Summary:

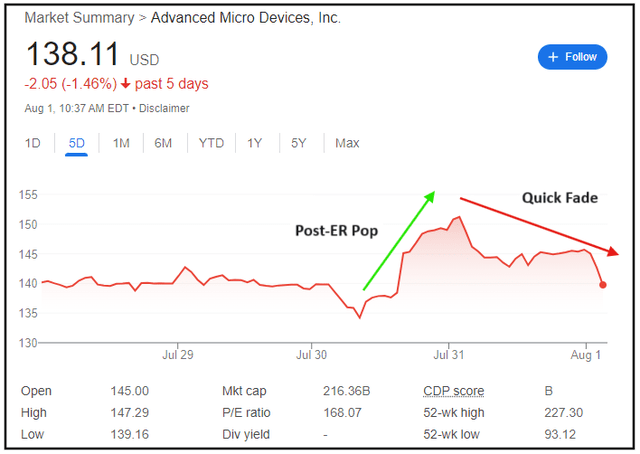

- Earlier this week, AMD stock initially popped after its Q2 2024 report but quickly faded, now trading at pre-report levels.

- AMD’s Q2 report showed robust performance in Data Center and Client segments, with Instinct AI GPUs, EPYC CPUs, and Ryzen processors driving the growth.

- AMD is finally delivering on the promise of AI-powered hypergrowth, and the near-to-medium-term demand outlook remains robust.

- In light of its valuation moderation, I think AMD’s long-term risk/reward is attractive enough for investors to restart accumulation.

Tim Robberts

Introduction

In light of its Q2 2024 report, Advanced Micro Devices, Inc. (NASDAQ:AMD) stock popped by a double-digit percentage; however, investors have quickly faded the bounce, and AMD is now trading where it was heading into the print!

Now, going into the report, I wrote the following in my earnings preview note:

Advanced Micro Devices is a fundamentally sound business that I want to own long-term; however, in the absence of AI-powered hypergrowth, I find it difficult to justify paying up a premium for AMD stock ahead of its Q2 report. Based on recent business trends, management’s guidance, consensus estimates, and earning revision trends, I do not expect to see any major fireworks from AMD later tonight; however, I will be happy to re-evaluate my “Hold/Neutral” rating on AMD stock if we get a blowout quarter, superlative guidance, and/or a significant post-ER decline.

Key Takeaway: I continue to rate Advanced Micro Devices, Inc. stock “Hold/Neutral” at ~$139.52 per share.

Source: Down 40% In 4 Months, Is AMD Stock A Buy Ahead Of Earnings?

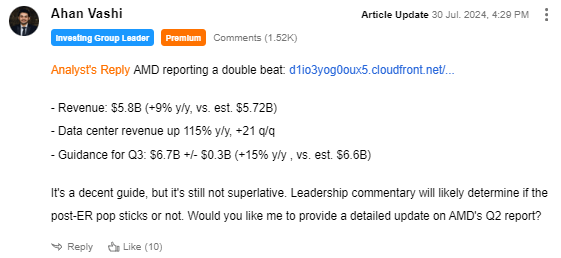

While AMD delivered a double beat and raised AI revenue guidance, the ~$110M top-line beat was not a blowout, and a $500M boost to AI GPU guidance [$4B to $4.5B] wasn’t superlative. Since the stock had jumped up to the $150s [i.e., moved further away from our fair value estimate, I expressed doubts over the staying power of this post-ER pop:

Seeking Alpha

Given my cautious pre-earnings view on AMD, the post-ER pop drew me a good bit of flak:

Seeking Alpha

However, I often talk about the need for investors to follow the business and not the stock price, and AMD’s volatility proves why. Now, I am not here to gloat; all I want is for my readers to avoid judging businesses based on short-term stock price fluctuations!

In today’s note, we will dive into AMD’s Q2 2024 report and re-evaluate AMD’s long-term risk/reward and technical chart to formulate an informed investment decision in light of the new information received from AMD’s Q2 report and earnings conference call. Let’s jump right in!

Brief Review Of AMD’s Q2 2024 Report

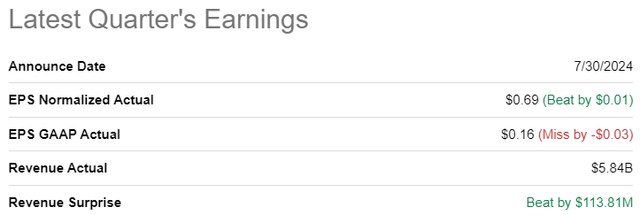

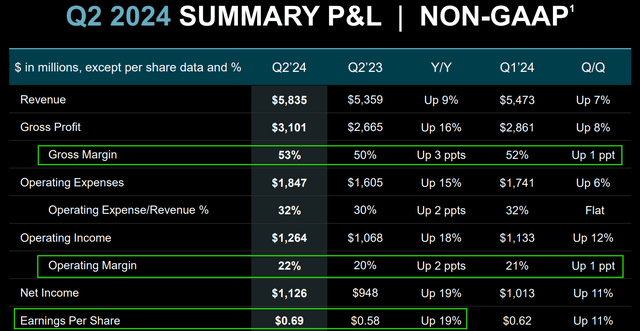

For Q2 2024, AMD delivered revenues of $5.84B [+8.8% y/y, +6.7% q/q], beating street estimates of $5.72B – driven by stronger-than-expected sales of Instinct Mi300 (AI GPUs), EPYC (server CPUs), and Ryzen processors. Also, powered by continued gross margin expansion and operational discipline, AMD recorded non-GAAP Q2 EPS of $0.69, exceeding non-GAAP EPS estimates by a penny per share.

From a big-picture perspective, AMD’s Q2 performance looks solid, but let’s dig a little deeper now.

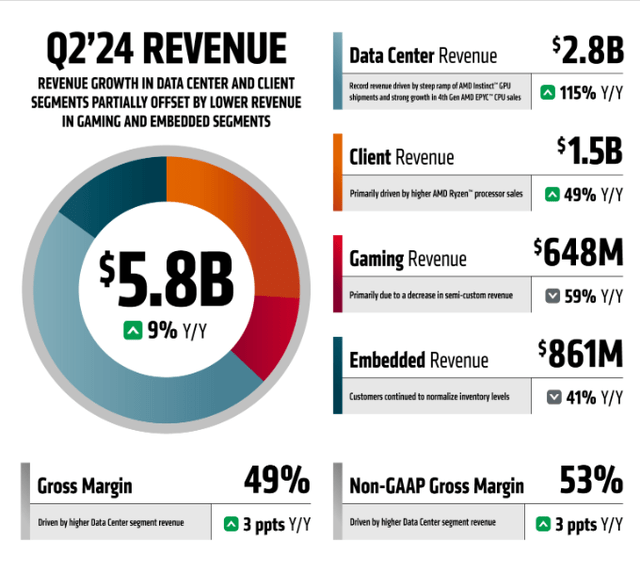

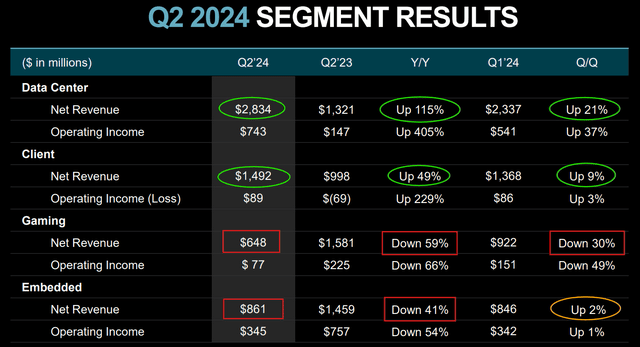

While AMD’s Data Center [$2.8B, +115% y/y] and Client [$1.5B, +49% y/y] business segments extended their recent momentum, the performance within Gaming and Embedded segments once again left a lot to be desired. Fortunately, AMD is quickly transforming into a Data Center-centric business, with Mi300x chips experiencing a fast ramp-up – the fastest one in AMD’s history, hitting a $1B quarterly revenue milestone in Q2 2024! EPYC CPU server processor revenue was up by a double-digit percentage, but AMD’s AI GPUs are set to be the primary driver of growth for the foreseeable future:

AMD Q2 2024 Transcript AMD Q2 2024 Transcript

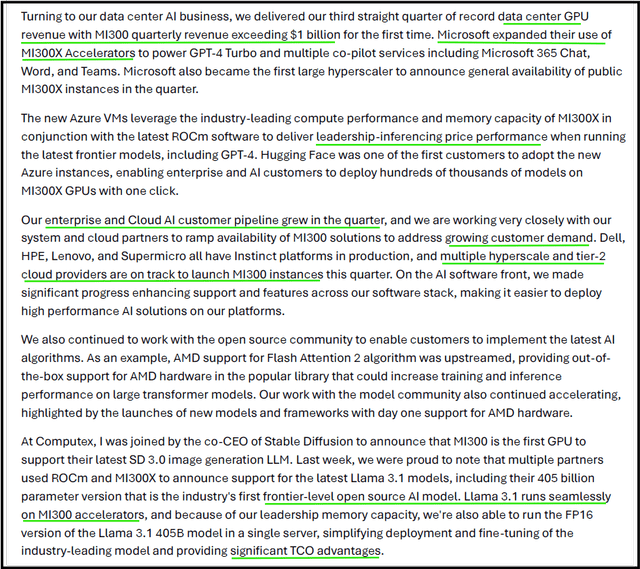

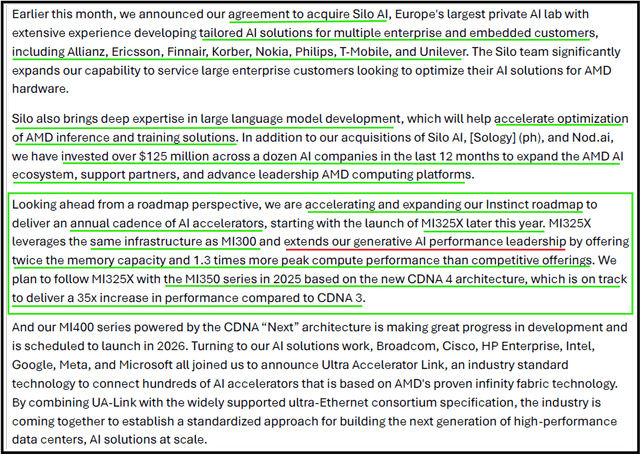

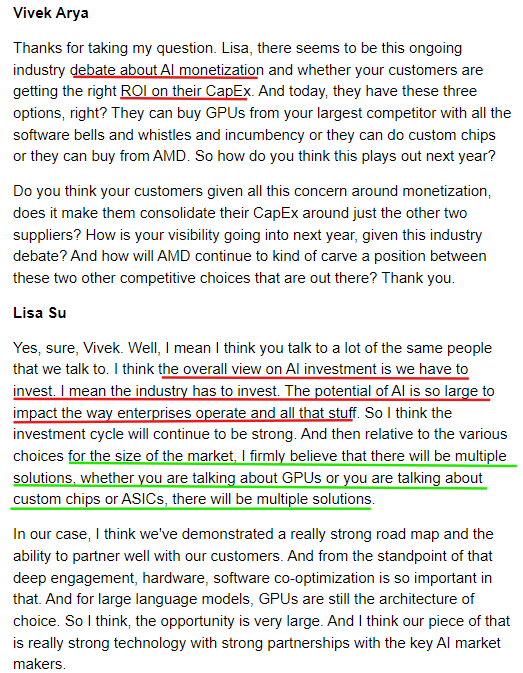

Based on strong demand signals for its Instinct accelerators, AMD is accelerating and expanding its product roadmap, adopting an annual cadence for GPUs [similar to Nvidia]. On the earnings call, AMD’s CEO, Lisa Su, expressed confidence in AMD’s budding AI ecosystem [hardware + software] and future roadmap. From what I heard, AMD’s leadership is determined to go head-to-head with Nvidia in an attempt to take a sizeable piece of the AI chip market, which is estimated to be a $400B TAM by 2027.

For 2024, Lisa Su & Co. are projecting AI GPU revenue to come in higher than previously anticipated:

Customer response to our multi-year Instinct and ROCm roadmaps is overwhelmingly positive and we’re very pleased with the momentum we are building. As a result, we now expect data center GPU revenue to exceed $4.5 billion in 2024, up from the $4 billion we guided in April.

Based on this updated outlook, AMD’s leadership is projecting $2.8B in AI revenues during H2 2024, which is quite a steep ramp for Mi300x. While Mi325x is coming out later this year, its contribution to Q4 revenues is expected to be minimal. That said, AMD’s management is looking for a strong ramp for Mi325x in H1 2025.

Now, Mi325x is based on CDNA3 architecture (same as Mi300x), and so the performance (1.3x) and memory (2x) improvements are somewhat incremental. However, with CDNA4-based Mi350x, AMD is targeting a 35x improvement in inference performance over CDNA-3, and Su believes Mi350x will compete directly with Nvidia’s Blackwell chips. While ROI on AI CAPEX remains an unanswered mystery thus far, the AI chip opportunity is undoubtedly massive. In my view, the cloud hyperscalers and other market participants would be more than happy about the emergence of a genuine alternative to Nvidia. Hence, AMD taking a 5-10% share of the AI GPU market is a reasonable assumption to make.

AMD Q2 Transcript (Seeking Alpha)

Now, in addition to strength in the Data Center, AMD’s Client business continued its recovery in Q2. With AI PCs coming to market, AMD is well-positioned to drive rapid growth within its Client segment with Ryzen AI processors. In the past couple of quarters, I have highlighted the lack of AI-powered hypergrowth as a reason to avoid AMD during its parabolic rally; however, we are finally getting evidence of AMD joining the AI party!

Unfortunately, AMD’s Gaming and Embedded segments remained significant drags on the semiconductor giant in Q2 2024. While Embedded revenues are stabilizing sequentially amid continued inventory adjustments from AMD’s customers, Gaming revenues are expected to weaken in H2 2024 due to weak console sales.

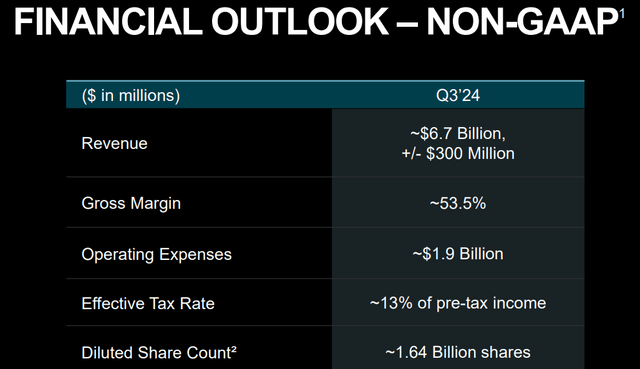

For Q3 2024, AMD’s management has guided for revenues of $6.7B (+/- $0.3B), which implies further acceleration in the business to ~15% y/y growth.

Compared to its largest competitor, Nvidia (NVDA), AMD’s overall revenue growth rates continue to look horrendous; however, the Data Center business now accounts for nearly 50% of total revenues, and this segment is growing at a triple-digit rate powered by AI GPUs. Finally, AMD is showing the AI-powered hypergrowth that we have been looking for as a justification for its valuation.

On top of accelerating sales growth, AMD is also driving its margins higher, expanding both gross and operating margins in Q2 2024.

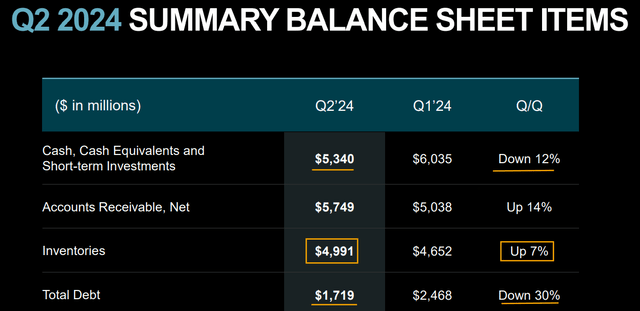

Consequently, AMD generated $439M in free cash flow at an FCF margin of 8% [up from 7% last quarter], and returned $352M to shareholders via stock buybacks. With ~$5.2B left in its buyback authorization, AMD’s management looks set to bolster shareholder returns using a sizeable portion of their free cash flow, which is likely to improve further in upcoming quarters as AI GPUs are expected to be accretive to overall margins.

During Q2, AMD’s cash and short-term investments fell 12% q/q to $5.35B as the company de-levered – paid down $750M debt (at maturity). With AMD re-accelerating top-line growth whilst expanding margins, free cash flows are likely headed higher in upcoming quarters. Given its cash cushion of $5B+, the chip giant continues to boast a strong financial foundation.

In Q2, AMD beat consensus estimates and delivered solid guidance. While Gaming and Embedded segments continue to mask the stellar performance within the Data Center and Client segments, AMD’s steep Mi300x ramp and future roadmap provide early evidence of the much-awaited AI-powered hypergrowth!

Concluding Thoughts: Is AMD A Buy, Sell, Or Hold After Q2 2024 Earnings?

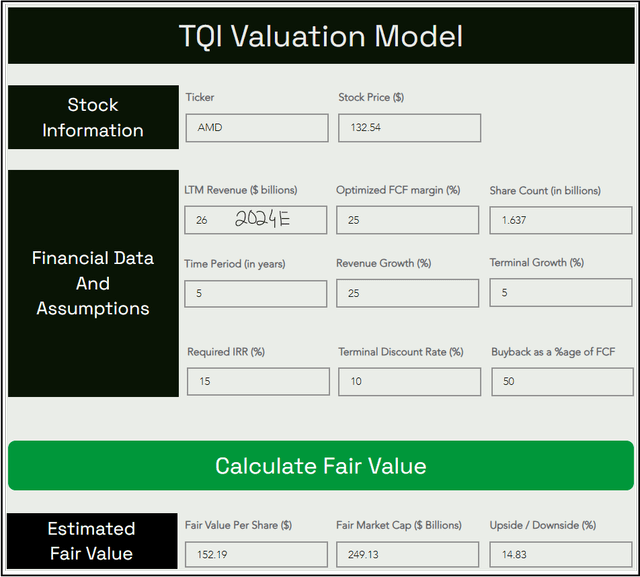

Considering the strong ramp for Mi300x, AMD’s updated product roadmap, and investments in its AI ecosystem (hardware + software), I am lifting my model’s revenue base for 2024 to $26B [up from $25.5B] and underwriting a 5-year CAGR sales growth assumption of 25% [up from 20%]. The risk of “overbuilding” AI capacity is very real [i.e., AMD can and will likely experience non-linear, volatile growth]; however, with $1T worth of cloud & data center infrastructure set to be replaced over the next 10 years, AMD has a long, long runway for growth. The raised growth assumption also expresses my optimism about AMD’s Client business with upcoming AI PCs and Intel’s apparent blow-up likely to allow AMD to steal even more market share in PCs.

All other assumptions are relatively straightforward, but please let me know if you have any questions.

Here’s my updated valuation model for AMD:

TQI Valuation Model (Free to use TQIG.org)

In light of AMD’s Q2 2024 report, TQI’s fair value estimate for AMD has moved up from $124 to $152 per share, which indicates an upside of ~15% from current levels.

Predicting where a stock will trade in the short term is impossible; however, over the long run, a stock will track its business fundamentals and obey the immutable laws of money. If the interest rates were to return to artificially low levels (i.e., ZIRP), higher equity multiples would be justifiable. However, I work with the assumption that interest rates will eventually track the long-term average of ~5%. Inverting this number, we get a trading multiple of ~20x (P/FCF).

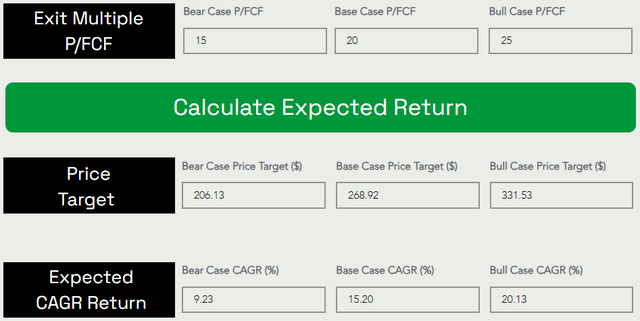

Assuming a base case P/FCF exit multiple of ~20x, we get to a 5-year price target of ~$269 per share for AMD, which implies a CAGR return of ~15.2%.

The Quantamental Investor (Free to use at TQIG.org)

With AMD’s base case expected CAGR meeting my investment hurdle rate (of 15%) and exceeding long-term market (SPY) returns (of 8%-10% per year), I like the idea of restarting the accumulation of AMD shares.

From a fundamental perspective, AMD is reporting green shoots in its Data Center business, driven by demand for its AI GPUs. The robust CAPEX guidance from cloud hyperscalers serves as a positive read-through for AI chipmakers. While AMD is a distant second right now (given Nvidia’s dominance in the AI GPU market), I think AMD can carve out a sizeable market share in this rapidly growing market as enterprise customers will require an alternative provider to limit Nvidia’s dominance.

We have finally received data-based evidence that supports AMD’s ability to deliver AI-powered hypergrowth. The product roadmap looks enticing, and Lisa Su’s confidence about going head-to-head with Nvidia is inspiring.

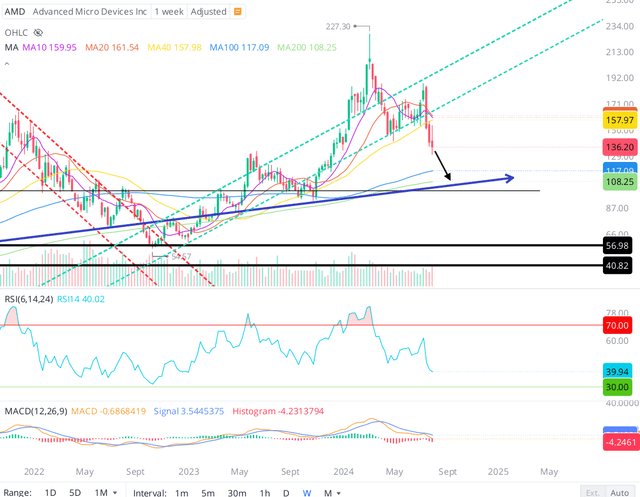

In recent sessions, AMD’s stock has moderated to the low $130s. From a technical perspective, AMD looks primed for another push down to test the long-term support trendline in the low-$100s. In the event of a hard landing, broader equity markets and AMD stock could drop even lower.

However, considering improving business trends, robust demand outlook, and the seismic shift in long-term risk/reward, I am upgrading AMD stock from “Hold/Neutral” to a “Buy” rating in the low $130s. Given the technical setup, I like the idea of slow, staggered accumulation. If AMD stock were to slide down to the low-$100s, I would turn into an aggressive buyer.

Key Takeaway: I rate AMD a “Buy” in the low $130s, with a strong preference for slow, staggered accumulation.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill and exceed your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.