Summary:

- Advanced Micro Devices, Inc. Q2 beat consensus estimates on both lines despite some unevenness among its segments.

- However, AMD’s profit margin did not expand as the market expected.

- Looking ahead, the market continues overestimating its margin expansion potential, a setup for disappointing stock price movements.

- Insider activities preceding the release of its Q2 ER were dominated by selling.

- In particular, many batches were sold between $160 to $180, a key support level that will take a while for AMD to regain.

Vladimir Zakharov

AMD stock: Q2 recap

My last article on Advanced Micro Devices, Inc. (NASDAQ:AMD) was an earning preview article for its Q2 earnings reported on July 30th. As illustrated by the chart below, that article was titled “AMD Q2 Preview: High Consensus Expectations Set It Up For Disappointment” and was published on July 24, 2024. In it, I cautioned readers about the downward risks (its stock price was hovering around $153 at the time of publication) due to the following concerns:

The market expects profit margin expansion for AMD, but competition pressure and inventory concerns may lead to disappointment in Q2. Looking further out, I consider the market’s margin expectations to become even more disconnected from the competition landscape in the next few years.

Since then, the company has reported its earnings, and the stock price did suffer substantial corrections, as illustrated by the chart above. It is debatable whether AMD’s stock price setback was a result of the broader market’s panic, or if its earnings report (“ER”) helped to cause the market panic. With such sizable stock price movements and the new development described in the ER, I think it would be helpful to write this earnings review article.

In this review article, I will first briefly follow up on some of the projections I made in my preview to point out areas that deserve special attention. I will then comment on the new developments surrounding the stock since the release of the Q2 ER. And finally, I want to draw your attention to the insider transactions (which were all selling transactions) proceeding with the Q2 ER. In the end, my conclusion is that I am still seeing a lack of definitive direction for its stock prices in the near term, both due to business fundamentals and market sentiment.

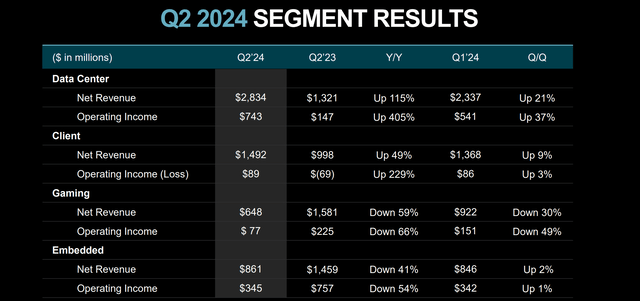

Overall, AMD delivered a solid Q2 and beat consensus estimates on both lines. Non-GAAP EPS dialed in at $0.69, beating consensus by $0.01. Revenue totaled $5.84B, beating consensus by $120M. Looking deeper, there is some unevenness among its segments, as seen in the slide below.

One area I underestimated, badly, in my preview article, was the growth of its data center business. As seen, Data Center revenue significantly increased by 115% year-over-year (YoY) to $2.8 billion in Q2. Client revenue also grew strongly by 49% YoY to $1.4 billion. Conversely, the Gaming and Embedded segments experienced declines, with Gaming revenue dropping 59% YoY to $648 million and Embedded revenue falling 41% YoY to $861 million. I will revisit these developments a bit later.

Another key area I did project correctly in my preview was the margin pressure, as detailed next.

AMD stock: market kept overestimating its margin

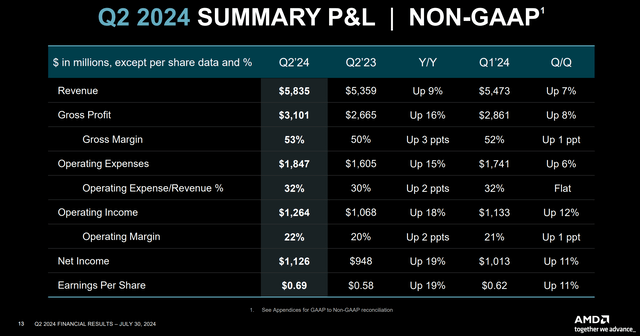

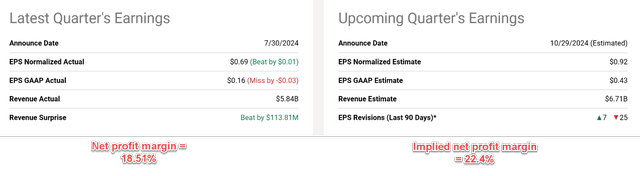

As aforementioned, a key reason for my concern about Q2’s disappointment was that the market expects profit margin expansion for AMD, but I anticipated the opposite. As you can see from the next chart, in its Q1 ER, the company reported a net profit margin (NPM) of 18.5%. While for its Q2, the consensus estimate implies an expansion of the NPM from 18.5% to 19.4%. I view such a projection as very unlikely.

The Q2 results have indeed failed to materialize such expansion. As seen in the chart below, its revenue totaled $5.8 billion and net income totaled $1.01 billion, translating into a net margin of 18.51%, essentially unchanged from the net margin in the previous quarter. Looking ahead, the market keeps — stubbornly, in my view — expecting better net margins. As illustrated by the second chart below, for its Q3 results (estimated to be released on October 29, 2024), the market expects a normalized EPS of $0.92 and a total revenue of $6.71 billion. Assuming no change in its share counts, these numbers translate into an implied net margin of 22.4%!

I keep considering such a margin expectation to be implausible (given the competition pressure from Nvidia (NVDA) and its inventory buildup as detailed in my preview article for more details) and will be reflected in disappointing stock price movements.

AMD stock: trading patterns indicate continued selling pressure

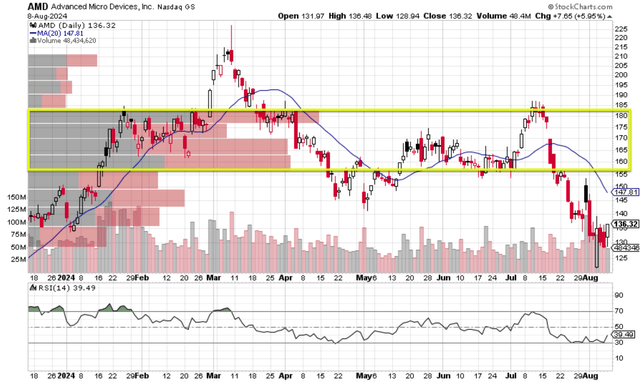

Another reason I expect disappointing stock price movements in the near future involves the stock’s recent trading patterns. More specifically, the top panel of the chart below shows the price-volume trading information of AMD with its 20-day moving average and the bottom panel shows its Relative Strength Index (“RSI”). I see little encouragement for bullish investors, judging by the trading patterns here. First, the current stock price is hovering well below its 20-day moving average of $147.81, a textbook bearish signal for traders. To compound the bearish outlook, the RSI currently resides at 39.49, border-lining oversold conditions and suggesting persisting selling pressure.

Finally, I want to focus on the volume bars highlighted by the yellow boxes. The bars correspond to the price range (between $160 and $180) that has attracted the largest trading volumes in the past few months. The cumulated volume in this range far exceeds other price ranges as seen. Given the dominating volume, the price range of $160 to $180 represents a crucial support level for the stock in my view. ADM’s current stock price has fallen well below this level now.

To add to my concern, this price range is also where many of the recent insider transactions have occurred, as detailed next.

Other risks and final thoughts

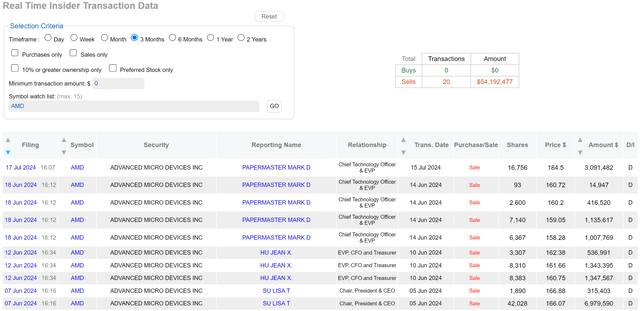

Another downward risk involves its insider activities. The chart below describes insider selling activities on AMD stock in the past 3 months preceding the release of its Q2 ER. Such recent insider trading activity at AMD warrants close attention due to A) the fact that the activities are completely dominated by selling transactions, and B) the timing of the selling as seen. Notably, high-level executives, including CEO Lisa Su, CFO Jean Hu, and Chief Technology Officer Mark Papermaster, have offloaded multiple chunks of their AMD shares. Also note their recent batches were mostly sold in a price range of $160 to $180, which I view as the key support level as analyzed above.

In terms of upside risks, the momentum with its data center segment was stronger than I thought and could be sustained longer. In particular, my observation of recent data points shows is the LLM (large language model) sizes and the corresponding computing requirements double every ~6 months and statistics monitored by EpochAI suggest that such a trend still holds. Such demand could keep supporting the growth of AMD’s data center business.

On the PC and gaming front, AMD keeps launching new products at competitive prices (and cutting-edge specs, too). Notably, it recently disclosed the launch price of its new AMD Ryzen 9000 Series. Thus, these new chips are priced cheaper than the previous-gen chips. With the combination of performance and pricing, I expect AMD to continue gaining market share from Intel (INTC). A quick search on Amazon just showed me that the top ten CPU lists are dominated by AMD chips. INTC’s cheap 12th-generation Intel i5 was the only one on the list. None of Intel’s newer 13th or 14th Gen CPUs made the list.

To conclude, I see a lack of definitive direction for its stock prices in the near term due to a confluence of negatives and positives. To recap, the top positives in my view are the rapidly growing demand for its data center segment and its competitive product lineup. The top negatives in the near term are the market’s overly optimistic expectation of its margins, the competition pressure (especially from NVDA), and also the selling pressure as indicated both by market and insider activities. In particular, judging by the recent trading patterns and insider transactions immediately preceding the Q2 ER, I think it will take a while before AMD stock prices can challenge and hold the $160~$180 level again.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.