Summary:

- AMD has underperformed in the generative AI and x86 CPU races, with it currently relegated to the second place.

- Prior to a healthier competition against the market leader and the eventual reversal in its prospects, we are uncertain if it is wise to recommend a Buy here.

- Combined with the abrupt departure of Victor Peng from the acquisition of Xilinx, we believe that market sentiments surrounding AMD’s prospects are likely to remain depressed ahead.

vm

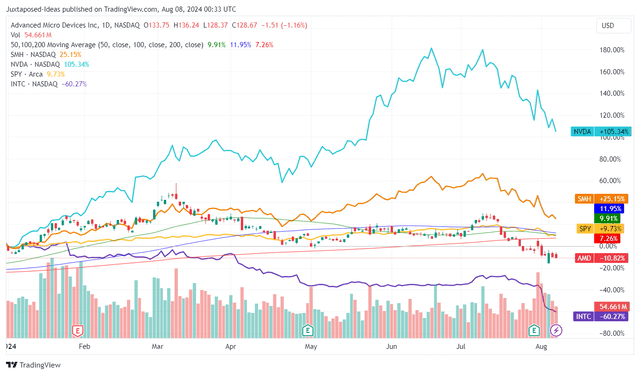

We previously covered Advanced Micro Devices, Inc. (NASDAQ:NASDAQ:AMD) in May 2024, discussing its underperformance in both stock and financial performance, as Nvidia (NVDA) took the lead in the generative AI race and Intel (INTC) in the x86 CPU race.

With the gaming segment still reporting elevated inventory channels and slower IoT/ automotive recovery in the embedded segment, we had been uncertain about its intermediate term prospects, resulting in our reiterated Hold rating.

Since then, AMD has fallen by another -11%, well underperforming the wider market at +3.4%.

Part of the headwinds may be attributed to the ongoing market correction observed in high growth/ generative AI stocks, with the balance likely attributed to the lackluster FQ2’24 earning results and underwhelming FQ3’24 guidance.

Combined with the abrupt departure of Victor Peng from the acquisition of Xilinx, it appears that AMD is likely to continue being relegated as the second best, resulting in our reiterated Hold rating.

AMD’s Data Center Investment Thesis Remains Underwhelming

AMD YTD Stock Price

Trading View

At a time of generative AI boom and a supposedly insatiable AI chip demand from enterprises/ hyperscalers, two semiconductor companies have stood out as laggards, namely AMD and INTC.

For context, NVDA has guided excellent FQ2’25 revenues of $28B (+7.5% QoQ/ +107.4% YoY), well exceeding the consensus estimates of $26.84B, with most of the tailwinds likely attributed to Grace Hopper while building upon the FQ1’25 data center sales of $22.56B (+23% QoQ/ +427% YoY).

With that in mind, AMD only reported FQ2’24 Data Center revenues of $2.83B (+21.4% QoQ/ +114.3% YoY), with the absolute number being rather underwhelming despite the robust QoQ/ YoY growths.

With INTC also reporting and guiding poor Data Center/ AI related revenues in FQ2’24 and FQ3’24, it is no secret that both companies have been unable to capitalize on the ongoing AI boom, underscoring why NVDA has been estimated to command the leading share of up to 90% in the AI GPU chip market/ 80% of the entire data center AI chip market.

This is despite Microsoft’s (MSFT) CEO having praised AMD’s Instinct MI300X AI accelerators as the best “price-to-performance” AI chip on the market, as hyperscalers increasingly place orders for NVDA’s next-gen chips, as observed with GOOG (GOOG) at $10B, Meta (META) at $10B, and Microsoft (MSFT) at $1.62B, with Amazon (AMZN) also opting to swap Grace Hopper orders for Blackwell.

Based on these developments, we believe that NVDA’s CUDA platform has been very sticky indeed, with it naturally being a barrier of entry for latecomers, such as AMD.

At the same time, this development also demonstrates the hyperscalers willingness to spend and wait for top-tier performance, despite the supposedly hefty price tags and long-lead time.

Therefore, while Blackwell’s launch may have delayed due to technical issues, we believe that the potential boost on AMD’s top-line may not be material, with hyperscalers likely to continue waiting for NVDA’s next-gen offerings.

The only silver lining to AMD’s investment thesis is the sustained gains in its x86 CPU market share to 33.6% by Q3’24 (+0.2 points QoQ/ -1.5 YoY/ +10.5 from F2’19 levels of 23.1%), naturally eroding INTC’s share to 63.5% (-0.4 points QoQ/ +0.9 YoY/ -13.4 from FQ2’19 levels of 76.9%).

At the same time, AMD has reported expanding Client Segment operating margins of 6% (+13 points YoY), though still far from the 30.2% reported in FY2021 and 12.2% in FY2019.

These developments imply that the ongoing PC refresh cycle has been a boon indeed, significantly aided by the new launch of AI-ready PCs with MSFT already projecting up to 50M units of AI PCs sold in 2024.

The latter includes AMD’s Ryzen AI 300 chipsets, along with other AI PCs featuring INTC’s x86 Lunar Lake chipsets and Qualcomm’s (QCOM) ARM-based Snapdragon X Elite CPU chips.

As a result, we believe that AMD’s Client Segment may continue to record robust top/ bottom-line numbers over the next few quarters.

Even so, with the other segments, such as Gaming and Embedded still drastically impacted, it is unsurprising that sentiments surrounding its intermediate-term prospects have turned sour.

Combined with the abrupt departure of Victor Peng, with it backpedaling AMD’s unified AI strategy and vertically integrated ecosystem based on the MI300 Accelerated Processing Unit across the open-source ROCm and Xilinx’s proprietary Vitis platform, we can understand the drastic correction observed in its stock prices and valuations.

The Consensus Forward Estimates

Tikr Terminal

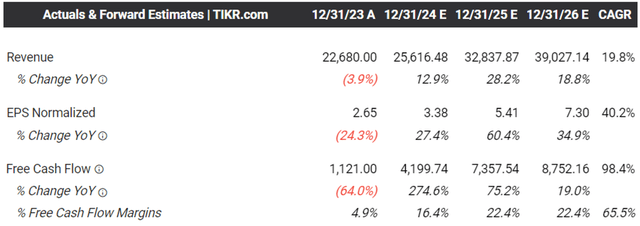

On the one hand, the consensus forward estimates for AMD’s top/ bottom-line growth through FY2026 remain somewhat optimistic, with it signaling the eventual recovery in financial performance.

On the other hand, at the risk of repeating ourselves, it is apparent that AMD is likely to be left behind by the ongoing data center/ AI capex boom, with the management only offering a FQ3’24 revenue guidance of $6.7B (+14.9% QoQ/ +15.5% YoY), compared to NVDA’s annualized revenues at $112B.

With the sales gap to NVDA painfully widening, AMD likely has to contend with INTC in both the data center processor and AI accelerator markets, with the latter’s Xeon already powering data centers (thanks to the partnership with NVDA’s H100 GPUs) and Gaudi 3 set to launch in Q3’24, with it supposedly offering “two-thirds the cost of competitive offerings.”

Only time may tell how AMD may perform.

AMD Valuations

Tikr Terminal

As a result of the potential underperformance, the market has temporarily discounted AMD’s FWD P/E valuations to 29.22x, down from its 1Y mean of 39.84x, 5Y mean of 37.57x, and pre-pandemic mean of 39.56x.

While the stock may appear to be cheap at current levels, we believe that the market has merely re-priced AMD’s valuations according to its (temporal) inability to directly compete with NVDA, currently at FWD P/E of 33.48x, while nearing INTC at 18.78x.

Even when comparing AMD’s projected top/ bottom line growth at a CAGR of +13.4%/ +20.2% through FY2026, to NVDA at +62.6%/ +89.3% and INTC at -0.6%/ +1.4%, it is painfully apparent that the former has a lot to catch up on – warranting the moderated P/E valuations.

So, Is AMD Stock A Buy, Sell, or Hold?

AMD 4Y Stock Price

Trading View

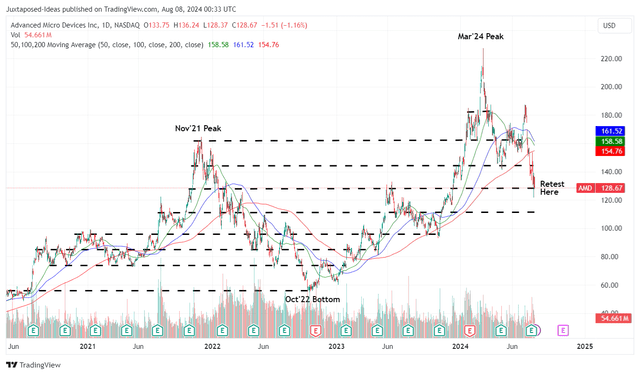

For now, AMD has already lost -43.3%, or the equivalent $133.23B of its market capitalization since the March 2024 peak, while trading below its 50/ 100/ 200 day moving averages.

For context, we had offered a long-term price target of $244.50 in our last article, based on the consensus FY2026 adj EPS estimates of $7.41 and the 1Y P/E mean of ~33x.

While those numbers remain largely in-line, with the moderate downgrade to $7.30 (-1.4% YoY) resulting in a still promising updated long-term price target of $240.90, we maintain our belief that the market sentiments surrounding AMD are likely to remain depressed, nearing that of INTC’s.

Prior to a healthier competition between AMD’s and NVDA’s Data Center prospects and the eventual reversal in the former’s prospects, we are uncertain if it is wise to recommend a rating upgrade at current levels.

This is especially since AMD has continued to chart lower highs and lower lows over the past few weeks as the market-wide correction occurs, with bullish support yet to be found.

With the AMD stock likely to underperform its peers and the wider market, we believe that it may be more prudent to reiterate our Hold (Neutral) rating here.

This may be a value trap.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.