Summary:

- Advanced Micro Devices, Inc.’s stock price has advanced significantly, leading to heightened risks and limited potential for further gains in the near term.

- Competition pressure from Nvidia in the data center segment (with potential for customer lock-in) poses a significant challenge for AMD.

- AMD’s high inventory levels and valuation risks are additional concerns that could impact its margins and profitability in the coming quarters.

IvelinRadkov

Mixed outlook

Readers following our writing on Advanced Micro Devices, Inc. (NASDAQ:AMD) know that we have been long-term bulls on the stock. We have been arguing for a BUY thesis since early 2022 (when the price was in the ~$100 range). However, a bull thesis that works tends to eventually defeat itself. As prices advance, risks heighten, the potential for further gains shrinks, and the reward/risk profile changes.

And the thesis of this article is to explain why we think AMD has reached this point under current conditions. To be clear, we still feel positive about the stock’s long-term outlook (say the next 5~10 years) and we will elaborate on the positives later. But we feel in the near term (say the next ~1 year), the stock price advancement is far ahead of its fundamentals and the return potential is very bleak. Hence, we rate the stock as a HOLD for now.

In the remainder of this article, I will discuss 3 top concerns in my mind: the competition pressure especially from Nvidia (NVDA), the inventory issue, and the valuation risks.

Competition pressure and inventory issue

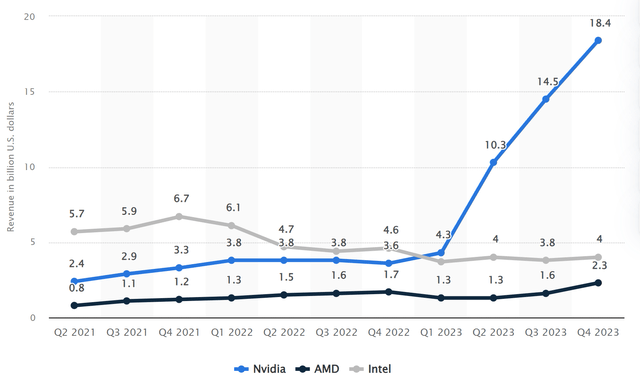

I think the most important segment and also the clearest area to see the competition pressure is on the data center front. The chart below shows the data center segment revenue of Nvidia, AMD, and Intel (INTC) from 2021 to 2023, by quarter. As seen, the good news is that AMD’s data center segment revenue has not only recovered from its recent dips but also reached a new record quarter in the past few quarters. To wit, its data center segment revenue reached $1.7B in Q4 2022 and started to lose market share – the time that NDVA’s market share began to skyrocket as seen. In Q4 2023, AMD’s market share has recovered to $2.3B, a record high.

However, I could not really feel happy about AMD for such a recovery. The bigger picture in my ideas is the almost insurmountable pressure from NVDA. NVDA’s market share ($18.4B now) is so far ahead of AMD. I am afraid that NVDA’s much larger market share could create a snowball advantage in the data center segment. Besides the obviously increased economies of scale, a much larger market share could also cause customer lock-in. Data centers often invest heavily in optimizing their infrastructure for specific chip architectures. For example, if a data center uses a lot of Nvidia GPUs, switching to AMD chips might require significant hardware and software adjustments. Hence, this creates a certain level of customer lock-in, making it harder for competitors to gain traction.

A much larger market share can also lead to network effects. As more data centers adopt a particular company’s chips, software developers are more likely to optimize their software for those chips. This further strengthens the dominant player’s position. Additionally, a larger company might attract stronger partnerships with cloud computing providers or other industry players, giving them an edge in securing new deals.

To compound my concern, I think NVDA’s chips are technologically better suited to exploit the advantages. For example, Graphic Processing Units (“GPUs”) are Nvidia’s core strength. And GPUs precisely excel at parallel processing, making them ideal for accelerating tasks like AI workloads, scientific simulations, and data analysis in data centers. The data center market is increasingly adopting AI, and Nvidia has a strong reputation for its AI-focused hardware and has made impressive progress in developing its software ecosystem too (as detailed in our recent NVDA article).

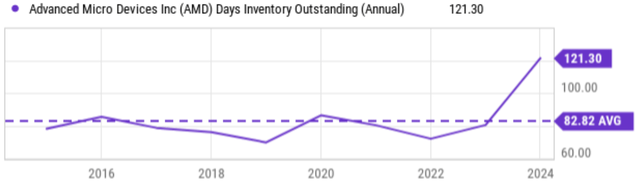

The second best area to feel the competition pressure is probably inventory. The chart below shows the days of inventory outstanding at AMD. As seen, AMD’s current inventory hovers around 121 days, the highest level in at least 5 years and far above its historical average of 82 days. Storing such a large inventory costs money (warehousing, security, and insurance) and I anticipate these costs to be reflected in its margins in the coming quarters. But the problems do not stop here. High inventory levels can tie up significant cash flow that could be used for other purposes, like investing in R&D and growth CAPEX. The chip industry is famous for its rapid movement and upgrades. If AMD holds onto inventory for too long, there’s a risk that the chips could become obsolete before they are sold. This could lead to write-downs and lost profits.

Valuation risks

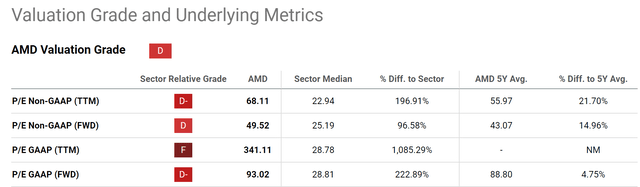

In the meantime, AMD’s valuation risks have become too high for us under current conditions. The chart below shows the P/E ratios of AMD on different accounting basis. As seen, these multiples are simply too high no matter which basis we use both compared to the overall market or the sector average.

to better contextualize things with a broader horizon, the chart below shows the P/sales ratios of AMD om the past decade. I use the P/S ratio here instead of P/E because AMD has not had substantial profit until the recent few years. As seen, AMD’s current P/Sales ratio is 12.92x. In contrast, the average historical P/Sales ratio is only 4.9x. To provide another benchmark, the highest P/S ratio for the S&P 500 index since 2006 was 3.04x (observed in Dec 2021).

Insider activities, upside risks, and final thoughts

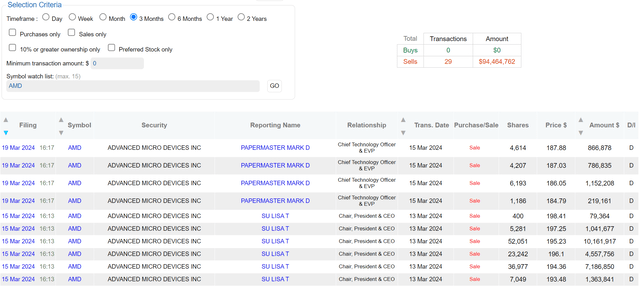

There are a few other risks, both in the upward and downward direction, worth mentioning before I close. On the negative side, insider activities were dominated by selling in the recent method. As seen in the chart below, there have been a total of 29 insider transactions filed on AMD stock in the past 3 months and there have been zero purchases by insiders in the last 3 months. Most recent transactions include those from Lisa Su (the Chair, President & CEO). She sold several batches in March 2024 around a price level close to $200. Most recently, Mark Papermaster (the Chief Technology Officer and EVP) sold several batches around an average price of $185.

It is important to note that in general, insider selling does not necessarily mean that the insiders are bearish on the stock. There could be a variety of reasons why an insider might sell stock, such as diversification, exercising stock options, or needing cash for personal reasons. However, when the activities are completely one-sided like in this case, I interpret it as a reflection of the issues ahead and the mounting valuation risks.

As aforementioned, my concerns are mostly geared towards the near term. In the longer term, I still feel positive about AMD’s growth prospects. To start, I have an overall bullish view of the secular growth of chips as we evolve into a digital era. Specific to AMD, I see a few differentiation factors in its business model compared to other chip companies.

The top one on my mind is AMD’s offering of both the x86 architecture and also new architectures. At the same time, for other applications (such as data centers), AMD utilizes a different architecture called CDNA (code name for Computer DNA). And its MI300x chip is a huge success on this front. The MI300X is now tracking to be the fastest revenue ramp of any product in AMD’s history, thanks to its technological advancements (and also enterprise and supercomputing customer demand). AMD’s CDNA offers features like Matrix Cores specifically designed for accelerating machine learning tasks. And it is optimized for demanding computing applications like AI workloads, scientific computing, and high-performance data analytics. Such a strategy allows AMD to diversify its revenues and be well-positioned for growth in several areas (PCs, servers, data centers, etc.).

To conclude, despite the long-term growth prospects (due to factors like high-performance computing expansion and AI adoption), the thesis of this article is that AMD will offer an unattractive return/risk ratio in the near term. And to reiterate, the top concerns in my mind include the competition pressure, the inventory issue, and the valuation risks. As such, we rate the stock as a HOLD and suggest potential stay on the sideline for now (unless you have a long investing timeframe to wait for the fundamentals to catch up).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.