Summary:

- Advanced Micro Devices, Inc.’s acquisition of Silo AI is as strategic as they come.

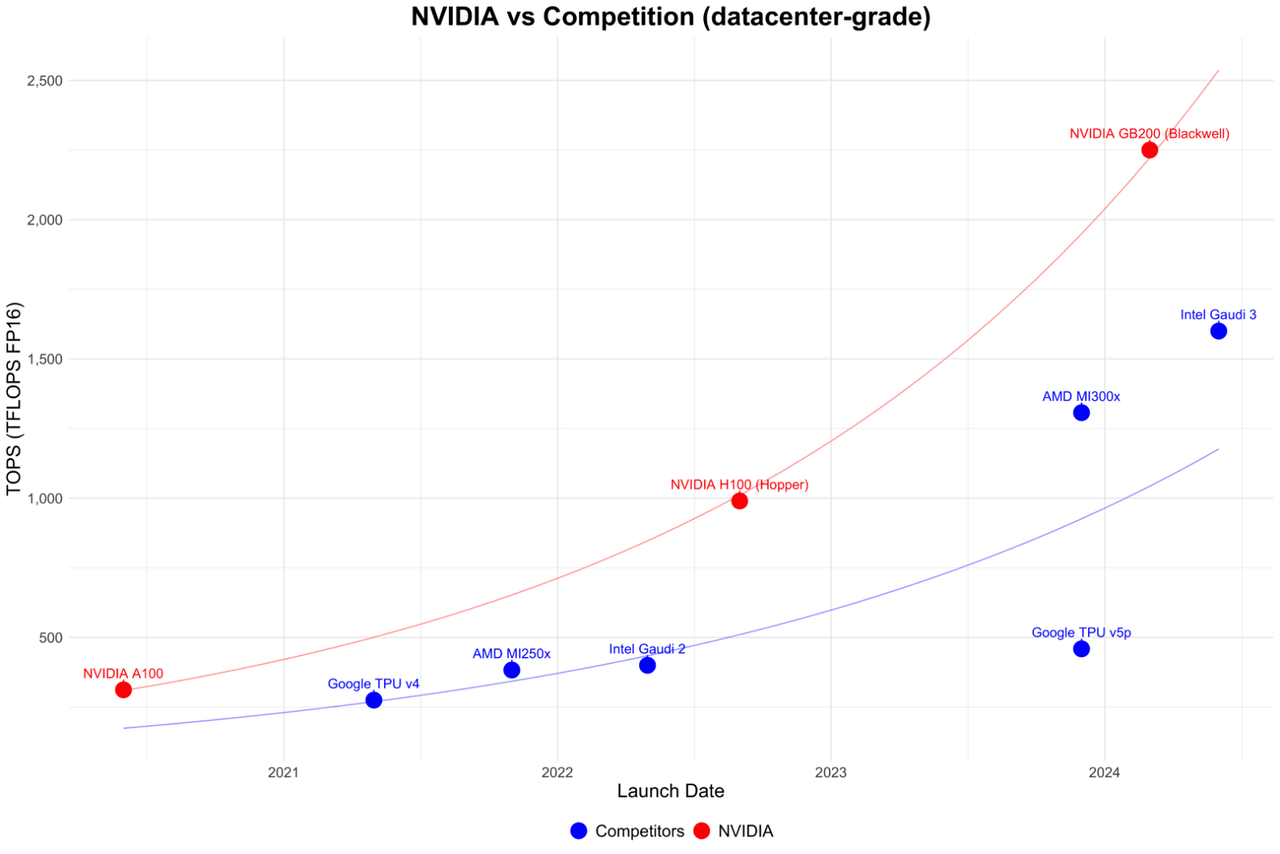

- The gap with Nvidia won’t close, but it’ll eventually bring AMD that much closer to the competitor with a +10X market cap.

- It could also mean the beginning of a new stream of income from AI software deployments, bringing the company closer to its dream of being an end-to-end AI solutions provider.

- I’m recommending a Buy, but with the caution that the stock is likely to go through a quasi-cyclical growth pattern.

JHVEPhoto

When you’re in second or third place in a race and the front-runners just seem so far away, there are only two ways to close the gap. The slow way is to gradually build up your speed until you can exceed that of the runners ahead. The fast way is to get a booster shot of something that will propel you forward, toward them and hopefully beyond. The first way is usually more sustainable, but the second way is far more efficient. Even though your “booster” may or may not work, when you’re playing a high-stakes game against masters of their craft, it’s the only long shot that could work in your favor. Besides, if it does work, it can become as sustainable as the organic way to the front of the race.

I believe Advanced Micro Devices, Inc. (NASDAQ:AMD) has been taking this route for the past year or so with its multiple acquisitions. Arguably the most impactful one — their “booster” shot — will be the recently announced acquisition of Silo AI, a European powerhouse in the realm of AI software and model development and deployment.

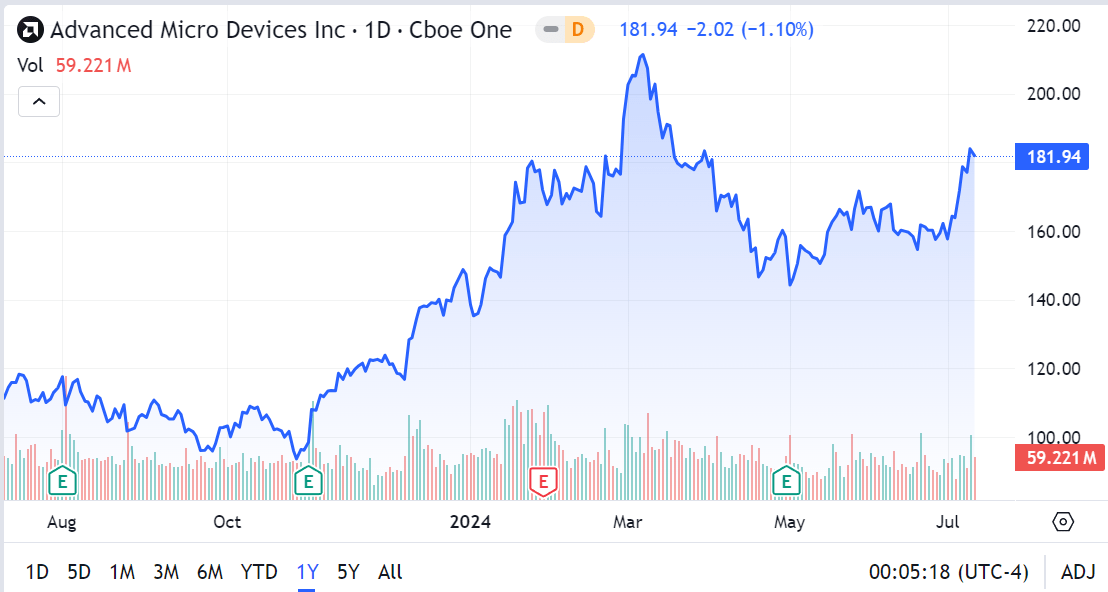

Today, I’m hoping to look at the potential impact of the Silo AI acquisition on AMD’s attempt to close the gap with the AI GPU leader, Nvidia Corp. (NVDA). Does this strengthen my bull case for AMD that I initiated in March with my article on the YieldMax AMD Option Income Strategy ETF (AMDY)? It certainly does. Does it allow me to reiterate my positive sentiment on AMD despite the stock being down more than 5% since then? It certainly does. Does it hurt my thesis that NVDA gained more than 50% since that article, with AMD losing ground and not even being able to keep up with SP500? No, it certainly does not.

Why? My biggest reason is that AMD already has a powerful product in the Instinct MI300X GPU. Along with driving $2.3 billion in first-quarter revenues for the data center segment, that’s already a good use of the first method of catching up with the leader. It’s a slow, organic process, but we’re seeing tangible results. Coupled with the booster shot that Silo AI now represents, I think AMD has a real shot at significantly closing the gap with NVDA in terms of real-world AI deployments, if not in the data center GPU space. In other words, it’s taking a different tack by focusing on fortifying its strengths in AI software and real-world deployments.

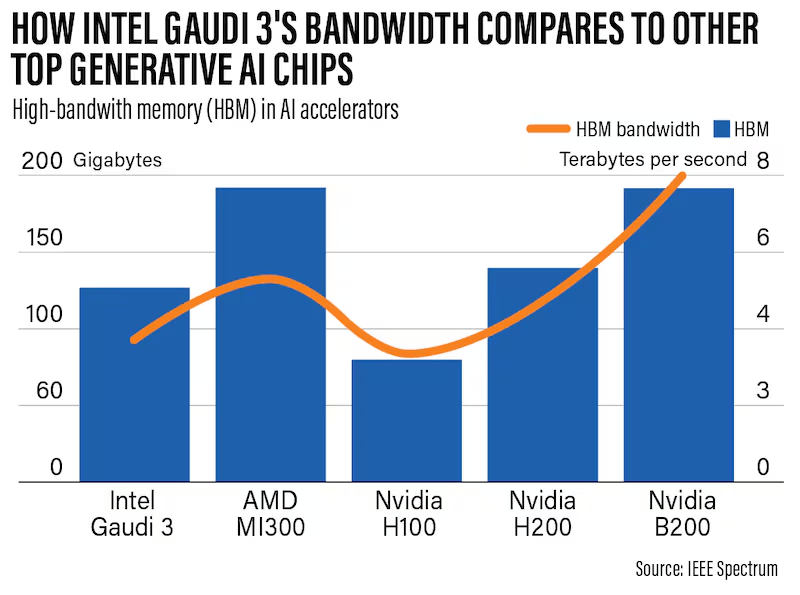

To be clear, there’s no doubt that real-world performance differences between the MI300X and NVDA’s Blackwell are significantly tilted in the latter’s favor. That allows NVDA to maintain its data center GPU dominance. I’m not arguing that point. My contention is that the combination of leveraging AI software (via Silo AI) alongside its proprietary hardware will help it accelerate quickly. It may not close the gap with NVDA for several years, or ever, but what it’s likely to do is establish AMD as a clear #2. That, in itself, would be a major achievement. This is not to dismiss Intel’s (INTC) Gaudi 3 release this quarter, but I don’t see it as a serious threat to the MI300, let alone the B200 that ships later this year.

The National News

Why The Silo AI Acquisition Is Crucial

AMD has attempted virtually everything under the sun to beat CUDA’s dominance. Its open-source ROCm didn’t have the kind of widespread adoption that AMD had hoped for. On the hardware side, its MI300 series will likely be overwhelmed when NVDA starts shipping its B100s and B200s at the end of this quarter or in Q4. Production is already underway, and assuming everything is on schedule, that spells trouble for AMD.

Granted, AMD did have a good lead time with the MI300 series ahead of Blackwell-architecture-based shipments from the market leader, but that’s very likely going to melt away in the next couple of quarters. Moreover, one of the key reasons AMD made significant gains in Q423 and Q124 was the fact that Hopper chip supply was constrained. Interestingly, in its Q424 earnings call back in February, NVDA also said the same of its Blackwell hardware:

We are delighted that supply of Hopper architecture products is improving. Demand for Hopper remains very strong. We expect our next-generation products to be supply constrained as demand far exceeds supply. – NVDA EVP & CFO Colette Kress.

More recently, at the Q125 earnings call, that point was reiterated:

While supply for H100 grew, we are still constrained on H200. At the same time, Blackwell is in full production. We are working to bring up our system and cloud partners for global availability later this year. Demand for H200 and Blackwell is well ahead of supply, and we expect demand may exceed supply well into next year. – NVDA EVP & CFO Colette Kress.

That brings us to why Silo AI is a key acquisition for AMD. I believe this represents an indirect attack on NVDA’s end-user; not the data center operators, but their clients. That’s where AI revenues are generated for cloud giants like Amazon (AMZN), Microsoft (MSFT), and Alphabet (GOOG, GOOGL), so it makes strategic sense to go directly to the source of revenues and acquire a key player in that space. And here’s the kicker:

“Silo AI has been a pioneer in scaling large language model training on LUMI, Europe’s fastest supercomputer powered by over 12,000 AMD Instinct MI250X GPUs,” said Dr. Pekka Manninen, Director of Science and Technology at CSC-IT Center for Science, Finland. “Together with university collaborators, they have trained state-of-the-art open-source models for EU languages, such as the Nordic Poro and Viking models. We have collaborated extensively with the team in optimizing the software layer, allowing for efficient training of AI models on LUMI.”

Silo’s experience with training on AMD’s GPUs and EPYC processors already gives it a head start, as CEO and co-founder Peter Sarlin stands on the verge of taking the reins at AMD’s newly formed Artificial Intelligence Group. Together with their roster of elite clients, among whom are none other than Nvidia, Silo AI will give AMD the sorely needed booster shot it needs at this time. Combine that with ongoing supply constraints for NVDA, and what you have is a recipe for a short-term burst in speed that’s crucial to AMD’s position in the AI solutions race.

The roughly $665 million (€613.7 million) valuation for Silo AI obviously includes a control premium, but it’s not a stretch to say that it will be worth far more to AMD when synergies are fully realized. With the kind of expertise that Silo AI’s team will bring to AMD’s AI hardware and existing AI software efforts, this acquisition is indeed a very strategic one for the chipmaker.

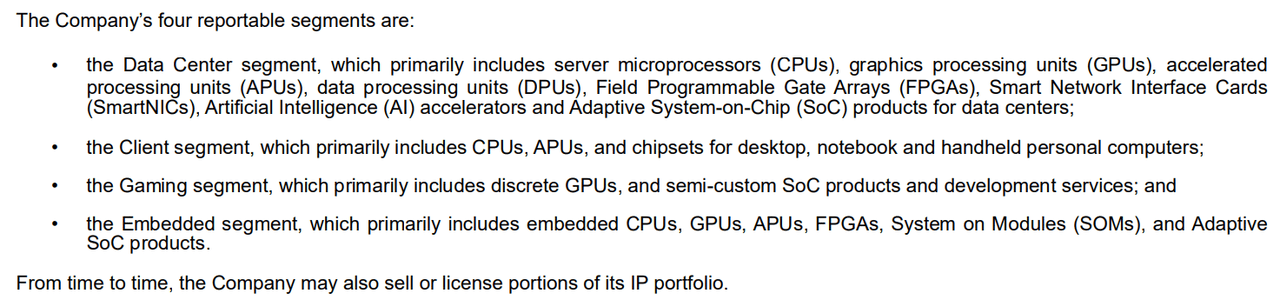

Will this acquisition help AMD overtake NVDA eventually? No, it won’t, at least, not in the medium term and certainly not in the near-term. However, there’s one thing it will most certainly do, and that’s create a new revenue stream from deployed AI solutions outside its core hardware sales. All of AMD’s reporting segments — data center, client, gaming, and embedded — essentially generate revenue from hardware sales, with a small portion coming from IP licensing and sales. For the first time, we could see a new line item being introduced into the mix, and the bulk of that is going to come from its AI Group.

AMD 10-Q for the Period Ended 3/30/24

To Summarize…

The acquisition is expected to close later this year, and we’ll eventually see the coming to fruition of AMD’s long-time goal of being an end-to-end AI solutions provider. AMD has ample cash on its books to fund the all-cash acquisition, and the company’s levered free cash flow in the last reported quarter alone is sufficient to cover this cost. It’s a small price to pay for the massive potential gains from the synergies that this business combination offers.

Again, will it move the needle for this $300 billion enterprise against its gigantic $3.3 trillion competitor and AI hardware market leader? Not so much. However, the timing of NVDA’s Blackwell shipments against strong Instinct and EPYC sales that are filling the demand-supply gap for enterprises around the world is a clear sign that AMD is slowly but surely reducing the distance between itself and the incumbent front-runner.

To me, that’s as bullish an argument as I need to recommend a Buy for AMD. Please recall that my investment horizon is typically in years and decades, not months. This story is going to play out very well for AMD eventually, and each time AMD makes a right move and NVDA makes a wrong move, that distance will close by that much more.

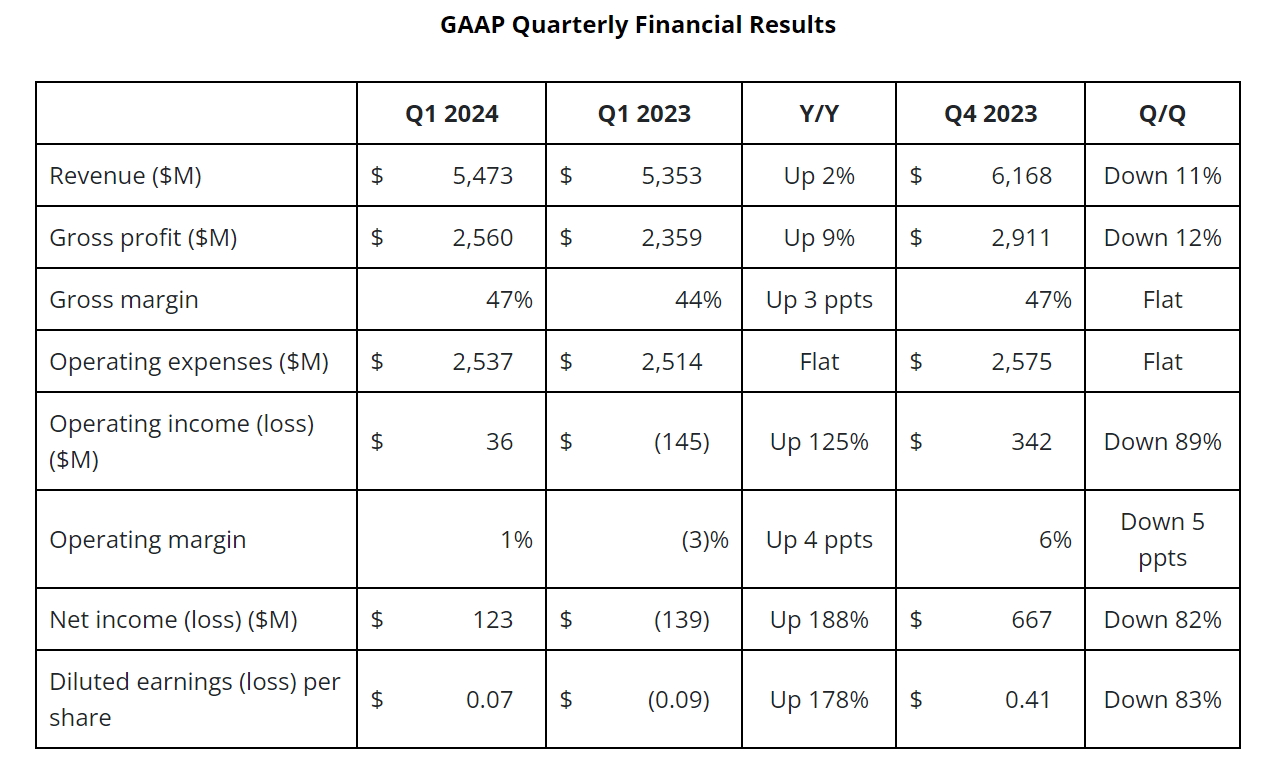

NVDA’s success is a paradox right now. On the one hand, demand for its products will remain very high for the foreseeable future, so most investors are naturally hesitant to get off the train while it’s moving so fast. On the other, these same investors are well aware (but are they, really?) that such demand is unsustainable in the long term. The supply crunch that it keeps facing with its newer products only allows players like AMD to quickly fill that vacuum and generate billions in sales. However, that’s cyclical right now because its data center and other hardware revenues are dependent on market conditions and, more pointedly, the demand gaps that NVDA leaves wide open. You can see this from AMD’s revenue movements across Q423 and Q124, when total revenues were down by 11% on a sequential basis.

AMD

I believe the reason for that is reflected in the supply constraints for H100 and H200 easing up over the first quarter, as NVDA noted in its earnings call. Those constraints were fully in place when AMD launched its MI300 series, so that was able to fill the demand gap initially, but by the time Q124 rolled around, the demand flowed back into NVDA’s offerings. I think that’s going to be a repeated story over the next few product releases, which also means NVDA is feeling the heat from AMD’s products — at least, from a lost opportunity perspective, if not an absolute one.

SA

In closing, while I’m recommending a Buy for AMD at this time, my thesis will play out over several years, possibly into the next decade. We will see this continued cyclical revenue performance over and over again, and every time AMD fills the demand gap that NVDA leaves behind, the stock is likely to go up. Conversely, whenever AMD has a soft quarter with minimal YoY growth or even a sequential drop, as it did in Q124, we’re going to see a sideways movement with the risk of downward selling pressure. That’s why it’s crucial to watch any news coming from NVDA, especially updates on product shipments, and definitely their Q225 earnings call next month. AMD announces its own Q2 results at the end of this month, but in the absence of strong sequential revenue growth, investors shouldn’t expect a sudden surge in price.

We already saw such an AMD surge on the Silo AI deal announcement. It was short-lived, but the stock regained some of that lost momentum in Thursday’s trading. I see that as a positive. Investors are slowly realizing that the Advanced Micro Devices, Inc. synergies from Silo AI represent long-term upside potential, and I agree with that view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.