Summary:

- Advanced Micro Devices, Inc.’s Q3 earnings were followed by large price corrections.

- These corrections are mostly due to concerns of uncertainties in PC demand and AI chip cycle.

- The prevailing sentiment has gone too far in the fear extreme.

- It has factored in the downside risks already but largely ignored the positives such as its robust economic earnings, attractive valuation, and improving inventory data.

MediaProduction

AMD Stock: Previous Thesis and Q3 Earnings

I last wrote on Advanced Micro Devices, Inc. (NASDAQ:AMD) back in October 2024. As reflected in the article’s title, “AMD Q3 Preview: Status Of The Cycle,” it was a preview of its FY Q3 earnings report (ER). In the article, I argued for a bullish thesis based on the use of Taiwan Semiconductor Manufacturing’s (TSM) strong Q3 earnings as a leading signal for AMD’s business cycle. To be more explicit, I argued that:

TSM recently reported strong Q3 earnings, largely driven by AI and high-performance computing demand. TSM’s earnings growth foreshadows a strong Q3 from AMD, given AMD’s position in these segments. In particular, when considered in combination with AMD’s historical cyclicality, I think AMD is very likely entering a new expansion phase.

Since that time, there have been a few new catalysts evolving around AMD stock. These catalysts have titled the prevailing sentiment surrounding the stock to the fear extreme in my view. In the remainder of this, I will elaborate on some top causes of such fear and argue why the fear is overblown. As such, this article reiterates my BUY rating on the stock.

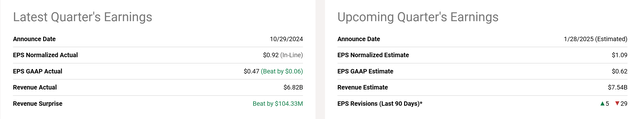

The first new catalyst since my last writing was the Q3 ER itself. As seen from the screenshot below, AMD announced its Q3 earnings on October 26, 2024, shortly after my last article. The earnings are quite robust as I expected. To wit, the normalized EPS was $0.92, which was in line with expectations. The GAAP EPS was $0.47, beating estimates by $0.06. Revenue came in at $6.828 billion, exceeding expectations by $104.33 million.

However, there are also some areas of the ER that deviated from my expectations. The most notable area is the demand outlook for both PC and AI-related chips. These issues have created uncertainties for the company’s future growth. As a reflection of such uncertainties, EPS revisions for the stock were dominated by downward revisions as seen. Only 5 analysts upped their estimates over the past 90 days, against a total of 29 downward revisions.

AMD Stock: Fear is Overblown

And admittedly, there are good reasons behind the prevailing downward revisions. For example, leading institutional analysts are expecting tampered demand from leading AI customers. For example, Citi analysts believe that:

…industry stalwart Broadcom’s F1Q25 guidance will be tempered as there appears to be a slowdown in orders from leading AI customer Google.

Speaking of GOOG, another new catalyst that could have a far-reaching impact on AMD is the latest advancements in quantum chips. I don’t use the phrase “game changing” lightly, and quantum chips are among the few game-changing technologies in my mind. More specifically, GOOG recently unveiled its Willow quantum computing chip. According to a study published in Nature:

The chip is capable of handling complex calculations in a span of five minutes, while the world’s most powerful supercomputers would need 10 septillion years. “Our results present device performance that, if scaled, could realize the operational requirements of large-scale fault-tolerant quantum algorithms, Google researchers wrote in the study’s abstract.

These near-term and long-term factors have helped to pressure AMD’s stock price. As seen in the chart below, its stock price has declined significantly over the past few months, dropping almost 20% in the past 6 months while the broader market enjoyed a strong rally.

The current situation surrounding AMD has reminded me of the adage of being greedy when others are fearful. And I do see two particular reasons to be greedy in this case, 1) the stock’s attractive valuation, especially adjusted by growth and growth CAPEX, and 2) the improving inventory data.

AMD Stock: Attractive P/E and PEG Multiples

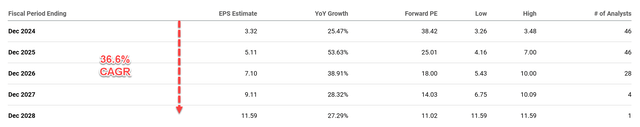

The prevailing fearful sentiment has brought the stock’s P/E to a very attractive level, especially when adjusted for its growth outlook. More specifically, the next table provides EPS estimates for AMD in the next five years. These estimates show a rapid increase in its earnings, with a compound annual growth rate (CAGR) of 36.6%. The current forward P/E ratio is about 38x. As such, the PEG (P/E growth) ratio is about 1x, the gold standard for most GARP investors (growth at a reasonable price).

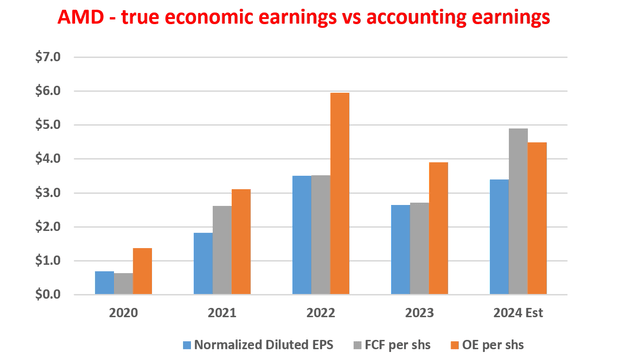

More importantly, as a fabless chip player, AMD features a very capital-light model, and its CAPEX is largely towards growth CAPEX (rather than maintenance CAPEX). Hence, its accounting EPS represents a substantial underestimation of its true owners’ earnings (OE).

The detailed analysis of its OE is a bit involved, so here I will skip the process and only quote the results. These results were obtained following the approach described in Greenwald’s book entitled Value Investing.

The growth part should actually be considered part of the OE because it can be returned to the owners if the owners decide not to grow the business anymore – a key insight that investors like Buffett have recognized. The growth CAPEX for AMD is estimated in these steps. First, calculate the ratio of PPE (properties, plants, and equipment) to sales for each of the five prior years and find the average. We use this to indicate the dollars of PPE it takes to support each dollar of sales. We then multiply this ratio by the growth (or decrease) in sales dollars the company has achieved in the current year. The result of that calculation is growth CAPEX. We then subtract it from total CAPEX to arrive at maintenance CAPEX.

Following these steps, the next chart summarizes my results for AMD’s OE recently. As you can clearly see, AMD’s OE has systematically and considerably exceeded its accounting EPS. For readers who do not want to go over the trouble of sorting out the growth CAPEX, the fact that its free cash flow (“FCF”) has been in general above its accounting EPS provides an easy and quick indicator for its capital-light model already. Quantitatively, my results show that AMD’s OE is about 32% higher than its accounting EPS based on its 2024 EPS estimate and CAPEX outlay. Thus, its P/E based on owners’ earnings would be about 32% lower than its accounting P/E.

AMD Stock: Improving Inventory Data

The second reason to be greedy here is that AMD’s latest inventory data is improving. For growth and cyclical businesses like the chip industry, I strongly urge investors to start looking at their inventory data following these insights from Peter Lynch:

To start, unlike many other financial data that are more open to interpretation, inventory is one of the less ambiguous financial data. Lynch also explained why inventory levels can be a telltale sign of business cycles. Especially for cyclical businesses, inventory buildup is a warning sign, which indicates the company (or sector) might be overproducing while the demand is already softening. Conversely, depleting inventory could be an early sign of a recovery.

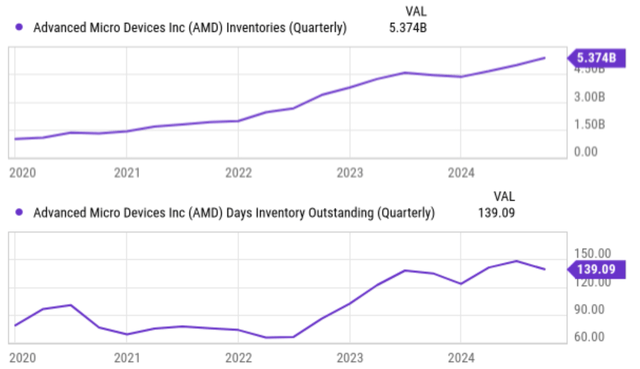

In the case of AMD, the chart below illustrates its inventory (in dollar amount, top panel) and also days of inventory outstanding (bottom panel) recently. As seen, its inventory has been steadily increasing and currently sits at a record level of $5.374 billion as of Q3 2024.

A high level of inventory is only a bad sign when it outgrows the pace of sales growth, which was unfortunately the case for AMD in the past few quarters. As seen, its Days of Inventory Outstanding (DIO) fluctuated in the past few years but has followed an overall upward trend since 2020. In particular, the DIO peaked at around 150 days in early 2024. However, the latest inventory data began to show a reversal of the trend. Its DIO decreased from the peak level of 150 days to the current level of 139 days.

Other Risks and Final Thoughts

In terms of downside risks, as mentioned earlier, the cycle of the AI chip demand is the top near-term risk, and disruptive technologies such as quantum computing chips are lurking as a long-term risk. Besides these risks, the competition pressure in the data center market is also a risk among my top concerns. Recently, AMD has been making gains in the data center market, replacing existing offerings with its EPYC central processing units. These newer products are known for their performance and energy efficiency advantages. However, its competitive position against the sector leader Nvidia (NVDA) is still quite fluid in my view with NVDA’s Blackwell chips, which also feature a substantial boost to computing performance and energy efficiency compared to its earlier chips.

All told, my verdict is that these downside risks are already well priced in under the current conditions. Actually, I consider the price corrections to be overdone due to the fearful market sentiment despite sound business fundamentals as reflected in its robust cash flow, economic earnings, and inventory data. I consider this a good contrarian opportunity to be greedy and bet against the prevailing sentiment. As such, this article reiterates my buy rating on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If you share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

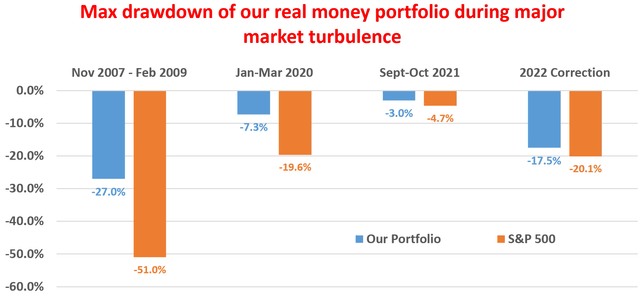

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.