Summary:

- AMD investors have endured a hammering as the stock collapsed 45% from its early 2024 highs.

- Nvidia’s AI lead is significant, and AMD is far from closing the gap — not yet, at least.

- AMD needs the hyperscalers to diversify their reliance on Nvidia. Recent engineering issues on Blackwell could be a start.

- AMD’s PEG ratio is below 1.0 after the steep decline. I explain why the market’s pessimism is overstated.

- With AMD potentially bottoming above the $120 level, I argue why investors should consider buying the fear.

JHVEPhoto

AMD Stock Suffered A Steep 45% Decline

Advanced Micro Devices, Inc. (NASDAQ:AMD) investors have suffered a brutal hammering recently as semiconductor investors experienced a significant market meltdown. As a result, AMD has dropped over 45% from its 2024 highs through this week’s lows. Since March, the stock has underperformed its semiconductor peers, VanEck Semiconductor ETF (SMH), and iShares Semiconductor ETF (SOXX), baffling investors who believe the Lisa Su-led company is recognized as a well-established AI challenger against NVIDIA Corporation (NVDA).

I last updated investors in a bullish AMD article in May 2024. I had expected its buyers to capitalize on Nvidia’s AI surge. However, the thesis has not panned out as AMD markedly underperformed the S&P 500 (SP500). In addition, AMD’s Q2 earnings release demonstrated that the company is nowhere close to catching up with Nvidia. While management lifted AMD’s AI revenue guidance for 2024, investors are likely still skeptical about it possibly falling further behind Nvidia. Is the relative pessimism justified?

AMD Still Far From Dethroning Nvidia

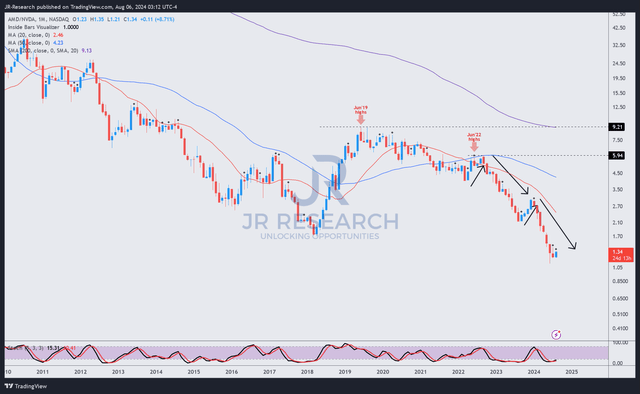

AMD/NVDA price chart (monthly, long-term, adjusted for dividends) (TradingView)

Should we be surprised by the long-term AMD/NVDA chart showing a relative downtrend? AMD’s AI optimism on its earnings call is palpable. Management highlighted that its AI quarterly revenue has surpassed “$1B for the first time.” In addition, it also corroborated the adoption of its AI chips, emphasizing that Microsoft Corporation (MSFT) “expanded their use of MI300X Accelerators to power GPT-4 Turbo and multiple co-pilot services.” Therefore, it indicates that AMD’s AI solutions are potentially gaining traction with the hyperscalers.

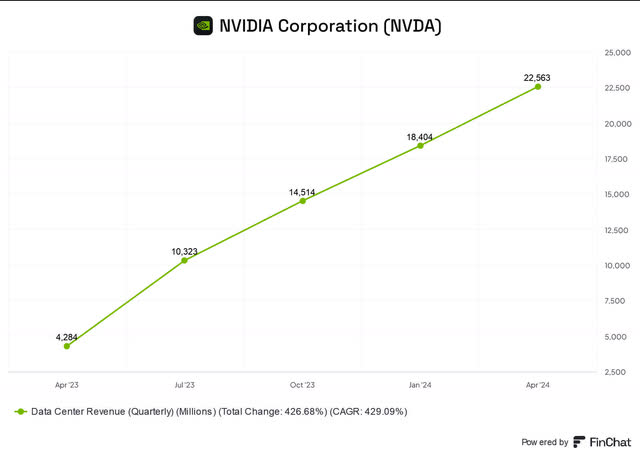

Nvidia data center revenue (quarterly) (FinChat)

However, the numbers don’t lie. Nvidia’s data center revenue has nearly reached a $100B annualized run rate at its most recently reported April 2024 quarter. Given the commentary on aggressive investments in technical AI infrastructure by the hyperscalers at their recent earnings conferences, Nvidia looks well-primed to benefit markedly.

In AMD’s case, even the most ardent supporter could find it hard to argue that a $0.5B upward revision to its FY2024 data center revenue guidance of $4.5B is anything to shout about. Compared to Nvidia’s revenue surge, AMD is arguably still far behind.

However, AMD can still gain more share against Intel Corporation (INTC) in the data center CPU business. Intel’s execution has continued to disappoint as the Pat Gelsinger-led company faces challenges across its ecosystem. AMD expects to ramp up production for its Turin platform, which will likely be in time for “broad OEM and cloud availability later this year.”

AMD’s non-AI business still makes up for most of its data center revenue in Q2, which reached $2.83B. As a result, I’m less concerned with AMD’s nascent attempts to unseat Nvidia’s dominance. Moreover, the recently reported Blackwell architecture delay attributed to “engineering issues” could encourage hyperscalers to consider diversifying their AI roadmap. AMD looks well-positioned as the No.2 player to capitalize on such opportunities, given Intel’s current missteps in execution.

AMD’s AI PC Prospects Could Reignite Momentum

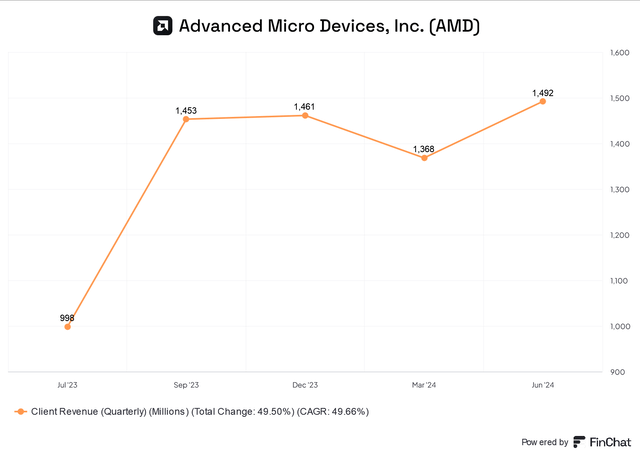

AMD Client segment revenue (FinChat)

A cyclical upturn has helped AMD notch a 49% YoY increase in Client segment revenue. As a result, the PC business has gained renewed traction, moving past the downstream inventory challenges that previously hobbled it.

In addition, the growth prospects of the AI PC upgrade cycle should lower the cyclical risks against potentially more intense macroeconomic headwinds. Hence, it should afford AMD a relatively stable Client revenue base over the next few years as the semiconductor leader attempts to gain more share in the data center segment.

Despite that, AMD investors must be cognizant of the challenges of emerging Arm-based AI PC platforms that could gain more share. Apple Inc. (AAPL) has demonstrated its ability to gain share with its Arm-based Macs. QUALCOMM Incorporated’s (QCOM) commitment to diversify from its smartphone-based revenue streams could spur a more competitive landscape as QCOM looks to gain momentum in the AI PC market. Notwithstanding my caution, AMD’s ability to chart a remarkable turnaround from last year’s malaise underscores its solid execution against its leading peers.

AMD Stock: Undervalued When Adjusted For Growth

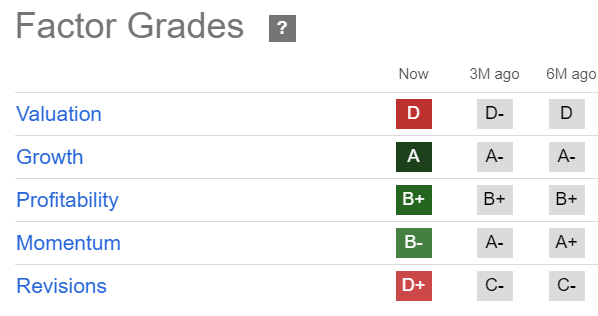

AMD Quant Grades (Seeking Alpha)

Given AMD’s growing opportunities discussed above, I’m not surprised that the stock is priced at a premium. AMD’s forward adjusted P/E multiple of 39x is markedly above its tech sector median of 22.8x. However, the gap with its 5Y average of 43x indicates relative undervaluation.

Therefore, I urge investors to consider its growth-adjusted valuation, given its “A” growth grade. Based on its forward-adjusted PEG ratio of 0.91, it’s almost 50% below the tech sector median of 1.76. In other words, AMD seems significantly undervalued when adjusted for growth.

Therefore, given its growth potential, it could have baffled investors why the market de-rated AMD markedly. I believe Wall Street’s relative pessimism in AMD could have played a key role in determining AMD’s recent sentiment. Accordingly, Wall Street is mixed about AMD’s earnings prospects, suggesting the need to reflect higher execution risks. The clarity management gave in its AI segment revenue might not be as robust as some analysts had anticipated. In addition, potential gains made by Qualcomm in Arm-based PCs could also impact AMD’s opportunity in the critical AI PC upgrade cycle. These concerns are valid, as AMD is priced for growth.

Is AMD Stock A Buy, Sell, Or Hold?

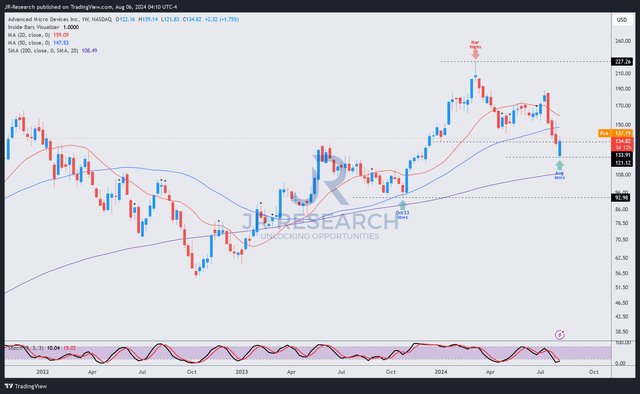

AMD price chart (weekly, medium-term) (TradingView)

Notwithstanding my caution, I assess that AMD could bottom out above the $120 level. Buyers appeared to have returned quickly to defend against the steep decline that started four weeks ago.

However, dip-buyers must regain control of the $135 level to help the stock reignite its growth momentum. Accordingly, AMD’s buying momentum has weakened over the past six months (lowered from “A+” to “B-“). Therefore, a failure to regain control over the $135 level could weaken its buying sentiment further, leading to a protracted consolidation phase.

Despite that, I’ve assessed AMD’s buy thesis as intact, which is marked by my confidence in its AI market share gains in the data center segment and AI PCs. Coupled with a relatively attractive PEG ratio, the market has likely baked in significant execution risks to justify its growth opportunities.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive comments to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below to help everyone in the community learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA, SMH, MSFT, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!