Summary:

- I keep rating Advanced Micro Devices, Inc. as a hold due to inventory concerns.

- With its current inventory buildup, AMD’s growth outlook and valuation multiples have come into question.

- Competition pressure from Nvidia heightens the concerns.

- Nvidia chips demonstrate far superior pricing power and no inventory issues at all.

Mykola Pokhodzhay

AMD stock: hold rating reiterated due to inventory concerns

I last wrote on Advanced Micro Devices, Inc. (NASDAQ:AMD) with a holding rating back in April 2024 (see the next chart below). My primary concerns at that time were mainly the following:

To conclude, despite the long-term growth prospects (due to factors like high-performance computing expansion and AI adoption), the thesis of this article is that AMD will offer an unattractive return/risk ratio in the near term. And to reiterate, the top concern is the competition pressure from Nvidia in the data center segment (with the potential for customer lock-in). Its high valuation is another additional concern.

Fast-forward to now, a few new developments surrounding the stock have promoted this updated assessment. These developments include the release of its 2024 Q1 earnings, the price correction (about 12% since my last writing), and the new inventory data. After reviewing these updates, the remainder of this article will explain why I keep seeing a mixed picture and thus reiterate my holding rating.

I will start with my top concern: its elevated inventory. For my investments with high-growth and cyclical stocks like AMD, I kept benefiting from the following timeless wisdom of Peter Lynch on the use of inventory data:

To start, unlike many other financial data that are more open to interpretation, inventory is one of the less ambiguous financial data. Lynch also explained why inventory levels can be a telltale sign of business cycles. Especially for cyclical businesses, inventory buildup is a warning sign, which indicates the company (or sector) might be overproducing while the demand is already softening. Conversely, depleting inventory could be an early sign of a recovery.

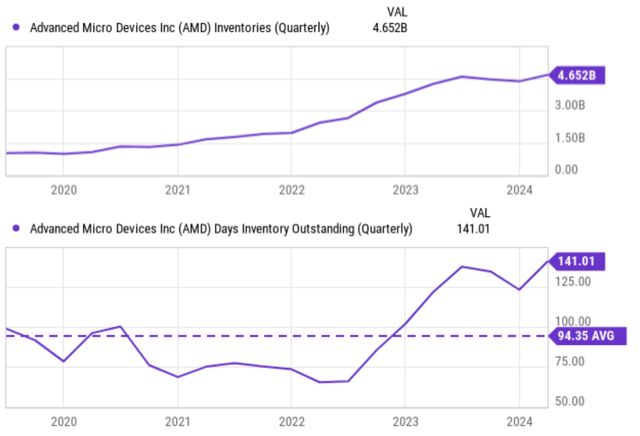

As illustrated by the chart below, AMD’s latest inventory data persists at a near-record level both in terms of dollar amount (the top panel) and in terms of days of inventory outstanding (DOIO, the bottom panel). To wit, in terms of dollar amount, the number has almost tripled in the past ~3 years, from about $1.5B in 2021 to the current record level of $4.6B. Of course, it is only normal for inventory to grow for a rapidly expanding business IF the sales can grow in tandem too. Unfortunately, it has not been the case for AMD recently, judging by the DOIO data shown in the bottom panel. AMD’s DOIO currently also hovers around a record level of 141 days. In contrast, its average DOIO was only about 94 days in the past 5 years.

Next, I will argue that given such a buildup, AMD’s growth outlook and high valuation multiples (over 46x as of this writing) have become difficult to justify.

AMD: why the inventory builds up

If you look at the previous chart closely, you can see that its DIDO was also been above average in 2020. But that buildup was mainly the result of the global logistic ingesting amid the chaotic COVID-19 pandemic, not because of the demand for its chips. This time, I think it is.

As a reflection of the softened demand and also heightened competition pressure, its 2024 Q1 performance is a mixed bag in my eyes. The results varied significantly across its divisions. On the positive side, the Data Center segment led with a revenue increase of 80% year over year, reaching $2.3 billion, driven by strong GPU and server CPU sales. Specifically, the MI300 became the fastest-ramping product in AMD history, passing $1 billion in total sales in less than two quarters (However, I see lurking risks here too – to be elaborated on later). Conversely, the Gaming segment declined 48% to $922 million due to lower console and GPU sales, as the current generation of devices enters its fourth year. Embedded revenue fell 46% to $846 million as customers managed inventories.

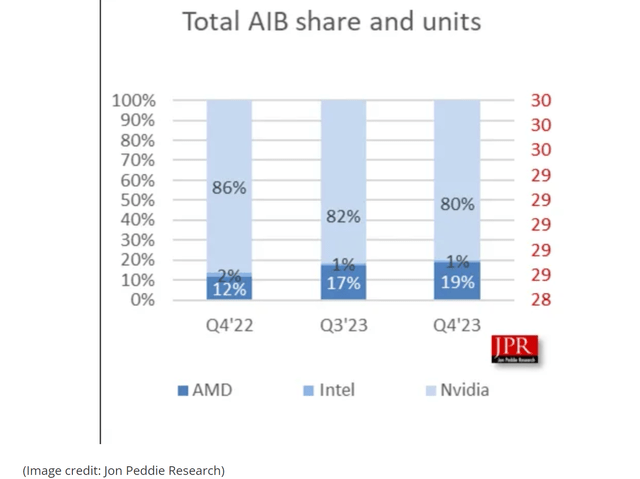

In terms of market share (see the next chart below for the key GPU market), the good news is that among the 3 major GPU providers, AMD has been gaining market share in recent quarters. Its market share advanced from 12% in Q4 2022 to 17% in Q3 2023 and 19% in Q4 2023. However, the bad news is that Nvidia (NVDA) is still the dominant player in town, with about 80% of the market share as of Q4 2023.

Moreover, NVDA chips also demand far superior pricing power. In terms of performance, there is no lack of benchmark test results (and the corresponding interpretation of the results) comparing AMD’s MI3xx series against NVDA’s H100 /H200 chips. You can see this report from Tom’s Hardware and this thread on Reddit to get an idea. My view is that these results are inconclusive or sometimes even apple-to-orange comparisons due to some unmentioned caveats and parameters used in the testing.

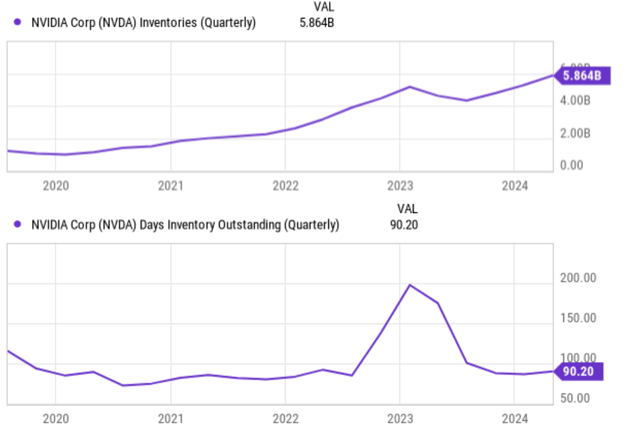

However, in terms of pricing, the picture is quite one-sided. NVDA’s H100 AI GPUs are priced about 4x more expensive than AMD’s competing MI300X. More specifically, AMD’s chips are priced in the range of $10 to $15K apiece. While in contrast, NVDA’s H100 has seen a peak price of over $40,000 apiece. Yet, I do not see an inventory issue at NVDA at all, despite its vastly higher pricing.

As illustrated by the next chart below, NVDA’s inventory is currently hovering around the lowest levels in terms of DOIO, reflecting the robust demand for its chips despite the more expensive price tag. Again, inventory does not lie.

Other risks and final thoughts

In terms of upside risks, collaboration with hyper-scale and enterprise customers has played a key role in solidifying AMD’s position in the server CPU market. I see this as a key driver for its growth going forward. For example, at the recent Microsoft Build event, AMD announced that its MI300X GPUs, combined with ROCm software, power Microsoft’s Azure OpenAI services, including ChatGPT. However, in such large deals, AMD faces even stiffer pricing pressure and margin pressure. For example, according to the following Citi analysis (via Seeking Alpha):

Citi estimates that AMD sells its Instinct MI300X 192GB to Microsoft for roughly $10,000 a unit, as the software and cloud giant is believed to be the largest consumer of these products at this time (and it has managed to bring up GPT-4 on MI300X in its production environment).

Another key upside risk involves AMD’s FPGA (field programmable gate array) chips, especially with the acquisition of Xilinx. This acquisition has strengthened AMD’s market presence, IP, and also talent pool in the adaptive computing space. As argued in an earlier article:

The top advantage of FPGA chips in my mind is flexibility: the flexibility to be reprogrammed or functionally upgraded even after they are manufactured and installed. This is a key strategic advantage considering the costs of advanced chips and the quickly evolving computing landscape.

All told, I could not see a definitive direction for AMD stock in the next ~1 year or so given the mixed signals and thus reiterated my HOLD under current conditions. To recap, the upside is the secular growth of high-performance computing and AI applications. AMD is well-positioned to capitalize on these applications with its critical products and technologies. However, in the next 1~2 years, I see a very uncertain return profile for Advanced Micro Devices, Inc. judging by its current inventory buildup and pricing power. I consider its current valuation difficult to justify given these concerns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.