Summary:

- Ambarella Inc. reported in-line Q4 results and outlook for 1QFY25. I expect this in-line trend to continue in 1HFY25.

- I think the company is too exposed to IoT and automotive markets to be able to outperform given the current correction cycle.

- The stock has underperformed the S&P 500 and lacks potential upside in the first half of FY25, in my opinion.

- Ambarella’s Asia exposure, particularly in China, may weigh further on its top-line growth, but this worst-case scenario is unlikely.

- I share my thoughts on Ambarella here, and why I think it’ll be in-line performer in 2024.

Evgenii Emelianov/iStock via Getty Images

Investment Thesis

Ambarella, Inc. (NASDAQ:AMBA) reported its fourth quarter of FY2024 results and outlook for FY25 in late February, confirming what I believe will be a lackluster first half of FY2025. Ambarella is a relatively small-cap semiconductor company that develops low-power semiconductor solutions offering HD and Ultra HD compression, image processing, and powerful deep neural network processing, as outlined in their recent 10Q filing. I’m less optimistic about Ambarella because of the company’s exposure to the IoT (Internet of Things) and automotive markets, both undergoing a correction cycle in the first half of 2024. Sales to the former grew slightly in 4Q24 while the sales in the latter were flat. The company’s been somewhat stagnant in terms of outperforming consensus numbers for the past two quarters. I don’t see this changing even as the inventory correction is completed. I’m initiating Ambarella with a neutral rating as I don’t believe there is enough momentum to drive automotive and IoT demand this year, even after the correction cycle is over.

Ambarella’s Value Proposition

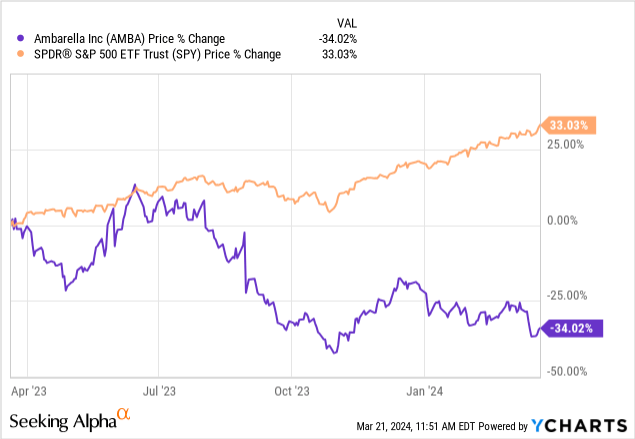

Ambarella stock has taken a hit over the past year, declining 34% compared to the S&P 500, up 33%, as shown in the graph below. Management reported that FY24 revenue was down 32.9% year-over-year due to “customers digested inventory resulting from the industry-wide semiconductor cyclical downturn,” as Ambarella CEO Fermi Wang noted on the earnings call. Ambarella’s products are used in “human vision and edge AI applications,” which encompass “video security, advanced driver assistance systems (ADAS), electronic mirror, drive recorder, driver/cabin monitoring, autonomous driving, and robotics applications.” It should be noted, however, that Ambarella was originally a human vision applications center company and only shifted to investing in AI over the past decade, roughly speaking.

YCharts – SeekingAlpha

The company’s main selling point (or expected growth catalyst) is its 10-nanometer CV2 family and 5-nanometer CV5, and management is particularly excited about the CV3 SoC family entering production. I like Ambarella’s position in the automotive and AI inference markets, with the majority of revenue coming from the IoT market. From my coverage of the IoT market, I can see a mixed outlook for 2024. I don’t see any catalyst to spark an end-demand recovery in the first half of FY25.

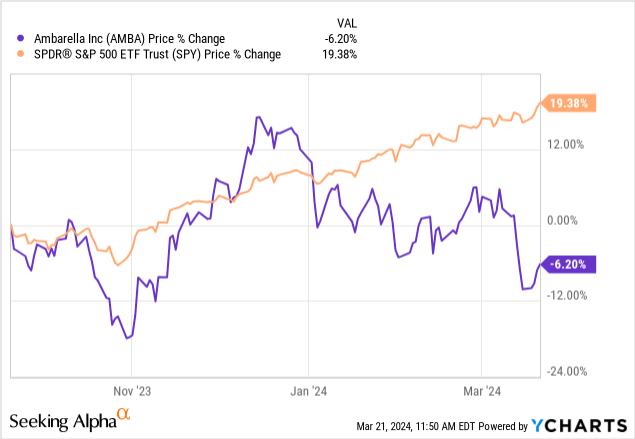

The stock’s underperformance has been somewhat consistent over the past three months, underperforming the S&P 500 by ~26% (shown in the graph below) and 25% over the past six months. Underperformance will moderate after the correction cycle is over as a result of inventory replenishment on the automaker front, but I don’t see enough potential upside to make the stock a buy for investors in 2024.

SeekingAlpha – YCharts

Management is now guiding for revenue between $52M-$56M for the next quarter; according to my calculations, this translates to 1-8% sequential growth, relatively in line with consensus numbers at $53.6M. Management noted on the call expectations for both IoT and automotive sales to grow sequentially, which inspires confidence in the next quarter’s results. There’s also a lot of talk about automotive taking over IoT as Ambarella’s bread and butter. I think this will be challenging for the company to achieve in 2024, given the mixed automotive outlook reflected in other semis like On Semiconductor (ON). I don’t expect Ambarella to underperform consensus, but I also don’t think it’ll materially outperform them. I expect the stock to be an in-line performer at best over the next quarter.

What Could Go Wrong?

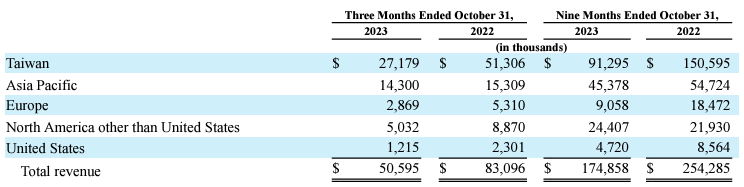

Ambarella has an Asia issue, specifically an Asia exposure issue, with ~81% of total sales coming from Taiwan and Asia Pacific, as shown in the geographic breakdown of revenue provided below. I believe the current slowdown in China, particularly in EVs and the real estate market, will act as a headwind and weigh on Ambarella’s top-line growth for the year. Management noted on the earnings call for 4Q that the first CV3 revenue would come from China; this concerns me due to the softer end demand in China in the current macro backdrop.

Ambarella 10K

Management’s response when being asked about the revenue out of China during the Q&A section of the call was as follows: “China continues to be one of the focus areas that we are in because I think that — I think everybody sees the EV development in China and we believe autonomous driving also will happen in China faster than other areas. So that’s definitely why we believe we can monetize our CV3 technology in China faster than any other areas.” I’m constructive on Ambarella’s longer-term position in China, but I don’t see the company experiencing any true recovery in the region during 1H24.

The worst-case scenario here, in my opinion, is that my hold is too gentle, and there is actually more downside to come. I think this could happen in the following scenario: if things in China get substantially worse. After wrapping up the first quarter of the year, I’ve come to believe that things in China for semis can’t get worse, and the impact across the peer group has been more or less priced in. However, if unexpected geopolitical tensions materialize between China and Taiwan, I think there could be a material downside for the entire semi peer group, including Ambarella. I don’t believe this is likely, as I don’t think China can afford that kind of confrontation given its internal challenges in boosting the economy.

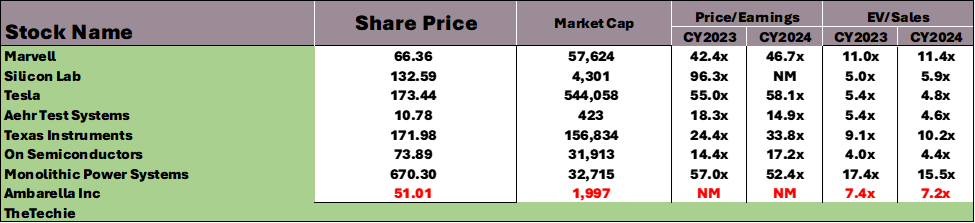

Don’t Get Fooled by the Valuation

Ambarella’s valuation makes the stock inexpensive or cheap, based on a relative methodology of valuing stocks in my coverage. Ambarella trades at a ratio of 7.2 for EV/Sales CY2024 compared to the peer group average ratio of 8, as shown with data generated by Refinitiv. I understand investors who would be tempted by the valuation, but I’d warn against getting fooled by it. I think the stock has a balanced risk-reward scenario for the year, but I see limited room for outperformance. I’d recommend looking into the stock in two quarters rather than today.

Image created by The Techie with data from Refinitiv

What’s Next?

In my opinion, Ambarella should be on investors’ watch list for the October quarter this year rather than at the end of Q1. I think the company does have a unique position in IoT and automotive and expect this to be a growth driver once the correction ends and once end demand shows signs of rebounding. I currently can’t see any catalyst at play that’ll drive automotive end demand, particularly for EVs; I think the price wars and Tesla (TSLA) and other EV makers’ results next quarter will confirm my expectation of a lack of momentum in the auto market for 1H24 and early 2H24. I think investors should hold the stock if they own it and stay in the stands if they don’t until we see a catalyst at play or an inventory replenishment cycle near the October quarter.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.