT and automotive camera markets. The pivotal nature of these sectors to the company’s success underscores the potential risks associated with their uncertainties. Should these markets not materialize according to the company’s current projections or if the technical requisites of these sectors shift unexpectedly, the products specifically tailored for these markets could potentially lose their competitive edge. Where I think investors can rest assured though is that AMBA has been very efficient in growing its customer base and successful unit growth sales have resulted in strong revenue growth through the years.

Company Growth (Investor Presentation)

In essence, the company’s revenue potential is inextricably tied to its adaptability and ability to align with evolving market dynamics, making strategic foresight and innovation crucial for navigating these potential challenges. The intersection of diverse markets with or merging into the camera market presents a critical factor that could potentially render the company’s offerings outdated. This underscores the company’s susceptibility to market shifts and the need for proactive adaptation. In conclusion, we need to see solid market momentum and a shift in demand towards the more positive if we are to consider AMBA a buy in my opinion. The sector is volatile as the cyclical nature is on display.

Financials

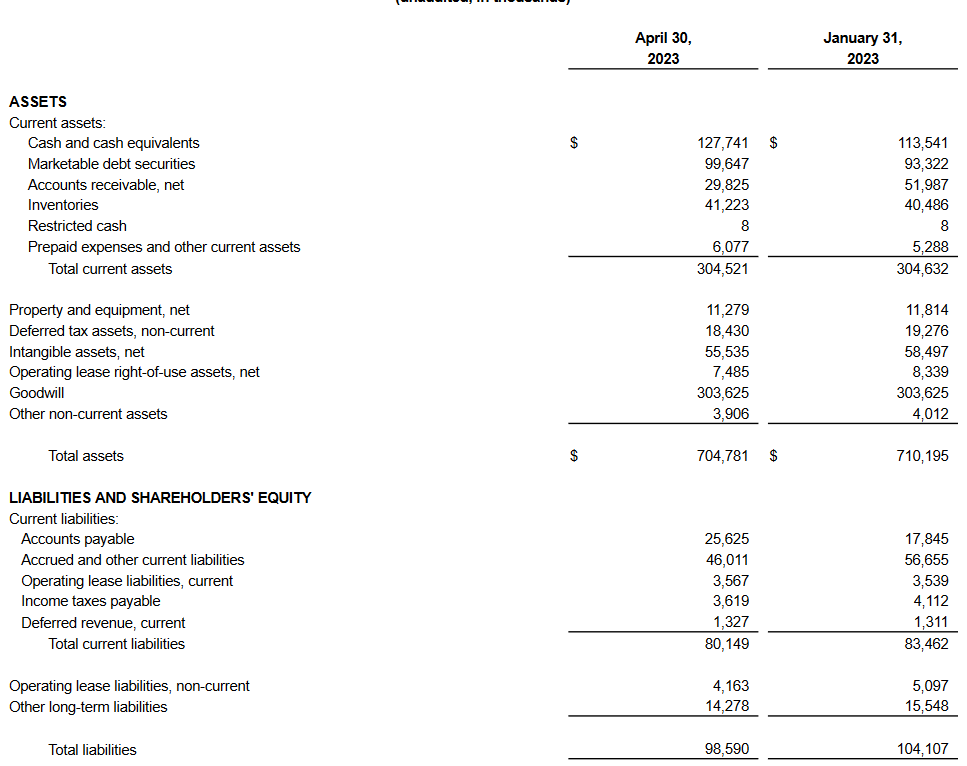

Without a profitable net margin, maintaining a sound financial position becomes incredibly important for AMBA. Reckless spending and they are forced to dilute shares at a faster rate which would cause the share price to decline.

Balance Sheet (Earnings Report)

The cash position continues to grow, which is very good to see, and it sits around $122 million currently. Without any debt as well, the company is in a fantastic position to continue to invest heavily and drive more growth. The entire cash position more than covers the total liabilities, which further amplifies the value of the business.

Final Words

AMBA offers investors a great opportunity to get exposure to some of the major trends that will define manufacturing and industries in the coming decades, automation. The company may lack a profitable bottom line that isn’t sufficient to warrant a sell case in my opinion. The balance sheet is solid with no debt and a good amount of cash. As we are approaching the next earnings report though, I think some challenges need to be tackled, mostly customer growth and margin expansion. I doubt we will see sudden improvements there and that results in me rating in a hold for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.