Summary:

- Advanced Micro Devices, Inc. has experienced a bearish reversal in momentum, with intense March-April selling pressure replacing the upside buying of 2023.

- The current pattern in AMD stock trading is similar to previous instances during 2022 and 2006, both of which resulted in major price declines.

- AMD remains overvalued on almost every business valuation scale, making it a risky investment with substantial downside potential.

PM Images/DigitalVision via Getty Images

I thought I would write a quick note on the uniquely bearish reversal in momentum from upside buying to intense selling in Advanced Micro Devices, Inc. (NASDAQ:AMD) over the last several weeks. Unquestionably, it’s the biggest negative change in direction since the December 2021 to January 2022 period, which proved an opportune time to sell shares.

Will this time around provide a similarly successful sell signal? I cannot say for sure, with 100% confidence. But, the odds of a material price decline over the rest of 2024 are likely much higher than you think. It could be the artificial intelligence [AI] buzz about its new chip offerings and almost-guaranteed huge jump in profitability after this year (sentiment espoused by bullish investors), will prove an overly hot forecast skating on thin ice (given a recessionary macroeconomic future).

Let’s take a look at the momentum reversal similarities between today and early 2022. In addition, I will throw in another close-cousin pattern experienced in 2006, which was followed by a bruising price decline over the next 13 months.

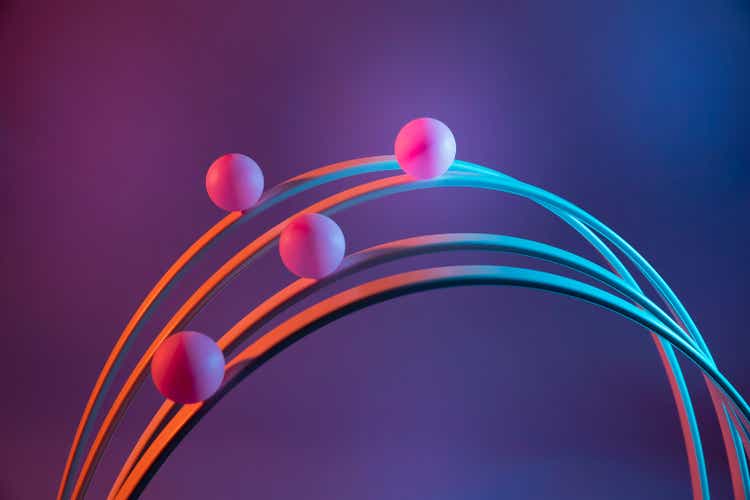

Today’s Reversal

To clear the air, I did not expect a major AMD price gain above $100. Last August here around $110 for price, I put out a bearish outlook for the stock, expecting a recession to arrive before any jump in AI chip sales. Well, it appears that AI optimism beat a recession to the punch. As a result, the price doubled to an intraday high around $227 in early March.

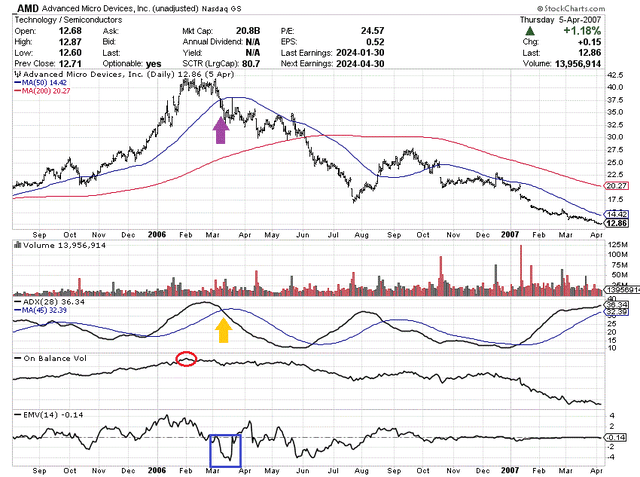

However, the stock has endured mountains of selling after reaching $227, with a quote under $170 just five weeks later. Unfortunately for shareholders, price support was not found at the important 50-day moving average (marked with a purple arrow below).

The bad news is previously strong On Balance, Volume readings peaked in January (circled in red) and did not confirm the price highs of March. In terms of a change in momentum, the robustly rising 28-day Average Directional Index rolled under its 45-day moving average (gold arrow). Statistically speaking, having both the ADX calculation exhibit a reversal in the same direction as price (using the presented moving averages for each) is quite rare. It’s like getting hit in the head during a boxing match when you are trying to take a deep breath. One compounds the other as you try to keep your wits and balance.

But that’s not all the bad trading news. Perhaps the worst part of the AMD chart pattern today is that heavy selling volumes have created a thud in the 14-day Ease of Movement calculation. It’s the worst EMV score since January 2022.

This abnormal combination of momentum “blows” simultaneously may mean the tide of AI enthusiasm in Advanced Micro Devices has turned. What evidence do I have?

StockCharts.com – AMD, Daily Price & Volume Changes, Aug 2022 to Apr 2024, Author Reference Points

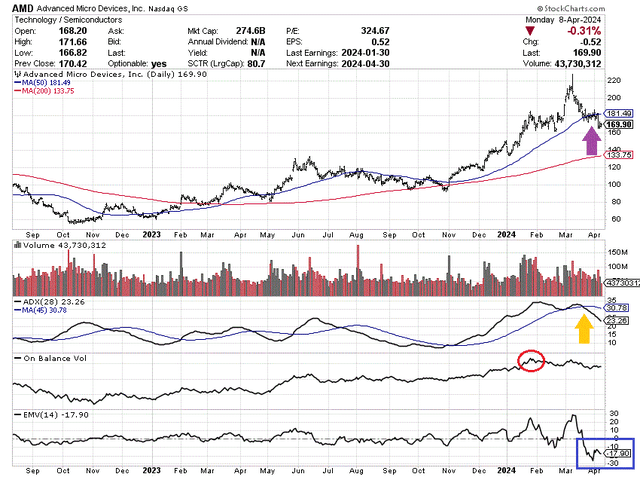

2021-22 Pattern

Honestly, if you comb through decades of AMD charts, similar reversals from strong buying to selling trends have only happened two other times since 2004. Both previous instances pinpointed major price tops. I am sorry upfront if this does not fit your investment outlook or AI-boom hopes and dreams.

Following the giant 2020-21 share gain, a nearly identical momentum switch to mass liquidation occurred right after the November 2021 price peak. Below, you can see OBV topped four months (circled in red) before the final share quote high. The 50-day moving average (purple arrow) and 28-day ADX trend average (gold arrow) were broken on the downside at roughly the same moment. Plus, an out-of-character 14-day EMV dump warned selling was overwhelming buying interest (blue box).

Then, from the middle of January to October 2022, AMD fell -50% further in price, -60% in total from the November 2021 peak.

StockCharts.com – AMD, Daily Price & Volume Changes, Feb 2021 to Oct 2022, Author Reference Points

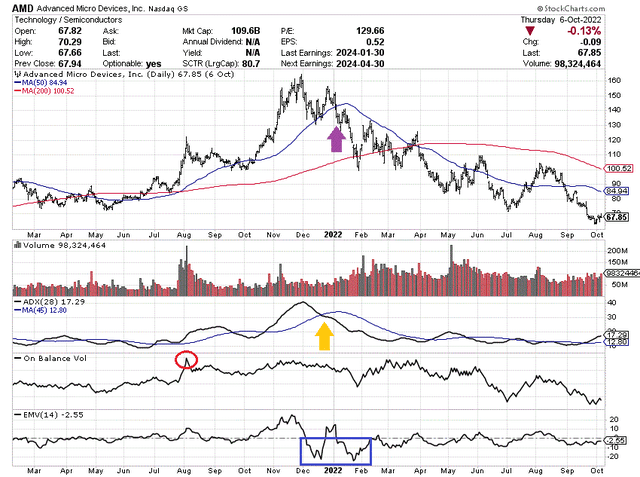

2005-07 Pattern

The only other similar investment setup over the latest two decades of trading in AMD was outlined during 2006. Repeating our pattern, a large and quick share gain was the story during the second half of 2005 into January 2006. Then, between late January and March, price crumbled in rapid fashion. The main difference between today’s momentum picture and 2006’s example is OBV (red circle) did not peak months before price.

Otherwise, the same price slide underneath its 50-day moving average (purple arrow) concurrently with an ADX momentum reversal (gold arrow) was present. Most importantly, the EMV indicator was crushed to multi-year lows. Again, this specific combination of technical momentum and price reversal change has not appeared at any other time, measured since 2004.

From late March 2006 to April 2007, AMD fell another -65% in price, and close to -80% from January’s peak.

StockCharts.com – AMD, Daily Price & Volume Changes, Aug 2005 to Apr 2007, Author Reference Points

Fundamental Overvaluation

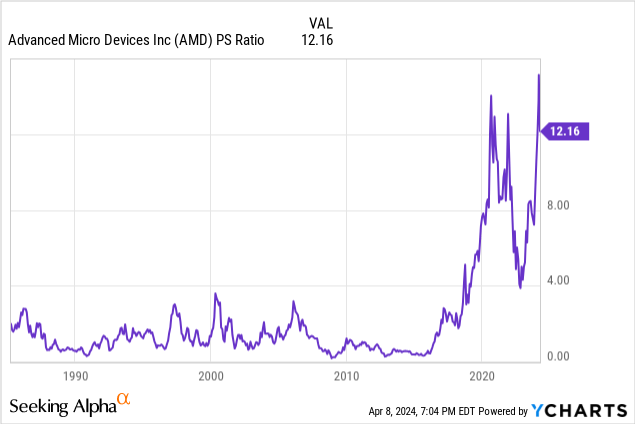

Remember, AMD remains expensive on almost every business valuation scale. Reviewing price to trailing sales, it’s basically sitting at or very close to a modern record high multiple of 12x.

YCharts – AMD, Price to Trailing Sales, Since 1987

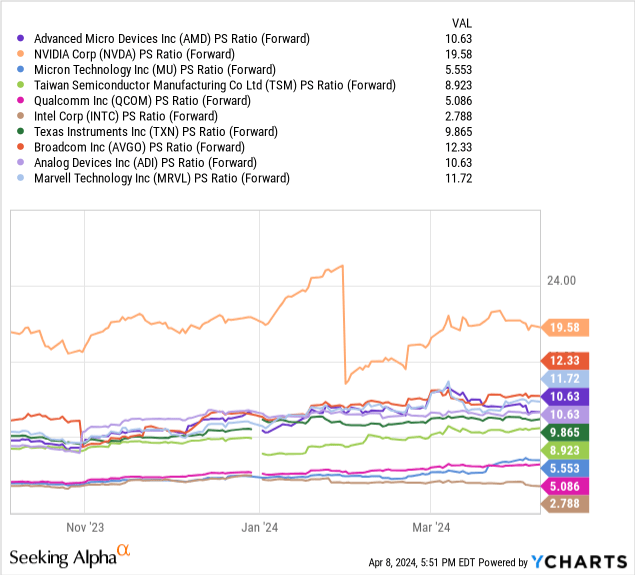

Accounting for some 2024 growth, the business still remains on the higher end of the major semiconductor spectrum for price to forward sales (10.6x). My peer sort group includes Nvidia (NVDA), Micron (MU), Taiwan Semiconductor (TSM), Qualcomm (QCOM), Intel (INTC), Texas Instruments (TXN), Broadcom (AVGO), Analog Devices (ADI), and Marvell Technology (MRVL).

YCharts – Largest U.S. Traded Semiconductor Equities, Price to Forward Estimated Sales, 6 Months

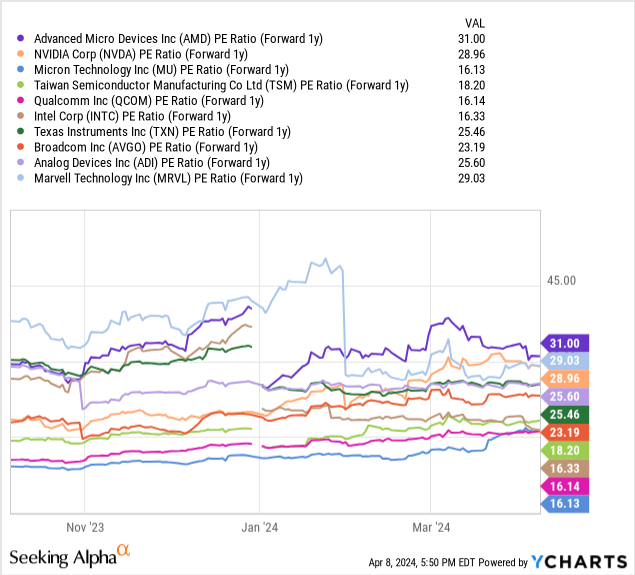

And, comparing price to forward 1-year earnings projections (31x ratio) from Wall Street analysts, AMD sits at the top of the biggest semiconductor list of names for extreme share pricing.

YCharts – Largest U.S. Traded Semiconductor Equities, Price to Forward 1-Year Estimated Earnings, 6 Months

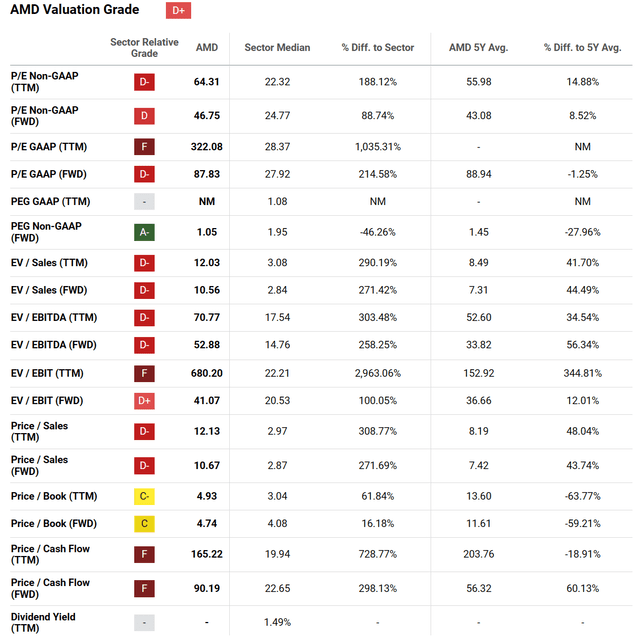

In terms of big data, big picture analysis, Seeking Alpha’s computer-sorting formulas put a weak “D+” score on AMD for a Quant Valuation Grade. Reviewing the stock’s past trading history and current valuations in the semiconductor sector, few names are this expensive.

Seeking Alpha Table – AMD, Quant Valuation Grade on April 8th, 2024

So, selling, avoiding, or even shorting AMD is supported by the monster technical momentum reversal, in addition to underlying fundamental valuation analysis.

Final Thoughts

No matter your view of our AI future, the price and volume momentum reversal in AMD fortunes is difficult to ignore. It appears the March-April 2024 selling pattern is a wicked change, of course. Ignoring the high odds of a major decline in price from here may be a risky proposition.

Is a substantial price decline the only possible outcome into the autumn? No, but with inflation picking up and the Fed ready to make the same policy mistake of ignoring rising inflation like late 2021 and early 2022, AMD is a stock overburdened with downside risk. Basically, for the bull case to reassert itself, stronger-than-projected earnings and sales growth are now required.

I have no desire whatsoever to own Advanced Micro Devices on the AI-boom optimism of present day. Eventually, long-term valuation averages will play out for this semiconductor favorite, with a “reversion to the mean” move lower in price. My thinking is either higher interest rates (dragging elevated growth-stock valuations lower) or a recession in the general economy (sinking AMD sales and earnings below expectations) will be the trigger for an oversized share selloff.

I rate AMD a Sell and Avoid for a 12-month outlook. In my research, a price decline back to $100 a share or lower is possible, especially if U.S. interest rates start climbing again in an unexpected and unpredictable manner. Another -40% to -50% price tank would bring its earnings and sales valuation in line with industry averages. It’s a bit of déjà vu, where a 2022 replay of rotten investment performance seems to be the path of least resistance going forward. The whole investment setup is far worse than existed back in August.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.