Summary:

- Ambarella, Inc. has consistently performed well in recent quarters, but inventory challenges in the IoT and auto sectors raise concerns about the future outlook.

- Market weaknesses and a decrease in share in specific segments further cloud revenue projections.

- Despite challenges, Ambarella’s core market in professional surveillance is shifting towards promising computer vision technology. However, setbacks in specific surveillance segments and inherent challenges present roadblocks.

OneForAll

Summary

This post is to provide my thoughts on the business and stock of Ambarella, Inc. (NASDAQ:AMBA). AMBA has consistently performed over recent quarters, but their outlook raises concerns due to inventory challenges, particularly in the IoT and auto domains. Newer hurdles, like market weaknesses and a decrease in share in specific segments, further cloud the revenue projections. Interestingly, these difficulties arise while AMBA’s core market, professional surveillance, is shifting towards the promising CV technology. While there are clear signs of the company’s technological strengths and partnerships in the automotive and potential broader markets, setbacks in specific surveillance segments and inherent challenges present roadblocks. A closer look at AMBA’s historical performance underscores these challenges, hinting that they have been brewing for a while. Given these dynamics, investors should approach AMBA with a balanced perspective, acknowledging both its potential and existing challenges. Therefore, I recommend a hold rating.

Business overview

Ambarella, Inc. is a technology company renowned for its expertise in high-definition video compression and advanced image processing semiconductors. Their products can be commonly found in devices such as digital cameras, camcorders, and video-enabled mobile phones. Beyond conventional consumer electronics, Ambarella’s semiconductors have found applications in a variety of human and computer vision tasks. This includes sectors like video security, advanced driver assistance systems [ADAS], autonomous driving, and various robotics applications. What sets Ambarella apart is its commitment to producing energy-efficient, high-quality video compression technology alongside innovative image processing and deep neural network capabilities. This ensures not just capturing high-resolution video streams but also smartly extracting valuable data from them, thereby enabling cameras and devices to be more intelligent and data-rich.

Investment thesis

AMBA, for the past six quarters, has delivered consistent results. However, their forward guidance has consistently underwhelmed. Much of this stems from inventory challenges, most prominently in the IoT and auto segments. Moreover, newer concerns seem to have emerged from end markets, notably within low-end consumer IoT products. Such compounding issues project a concerning revenue outlook, a 20% quarterly decrease in third quarter, followed by an unchanged fourth quarter, with aspirations of a rebound only in first quarter of next fiscal year.

Surprisingly, these challenges come at a time when AMBA’s most significant market, professional surveillance, is undergoing a transition to more lucrative CV technology. Despite this positive transition and the benefits from several design wins in the automotive sector, consumer surveillance’s persistent hurdles, professional surveillance’s inventory excess, and possible share losses in legacy surveillance are causing significant setbacks.

It’s undeniable that the extent of these challenges, especially the ongoing inventory corrections had tangible repercussions on revenues, illustrated by an $80 million revenue drop in “video processing”, AMBA’s legacy products. This has reduced these revenues to just under $90 million for this year. The shift isn’t towards CV sockets as anticipated, but rather the company seems to be getting substituted for older models. Additionally, despite prior momentum in the professional surveillance sector, a contraction in computer vision revenues this year has been indicated.

Analyzing AMBA’s past financial records, I observe an 8% CAGR in revenue. Notably, this growth rate was influenced by the exceptional revenue in 2021 due to the semiconductor shortage, which, by 2023, is anticipated to stabilize. Excluding this anomalous period, AMBA’s adjusted CAGR shows stagnation. This stagnancy suggests inherent challenges within the company’s product lineup, as indicated by the consistent issues in consumer surveillance, the decline in legacy surveillance market share, and the mounting inventory in professional surveillance, aligning with the concerns raised earlier. This trend has continued into its most recent second quarter results, as AMBA has reported revenue of $62.1 million, down 23% from $80.9 million in the same period in fiscal 2023. GAAP net loss for the second quarter of fiscal 2024 was $31.2 million, or loss per diluted ordinary share of $0.79, compared with GAAP net loss of $23.7 million, or loss per diluted ordinary share of $0.62, for the same period in fiscal 2023.

However, it’s essential to highlight AMBA’s technological strengths. Their expertise in low-power, high-performance CV processors, showcased in partnerships with giants like Continental and Bosch, presents considerable long-term growth prospects. Their commitment to further investments in the automotive market and their potential across IoT, automotive, and possibly DC markets are noteworthy. But capitalizing on these trends requires intense dedication of both time and resources, and the company is not without its cyclical and secular challenges.

AMBA has shown steady performance over recent quarters but faces headwinds in the near future due to challenges in the IoT and auto sectors and emerging market weaknesses. Despite promising shifts in their professional surveillance market towards CV technology, gains in the automotive segment, and AMBA’s technological strengths, setbacks in consumer surveillance and inventory issues cast uncertainties. In addition, its historical financial performance shows that the company was facing these challenges long before this quarter.

Valuation

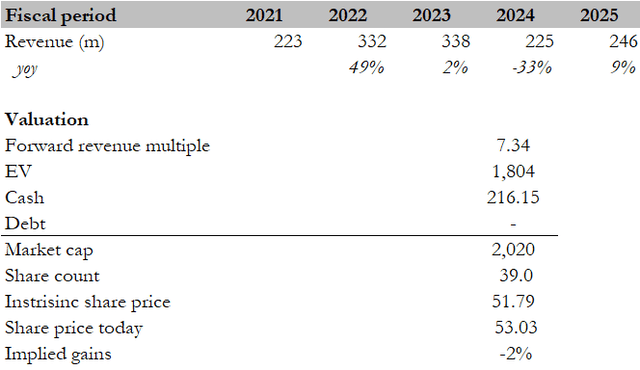

I believe the fair value for AMBA based on my model is $51.79. My model assumptions are that AMBA will experience a low single-digit [LSD] growth rate of 9%. This projection is influenced by its historical financial performance, which, when omitting the unusual 2021 year due to the semiconductor shortage, shows flat revenue growth. AMBA’s recent data further corroborates this, revealing a notable year-over-year decline. The company’s management anticipates a dip in third quarter revenue, stagnancy in the fourth quarter for this fiscal year, and potential upticks only by first quarter of next fiscal year. Factors underpinning this subdued growth expectation include the fading semiconductor shortage impact, challenges in the consumer surveillance domain, a surge in professional surveillance inventory, and a dwindling market share in legacy surveillance. Such impediments are anticipated to curtail AMBA’s near-term revenue expansion.

Peers like Lattice Semiconductor (LSCC) trade at a forward revenue multiple of 13.75x. In comparison, AMBA is projected to see a 1-year growth decline of 15%, while LSCC is forecasting a 5% growth. Additionally, AMBA’s EBITDA margin is at a negative 15%, distinctly lower than LSCC’s 33.97%. AMBA’s free cash flow yield/current market cap is only 0.57, which is under LSCC’s 2.04. Considering these factors, AMBA’s lower forward revenue multiple appears justified. Thus, I recommend a hold rating for AMBA stock.

Risk

One of the notable upside risks for AMBA is the potential for technological breakthroughs or the introduction of new product lines. Should the company unveil cutting-edge technology or products that quickly resonate with the market, it could significantly elevate its revenues and market presence, potentially warranting a reevaluation of its stock value.

Additionally, the strategic landscape presents another dimension of upside risk. Any strategic partnerships or acquisitions, whether AMBA aligns with another significant player or becomes a target for acquisition itself, can reshape its market trajectory. Such moves can expand its market reach, infuse additional resources, and potentially accelerate its growth trajectory, pushing the stock value upward.

Lastly, the broader semiconductor landscape also holds promise. As global economies rebound and the pace of technological integration hastens, a resurgence in semiconductor demand could be on the horizon. If AMBA efficiently taps into this surge, its sales and profitability could witness a robust uptick, casting a positive light on its stock valuation. These factors collectively suggest the possibility of a bullish outlook for AMBA and could challenge the current hold recommendation in future evaluations.

Conclusion

In examining AMBA’s trajectory, several points stand out. AMBA’s consistent performance across six quarters juxtaposes its underwhelming forward guidance, with challenges like inventory issues in the IoT and Auto segments being particularly acute. These are compounded by market weaknesses and share losses, especially in low-end consumer IoT products, setting an uncertain revenue projection. Despite these, AMBA’s transition in the professional surveillance sector towards more advanced CV technology signals potential growth. However, it’s tempered by setbacks across various segments and my earlier underestimation of these challenges. AMBA’s financial growth remains modest with an 8% CAGR, a figure skewed by the 2020 semiconductor surge. Strip that away, and growth stagnates. While the firm boasts technological alliances with heavyweights like Continental and Bosch and shows a commitment to expansion, it grapples with systemic issues. My DCF model pegs AMBA’s fair value at $51.79, influenced heavily by its past and recent performance trends. When viewed alongside peers, its conservative debt stance gives it resilience against external shocks. Nevertheless, considering all variables, a hold position for the stock seems prudent at this juncture.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.