Summary:

- We initiate our coverage of Ambarella with a hold.

- 3Q24 results and outlook lead us to believe AMBA is seeing a slow recovery post-customer inventory correction and facing muted demand in IoT and auto markets.

- We think the weakness has been priced into the stock for the most part but don’t see a near-term catalyst driving substantial outperformance in the near term, underperforming the S&P 500 by 34%.

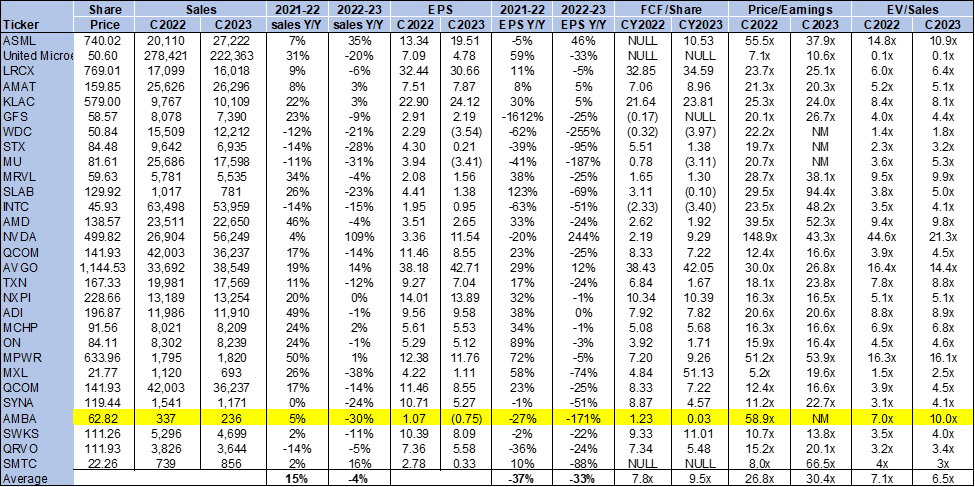

- Additionally, we believe AMBA is expensive at current levels, trading at 10.0x EV/C2023 sales versus the peer group average of 6.5x.

- We expect the stock to be an in-line performer to a slight outperformer in the near term.

mikkelwilliam/E+ via Getty Images

We’re initiating Ambarella, Inc. (NASDAQ:AMBA) with a hold. AMBA is a semiconductor company that produces products used for human vision and edge AI applications, including video security, advanced driver assistance systems (ADAS), electronic mirrors, and monitoring for drivers/cabins. This quarter, management reported sales down 19% QoQ and 39% Y/Y to $50.6M, relatively in line with consensus expectations at $50M, and is now guiding for a slight QoQ growth to $50-53M, representing a 36-40% Y/Y decline and slightly ahead of consensus of $50.4M. We see a longer recovery story for the stock due to muted demand in both IoT and auto end markets. We think the auto and industrial correction will be the last leg of the correction in the semi space, aside from the AI correction next year that we expect to impact Nvidia (NVDA) primarily. Our neutral rating is based on our belief that the stock will only slightly outperform expectations for its January quarter by better-than-expected IoT growth while auto sales remain flat sequentially. We think investor money can be better placed elsewhere in 1H24. We see other semi stocks better positioned to outperform AMBA in the near term, including Semtech (SMTC). We think it’s still too early to jump into AMBA as 1. We expect sales to continue to be weighed down by inventory corrections and macro weakness, and 2. We don’t see any near-term catalyst offsetting the weakness.

Additionally, management also pushed out the timeline for its CV-based SoC auto program to 2026 or later, further confirming our belief that the company still hasn’t found stable footing post-correction is trying to manage expectations; for reference, AMBA’s low-power systems-on-chip or SoCs provide high-resolution video compression, advanced image, and radar processing.

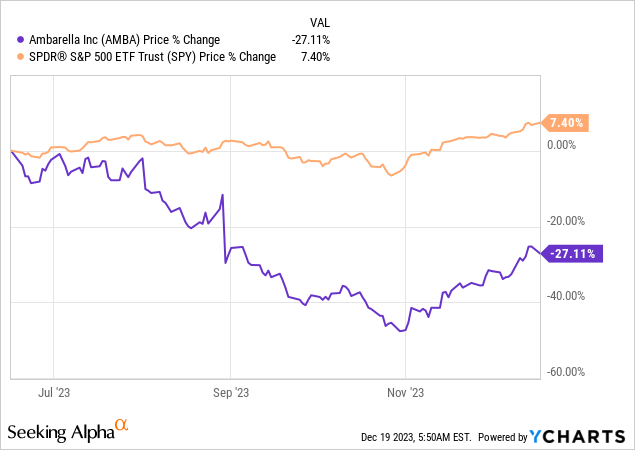

The stock is down ~27% over the past six months and 21% YTD, underperforming the S&P 500 by roughly 34% and 45%. We think the macro weakness has been priced into the stock for the most part. Still, we expect AMBA to be more of an in-line performer in the near term.

The following graph outlines AMBA stock against the S&P 500 over the past six months.

YCharts

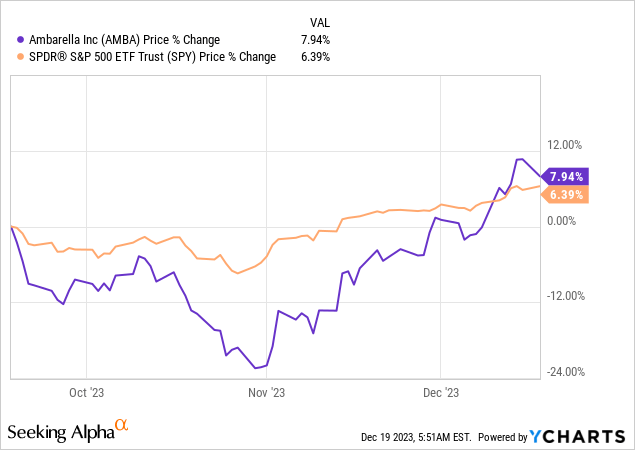

The following graph compares AMBA stock against the S&P 500 over the past three months. The stock is up 8%, roughly in line with the S&P 500.

YCharts

We’re more optimistic about the stock in 2HFY25 as management noted, “Our customers appear to be making progress with their inventory reduction efforts, and we expect to return to revenue growth in Fiscal 2025.” We think it’s too early to jump into the stock at current levels. We expect to see more favorable entry points down the line.

Valuation

AMBA is expensive, trading well above the peer group average. We think the higher multiple is not =justified with growth expectations in 2HFY24 and early FY25. The stock is trading at 10.0x EV/C2023 sales versus the peer group average of 6.5x. We think the pullback creates an attractive entry point into the stock at current levels – the stock dropped from a 52-week-high of $99.86 to a low of $43.59. Still, we don’t see AMBA outperforming materially in the near term and see no rush for investors to begin to initiate a position or add to their position at current levels.

The following outlines AMBA’s valuation against the peer group.

TSP

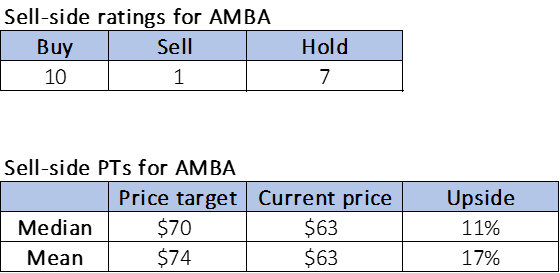

Word on Wall Street

Wall Street doesn’t share our neutral sentiment on the stock. Of the 18 analysts covering the stock, 10 are buy-rated, seven are hold-rated, and the remaining is sell-rated. We think Wall Street is more bullish on the stock due to the pullback in FY24 so far and attribute the sentiment to Wall Street’s belief that AMBA revenue has bottomed, and now the stock is better positioned to outperform. We see AMBA stock being an in-line performer to a slight outperformer but wouldn’t recommend investors add to their position for the near term due to AMBA’s slower recovery path post-inventory correction.

The stock is currently priced at $63 per share. The median sell-side price target is $70, while the mean is $74, with a potential upside of 11-17%.

The following graphs outline Wall Street’s sentiment on AMBA.

TSP

What to do With the Stock

We’re initiating our coverage on AMBA with a hold. We think the worst of the macro weakness and the correction is factored into the stock price, and outlook after the company forecasted sales below consensus in 2QFY24 for 3QFY24, and the stock dropped 21% YTD. We don’t see the stock working in the near term due to continued weakness in IoT and auto. We don’t see the company accelerating top-line growth materially in the first half of the year amid the current macro backdrop and recommend investors stay on the sidelines.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.