Summary:

- AMD’s valuation is high, with future growth priced in early. This could lead to volatility, making it risky for investors to buy at current levels.

- Intel’s strategy targets AI and data center growth but faces competition from Nvidia and AWS, who lead in AI GPUs and cloud AI services, respectively.

- AI and HPC markets may not grow as expected. Regulatory challenges and resistance could slow short-to-medium-term growth despite a favorable long-term outlook.

Flashpop/DigitalVision via Getty Images

I first covered Advanced Micro Devices, Inc. (NASDAQ:AMD) in January 2024; I put out a Hold rating at the time, and since then, the stock has gained ~10% in price. In this analysis, I explain why I am reiterating my Hold rating for AMD stock, even though I consider its long-term growth potential to be exceptional. I still believe that the current valuation is too high and that there is some potential for the AI markets to face a short-term correction before long-term growth resumes with more stability.

Future Operations Outlook

In my opinion, AMD is going to be one of the leading beneficiaries of high growth in the AI and data center markets, which I believe could be its two core revenue generators over the next few decades. I believe AMD is going through a subtle restructuring at the moment, spending heavily, which is meant to pay off in 2025 significantly and then further beyond this. AMD has also been struggling with macroeconomic challenges over the last few years, including a lower spending environment due to high interest rates. Yet, the company has been developing its future operations with diligence:

| Strategic Area | Summary |

| AI and Machine Learning | Integration of AI across product lines with Ryzen AI 300 Series and Instinct MI325X accelerator. Future architectures (CDNA 4, CDNA Next) aim for a 35X speed increase. |

| Data Center Expansion | Introduction of 5th Gen EPYC “Turin” processors with Zen 5 cores, enhancing efficiency and performance. |

| Partnerships and Ecosystem | AMD has collaborated with Microsoft (MSFT), HP Inc. (HPQ), Lenovo Group Limited (OTCPK:LNVGF), and ASUSTeK Computer Inc. (OTCPK:ASUUY) to enhance AI and personalized computing experiences. |

| Gaming and Graphics | New RDNA 3 architecture-based Navi 3X products and Ryzen processors enhance gaming performance. The company is also exploring metaverse applications and cloud gaming. |

| Adaptive and Embedded Computing | AMD’s acquisition of Xilinx allows it to advance adaptive computing and AI engines with Versal AI Edge and other products. This area targets automotive and industrial markets. |

While these strategic developments are noteworthy and promising, I believe that we should remember that AMD is going to continue to face high levels of competition from NVIDIA Corporation (NVDA), Intel Corporation (INTC), and Amazon.com, Inc. (AMZN) Web Services:

| Company | Competition |

| Nvidia |

Nvidia has leadership in AI GPUs, including its A100 series GPUs, which are widely used in data centers for machine learning and AI. Its CUDA platform and ecosystem also provide an extensive moat. This informs its AI software stack with a range of libraries supporting AI development and deployment. Nvidia will also be challenging AMD significantly in data center GPUs, particularly through its A100 Tensor Core GPU, which is highly regarded for performance in AI and HPC applications. Nvidia also continues to lead in both AI inference and training workloads, with major cloud platforms like AWS, Alphabet Inc. (GOOGL) (GOOG) Cloud, and Azure being major adopters. |

| Intel |

Intel’s AI strategy includes a range of AI accelerators, including the Habana Labs Gaudi processors for training and inference and the Movidius VPUs for edge AI applications. Intel aims for its AI portfolio to cover a broad range of use cases, from data centers to edge. Intel also offers integrated AI solutions, for example, utilizing AI in its Xeon processors, which is used with the OneAPI unified programming model to help enterprises integrate AI seamlessly into their existing infrastructures. |

| AWS |

AWS has developed its own custom AI chips, including Inferentia for inference workloads and Trainium for training workloads. These chips offer superior performance and cost-efficiency for AI applications on AWS. The company’s SageMaker platform also offers a suite of AI services, making it easier for developers to build, train, and deploy machine learning models. Significantly, AWS is the leading cloud service provider, with a vast global infrastructure to support a wide range of AI and HPC workloads. In my opinion, it is likely to retain the leading position for the foreseeable future. |

In my opinion, I think AMD has a strong probability of outperforming Intel in overall financial results, primarily because AMD operates with a fabless model, similar to Nvidia, which allows these companies to reduce capex by outsourcing manufacturing to major foundries like Taiwan Semiconductor Manufacturing Company Limited (TSM). However, I think it is quite unlikely for AMD to be as successful as Nvidia and AWS over the long term because I believe its moat will not be as extensive as either of these companies. Instead, AMD is focusing on the ‘cost-effective’ or lower-end market solutions. This is a clever play by AMD, and in this niche, it is likely to be very successful over the long term.

Financial & Valuation Analysis

First of all, I believe it is helpful for investors to get an understanding of AMD’s financial results in comparison to the leading competitors I have outlined above:

| AMD | NVDA | INTC | AMZN | |

| FWD Revenue Growth 5Y Avg | 26.22% | 28.45% | -1.18% | 18.48% |

| FWD Diluted EPS Growth 5Y Avg | 47.79% | 34.47% | -8.6% | 24.81% |

| FWD Free Cash Flow Growth 5Y Avg | 75.89% | 40.92% | -8.5% | 28.63% |

| TTM Net Income Margin 5Y Avg | 11.08% | 29.23% | 19.94% | 4.16% |

| Equity-to-Asset Ratio | 0.83 | 0.64 | 0.55 | 0.41 |

| FWD P/E GAAP Ratio | ~115 | ~70.5 = TTM, FWD = Not meaningful | ~32 = TTM, FWD = Not meaningful | ~40.5 |

| FWD P/S Ratio | ~10.5 | ~37.5 = TTM, FWD = Not meaningful | ~2.5 | ~3 |

In the data listed above, I have bolded items I believe are relatively strong and italicized items I believe are relatively weak.

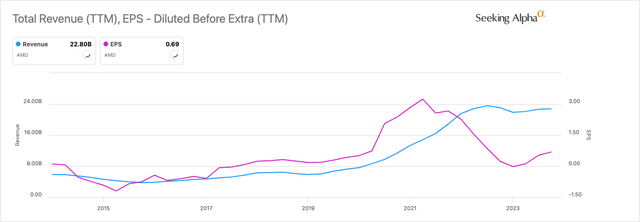

AMD has been benefitting from very high growth if we zoom out a little further than the recent few years of decline:

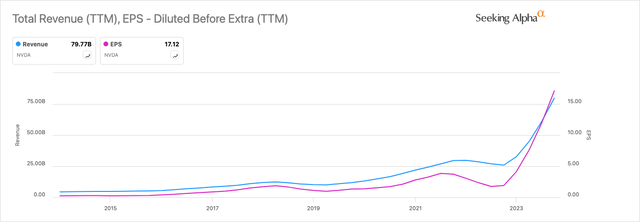

However, Nvidia’s recent success has been much more pronounced, which I believe is indicative of the long-term moat it will command against AMD in years to come, even though AMD’s future growth is likely to increase significantly, too, based on the operational considerations I outlined above:

Nvidia has also been able to develop the highest net income margin of the peer group in quite some way, which is remarkable when considering how new the company is in comparison to Intel, which is the second highest in net income margin.

Most importantly, I believe that investors would be wise to consider the broader interplay between AMD and the two companies that I believe are its biggest threat moving forward, AWS and Nvidia. The recent growth that Nvidia has managed to achieve places it in a more favorable position when looking at its valuation, but AMD stock seems to be on the receiving end of exuberance in the markets surrounding AI at the moment, and the key to this thesis is that I believe AMD’s stock valuation is too high, and I am expecting a correction in this over the next year or so.

In my opinion, even Nvidia’s valuation, which is more reasonable than AMD’s to some degree because of current growth results, is too high. The current uptake of AI systems will eventually plateau, and at that time, I think it is quite likely that Nvidia’s valuation will begin to seem too optimistic. I think early Nvidia investors will be wise to keep holding on to their shares, but over the next few years, investors in Nvidia may want to prepare for some volatility due to revenue and earnings growth slowdown. It is difficult to predict what P/E and P/S ratio the market will then ascertain is fair for Nvidia, but it will most likely be considerably lower than what it is now.

In the case of AMD, the price is currently highly anticipative of future growth, which the firm may be delivering reliably in 2025 and beyond. However, because this is already priced into the stock, investors looking to allocate to the company now are probably doing themselves a disservice. Instead, the stock price could easily be corrected before reaching present levels again in 2026 and beyond. In my opinion, a fairer value for AMD stock at this time would be about a 30% reduction from present levels. Consider that the company’s median price-to-sales ratio over 10 years is ~3.75. Therefore, the increase to today’s ~12 is stark. This is warranted due to the growth that the company has delivered recently, but I think investors still need to be cautious. That being said, considering that the company’s financial strategy seems to involve spending its income rather than taking on heavy liabilities for expansion, its valuation may look worse than it actually is from a P/E ratio standpoint. That is why I am using the P/S ratio in this instance.

Risk Analysis

While I am very optimistic about the future of AI and high-performance computing, I also think it is worth considering that the markets for these products and services are not as pronounced over the long term as most people are initially assuming. Whilst there is potential for a future economy that is highly automated and entrenched with robotics and AI systems, regulation and intervention based on consensus human preferences could mean that these changes and the associated growth for AMD are slower than one would initially expect. I think it is reasonable to anticipate strong future adoption of the advanced technologies that AMD helps to facilitate, primarily because of the benefits to lifestyle that these could aid, such as advanced leisure capabilities, less need to work due to automation, and potential restructurings in government to provide financial support, but these developments are a long way off, and it is likely they will be met with a lot of resistance from many different parties and stakeholders.

AMD investors will also be wise to consider how competitive the company will be over the long term compared to the companies that I believe will develop the most enduring moats, including AWS, Nvidia, TSMC, and Google. AMD is likely to be a significant beneficiary in the AI and HPC arms race, but it is unlikely to be one of the key leaders to the same level as the above companies, and its valuation needs to be monitored accordingly.

Key Elements

Intel has developed a strong future operational strategy where it will be a significant beneficiary of AI and data center growth, among other HPC areas. However, it faces key competitors like Nvidia, AWS, and Intel.

AMD’s valuation is arguably much too high right now, with investors pricing in future growth much too early. This opens up the risk of volatility, with particular caution needed by investors buying in at present levels.

The AI and HPC markets may not grow as significantly over the long term as investors are initially assuming. While the long-term outlook is likely to move in this direction, the short-to-medium-term environment will likely be met by regulation and other resistance.

Conclusion

I consider AMD well-positioned for significant future success. However, at the current valuation, it seems like an unwise investment. Instead, I think investors would be better off looking for high-growth opportunities that are less exposed to current exuberance surrounding AI capabilities but still potential leaders in the AI markets. For example, Google is currently ~17.5% undervalued, based on continued research from my recent analysis of the company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.