Summary:

- Advanced Micro Devices, Inc. is capitalizing on AI and tech markets, eyeing over $50 billion in chip demand by 2024, despite Nvidia Corporation’s lead.

- Post-peak, AMD’s stock corrects 25% with a pivot at $152, setting sights on a $275 target in 2024.

- China’s tech restrictions threaten AMD’s significant revenue amid growing US-China tech tensions.

- AMD’s M1300X AI GPU and chiplet innovations, alongside key partnerships, highlight its push for market growth amidst challenges.

Jonathan Kitchen/DigitalVision via Getty Images

Investment Thesis

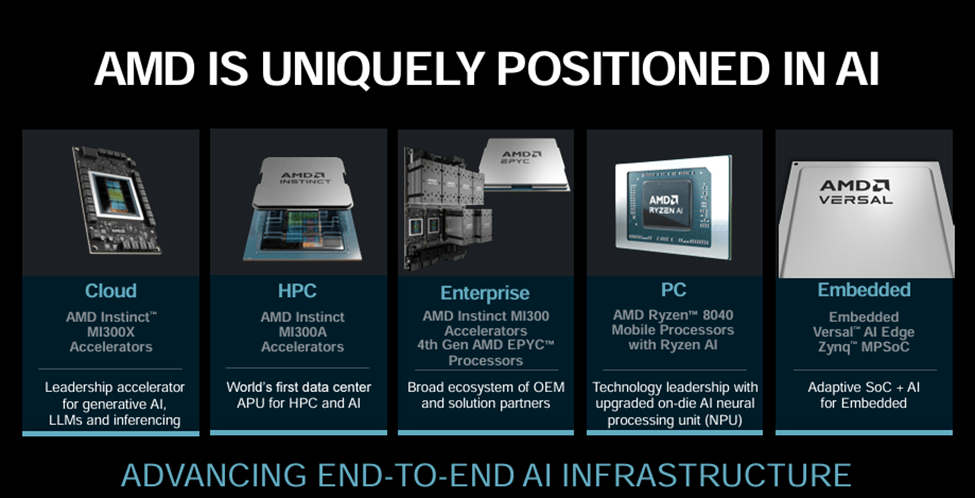

Advanced Micro Devices, Inc. (NASDAQ:AMD) has emerged as a breakout stock amid the AI frenzy owing to its massive business potential in data centers, gaming, and PCs. With demand for specialized chips optimized for generative AI expected to exceed $50 billion by 2024, the company has a tremendous opportunity to capitalize on this.

The world’s AI chip market should reach between $100 billion and $400 by 2024. This explains AMD’s investment growth, which signals it aims to strengthen its prospects in a burgeoning sector. It also explains why the company has sought to strengthen its prospects in other growing sectors beyond generative AI chips, with the knowledge that AI chip sales account for only 11% of the global chip market.

AMD still has a lot more left in its tank, though it is more likely to play second fiddle to Nvidia (NVDA), which has emerged as the poster child of the AI revolution. Undoubtedly, Nvidia is still the market leader in offering chips designed specifically for training and running AI applications. This might explain why the stock has rallied by over 100% over the past six months, during which AMD has gained about 66%.

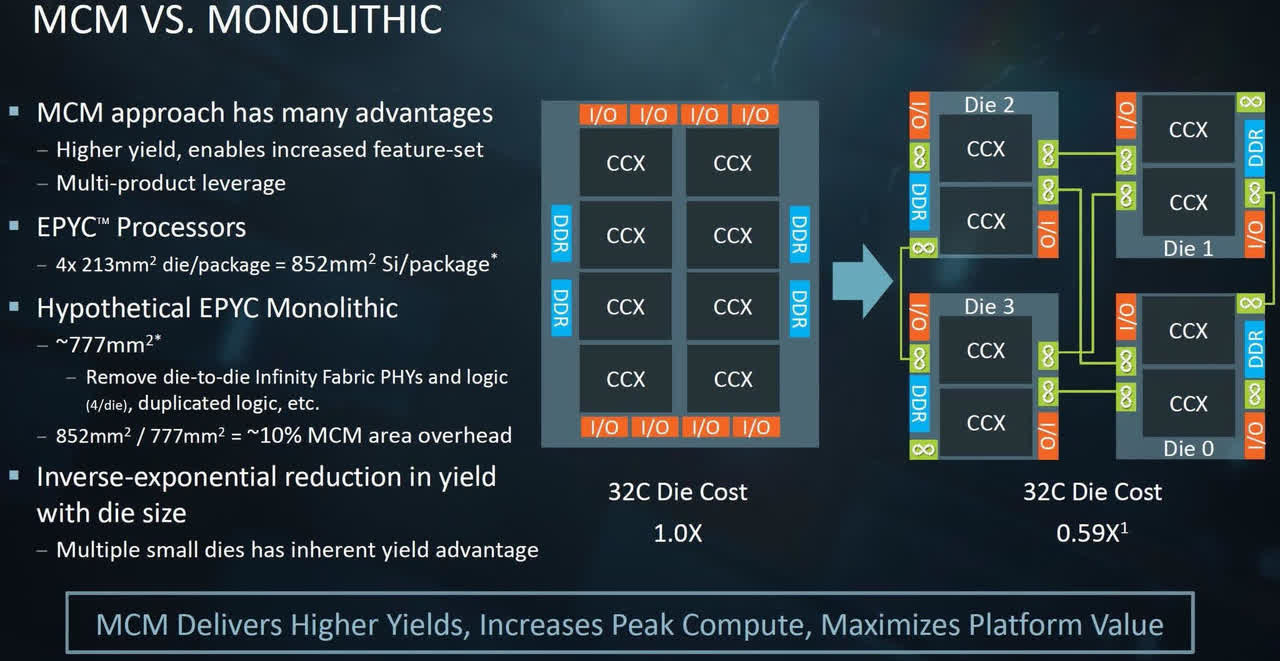

AMD’s chipset-based design strategy contrasts sharply with Nvidia’s monolithic approach, potentially reshaping the GPU market by offering cost-effective, scalable solutions. This innovation, coupled with strategic moves into AI and large language models, or LLMs, positions AMD to challenge Nvidia’s dominance despite the latter’s strong ecosystem and performance edge.

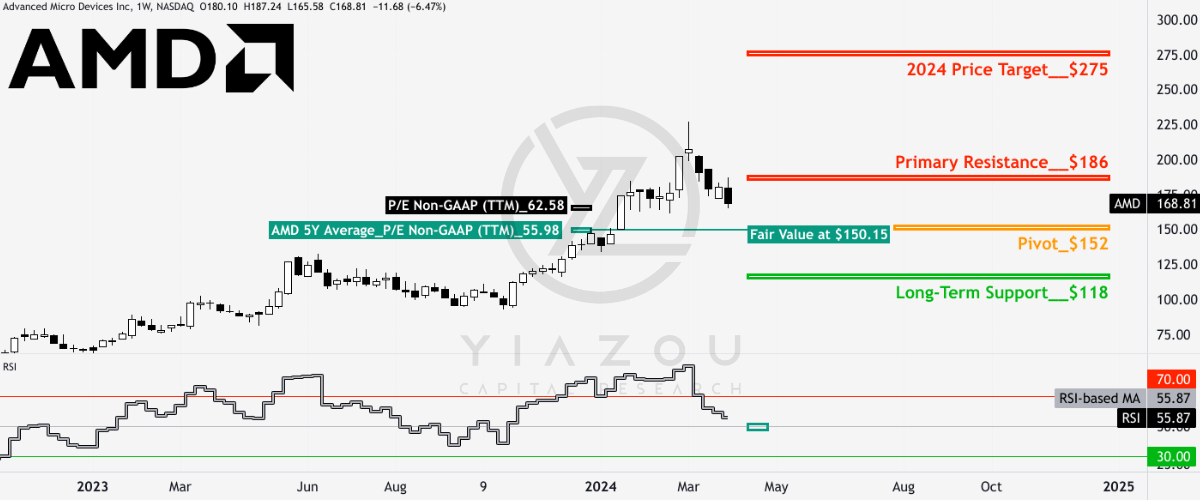

Pivoting at $152 with Eyes on $275 Target

AMD is in a downtrend, as after reaching a high of $227.30, the stock experienced over a 25% correction. Following the current momentum and key Fibonacci levels, the price may hit $152 in the coming days. $152 serves as the pivot for the current price swing, which may provide solid support for the price.

Looking at the Relative Strength Index (RSI), at 56, the stock price is in a neutral state. In an optimistic outcome, the price may take support at the pivot with the RSI near 50 and reverse its momentum to hit the primary resistance at $186. In the worst-case scenario, the price may hit $118, vital long-term support. In such a case, RSI may reach near 30 on an oversold trajectory before making an upward recovery. However, this bearish scenario is less likely.

Notably, the $152 also aligns with the multiple norms for price-to-earnings valuation. The price-to-earnings ratio (on a trailing twelve-month basis) is near 63, while AMD’s long-term price-to-earnings average sits near 56. This signifies a 12% overvaluation. The price has to reach nearly $150.15 to attain a fair valuation. Based on that assumption, the pivot may divert the price into the bullish trajectory again.

Given the shift in the recent bullish trend and Fibonacci indicators, we’re setting an ambitious 2024 price target of $275 for AMD and upgrading our rating to a strong buy.

tradingview.com

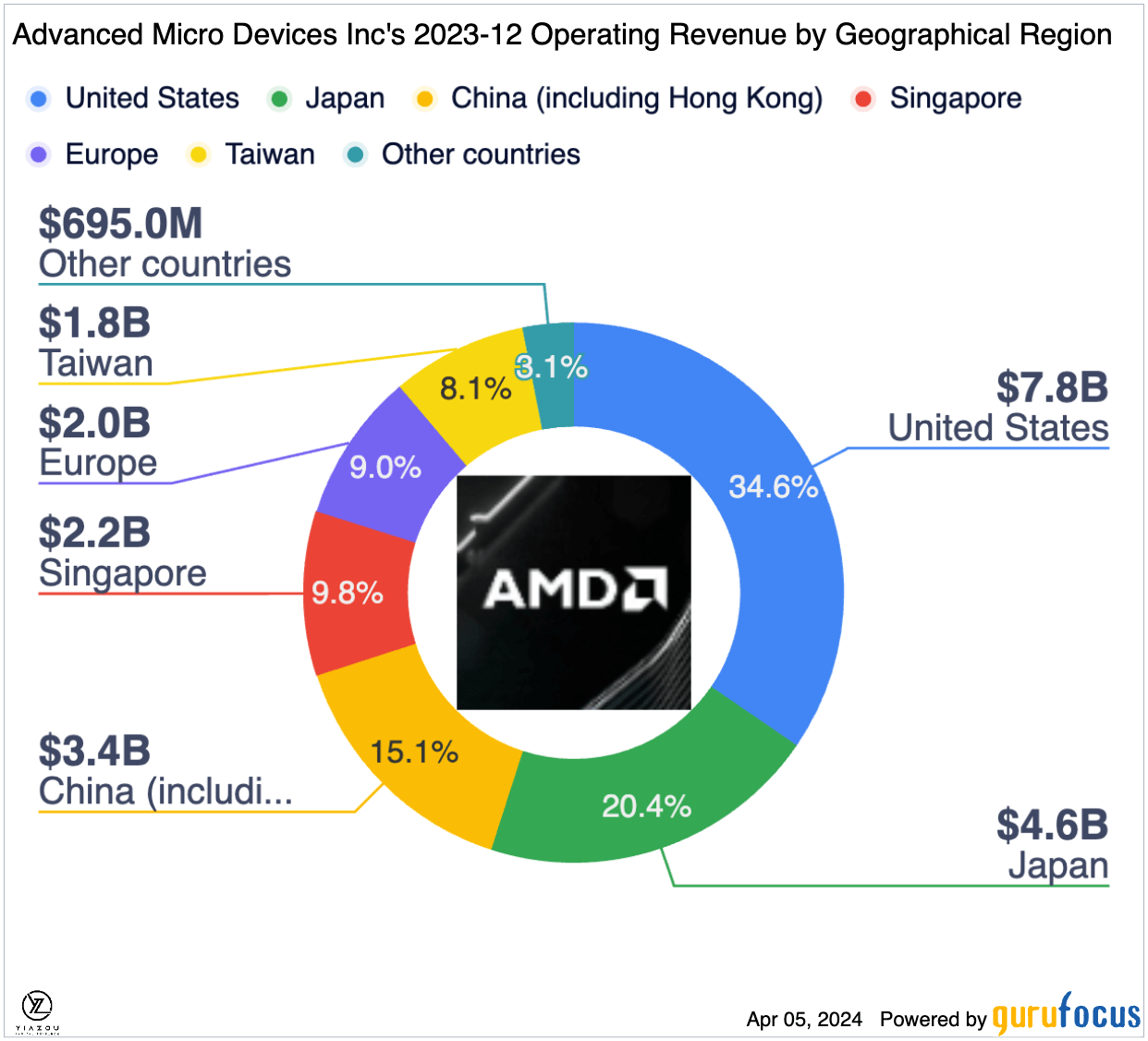

China’s New Tech Guidelines Threaten AMD’s Revenue

One catalyst behind AMD’s pullback is reports that China plans to introduce new guidelines that will make it difficult for the company to sell its chips in the country. Plans to phase out the use of U.S. microprocessors in government PCs and servers are another headwind that has rattled investors’ sentiments about the stock.

China is taking significant steps to build domestic substitutes for foreign technology. In addition, its ban of microprocessors from AMD, Intel (INTC), and others comes amid growing tensions with the U.S. over certain technologies that the countries bill as a matter of national security. Consequently, Beijing has already published a list of safe and reliable processors and operating systems from Chinese companies designed to undercut AMD, Intel, and Microsoft (MSFT).

AMD is one of the biggest suppliers of chips used in PCs and thus would be the most brutally hit should Beijing implement its plans. Last year alone, the company generated nearly 15% or about $3.5 billion of its $23 billion sales in China. Therefore, any ban would significantly impact one of the company’s key revenue streams.

AMD’s revenue breakdown

AMD vs. Nvidia: The Chiplet Revolution Upends the GPU Market

AMD’s technology uses a modular chiplet design, combining small chips to make one large processor. This improves manufacturing yields and production costs since one defect does not render the whole chip unusable. Think of it like Lego: It is much easier to snap together small building blocks than carve a large statue from one piece of plastic.

On the other hand, although Nvidia’s traditional monolithic chip design performs well, it raises prices and profits due to an all-or-nothing manufacturing process. The MI300 chip from AMD, incorporating the revolutionary chiplet technology in GPUs, is a strategic evolution that may eventually disturb Nvidia’s market dominance.

While generally at lower margins, the competitiveness of chiplet designs emphasizes a reduction in cost and constant technological improvement of the lauded Radeon RX 6000 series, AMD has added a new facet to its high-margin business and will be on a potentially disruptive collision course with its rival, Nvidia’s lofty standing. Over the long run, Nvidia’s monolithic design and high-profit commitment may create a barrier to adapting to the chiplet approach, which might result in losing ever more market trends to AMD.

Nvidia does hold a strong position in the GPU market, much like Microsoft did in the past, and its CUDA platform has attracted a vast ecosystem of developers. However, AMD’s focus on the AI inference market and introducing hardware with significant AI capabilities, like the MI300X optimized for large language models, presents a strategic shift.

Lastly, AMD’s chips, offering up to 192GB of HBM3 memory, can handle larger models than Nvidia’s A100, showcasing AMD’s potential to compete in specific niches of the AI market.

AMD Unleashes M1300X AI GPU to Challenge Nvidia’s Dominance

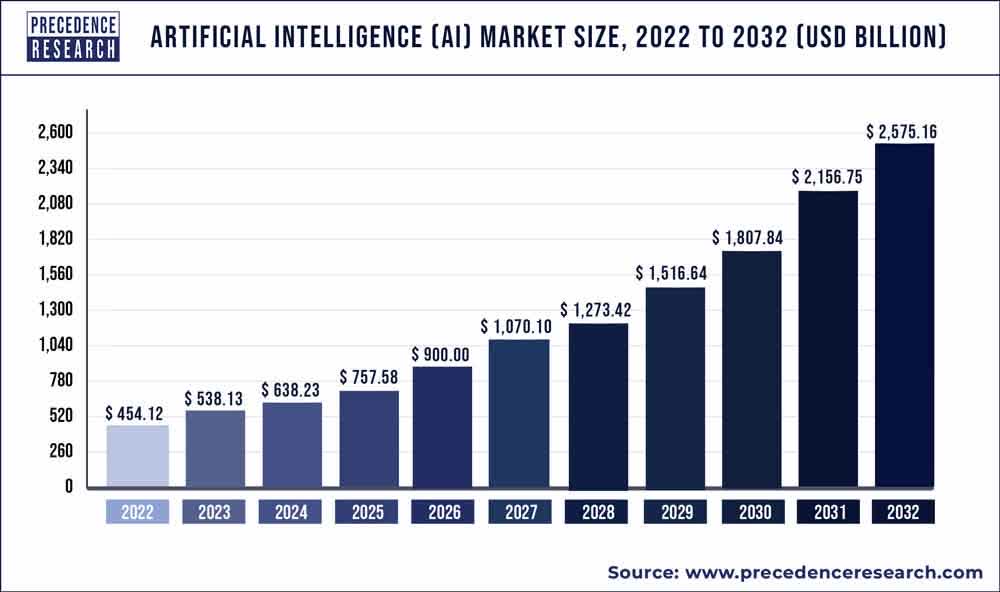

Over the years, CPUs for personal computers and servers have always been the main business of semiconductor companies. However, AI chips have been increasingly taking over thanks to the launch of new chips in recent quarters.

The company is increasingly investing to position itself in the AI market, which hit highs of $200 billion last year and is expected to expand to a compound annual growth rate of 37% by 2030. The stakes are high, and the industry is expected to be worth $2 trillion by the decade’s end.

While Nvidia controls close to 90% of the AI GPU market share, AMD is putting up a fair fight. The company is already looking to challenge the status quo by launching the M1300X AI GPU, designed to compete with Nvidia’s H100 chipsets in the segment.

www.precedenceresearch.com

The M1300X AI GPU stands out as cheap, thus lowering the costs of developing AI models for potential clients. While AMD has yet to reveal the pricing of the M1300X chip, it is not expected to cost more than $40,000 a chip, which is the cost of one chip of the Nvidia H100.

Additionally, it is based on a new architecture that leads to significant performance gains compared to the H100. Integrating a 192GB cutting-edge, high-performance memory dubbed HBM3 means the AI chipset can transfer data faster while fitting larger AI models. The CEO has already reiterated that the M1300 chipset will be the fastest to ramp up $1 billion in sales.

The biggest question has always been whether companies already using Nvidia AI GPUs would be ready to switch to another alternative or GPU supplier. AMD has addressed the issue by updating its software suite, dubbed ROCm, to better compete against Nvidia’s industry-standard CUDA software. Thus, the update addresses why most developers had opted for the Nvidia chip.

Following the software update, AMD has already signed up Microsoft (MSFT) and Meta Platforms (META) as its new customers for the M1300X AI chip. The two were the largest purchasers of H100 GPUs, which helped cement Nvidia’s control of the segment. OpenAI, spearheading the AI revolution, has already indicated that it will support AMD GPUs in its software products used for AI research.

Finally, while AMD is projecting nearly $3.5 billion in AI chip sales, there is still a massive untapped market opportunity, given that the market could climb to $400 billion over the next few years. Therefore, the high expectations explain why the company focuses entirely on the new product line.

AMD

AMD’s New AI Processors Target PC Revival, Gaming Industry Lead

In addition to pursuing AI growth, AMD is fixated on improving the PC market in recovery mode following the COVID-19-triggered slowdown. While PC shipments dipped by 16% in 2022 amid skyrocketing inflation, they showed signs of improvement in 2023. The company has unveiled a new desktop processor called AI PCs for the high-end personal computers market.

Ryzen 8000G Series is AMD’s new line of desktop PC processors, which it plans to use to strengthen its prospects in the sector and take on Intel. The new processors are designed for intensive gaming and content creation applications and optimized for local AI workloads.

The launch follows the unveiling of the 8040 Series processor late last year, which the company hopes to use to pursue market share on the notebook AI PCs. The new line of PC chips is already eliciting strong interest from PC makers, including Acer, Asus, Lenovo, and HP (HPQ), at a time when PC sales are on the rise.

Finally, AMD has also introduced the Radeon RX 7600 XT graphics cards that it plans to use to strengthen its prospects in the multibillion-dollar gaming industry. The chip is meant to demand PC games and create content.

Bottom Line

AMD is firing on all angles, even as it appears to play second fiddle to Nvidia in the AI chips market sector. Backed by a strong product line of chips targeting opportunities in the data center, personal computer, and gaming industry, the company is in a solid position to generate long-term value. Its net income grew by over 3000% in the fourth quarter, underlining its robust growth phase.

Likewise, AMD is well positioned to take on Nvidia and eat a significant market share, having unveiled the M1300X, a much more powerful and cost-effective AI GPU. Given the ever-growing demand for chips to power AI-generative services and hardware, there is plenty of room for growth, which positions AMD to offer investors bigger gains over the long term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.