Summary:

- AMD’s upcoming AI event on October 10 will showcase next-gen Instinct and EPYC processors, crucial for long-term AI growth.

- AMD’s AI GPU roadmap includes MI300, MI325X, MI350X, and MI400, with significant performance improvements aimed at competing with Nvidia’s Blackwell GPUs.

- Despite muted AI growth so far, AMD is projected to increase AI GPU sales significantly, potentially capturing up to 10% market share by ’26.

- The stock trades at just 20x ’26 EPS targets for 10% AI chip market share.

Black_Kira

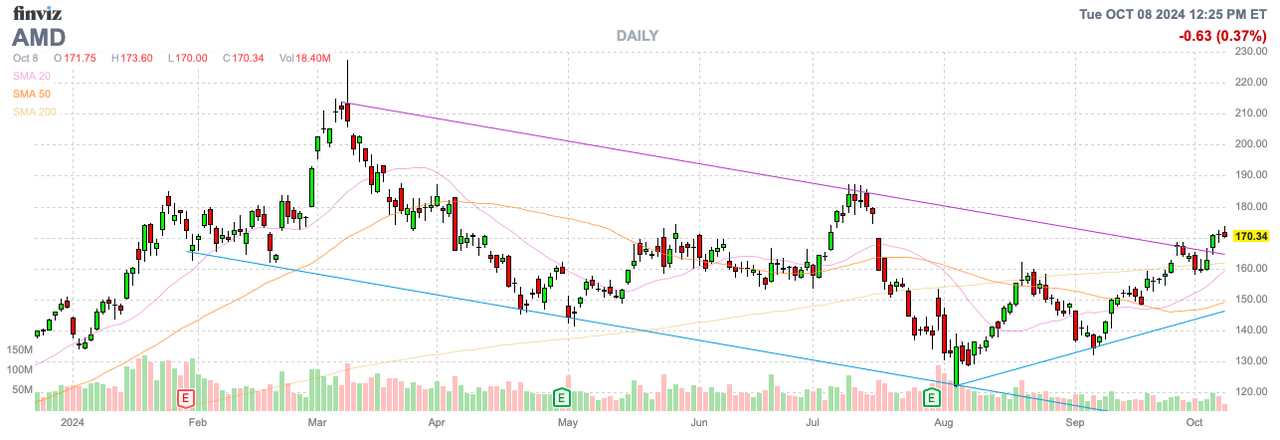

Advanced Micro Devices, Inc. (NASDAQ:AMD) (NEOE:AMD:CA) is getting a lot of buzz from the upcoming AI event this week. The key to this event is to not get trapped into looking for big new financial metrics and instead focus on the product development. My investment thesis remains very Bullish on the chip stock due to the ability for outsized AI growth over the long term.

Source: FINVIZ.com

Big AI Event

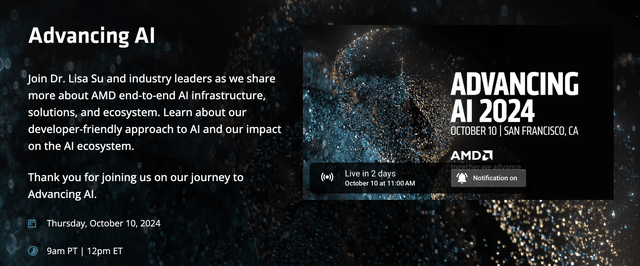

AMD has a big AI event scheduled for October 10. The event will showcase next-gen Instinct and EPYC processors.

Source: AMD

The chip company held a similar event last December to officially launch the arrival of the MI300X accelerator. AMD was quickly launching an AI GPU after NVIDIA (NVDA) had reported explosive growth starting just in the July 2023 quarter.

This event is the first where AMD has products on market and the big question is as much on sales ramp as functionality. Entering this event, investors already know Nvidia CEO Jensen Huang has highlighted “insane demand” for the upcoming Blackwell GPUs.

The big question for AMD is how well the roadmap keeps up with the new Blackwell GPUs. AMD has provided the following general AI GPU roadmap heading into the event:

- MI300: on market

- MI325X: Q4’24 – accelerator will have industry-leading memory capacity and bandwidth, 2x and 1.3x better than the competition respectively, and 1.3x better compute performance than the competition.

- MI350X: 2025 – new AMD CDNA™ 4 architecture, is expected to be available in 2025 bringing up to a 35x increase in AI inference performance compared to AMD Instinct MI300 Series

- MI400: 2026 – AMD CDNA “Next” architecture.

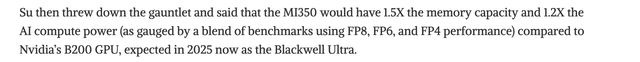

Back at the Computex conference in Taiwan, AMD initially released their updated AI GPU roadmap with some big claims. CEO Lisa Su predicted the Instinct MI350 series would be favorable to the Blackwell 200 released in 2025 as Blackwell Ultra.

Source: Next Platform

The market will naturally place a lot of focus on product updates and comparisons to the competition. Ultimately though, the favorable comparisons need to lead to stronger growth, or at least the opportunity exists for such growth.

Muted AI Growth So Far

AMD just ended a quarter where the consensus view is the chip company to have reported AI revenues in the mid-$1 billion range. While Nvidia keeps stacking quarters with $2+ billion in additional sequential revenues, AMD is still trying to print a quarter with $2 billion in revenues.

The general analyst view appears that AMD is forecast to just produce the following annual AI GPU sales:

- 2024 – $5.1 billion

- 2025 – $9.7 billion

- 2026 – $12.8 billion

In normal times, a chip company more than doubling sales in over a 2-year period would be glorious. Right now, AMD is actually losing market share with such limited relative sales growth.

AMD wouldn’t even capture a fraction of the AI market size predicted at $400 billion in 2027. The company wouldn’t even capture 5% market share with a sales path that might not even reach $20 billion.

BoA Securities analyst Vivek Arya suggests a path to 10% market share in 2026 adds $5 billion in AI sales. AMD would actually produce $17.8 billion in 2026 sales, providing for much more explosive growth from just $5.1 billion forecast for 2024.

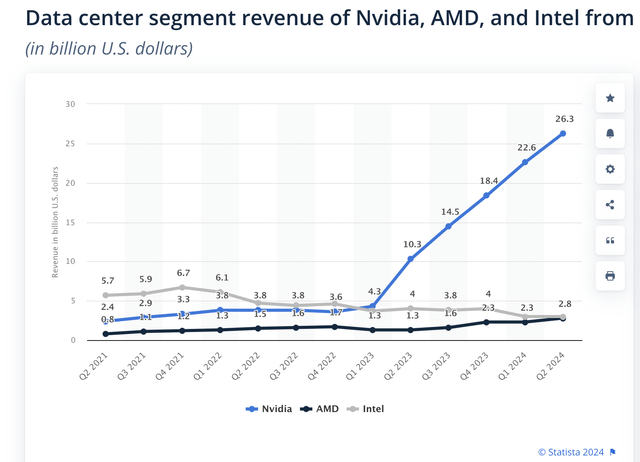

AMD’s data center revenue has seen some solid growth in the last year, but the company hasn’t seen explosive growth. Nvidia reported July quarter data center revenue exploded up to $26.3 billion for $16.0 billion in additional sales YoY while AMD only reached $2.8 billion in June quarter sales for $1.5 billion in sales growth.

Source: Statista

The 2H of the year will provide signs whether AMD will participate in material growth similar to Nvidia. To hit the $5.1 billion AI data center sales targets for 2024, the chip company has to generate $3.5 billion worth of Instinct GPU sales in the 2H as follows:

- Q3’24E – $1.5 billion

- Q4’24E – $2.0 billion

Under this scenario, AMD enters 2025 with AI GPU sales at an $8 billion run rate. The consensus estimate for sales just under $10 billion next year just doesn’t up.

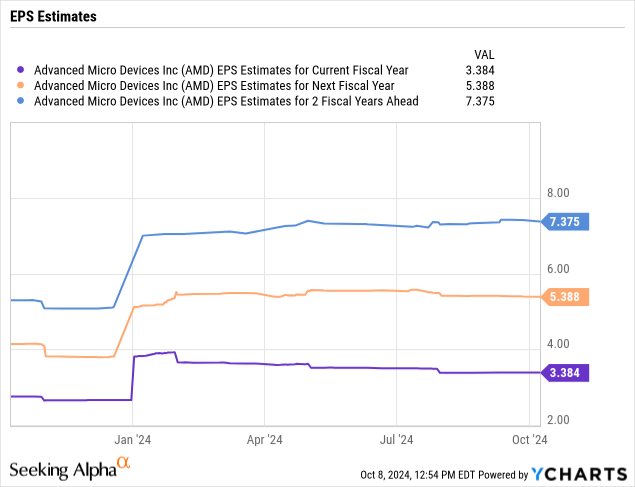

If AMD only needs 10% market share in 2026 to reach an $8 to $9 EPS per BoA, the stock is exceptionally cheap. AMD only trades at 20x this mid-point EPS target for 2026 and the opportunity exists for the company to garner far more than 10% market share.

The AI event is unlikely to focus much on the financial picture, but the AI GPUs should provide higher gross margins than the current corporate target in the 53% range. A more traditional 60% gross margin on these additional $5 billion in AI chip sales would provide $3 billion in gross profits with limited operating expenses. The company just has above 1 billion shares outstanding providing the big catalyst for current EPS targets to quickly jump from $7+ in 2026 to the potential for $9.

Of course, the biggest risk is AI chip demand not reaching growth targets of $400 billion in 2027. A secondary risk is that additional startup chip plays are able to garner more market share with the likely hot Cerebras Systems (CBRS) IPO an interesting test on whether the sector leaders are ready for new competition in a space dominated by the big 3 for a long time.

Even if AMD hits the revenue targets on additional AI chip sales, the company may fail to reach the 60% gross margins due to the position compared to Nvidia. In addition, TSMC (TSM) continues to hike foundry costs with N2 wafer costs reaching $30K, possibly placing margin pressure on the chip design companies like AMD.

Takeaway

The key investor takeaway for the AI Event on October 10 is to focus on the product roadmap. The revenue metrics will play out over time very favorably to AMD, if the company can produce AI GPUs competitive to Nvidia.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start October, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.