Summary:

- Advanced Micro Devices, Inc. stock has fallen almost 25% from its March 2024 highs, entering a bear market decline.

- Late buyers who purchased AMD near the $230 mark may have become “exit liquidity” for astute profit-takers.

- AMD hasn’t convinced Wall Street that it can monetize AI fast enough to lift AMD’s earnings estimates significantly.

- AMD’s AI hype has driven its optimism to unsustainable levels without a steep pullback to dissipate the FOMO.

- Unless we get a steeper pullback, I urge investors to stay out and avoid chasing AMD further.

JHVEPhoto

Late Advanced Micro Devices, Inc. (NASDAQ:AMD) investors who decided to chase AMD’s surge at its March 2024 highs have suffered a setback, as AMD fell almost 25% toward this week’s lows, entering a bear market decline. I provided a pre-earnings AMD update in January 2024, downgrading AMD to a Hold, as I cautioned that the market had gone into an AI frenzy. I believe AMD’s top in March 2024 has justified my caution, even as buying momentum continued at its feverish pace initially post-earnings but eventually proved unsustainable. As a result, AMD has slightly underperformed the S&P 500 (SPX, SPY) since my previous article, corroborating my caution.

Late buyers who added AMD close to the $230 mark have likely ended up as “exit liquidity” for astute profit-takers, as earlier investors saw the opportunity to cash in on significant gains. Is the market foolish in not trying to give credit to an expanded AI TAM of $400B by 2027? Didn’t AMD management try to lift the AI fervor a few notches, as it telegraphed a faster cadence to ramping AMD’s revenue this year from $2B to $3.5B for 2024? As a result, it demonstrated AMD’s ability to compete effectively with Nvidia (NVDA), suggesting customers desire a competing alternative in this burgeoning and fast-growing market. Moreover, with generative AI set to percolate across various verticals from the data center to the edge, AMD’s consumer ecosystem is well-primed to benefit.

The AI PC refresh cycle is expected to increase the AI PC market share in the overall TAM through 2028. Accordingly, AI PCs are projected to account for 40% of PC shipments by 2025. In addition, the segment is also estimated to grow at an astounding 44% CAGR from 2024 to 2028, suggesting AI-driven spending is sustainable. As a result, given AMD’s well-diversified business model covering enterprise, cloud computing, and consumer verticals, I believe it’s justified for investors to feel confident about its growth momentum.

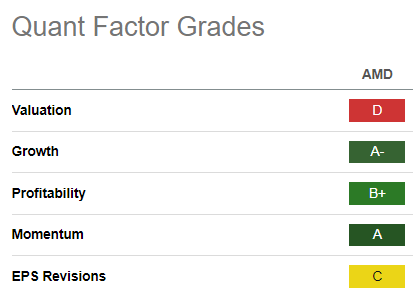

AMD Quant Grades (Seeking Alpha)

As seen above, AMD is assigned a “D” valuation grade and a robust “A-” growth grade. Therefore, AMD bulls could argue that market sentiments on AMD should remain well-supported at steep pullbacks, as seen with its “A” momentum grade.

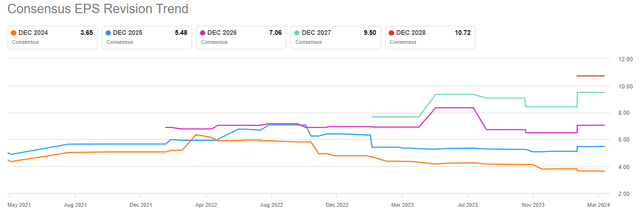

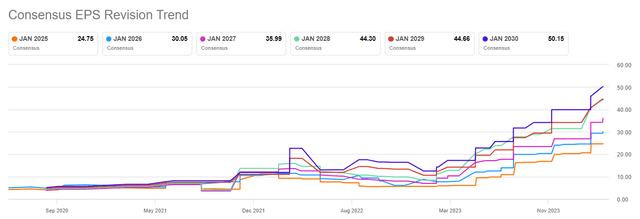

AMD EPS revisions trend (Seeking Alpha) NVDA EPS revisions trend (Seeking Alpha)

Despite that, I observed AMD’s earnings revisions trend as largely tepid over the past year. Compared to Nvidia’s significant earnings upgrade, it suggests Wall Street analysts are still relatively skeptical whether AMD can potentially capture a considerable slice of the $400B total addressable market, or TAM, that it articulated.

AMD management is confident that AI could become the company’s most significant segment. Based on Nvidia’s earnings performance, I believe optimism isn’t misplaced. However, AMD must still justify its earnings performance to bolster Wall Street’s confidence. Its earnings revisions grade of “C” doesn’t provide substantial confidence that AMD’s risk/reward profile seems attractive enough at the current levels.

AMD price chart (monthly, long-term) (TradingView)

AMD’s price chart indicates that its long-term uptrend bias remains intact. Buyers have formed a higher low in October 2023 at a critical level, helping AMD to bottom out. Over the past six months, the surge has led to a significant outperformance that hasn’t been left unnoticed by investors, corroborating the AI gold rush.

However, I also assessed a potential reversal signal ready to be validated by the end of March 2024. Despite that, I didn’t assess red flags embedded in AMD’s price action, suggesting investors should consider cutting significant exposure unless there are reallocation opportunities.

While late buyers who chased Advanced Micro Devices, Inc.’s March highs are likely hurting from their over-optimism, I believe a drop toward the $130 to $150 zone could see more aggressive dip-buying. For now, it makes sense to stay out and watch how the pullback unfolds.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!