Summary:

- AMD investors sent the stock tumbling as the market turned more cautious over its AI growth inflection.

- AMD’s forward guidance missed Wall Street’s estimates, suggesting the market has tempered its enthusiasm.

- However, AMD’s forward adjusted PEG ratio is more than 40% below its tech sector median, highlighting the market’s significant pessimism.

- I argue why AMD is well-positioned to capture share in the burgeoning data center segment while facing a dominant Nvidia.

- With AMD returning closer to its September 2024 lows, a rare buying opportunity may have emerged again.

JHVEPhoto

AMD: Investors Nearly Sent It Back Into A Bear Market

Advanced Micro Devices, Inc. (NASDAQ:AMD) endured a torrid week as investors hammered AMD following its guidance at a recent earnings scorecard, which likely didn’t inspire sufficient confidence. In my bullish pre-earnings AMD update, I underscored my conviction about why the Lisa Su-led company is well-placed as the dark horse in the AI chips race against market leader Nvidia (NVDA).

While I recognized significant challenges in AMD’s attempt to scupper Nvidia’s ecosystem dominance, I assessed its valuation isn’t aggressive. Notwithstanding my optimism, the market’s negative reaction this week has threatened to unhinge my bullish proposition. Accordingly, AMD has plunged almost 20% from its October 2024 highs through this week’s lows, potentially revisiting a bear market.

AMD Raised Its AI Revenue Guidance, But Investors Wanted More

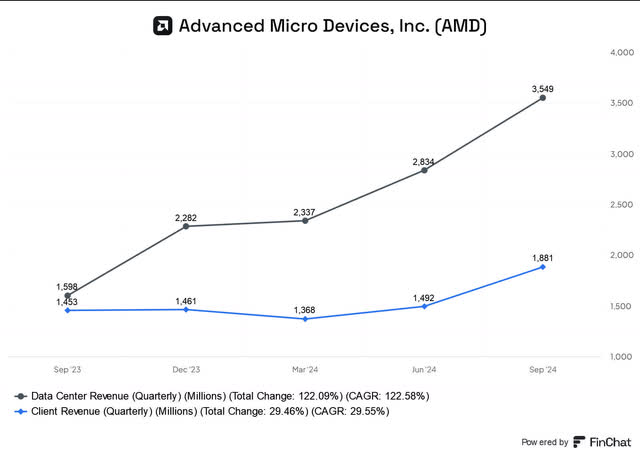

AMD Q3 revenue segments (FinChat)

In AMD’s Q3 earnings release, CEO Lisa Su highlighted the significant growth momentum in the company’s data center segment. Accordingly, AMD’s data center revenue growth surged by more than 120%, reaching $3.55B in Q3. Its client segment has also recovered, delivering a 29% YoY increase in revenue. However, the market is likely disappointed, as AMD upgraded its AI revenue outlook from $4.5B to just $5B for FY2024. Given AMD’s much lower AI revenue base than Nvidia’s dominance, I assess that the market is justified in asking for more. Furthermore, AMD’s forward revenue guidance was below Wall Street’s estimates, suggesting potential upside risks in 2025.

Management emphasized its confidence in anticipating a $500B TAM for the AI accelerator market through 2028, indicating a CAGR of 60%. However, AMD’s near-term outlook has not sufficiently captured its long-term optimism, highlighting execution risks even as it ramps up its MI300 series attributed to significant hyperscaler demand.

AMD alluded to supply chain challenges, given robust demand dynamics. Hence, it has also increased execution risks for the company, potentially affecting its production and shipment cadence in 2025. Therefore, investors are urged to scrutinize the company’s capacity planning parameters through 2025 to assess the company’s ability to continue capturing market share in the AI chips segment.

Notwithstanding the current challenges in raising the bar further against Nvidia, AMD seems to have the upper hand against Intel (INTC) in the data center CPU segment. Given the superior profitability profile, it’s also expected to bolster AMD’s margins, as the data center segment has crossed the 50% mark over the company’s total revenue exposure. Therefore, it should help mitigate the margin headwinds against its nascent AI revenue business, as AMD could face pricing pressures in attempting to compete for market share in training and inference workloads.

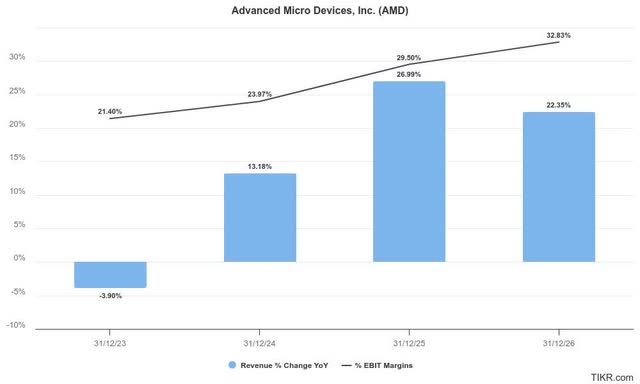

AMD’s Outlook Remains Robust

Wall Street’s estimates on AMD are mixed, as analysts downgraded AMD’s adjusted earnings outlook while lifting its revenue projections. Despite that, AMD’s revenue and earnings profile is expected to continue improving through FY2026, corroborating management’s confidence in recovering its critical business segments.

Although AMD’s embedded and gaming businesses are undergoing a challenging recovery, the AI PC refresh cycle is expected to bolster its medium-term outlook. However, the segment’s cyclicality and uncertain AI growth dynamics must be observed, although the segment seems to have bottomed.

Despite that, AMD’s data center growth profile should remain the company’s critical underpinnings in lifting buying sentiments in the stock. Hence, the opportunity for operating leverage growth should keep investors onside while awaiting more clarity on its AI revenue growth spurt through 2026.

AMD’s execution against Intel has delivered solid market share growth and stock outperformance over the past five years, gaining more than 300% in total return. However, taking on Nvidia’s AI leadership has proved more challenging than anticipated, suggesting volatility in AMD could persist.

Is AMD Stock A Buy, Sell, Or Hold?

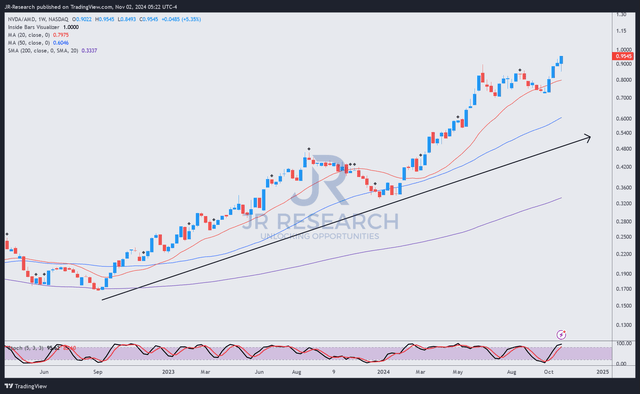

NVDA/AMD price chart (weekly, medium-term, adjusted for dividends) (TradingView)

Notwithstanding my optimism, investors must acknowledge that the market has bet on the NVDA horse over AMD’s since NVDA/AMD bottomed out in late 2022. Hence, AMD has not convinced the market (yet) that it has the necessary product and system leadership to challenge Nvidia.

I believe the uptrend bias in NVDA/AMD is not expected to reverse unless Lisa Su and her team deliver a more convincing AI revenue outlook by 2025. Hence, investors have likely lowered their confidence in a resounding outlook at AMD’s Q4 release and guidance, as Nvidia is expected to ramp up the shipment of Blackwell AI chips through 2025. Moreover, the annualized product launch cadence could lower the technological breakthroughs for AMD’s AI chips, helping Nvidia maintain its grip through its full-stack approach.

In addition, there’s an increasing possibility that the leading AI companies and hyperscalers could turn to their custom chips moving ahead. The revelation by Amazon (AMZN) that its “largest data center customers are using its Graviton chips” could impact the growth profile of AMD’s data center segment. In addition, OpenAI is reportedly working with Broadcom (AVGO) on custom AI chips, corroborating an ongoing trend to diversify their reliance on merchant chips. Given AMD’s developing opportunity in the AI revenue segment, it could impact the long-term accuracy of its TAM in merchant AI chips, which is worsened by Nvidia’s ability to maintain ecosystem incumbency.

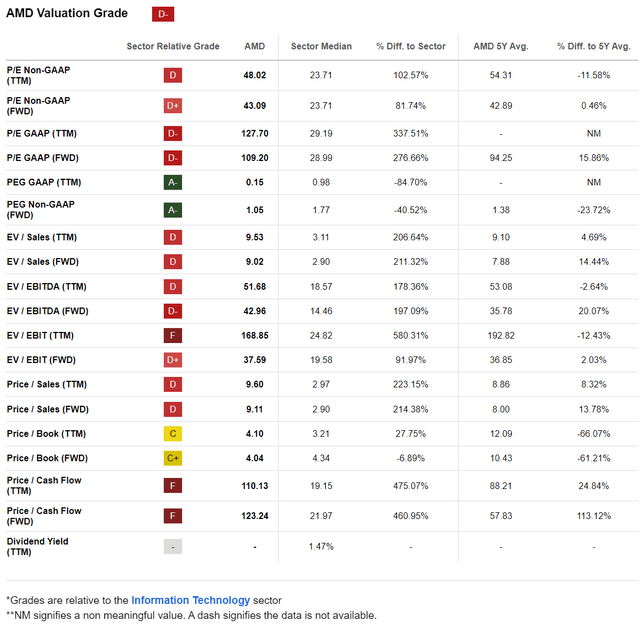

AMD Quant Grades (Seeking Alpha)

AMD’s forward adjusted PEG ratio of 1.05 is more than 40% below its tech sector (XLK) median. Hence, given the underlying challenges enunciated above, investors seemed to have de-rated its growth prospects.

There’s little doubt that AMD is still priced for growth (“A” growth grade). Hence, investors must anticipate potential volatility that could challenge their principal growth vectors in the data center segment (CPUs and GPUs). Notwithstanding my caution, I’ve not yet assessed a bearish reversal in AMD buying sentiments, suggesting a dip-buying opportunity could be close.

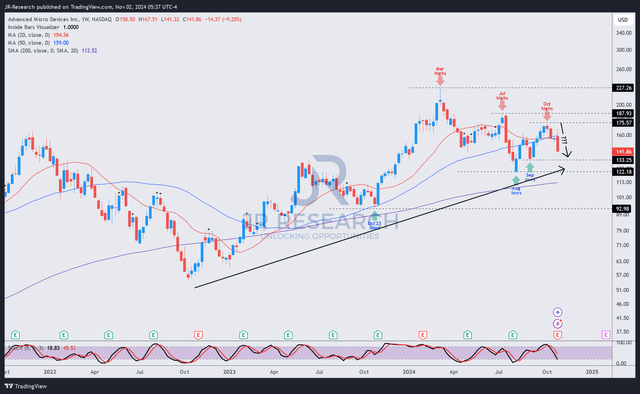

AMD price chart (weekly, medium-term, adjusted for dividends) (TradingView)

As seen above, AMD’s price action suggests it remains in an uptrend bias. Its “C+” buying momentum corroborates my observation that investors have not given up on the AI dark horse’s stock.

Also, given the steep decline over the past two weeks, I assess that AMD could bottom above its recent September 2024 lows. Although a bullish reversal has not been observed, I’m confident in AMD’s burgeoning data center AI chips opportunity and the growth inflection in its profitability margins as it scales its data center segment.

Moreover, its PEG ratio seems significantly undervalued, suggesting substantial execution risks have likely been reflected in its bullish thesis.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA, AVGO, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!