Summary:

- Advanced Micro Devices, Inc.’s Data Center revenue is surging due to AI demand, but overall growth lags Nvidia, impacting stock performance.

- Gaming and Embedded segments are struggling, but Data Center sales are expected to drive future growth, with no sizable segment dragging the business down going forward.

- AMD stock only trades at 21x ’26 EPS targets with substantial upside to estimates, if new GPUs like the Mi350 take market share at lower price points.

BlackJack3D/E+ via Getty Images

Advanced Micro Devices, Inc. (NASDAQ:AMD) (NEOE:AMD:CA) has slipped following another solid quarterly report due to the limited overall growth rates. The company hasn’t made the expected progress in AI chip sales, but the real culprit is the non-Data Center sales. My investment thesis remains ultra-Bullish on the stock, though the big AI inflection moment hasn’t occurred as expected.

Stall Speed

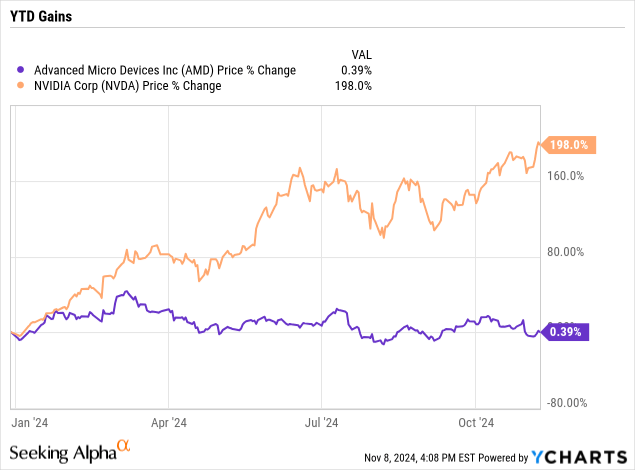

AMD is actually reporting strong growth in Data Center revenue due to soaring AI demand. The chip company just isn’t reporting growth as fast as NVIDIA (NVDA). The recent Q3 results were more of the same for AMD, with sales and guidance generally in line with estimates, but nowhere close to the growth rates of Nvidia.

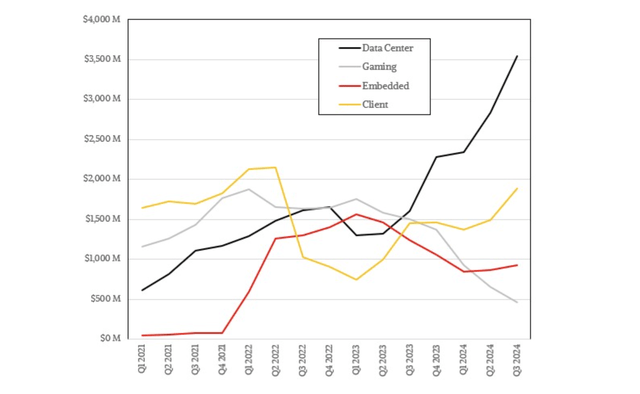

AMD reported sales of $6.8 billion, or relative stall speed compared to Nvidia. The key is that the Data Center segment is now more than 50% of the company, reaching $3.5 billion in Q3 ’24.

Going forward, AMD should see all the upside for the surging AI GPU demand, while the other divisions are closer to trough levels. Client revenue remains strong at $1.8 billion, leading to $5.3 billion worth of segments in strong growth mode.

The Gaming and Embedded segments are suffering, with revenues in Gaming dipping 69% YoY to $462 million. The Embedded segment fell by 25% YoY to $927 million.

The good news is that the Embedded segment continues to sign design wins at a 20% growth rate, hinting at a return to growth in 2025. The Gaming segment will struggle going forward, but revenues have slipped below the $500 million quarterly level, or 7% of total revenues.

The ultimate key is that AMD isn’t going to have any sizable segment dragging on the business going forward. All the Data Center sales in Q4 and 2025 will contribute directly to top-line growth.

AI Boost

As my prior research discussed, AMD needs to boost the AI GPU sales view above the general analyst views for revenues of $9.7 billion in 2025 and $12.8 billion in 2026. The company boosted AI sales forecasts to $500 billion in 2028 and continues to keep boosting quarterly sales as follows:

- Q4’24E – $1.84 billion

- Q3’24A – $1.57 billion

- Q2’24A – $1.02 billion

- Q1’24A – $0.61 billion

- Q4’23A – $0.42 billion.

The Q4 estimate of only $1.84 billion would be highly disappointing, but AMD likely hits $2+ billion in the quarter. The chip company should exit the year with an AI GPU run rate topping $8 billion.

At one point, AMD was estimated to have access to 400K to 600K GPUs this year, but The Next Platform estimates the company will only ship around 224K units at $22.5K each. Nvidia has already said the Blackwell GPU will cost between $30K to $40K per unit with the GB200 costing up to $70K, in a sign of the value AMD could provide customers.

AMD needs far more inventory to feed big AI GPU relationships with Microsoft (MSFT) and Meta Platforms (META). The company guided to Q4 revenues of $7.5 billion, a nice bump from the Q3 levels, but nowhere near the $4 billion sequential increases by Nvidia lately.

Nvidia has soared nearly 200% this year, while AMD is flat. The opportunity here is for AMD to start catching up to these gains as all the Data Center sales start directly boosting the top line versus offsetting losses in other segments.

Most notable, total sales only grew 18% in Q3, while the Data Center grew by 122%. The guidance only has revenues growing 22% in the current quarter, while the Data Center revenue should top $4 billion versus $2.3 billion last Q4.

AMD will be looking at over 70% growth in the key segment. The stock wouldn’t be trading down below $150 with such growth rates and trading at just 29x EPS targets for 2025.

Analysts have EPS targets surging to $7.12 in 2026. The stock trades at just 21x those EPS targets, with vastly higher growth rates targeted without AMD forecast to see a big AI boost in sales.

The upside remains for AMD to produce far higher revenues in 2025/26 and faster growth rates. The consensus estimates have 2025 revenues reaching $32.6 billion, up just $7.0 billion. Nvidia is forecast to report quarterly revenues of $33 billion, virtually all assigned to AI GPU sales.

On the Q3 ’24 earnings call, CEO Lisa SU highlighted the Mi350 as the GPU that might challenge Nvidia, as follows (emphasis added):

Longer term, we have successfully accelerated our product development pace to deliver an annual cadence of new Instinct products. Our next-gen MI350-series silicon is looking very good and is on track to launch in the second half of 2025 with the largest generational increase in AI performance we have ever delivered.

The big question is when AMD finally really takes the big sales step up, considering the strong GPU products at discounted prices. Our EPS estimates have shown how solid GPU growth leads to a 2025 EPS of $6.68 versus the consensus at $5.14.

The big upside might not occur until 2026 with the Mi350 being the major inflection GPU. AMD produced 54% gross margins in the last quarter, with nearly 30% operating margins from the Data Center segment. The EPS received a big boost when GPU sales really surged, while only somewhere around $10 billion in sales next year won’t make the big difference.

Takeaway

The key investor takeaway is that AMD remains a bargain after not rallying this year, despite considerable progress in selling AI chips. The numbers haven’t hit the major inflection point, and might not occur until late next year.

Investors should continue holding shares, as the lackluster stock price doesn’t reflect the ultimate opportunity over the coming years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start November, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.