Summary:

- Advanced Micro Devices, Inc. has fallen 20% since March peak despite strong Q2 earnings.

- Unloved by the market, but one of the cheapest AI stocks with a clear path for growth.

- AMD’s turnaround includes acquisitions, strong sales of Mi300 and EPYC processors, and the potential to outperform Nvidia.

Thomas Barwick/DigitalVision via Getty Images

Thesis Summary

Advanced Micro Devices, Inc. (NASDAQ:AMD) has performed well over the last year, but it has fallen over 20% since its March peak, despite posting strong Q2 earnings.

The company is unloved by the market, and is one of the cheapest AI stocks out there, especially when we compare PEG ratios across the sector.

AMD has a clear path forward to gain market share and continue to expand its revenue and margins as the AI market grows.

Furthermore, AMD has a very compelling technical setup at these levels.

I believe AMD’s price could quickly double from here, perhaps even outperforming Nvidia Corporation (NVDA) in terms of total return going forward.

Unloved AI Company

AMD may not have been able to shine as bright as Nvidia, but it is still benefiting from the rise of AI, and this much can be appreciated in the last quarterly earnings report.

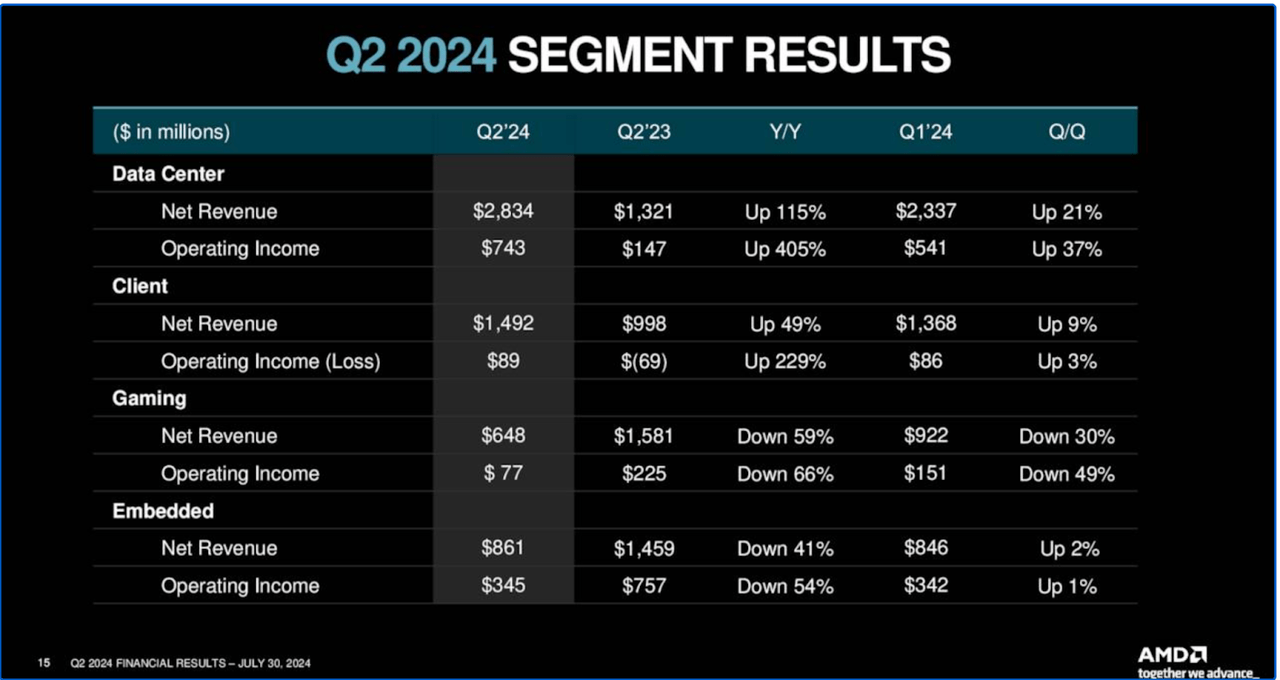

Q2 Segment Results (Investor Slides)

As we can see, Data Center revenues grew 405% YoY, while the client segment was up 49% YoY. These gains though were somewhat offset by the weaker revenues in the Gaming and Embedded segments.

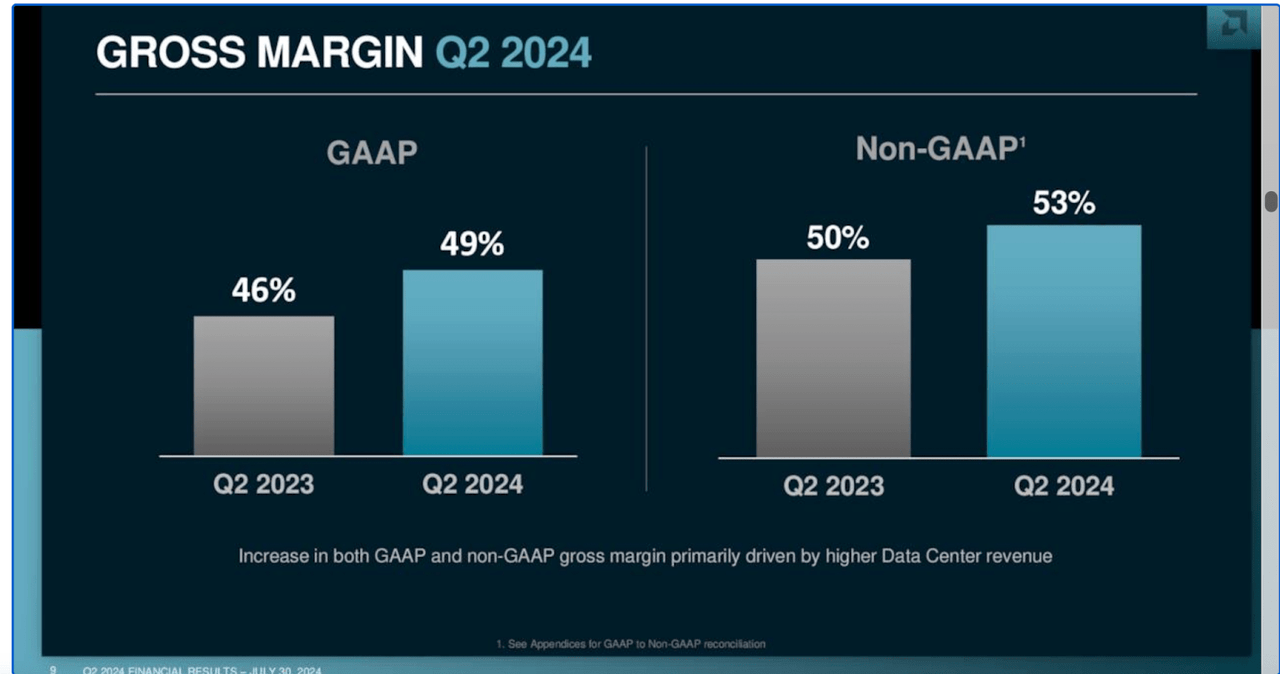

However, we can also see that AMD’s margins have been on the up, which is leading to substantial growth in EPS.

Gross Margin (Investor slides)

The company is benefitting from the revenues in Data Center, which comes with higher margins.

The primary driver is really the faster Data Center business growth. If you look at the Data Center business as a percentage of revenue from 37% in Q4 last year to now close to 50%. That faster expansion really helped us with the gross margin.

Source: Earnings Call.

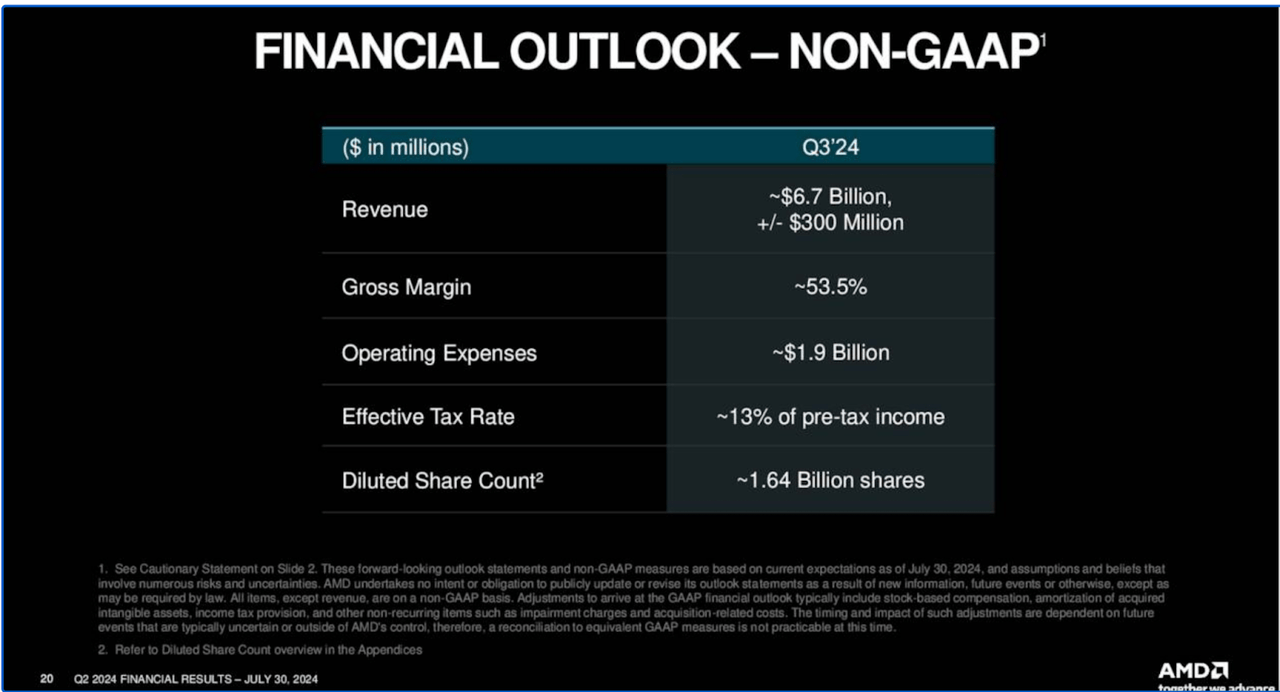

For the next quarter, AMD expects around $6.7 billion in revenues and a further increase in the Gross Margin to 53.5%.

Overall, AMD seems to be keeping up with the general growth in the AI market, and as we will see below, it is making some good moves to expand its presence.

Despite this, the market still appears to be quite skeptical of AMD, and this is reflected in the valuation.

AMD vs. Peers

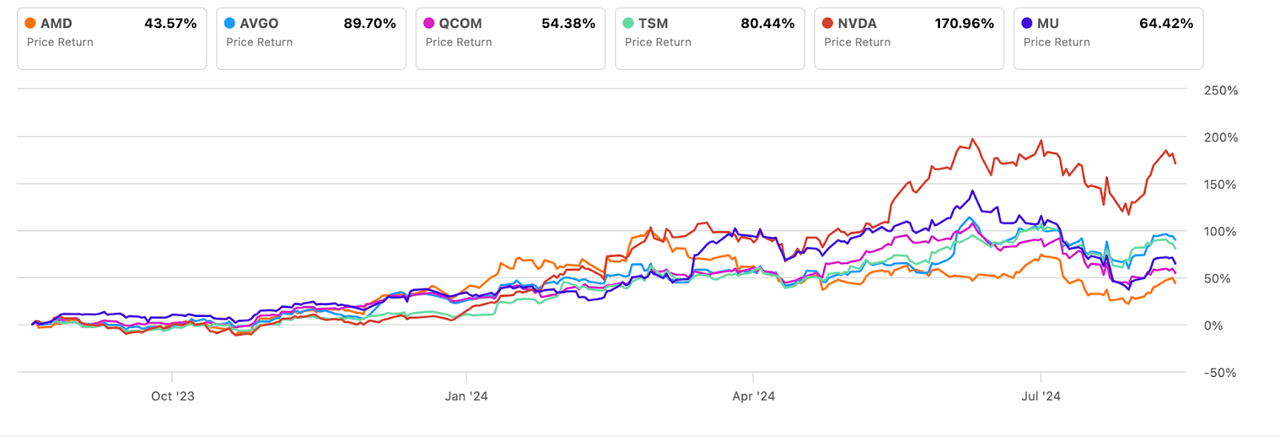

As we can see in the graph below, AMD has been the worst performer out of its AI peers.

AMD vs Peers performance (Seeking Alpha)

While Nvidia is up close to 200%, AMD is up 50% in the last year and has been outperformed by the likes of Broadcom (AVGO), Qualcomm (QCOM) Taiwan Semi (TSM) and Micron (MU).

This disparity in performance has made AMD one of the cheapest stocks in the space.

|

AMD |

AVGO |

QCOM |

TSM |

NVDA |

MU |

|

|

PEG Non-GAAP (FWD) |

1,08 |

1,94 |

1,61 |

0,99 |

1,28 |

NM |

|

EPS Growth Diluted (FWD) |

15,61% |

17,22% |

-3,58% |

8,37% |

125,19% |

4,32% |

|

EBITDA Growth (YoY) |

30,52% |

5,45% |

-2,66% |

8,66% |

709,11% |

18,99% |

|

Net Income Margin |

5,82% |

24,10% |

23,33% |

37,85% |

53,40% |

-7,20% |

As we can see here, AMD is the cheapest stock in terms of Non-GAAP Forward PEG except for TSM, though that stock also suffers from being a foreign stock.

Meanwhile, we can see that AMD has one of the best outlooks in terms of forward EPS growth, except for Nvidia. It also has grown EBITDA by 40% in the last year, outperforming the other AI companies, again, except Nvidia.

Now, a big reason for this hefty discount can be attributed to the much lower profitability, which can be seen in the much smaller net income margin AMD has compared to its peers.

The company has been investing a lot more in terms of R&D to try to catch up to Nvidia, and while this is expensive right now, it is setting up AMD for a much better future.

AMD’s Turnaround

It’s not the first time AMD has proven the market wrong. It managed to carve itself a space in the CPU market against Intel (INTC), and the company is doing the same today with GPUs and Nvidia.

There are at least three clear catalysts that are setting up AMD for a bright future.

Firstly, AMD has carried out numerous acquisitions over the last year. It acquired Silo AI a few months back, and more recently it announced the acquisition of ZT systems for $4.9 billion.

Wedbush analysts believe AMD was able to buy ZT systems for a good price, and have a $200 target on the stock.

“In turn, the relatively attractive deal price may allow AMD to recoup a meaningful portion of its acquisition cost when it sells ZT’s assets”

Source: Wedbush Analysts.

All in all, AMD is taking the necessary steps towards dethroning Nvidia, and that leads me to the second point.

The Mi300 and EPYC processor have already shown a great ramp up in sales, showing that AMD can offer a reasonably priced alternative to Nvidia’s chips.

Turning to the segments, data center segment revenue increased 115% year-over-year to a record $2.8 billion, driven by the steep ramp of Instinct MI300 GPU shipments and a strong double-digit percentage increase in EPYC CPU sales.

Source: Earnings Call.

What’s more, we should also begin to see these sales should also help AMD raise their margins even further as it optimizes the production.

Yes. On your second question about the profitability, first our team has done a tremendous job to ramp the product MI300. It is a very complex product. So we ramped it successfully. At the same time, the team also started to implement operational optimization to continue to improve gross margin. So we continue to see the gross margin improvement. Over time, in the longer term, we do believe gross margin will be accretive to corporate average.

Source: Earnings Call.

Lastly, it’s worth noting that Nvidia’s Blackwell delay will certainly aid AMD in gaining more traction with its customers. AMD’s own aggressive roadmap is putting pressure on NVIDIA, which may have just opened the door to AMD.

Technical Analysis

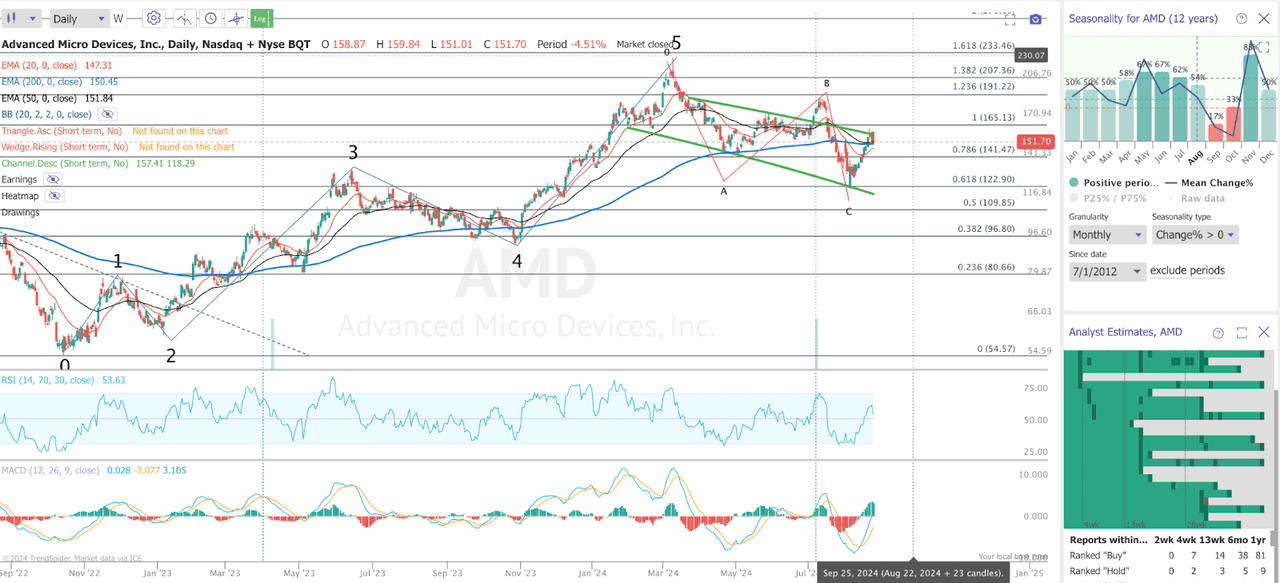

The technical outlook for AMD looks very compelling at the moment.

After rallying to over $200, the stock has formed a very clean ABC pull-back to the 38.25 retracement level. Since then, we have seen it rebound above its key EMAs. Note also that we have seen numerous analyst upgrades over the past month.

AMD looks ready to break out of the broadening channel it has been establishing and head up to new highs.

Takeaway

All in all, I like the setup in AMD at these levels. I think the valuation is reasonable, the chart looks good, and the company is executing well. I added some shares on the dip and plan to hold for at least a couple of quarters.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is a high-risk/high-reward opportunity, which is exactly what I look for in my YOLO portfolio.

Joint the Pragmatic Investor today to get insight into stocks with high return potential.

You will also get:

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video