Summary:

- AMD’s growth in AI data center GPUs, driven by strong product launches and a robust roadmap, positions it to challenge Nvidia’s dominance.

- Despite missing Q4 expectations, AMD’s sequential growth and expanding operating margins highlight its potential for significant revenue and EPS growth in 2025.

- The market’s pessimism mirrors 2017, but AMD’s strong product lineup and undervaluation, just like in 2017, presents a compelling buying opportunity.

- I recommend a Strong Buy for AMD, expecting it to deliver 20-25% y/y growth and EPS growth of 60% in 2025.

Olemedia/E+ via Getty Images

Investment Thesis

Throughout this year, I have expressed strong optimism on AMD (NASDAQ:AMD), making the case for the fabless chipmaker’s stock to be a part of investors’ portfolios.

In June, I explained how the maturity of ML models would expand the market for chips as ML inferencing expanded the TAM, and AMD would also be a beneficiary in a market that is for now dominated by Nvidia (NASDAQ:NVDA). At the time, AMD had already upped their targets for the AI chip sales, expecting $4 billion in 2024 sales.

Later, in September, I detailed how AMD was investing in scaling open-source software capabilities to optimize “AI workloads in data centers built using AMD’s MI300 series accelerators.” Management upped their AI chip sales targets by 13% for a second time.

AMD’s recent Q3 report, while impressive, failed to surpass “expectations” for Q4, keeping pressure on the stock.

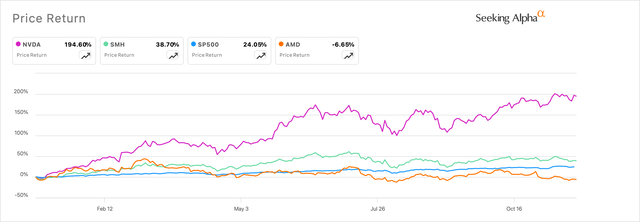

Exhibit A: AMD’s shares continue to flatline in 2024 (Seeking Alpha)

AMD’s harsh punishment by the market reminds me of the pessimism that sustained in the company’s shares through 2017 when there were fears of missing “expectations” through the year until its shares surged through 2018.

AMD is being unfairly adjudicated in fiercely fought target markets that it robustly competes in. I have added more to my AMD position here and continue to recommend a Strong Buy to AMD.

The Apparent Problem With AMD’s Earnings Reports

With the stock up in the mid-teens, bears have been able to contain any excitement in AMD’s shares, arguing that AMD is late to the AI data center GPU party. Other bears take a slightly different stand by saying that AMD is playing second fiddle to Nvidia in the AI data center market for GPUs, where Nvidia already holds a dominant 90-95% market share, with AMD holding almost all of the remaining 5-10% share, per a Forbes interview.

Many in the market still fail to recognize the potential for AMD, at the very least, to keep share in a TAM that is also growing rapidly. With Intel set on releasing its Falcon Shores AI chip next year, the competition is dead set between a dominant Nvidia and a relentless AMD.

During her sitdown with Forbes, AMD’s Lisa Su explained how their TAM expectations in the AI data center GPU market have been “conservative”, which they see now growing to half a billion by 2028 from $400 billion by 2027. The implied CAGR in the TAM hovers around 60% CAGR, and AMD has been delivering growth at a robust pace, with the company now expecting $5 billion per the Q3 earnings call:

We now expect Data Center GPU revenue to exceed $5 billion in 2024, up from $4.5 billion we guided in July and our expectation of $2 billion when we started the year.

The strength of its Data center GPU revenue is buoyed by strong product launches of its MI300X series of data center GPUs, a robust GPU roadmap ahead following an annual cadence to match Nvidia, as well as a growing open-source software ecosystem being rapidly developed to match Nvidia. This has a growing number of hyperscalers moving large ML inferencing workloads exclusively onto AMD’s MI300X data center GPUs.

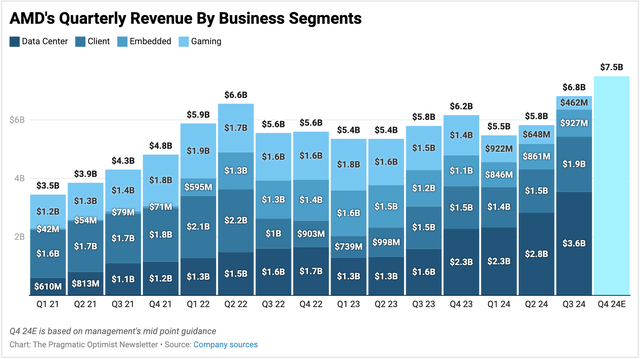

This has led to AMD reporting record quarterly revenues of $6.8 billion, marching on with its sequential growth rates, and management’s Q4 revenue guidance, if achieved, will mark the first time since 2022 when revenue will record sequential growth for 4 straight quarters.

Exhibit B: AMD quarterly revenues by business segment (Company sources)

The problem still lies in the targets given by management not meeting the tape for Q4 guidance. This leads to a couple of conclusions: either markets expect quicker data center revenue growth that can compensate for sluggish businesses such as Embedded & Gaming or, that Embedded & Gaming segments start to contribute their fair share.

On the call, management poured water on any potential for AMD’s Embedded segment to show growth through 2025, calling for “modest growth in 2025,” with communications and industrial verticals still dragging the Embedded business for AMD.

Gaming hasn’t delivered its fair share to AMD’s growth so far, which mostly has been supported by consolidated data center revenue, which includes traditional and AI. AMD has been preparing for this for a while and is readying a transition to the new Radeon GPUs, which should be released early next year. This is one area that has gotten investors concerned, as the operating margins for Gaming would hover in the ~12-14% range. In Q2, this fell to just 2%, likely due to channel inventory wind-downs by its partners Microsoft (NASDAQ:MSFT) and Sony (NYSE:SONY).

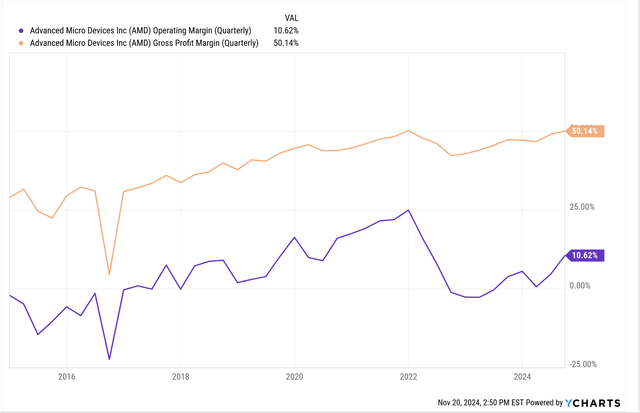

Still, AMD was able to elevate its margin profile quite robustly, I will add, with gross margin expanding by just under 300 bp to 53.6% and operating margins expanding by just over 600 bp to 10.6%. I will also mention that operating margins were the strongest I can note in the past 10 quarters.

Exhibit C: AMD operating margins and gross margins expanding. (yCharts)

However, AMD did miss expectations which resulted in a few downgrades after the Q3 earnings release which reminds me of a similar expectations game in 2017.

2017 Sentiment Echoing For AMD In 2024

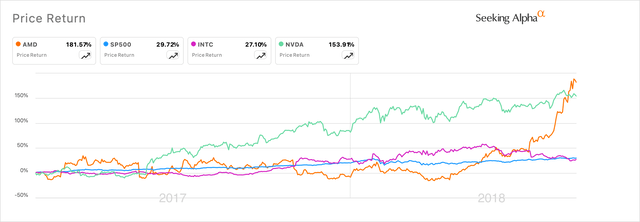

In 2017, AMD found itself on similar ground with analysts downgrading the company through that year as AMD missed “expectations.”

Through 2017, the pessimism continued starting in Q2 2017 as Goldman Sachs analysts cited expectations downgrading AMD as a “show-me-story.” A few months later, Barclays were unhappy with the traction in AMD’s products, causing the company to miss expectations and downgrade AMD. Later that year, some analysts even expected Intel to dig into AMD’s CPU market share and downgraded AMD on competition.

The pessimism did put pressure on AMD, closing 2017 down 9% for that year.

Exhibit D: In 2017, AMD faced similar pressures with expectations miss as through 2024 but markets eventually digested the company’s potential next year. (Seeking Alpha)

However, the company eventually delivered in 2018 on strong sales of its EPYC server chips and Ryzen PC chips, along with gaming that had already kickstarted AMD’s stellar 2018 year. This was all on the back of a strong product roadmap launched at the time. Eventually, analysts from Goldman backtracked their bearish ratings at the height of AMD’s meteoric stock in 2018, upgrading AMD after dialing back the competition risks they overestimated in 2017.

I continue to strongly believe we are at a similar juncture where AMD has a similar range of catalysts that are being misjudged by markets.

AMD’s move to RDNA4 architecture should reverse the architectural problems that RDNA 3 faced, and the company has confirmed the launch of RDNA4 chips in early 2025, most likely at CES25. Plus, markets are most likely underestimating the potential for growth for AMD, which also excludes the growth in AMD’s client segment that may benefit from any PC refresh sales cycle in 2025 onwards.

AMD Is Severely Undervalued

I continue to expect AMD to deliver growth in excess of 20-25% y/y in 2025. The sequential acceleration that I noted in Exhibit B above is alluding to the growth story, and AMD’s Q4 revenues point to further acceleration.

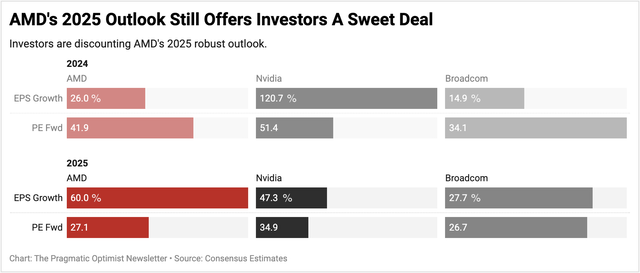

AMD’s operating margins are robustly expanding, contrary to the fears that markets have driven by efficiency and sharper gross margins. I continue to expect AMD to deliver EPS growth of 60% in 2025, which, per consensus estimates, looks to be the strongest EPS growth among AMD’s peers, Nvidia and Broadcom (AVGO).

Exhibit E: AMD is quite undervalued versus 2025 earnings growth as compared to its peers. (Author)

Nvidia is valued at 35x 2025 earnings, which is growing 47% in 2025. Nvidia’s 2025 valuation has expanded from 29x 2025 earnings when I last valued AMD. Given these expectations by AMD’s peer, AMD should be trading at 38-40x 2025 PE which implies a PT range of $210-213.

Risks & Other Factors To Know Of

Both the data center markets as well as the PC/Gaming markets are tough markets for AMD to operate in, where different market players fiercely compete for market share.

While AMD continues to penetrate the traditional data center market, the AI data center market for GPUs is closely protected by Nvidia’s dominance. Investors are hoping AMD’s MI300X AI chips can help the company penetrate Nvidia’s share. Currently, AMD holds a ~10% share in that market, with Nvidia holding the remaining ~90%. If AMD continues to report 10% share as its Data Center revenue grows, it could keep AMD’s shares range bound.

Additionally, there are emerging signs of 2025 being a strong demand year for PC and Gaming. Recently, Lenovo (OTCPK:LNVGY) hiked their 2025 targets, seeing strong demand next year. Gaming hardware markets too are expected to see strength next year, which boosts AMD’s prospects.

Takeaway

I continue to believe AMD is being subject to an unfair expectations game just like the company endured through 2017.

AMD has a strong roster of product lineups and is, without a doubt, the only company that could take on Nvidia in the data center GPU market. I am taking advantage of the mispricing in AMD’s valuation due to the short-sightedness of the market and loading up on the company’s shares.

AMD continues to be a Strong Buy for me.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.