Summary:

- Ambarella is entering another quarterly report with promises, but its history of execution is questionable.

- Quarterly revenue is expected to grow sequentially with all focus on FQ2 guidance for $60-plus million in quarterly revenue.

- The stock is already fairly valued at 6x to 8x sales targets, but Ambarella appears poised for another unsustainable rally due to AI and AV hype.

Shutter2U

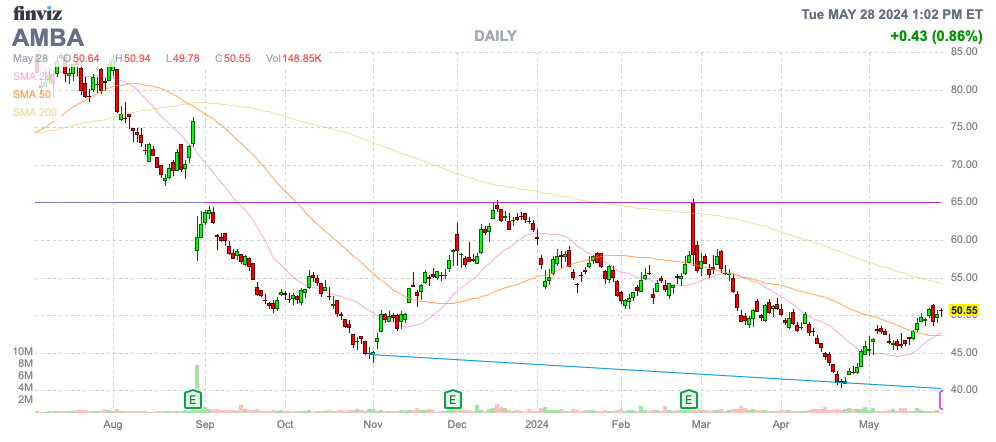

Ambarella (NASDAQ:AMBA) enters another quarterly report with a ton of promises, but the semiconductor company has no history of continuous execution. The most recent potential was a strong order backlog in automotive, but the company has already shifted to AI inference chips while sales have plunged. My investment thesis remains slightly bullish on the stock trading near lows due to a likely cyclical upturn in the business.

Source: Finviz

Turnaround Quarter

Ambarella has a history of catching onto the next trend without maintaining leadership for sustained growth over multiple years and cycles. The company reported weak FQ4 results back in February and the expectation is for FQ1’25 numbers on May 30 as follows:

- EPS -$0.31

- Revenue of $54.0 million (down 13% YoY)

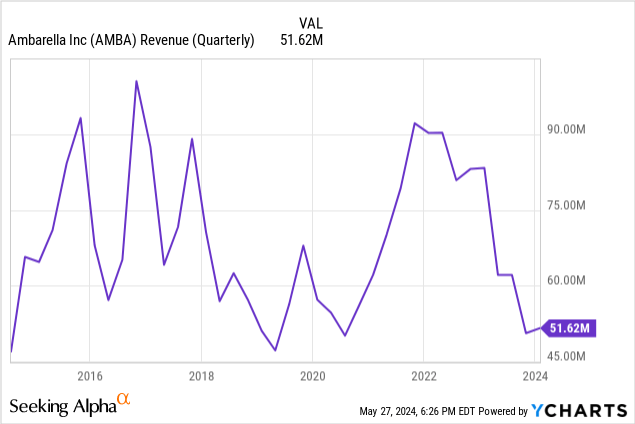

Quarterly revenue is expected to grow more than $2 million sequentially following the lows of just above $50 million in FQ3’24. The prior FY saw IoT revenues end the year down 40% YoY and automotive was down 14% leading to only $15 to $20 million in quarterly auto revenues. The tough semiconductor space in the last year didn’t help, but Ambarella is involved in autonomous driving and supposedly AI inference technology that should lead to sustained growth.

Unfortunately, the company has a massive history of high performance vision chips in demand from drones to now autos, but Ambarella is never able to sustain the growth. Quarterly revenues topped $90 million all the way back in 2015 and recently printed those levels in 2022 before leading to another dip back to $50 million again.

Consensus analyst forecasts have revenues rising back to nearly $60 million in FQ2 and closer to $70 million to end FY25 in January. The stock has a history of big runs, including hitting $100 on the automotive excitement back in early 2023 due to the company discussing automotive funnel reaching $2.3 billion last year.

As in the past, all of the stock rallies fizzle out as cyclical sales hit a wall. Investors will want to hear something from management regarding the sustainability of any up cycle this time.

For the stock to really rally, Ambarella has to confirm a FQ2 sales jump back above $60 million and the company is on a path back to $70-plus million in quarterly revenues. On the FQ4’24 earnings call, CEO Fermi Wang seemed to confirm confidence with analyst consensus estimates as follows:

First of all, we didn’t guide any quarter to be 70 million in our guidance. We talk about, we believe that we’re going to have growth this year and also believe that our Q1 guidance. But overall, I think when I look at the number that Street’s predicting, I think it’s reasonable. And also that based on what we have seen with our customer demands and as well as our booking, I feel comfortable with the current Q1, Q2 guidance. Of course, Q3, Q4, we haven’t seen enough booking, but however the momentum is there.

The new CV5 chip provides ASPs in the $30 to $40 range vs. the CV2 chip with an average ASP in the high teen range. The chip company has what appears substantial upside from selling more content. The company is confident in competing with Qualcomm (QCOM) on AI inference chips, but Ambarella has provided the market with no confidence of beating out a chip giant for a large market.

The automotive backlog is a prime example of a business where orders can grow over a four- to five-year period. Ambarella discussed deals with automotive customers, such as XPeng (XPEV), but again the company can’t actually produce sustainable sales growth.

Not Exactly Cheap

While Ambarella has unfulfilled potential, the stock tends to trade somewhat based on that potential. The stock currently has a market cap of $2 billion with a revenue run rate at $200 million, or close to 10x sales.

The consensus estimates have revenues rebounding to $250 million this fiscal year and reaching to $320 million in FY25. Ambarella trades at 6x to 8x those sales targets, which is probably aggressive for a semiconductor stock producing revenue near the lowest level of the last decade when chip demand has absolutely soared.

The chip company has a nice $220 million cash balance, but the company is forecast to produce losses for the next couple of years. One can’t really assume Ambarella finally hits a home run with AVs or AI.

Besides, the small chip company has struggled delivering profits recently due to the weak revenues. The FQ1 guidance for revenue of $54 million with gross margins of 62% leads to a gross profit of just $33.5 million.

The gross profit target is substantially below the $46 million-plus operating expense target. Ambarella would have to deliver $10 million-plus in additional quarterly revenues in order for gross profits to cover expenses, though the company does suggest quarterly revenues of $70 million are likely.

Takeaway

The key investor takeaway is that Ambarella appears poised for the next rally with a rebound in semiconductor demand and some promising sales growth in auto and AI. The chip company is unlikely to finally fulfill all of the big promises of computer vision chips, but Ambarella could be due for another big stock run. Investors just have to take the gains and not play Ambarella for a sustainable uptick in sales.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market in May, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.