Summary:

- Advanced Micro Devices, Inc.’s MI300 accelerator is driving explosive data center sales growth, narrowing the gap with Nvidia and promising significant profit surges in the coming quarters.

- AMD’s data center sales grew 115% YoY in 2Q24, with the MI300 accelerator and EPYC server CPUs as key growth catalysts.

- AMD is projected to grow profits 50% faster than Nvidia next year, making it a potentially better value investment at a lower profit multiple.

- The ongoing scaling of MI300 accelerators positions AMD for substantial sales and operating income growth, potentially making it a strong outperformer.

JHVEPhoto

We have all witnessed with awe the meteoric rise of Nvidia Corporation (NVDA) which was well-positioned in the data center GPU sector just when ChatGPT and other AI language models took off and required big investments in new AI tools.

While companies like Intel Corp. (INTC) and Advanced Micro Devices, Inc. (NASDAQ:AMD) have been sleeping at the wheel, Nvidia smashed expectations and went on wild upswing.

AMD, however, has lagged, but the company is now starting to see payoffs from its investments into its accelerators which are poised to challenge Nvidia’s still very dominant position in the market for high-performance GPUs.

I think that AMD has considerable potential to turbocharge its MI300 accelerator sales and investors could potentially benefit from a surge in AMD’s profits moving forward.

AMD’s Triple-Digit Data Center Sales Growth Points To Profit Surge

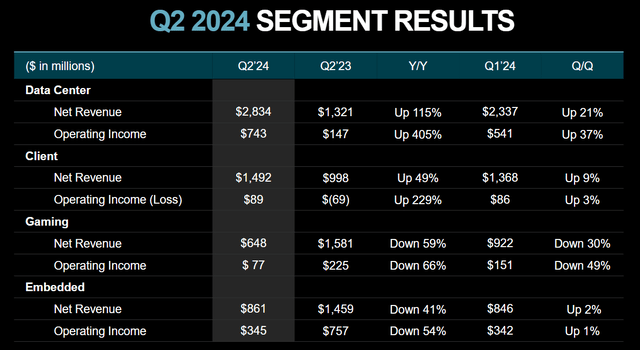

AMD’s data center sales are exploding, which not coincidentally is linked to the semiconductor company launching its data center GPUs at the end of last year. In 2Q24, Advanced Micro Devices produced a relatively modest 9% sales growth YoY, but a more in-depth look into the company’s operating segments showed a drastically diverging performance situation.

Gaming sales exhibited an ongoing down-trend with the associated segment seeing sales fall off 59% YoY to $648 million. Advanced Micro Devices’ embedded segment, which focuses on industrial and commercial applications, also experienced a sales downturn of 41% YoY.

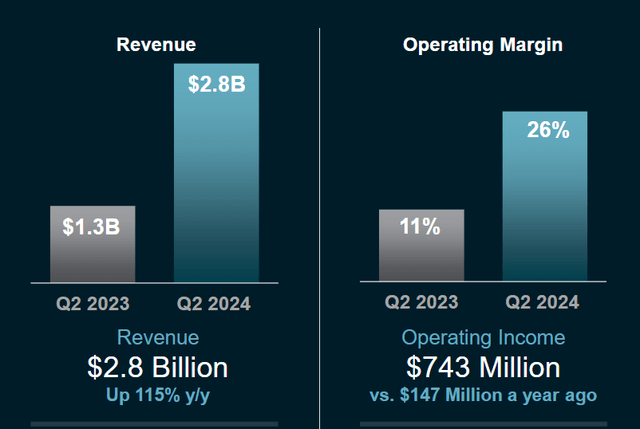

But the chip company is seeing some real momentum manifest in its Client, and particularly, its data center division, which is where AMD is probably going to make the most money moving forward. AMD’s data center chip sales skyrocketed 115% Y/Y in 2Q24 to $2.8 billion, with the MI300 accelerator being the main growth catalyst. Other drivers included strong sales of AMD’s EPYC server CPUs.

Nvidia’s sales skyrocketed 122% YoY in 2Q25 (the quarter ending July 28, 2024), so the chip company grew it sales about 13.5 times faster than Advanced Micro Devices. Nvidia’s data center sales hit $26.3 billion in the last quarter which reflected 154% YoY growth. This implies that Nvidia is growing its data center sales only 1.4 times faster than AMD. This also means that while Nvidia is still way better than Nvidia, on a full sales basis, the actual performance gap in the data center business is not that big.

With more sales shifting towards data centers, I anticipate Advanced Micro Devices to deliver strong (operating) profit growth moving forward which might catalyze an upside breakout for AMD’s stock.

Q2-24 Segment Results (Advanced Micro Devices, Inc.)

Advanced Micro Devices’ data centers are profiting from a serious upside surge in chip sales. Since the chip company only fairly recently started to sell its data center accelerators, AMD has a long runway to profit from this upscaling of GPU shipments. These accelerators, also known as MI300 accelerators, are specifically optimized for AI and high-performance computing workloads and are built on AMD’s CDNA™ 3 architecture. Shipments started in 4Q23 and the estimated shipment volume for 2024 is up to 400K units.

These chips are primarily utilized for large language model, or LLM, training and inferencing, and a growing number of hardware companies are using AMD’s latest chips for their products, including Microsoft, Oracle, and Dell. What matters here, in my view, is that the robust demand for those data center chips allows AMD to translate strong sales growth directly into huge operating margin growth.

Since data centers, based on total dollar sales, are now Advanced Micro Devices’ biggest segment, investors should be able to benefit from a drastic upscaling of AMD’s operating profitability in the next couple of quarters.

Investors should remember that AMD’s data center business momentum already boosted operating margins by a whopping 15 percentage points YoY in 2Q24 which was the result of growing sales of AMD’s high margin MI300X accelerator chips. The data center segment’s total operating income amounted to $743 million in 2Q24, which was about twice as much as the next-biggest segment, Embedded.

Operating Income (Advanced Micro Devices, Inc.)

AMD’s Stock Is Cheap

Advanced Micro Devices is in the early innings of scaling shipments of its MI300 accelerator, which already generated more than $1 billion in sales in the second quarter. On the earnings call, AMD’s CEO Lisa Su said that the company expects to pull in a total of $4.5 billion in data center sales directly attributable to MI300 GPUs, up from a prior forecast of $4.0 billion.

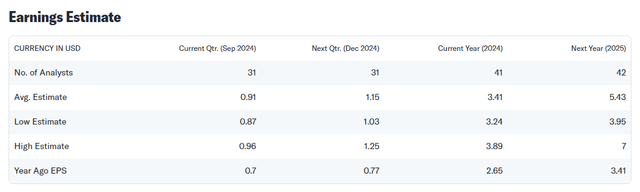

Presently, the market models $5.43 per share in profits for AMD which reflects a robust 60% jump in estimated profits YoY compared to a projected profit growth of 29% in 2024. Put simply, Advanced Micro Devices, due to the escalating shipments of its MI300 accelerator is anticipated to double its profit growth next year.

With the stock of Advanced Micro Devices selling for $152.08 at the time of writing, AMD is selling for a leading profit multiple of 28x. Nvidia is selling for $117.80 and is anticipated to produce $3.62 per share in profits next year, reflecting back to us a leading profit multiple of $33x. The consensus profit estimate for Nvidia implies 40% YoY growth next year. Thus, AMD is projected to grow its profits about 50% faster next year. The reason for this is Advanced Micro Devices’ MI300 accelerator, which is only shipping for about three quarters now and continues to have a four-five quarter accelerating GPU shipment run-way.

Considering that AMD has also arrived at triple digit sales growth in data centers in 2Q24, drastically reducing Nvidia’s lead, and that AMD is now projected to grow even faster than Nvidia next year in terms of profits, I think that AMD possibly represents better value than Nvidia. This, obviously, is an additional consideration in light of AMD also selling for a lower profit multiple.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis Might Not Work

The market is clamoring for data center GPUs right now, and companies across industries are spending their socks off to get a foot into the gen-AI market. Unfortunately, there is a risk of overspending in the short term, that could impact what kind of return investors are receiving on their AI hardware and infrastructure investments.

Softening pricing for Advanced Micro Devices’ GPUs may be another risk, as it would most likely throw cold water on the company’s data center GPU sales ramp.

My Conclusion

AMD’s data center business is poised to enjoy some serious growth in the next couple of quarters and this growth, in my view, is not yet reflected in Advanced Micro Devices’ valuation. The key to growth here is the ongoing scaling of AMD’s MI300 accelerator which is challenging Nvidia in its core GPU market, the one that focuses exclusively on high-performance data centers and gen-AI applications.

I think that AMD is poised to pull off a major surge in data center sales in the next 4–5 quarters. It will scale deliveries of MI300 accelerators in the second half of the year and then should enter 2025 with considerable shipment momentum.

Advanced Micro Devices had a major performance and execution gap compared to Nvidia in the last year, but AMD’s 2Q24 data center performance showed that the gap is narrowing quickly. If Advanced Micro Devices scales MI300 accelerator shipments in 2H24, I think AMD could experience the kind of sales and operating income growth that Nvidia already experienced last year.

Since we all know what happened to Nvidia’s stock price in the last year or so, Advanced Micro Devices could become an absolute outperformer in the next year. Strong Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.