Summary:

- Despite expectations for AI growth, Advanced Micro Devices, Inc.’s stock is near a 52-week low, underperforming the S&P 500 by nearly 20% since late October.

- Analysts have mixed views, with concerns about AMD’s competitive position against Nvidia and more custom-based chipmakers.

- AMD’s average EPS estimate has been cut, yet price targets have only slightly declined, and the valuation has improved quite a bit recently.

David Becker/Getty Images News

Many investors expect 2025 to be the year of Artificial Intelligence (“AI”). With US markets continuing to set new highs almost every day now, you would think a name that has a foothold in the AI space would be doing quite well now. Well, for Advanced Micro Devices, Inc. (NASDAQ:AMD), the opposite is actually true currently. Last Friday, the chipmaker saw its shares trade within $3 of a new 52-week low, as investors don’t see the AI bet paying off here just yet.

Previous coverage of the name:

When I last looked at AMD in late October, the company had just reported its third quarter results. Revenues came in nicely ahead of street estimates, but the bottom line just matched expectations. Unfortunately, guidance for the current quarter was a tad light overall, despite management raising its AI revenue target for 2024, sending the stock lower.

Since that late October time, AMD shares have lost nearly 15%, despite a nearly 5% gain for the S&P 500 (SP500). The stock closed Friday just over $100 off its 52-week-high, with the day’s low being just a few bucks from the 52-week low. Should the market see any kind of pullback at this point, it would seem likely that AMD would set a new low for 2024.

Analysts have a mixed view right now:

In late November, Bernstein analyst Stacy Rasgon painted a muted view of AMD. He said the PC space is showing signs of normalization, but third quarter PC and server market shipments were only “in-line(ish)”. Rasgon noted that while AMD was calling for $5 billion in AI revenue this year, there is a question as to how big that number can grow in 2025 with the company’s roadmap well behind its largest competitor, NVIDIA Corporation (NVDA).

Last week, AMD shares dipped a bit thanks to a downgrade from Bank of America’s research team. The analyst cited a higher competitive market against larger names like Nvidia and custom chipmakers in the cloud space while saying early 2025 could be weak in the PC space for AMD and Intel Corporation (INTC). The firm cut its 2025 and 2026 EPS estimates for AMD by 6% and 8%, respectively, while also reducing its price target from $180 to $155. The analyst there also referred to a recent note from an Amazon.com, Inc. (AMZN) executive regarding slow AI demand for AMD’s products, which AMD later came out and refuted.

It is certainly true that analysts have soured on AMD’s bottom-line prospects in recent quarters. If you look at the earnings revision page here on Seeking Alpha, you’ll notice that 2024’s average estimate has been cut in more than half over the past two years. Looking forward to next year, the average estimate is down by more than 5% over the past three months and more than 8% in the past six months.

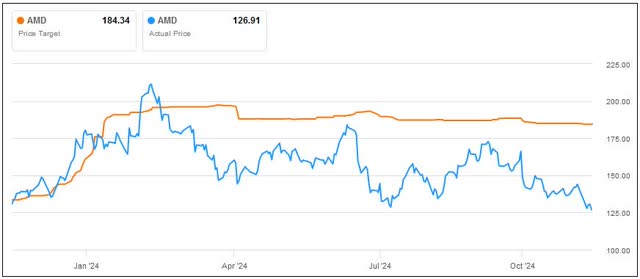

What I find a little strange is that with all of these negative EPS revisions, analysts aren’t really cutting their price targets that much. As illustrated by the graphic below, the average street target has only declined by a couple of dollars in the past few months. At a nearly $60 gap, AMD’s close on Friday is almost as far away from the average price target as we’ve seen over the past year. Each time the gap has been over $50, it appears that there has been a short-term bounce.

AMD Vs. Average Price Target (Seeking Alpha)

Lack of near-term catalysts:

Normally, there would be two items that, I think, could get AMD shares moving higher in the near term. The first would be if management came out and gave full-year guidance for its AI products for 2025, potentially showing that the growth story is fully intact. Unfortunately, I don’t think we’ll see this until the Q4 report, which is probably another 6 weeks or so away. One thing that complicates potential 2025 guidance is the pending acquisition of ZT Systems, a leading provider of AI infrastructure for the world’s largest hyperscale computing companies. AMD might not want to detail a full-year outlook until the deal is actually complete, expected to close in the first half of next year.

The second major item I would usually look for is a major share repurchase announcement. AMD’s outstanding share count soared after the all-stock Xilinx acquisition a couple of years back, and it really hasn’t come down since. Unfortunately for this angle, AMD is going to use over $3 billion in cash for the ZT purchase. While the company had about $4.5 billion in cash and investments on the balance sheet at the end of Q3, it may also issue some debt to finance the deal. Long-term debt stood at $1.7 billion at the end of September, and I don’t think management wants to go too far into a net debt situation just for buybacks. As the most recent 10-Q filing details, the current buyback plan had nearly $5 billion remaining at the end of Q3. It likely would take a full year or so of free cash flow just to finish off that plan, so a larger buyback announcement may not come until late 2025 or perhaps even 2026.

A look at current valuations:

When we look at valuations, there are a few things to keep in mind. AMD is expected to show more than quadruple the revenue growth percentage that Intel Corporation (INTC) is in 2025. AMD is projected for more than 53% adjusted earnings per share growth next year, while Intel is forecast to swing back into the green after an expected adjusted loss this year. For its fiscal year that ends in January 2026, Nvidia is expected to see a little less earnings per share growth than AMD, obviously coming off a much higher base number for net income, while projected to see about double the revenue growth. That being said, here’s a look at valuations since my previous article.

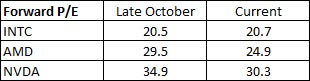

Semiconductor Forward P/E (Seeking Alpha)

Interestingly enough, Intel has seen its forward multiple rise slightly over the past roughly 6 weeks. That’s despite all the growth troubles there, as well as its recent CEO departure, and questions over its long-term strategy. Both AMD and Nvidia have seen their multiples come down by 4.6 points, but AMD was working off a lower base number, so it’s a higher percentage decline. In total, this means that AMD has gone from a 1.8-point premium to the average of the other two to a 0.6-point discount since my previous article.

Final thoughts and recommendation:

It’s been a rough few weeks for shareholders of AMD, as the chipmaker is close to setting a new 52-week low. While analyst estimates have come down a little recently, their price targets have not, increasing the gap here to a considerable amount. The recent pullback in valuation has sent AMD from a premium against the average of its two biggest competitors to a discount, so any further declines may start to bring this stock into value territory.

For the moment, I am going to keep my buy rating on AMD shares, but this is more of a long-term stance than a short-term one. This company is still expected to see a decent amount of growth in the upcoming years, even if it doesn’t gain a lot of market share. The valuation here is getting quite reasonable for this expected growth profile. However, there is a lack of short-term upside catalysts on the horizon, so we may see some more weakness into early 2025. I wouldn’t rush to purchase if I were searching for a short-term home run, but if the company hits its mark, we could see a decent upside here over the next couple of years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.