Summary:

- Today I raise concerns about the sustainability of AMD stock’s current rally and warn against buying at current highs. Read on to find out why.

- AMD’s valuation premium compared to Nvidia and innovation lag in GPUs are what raise questions for AMD bulls right now.

- News of AMD scaling back GPU solutions development and competition from Nvidia could limit AMD’s market share gains.

- I am convinced that investors will have a chance to buy AMD at better prices – today it is an ‘Avoid’ stock for me.

Mohsin Iqbal/iStock via Getty Images

My Investment Thesis

In today’s article, I would like to express my concerns about the sustainability of the current rally in Advanced Micro Devices, Inc. (NASDAQ:AMD) stock and warn potential investors not to buy AMD at its current highs. My main concerns relate to the stock’s valuation premium compared to NVIDIA Corporation (NVDA) as well as a certain innovation lag in GPUs, which in my opinion makes AMD’s business diversification in the CPU market insufficient for sustainable growth in the foreseeable future.

My Reasoning

In my recent article on Nvidia, in which I mainly touched on the topic of investment cycles, I briefly mentioned the latest news, which lends itself perfectly to the discussion in my AMD article today.

I expect that in the next 2-3 years NVDA will have to face stiff competition from Advanced Micro Devices, which is also actively working on solutions for the AI GPU market. To date, AMD is known for producing both powerful CPUs and GPUs, catering to a broader range of users, while Nvidia’s reputation is primarily built on its GPU prowess, making it the go-to choice for gaming, AI functions, and virtual machine networks. But that may change soon – in any case, I think the GPU market will be more diverse in the foreseeable future as AMD refocuses on producing its less powerful Navi 43 and 44 processors.

Pay attention to that last sentence – it basically means that AMD is scaling back its GPU solutions development for large enterprises that need more computing power. In the article referenced above I explain this move as the company’s desire to move more into the budget space given the shortage of processors.

This news comes six months after AMD announced it would start shipping the MI300X by the end of 2023.

As CNBC reported in June 2023, the MI300X was designed for large language models (LLMs) and other state-of-the-art AI models. In the past, AI developers have chosen Nvidia chips because they had a well-developed software package called CUDA that allowed access to the chip’s core hardware functions. Now AMD is ready to offer an alternative in the form of its new own software for its AI chips that it calls ROCm.

This means that AMD will certainly not completely give up the fight against Nvidia’s dominance in the GPU market, but the current market share of ~80% gives the latter company a strong competitive advantage. Ultimately, it all boils down to a banal battle for supremacy, with all the resulting consequences for both companies. Just put yourself in the shoes of AMD and Nvidia: what follows from the battle for a market that is structurally in deficit without even a hint of saturation? Logic dictates that AMD’s products will take some of the market away from NVDA, but it is unlikely that Nvidia will simply stand by and watch. The company’s dominance allows it to generate an

EBITDA margin of over 58% (TTM), so I think it can exert tremendous pricing pressure. If Nvidia starts to leverage this power, it will put heavy pressure on AMD’s growth rate and limit the potential for market share gains. Both companies will be hurt financially. The problem for AMD is that the market is only pricing in obstacles for its competitor NVDA.

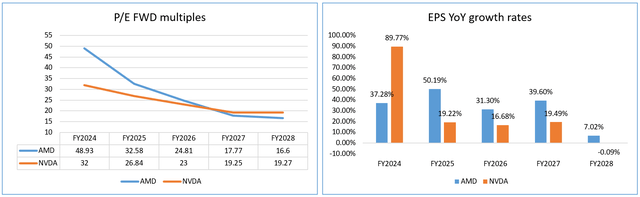

Let’s look at what multiples AMD and NVDA have for 2024 and beyond. The AMD stock is now 53% more expensive than NVDA, based on this 2024 year-end price-to-earnings ratio. At the same time, AMD’s EPS growth this year is expected to be 2.4 times lower than that of its peers. Next year, however, AMD’s earnings per share growth is expected to exceed Nvidia’s by about 2.6 times, and its implied P/E is going to keep a premium, but a relatively lower one (just 21.4%). Wall Street analysts expect AMD’s superior EPS growth to continue until 2028:

Seeking Alpha data, Oakoff’s work

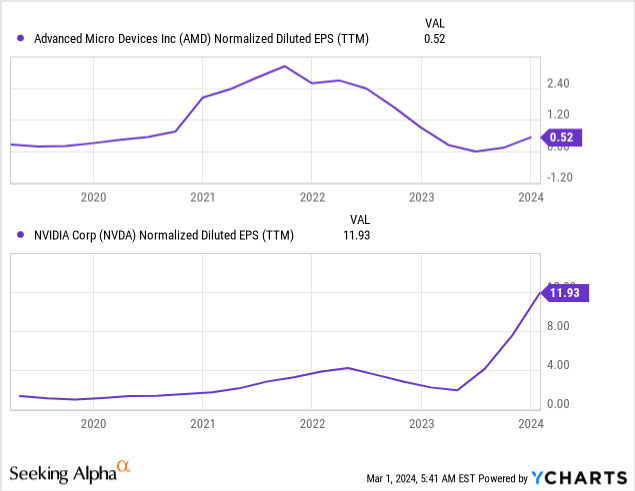

To some extent, the consensus suggests that AMD will experience something similar to what Nvidia experienced when its new chips hit the market – as evidenced by the lagging EPS growth trends:

But given the recent news and my assumption that Nvidia will probably defend its addressable market at the expense of its own margins despite all the market shortages, I think these predictions are a bit too high.

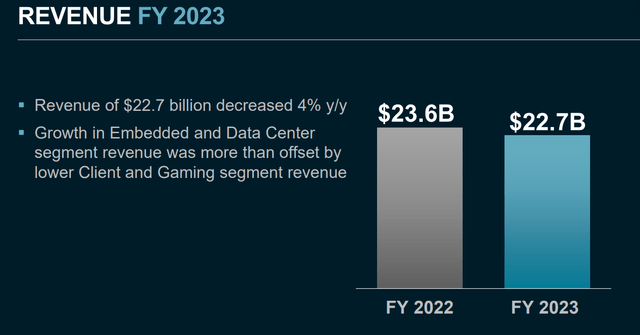

The diversification of AMD’s end markets should theoretically give the company stability, but in reality, it only limits its growth. In FY2023, the company’s revenue only increased by only 4% YoY due to problems in the Client and Gaming segments:

Moreover, the weakness in certain segments is likely to persist. Goldman Sachs analysts wrote in their short note (proprietary source) right after AMD’s Q4 FY2023 release that they expect some pressure on EPS estimates from the Gaming segment. To be fair, however, they rated AMD stock a ‘Buy’ due to continued customer traction in its Data Center GPU business.

We expect significant weakness in AMD’s Gaming business (i.e. >30% qoq revenue declines expected in 1Q24 and 2Q24) to drive negative revisions to Street estimates. However, we are encouraged by the ongoing customer traction in the Data Center GPU business as evidenced by the positive revision to management’s full-year revenue guide from $2bn+ prior to ~$3.5bn.

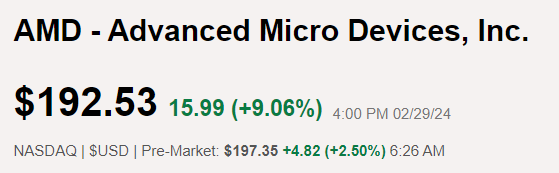

The bank valued AMD at a P/E multiple of 36x and EPS of $5, raising AMD’s 12-month price target to $180. And this forecast seemed very fair at the time – as it does today. The problem for AMD, however, is that the stock has already outpaced that target.

Seeking Alpha, AMD

I think that the market is still in a phase of euphoria and does not fully understand the risks for AMD that I described in my article today. So I’d recommend reducing your position in light of the current strength rather than increasing it (and not making the first purchases of the stock in case you don’t hold it). Most likely, better entry points await us ahead.

Risks To My Thesis

The biggest risk to my thesis today is primarily the strength with which the company’s GPU business is gaining momentum. Not long ago, AMD had little to no revenue from AI Data Center GPUs, and today banks are forecasting up to $10.5 billion from it next year (GS’s upper forecast range). If the strong performance continues and my fears that NVDA could hinder AMD’s development do not materialize, the stock could update its ATHs more than once this year and next.

It’s also worth noting that AMD looks very, very attractive from a technical perspective. As Mark Newton of Fundstrat Global Advisors (proprietary source) recently noted, AMD stock has broken above the highs of the consolidation that has been ongoing since mid-January on rising trading volumes – that’s a strong bullish sign.

However, the analyst notes that reaching the $205 zone may trigger profit-taking, and there is very, very little time left to reach that zone.

Your Takeaway

In my opinion, the abundance of positive sentiment in the market has triggered a strong rally in stocks such as AMD, with analysts focusing primarily on the positive factors. However, there is another side to the coin. In my opinion, AMD’s current valuation, which is higher than that of its direct peer NVDA, is a bit too high as its EPS growth estimates should be revised downwards due to the overweighting of lagging segments. I am convinced that investors will have a chance to buy AMD at better prices – today it is an ‘Avoid’ stock for me.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.

![GS [proprietary source]](https://static.seekingalpha.com/uploads/2024/3/1/53838465-17092929261197867.png)