Ambarella: Shift Forward To FY26, And Upgrade To Buy

Summary:

- I upgrade my rating from hold to buy due to potential turnaround signs, including positive inventory trends and 4Q23 guidance.

- The long-term growth outlook has improved by $100 million, indicating the business environment is better than last year.

- AMBA’s focus on low-power edge applications and strong value propositions position the company for increased demand.

B4LLS

Summary

Following my coverage of Ambarella Inc. (NASDAQ:AMBA), I recommended a hold rating as I was concerned about the headwinds in the automotive markets and the setbacks that AMBA has faced in the surveillance segment. This post is to provide an update on my thoughts on the business and stock. I am revising my hold rating to a buy rating as I am now focused on FY26 performance, where I expect AMBA to see a strong acceleration in growth. Management comments on inventories and 4Q23 guidance hint that the worst has passed. The long-term growth outlook (based on management disclosures on pipelines) has also modestly increased by $100 million, suggesting the current operating environment has improved vs. last year.

Investment thesis

For 3Q23, AMBA posted revenue of $50.6 million, which is a 19% decline sequentially and a 39% decline vs. last year. The sequential decline was mainly due to continued weakness in IoT. Gross margin saw 62.6%, in line with consensus expectation of 62.6%. That said, non-GAAP EPS came in at -$0.28, well above the consensus estimate of -$0.39. Even though the results were clearly not great, I think it was noteworthy that after six consecutive quarters of negative guidance, AMBA finally guided to a positive 4Q24 (4Q23 guided for $51.5 million, implying sequential growth). Additionally, AMBA is also seeing indications of stabilization in inventories at both its own books and customers, which I take as a possible indication of a turnaround. To give better context, daily inventory turnovers have declined by 5 days on a sequential basis to 145 days. These are promising signs that AMBA is entering the next upcycle. As such, I pivot my attention to FY26 performance.

Management updated AMBA’s funnel of automotive wins with their annual report during the call. For those who may not be aware, this is something that management does annually; it gives a six-year funnel of possible opportunities and won business, and it updates the reader on the automotive pipeline. I think this is the most accurate measure of AMBA’s long-term growth potential because it takes into account both new business opportunities and deals that the company has already secured over the next six years. Hence, this metric is indicative of the revenue growth potential. Encouragingly, this metric has seen an increase of $100 million from $2.3 billion to $2.4 billion. Assuming that this $2.4 billion is spread evenly across the next 6 years, this implies revenue of $400 million per year, which is a major step up from FY23 and LTM revenue figures. That said, I think it is important to note that there have been some project delays and cancellations within this funnel of opportunities, which is likely to impact near-term revenue realization. Especially considering that the auto business is only expected to contribute $80 million in revenues this year, I believe the materialization of revenue over the next 6 years is likely to be back-half-weighted.

Looking further into the long term, I believe AMBA has positioned itself correctly to take advantage of the AI narrative. During the quarter, AMBA showed that inferencing on CV3-AD using LPDDR5 memory instead of HBM memory was possible, and they also imported Meta’s Llama 2 13B model properly. In comparison to existing solutions, AMBA’s solution uses far less power (as of 1Q24); hence, this successful demonstration should drive more demand for AMBA. To help customers speed up the deployment of generative AI and LLMs at the edge of their networks, management also highlighted how the company is bundling LLM software building blocks with its silicon solution. I think the value proposition is quite evident here: lower power consumption (lower cost) and acceleration of deployment (reduced time to market)—both factors should contribute to AMBA capturing share ahead. All of these simply prove that AMBA’s move into premium domain controllers with CV3 was the correct call, since it is now able to tackle broader markets. In addition, AMBA has made it clear that they are concentrating on applications that use lower-power edge appliances and have no plans to pursue cloud-based inference due to the high investment required. This is great as it means AMBA will not be stepping up its rate of cash, and it is playing in the field where it is familiar, greatly reducing execution risk.

And it’s not that we don’t want to focus on bigger cloud or you know much bigger applications. It’s really that, I think with our current silicon and our current resources, we would like to focus on areas that we know that we are familiar with and we want to know that we can win. 3Q24

Valuation

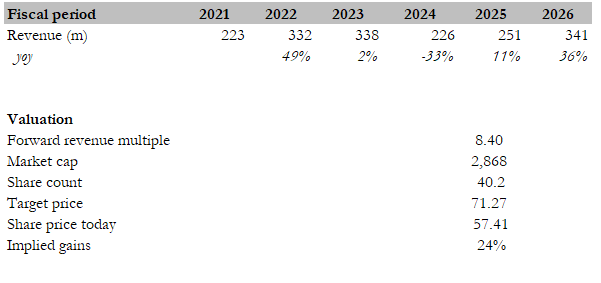

Own calculation

Before going into the details, note that I have shifted my focus from FY25 to FY26 as I look beyond the near-term performance (which has shown signs of stabilization). I believe the market is also adopting this longer-term view as valuation, on a forward revenue basis, has inched upwards to 8.4x, above the AMBA historical average of 6.4x. In my last model, I modeled FY25 to experience 9% growth, using AMBA historical financial performance as a benchmark. I have turned slightly more bullish, assuming that growth will come in line with consensus estimates, as management guided to positive revenue sequential growth in 4Q23, setting the base trend for FY24 (improving sequentially). For FY26, I believe the consensus 36% growth assumption is plausible. Using the subprime crisis cycle as a benchmark, the periods after FY12 saw accelerating growth, hitting ~31% in the 2nd year (FY24) after a strong 24% performance. Given that FY25 growth is only 11%, a good chance is that the 2nd year of recovery will see much stronger growth.

As AMBA shows that it has gotten past the worst of this cycle, I believe the market will continue to put more attention on future growth, thereby supporting the current elevated (vs. historical average) valuation multiple. I assume AMBA will continue trading at 8.4x forward revenue, which translates to a share price of $71.

Risk

AMBA could very well still be in a downcycle, which means AMBA could miss management’s 4Q23 guide. This will be very bad from a narrative standpoint, as I believe the market is already assuming AMBA will see growth acceleration from here. If growth continues to be negative, firstly, the market will re-rate AMBA’s valuation down, and consensus will adjust their revenue expectations downward as well. A combination of both will send the share price diving.

Conclusion

I am upgrading my rating for AMBA from hold to buy. The positive development in inventories and guidance for 4Q23 hint at a potential turnaround. AMBA long-term (6 years funnel) pipeline also showed positive growth of $100 million, further cementing the possibility of a turnaround. Importantly, the $2.4 billion funnel implies strong growth potential ahead as it is back-end weighted. AMBA focus on the low-power edge applications have seen success and I expect it to drive more demand due to the strong value propositions (lower power consumption and time-to-market).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.