Summary:

- AMD stock is a Strong Sell, primarily due to high valuation, despite potential in AI accelerators and an 80% YoY Data Center segment growth in Q1.

- The premium is unfair because AI growth momentum is nullified by struggles in three other segments, with Data Center revenue representing less than half of AMD’s total sales.

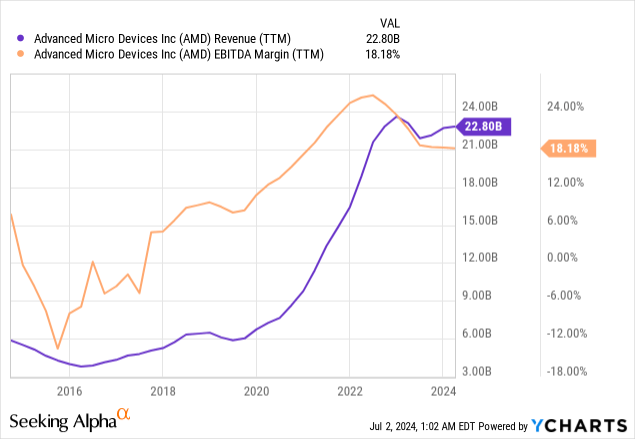

- As a result, the company does not demonstrate revenue growth even despite AI tailwinds, with consolidated revenue decreasing compared to two years ago.

- Intrinsic value calculations show that the market is pricing in unrealistically high perpetual growth rates for AMD.

JHVEPhoto

My thesis

I think that Advanced Micro Devices (NASDAQ:AMD) is a Strong Sell, primarily because of its unrealistically high valuation. The company has a solid potential in AI accelerators, despite being significantly behind Nvidia (NVDA) in this market. The industry is thriving, and AMD’s notable set of offerings for data centers increases its chances to ride this growth wave. However, it is only one of four AMD’s revenue streams, and the remaining ones have been struggling for the last two years. These struggles of other businesses did not only offset stellar growth in AI revenue, but also has led to record inventory levels. With these negatives offsetting AI tailwinds, I think that the stock does not deserve the premium that is currently priced in.

AMD stock analysis

AMD has a solid position in the thriving semiconductor industry with exposure to various end markets: data centers, personal computers (“Client” and “Gaming” segments), and industrial/commercial applications (“Embedded” segment). AMD’s core products are CPUs and GPUs.

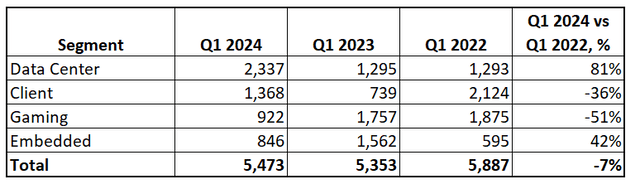

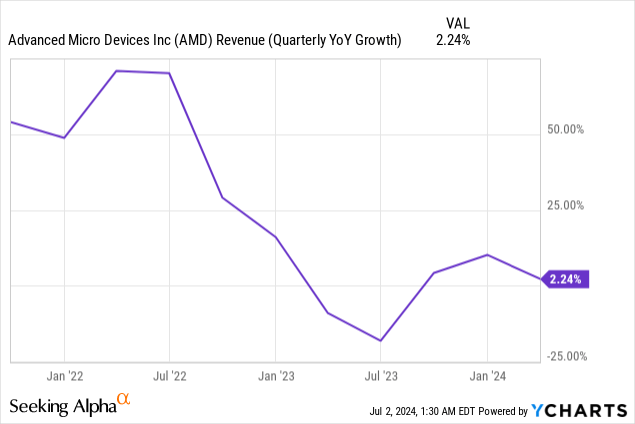

This diversification of revenue streams is good for investors because it helps the company to decrease concentration risks and smooth out cyclicality in separate end markets. But diversification mitigates risks in theory, and the reality might be different. It is actually AMD’s case, as the company’s revenue growth momentum started vanishing in 2022 and is still in single digits.

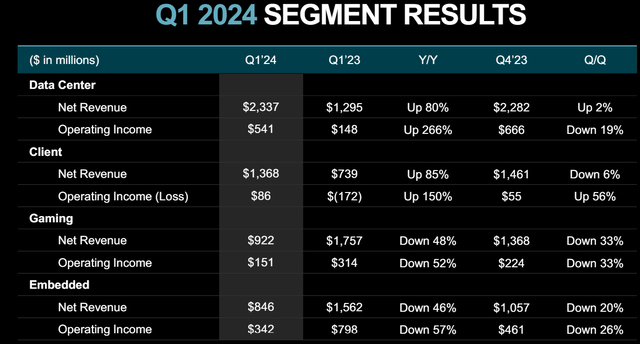

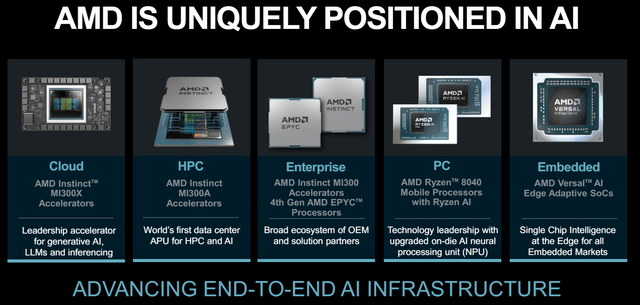

Some authors consider AMD as one of the “best positioned AI players”. AMD’s GPUs and CPUs are deployed for high-performance computing (HPC) and data centers. The company’s Data Center revenue soared by 80% YoY in Q1, which is undisputedly impressive. AMD’s footprint in AI is notable, with a solid portfolio of products. Its MI300 series AI accelerator is the flagship product for HPC and AI. AMD’s strength in HPC is underscored by its wide presence in the Top500 supercomputers list.

AMD’s MI300 series AI accelerator is a direct competitor to Nvidia’s H100 family of accelerators. According to the comparative analysis conducted by authors of cudocompute.com, AMD’s flagship accelerator is very competitive from the technological perspective. Strong evidence of MI300 accelerator is the fact that it powers Microsoft (MSFT) Azure OpenAI servers workload.

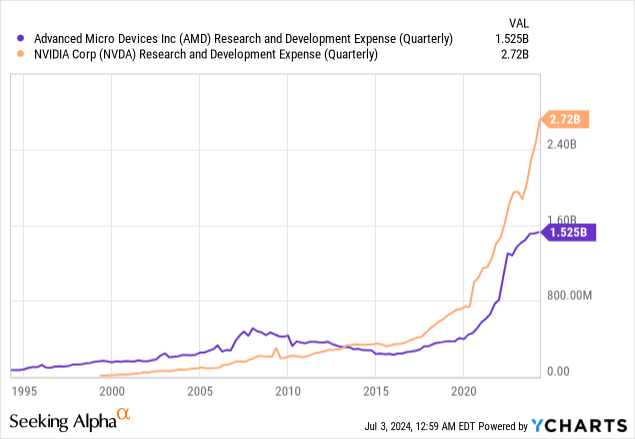

AMD’s exposure to thriving data center and AI industries is not only powered by its MI300 accelerator series. The company’s EPYC processors also boast wide adoption among all most prominent cloud players like Amazon (AMZN), Microsoft, Google (GOOGL), IBM Cloud (IBM), and Oracle (ORCL). AMD constantly releases upgrades to its key products, which will likely help in keeping its competitive edge. Upgrades which will be positively adopted by the industry are only possible after companies invest massive amounts in engineers to spend hundreds of hours on developing new features. AMD’s R&D spending has been growing exponentially in recent years, and soaring revenue from AI accelerators will likely help in increasing R&D investments.

To summarize, AMD is indeed firmly positioned to benefit from the rapid global adoption of AI capabilities. However, AMD’s footprint in AI is incomparable to Nvidia’s. The AI accelerators market is dominated by NVDA, and this company invests in R&D about two times more compared to AMD. According to Vijay Rakesh from Mizuho Securities, NVDA had 94% unit market share in AI server sales in 2023. He expects that Nvidia’s market share will drop to 75% by 2026 due to intensifying competition. AMD will definitely have its chance to expand its market share in AI accelerators, but this expansion potential is likely to be limited as Nvidia is very unlikely to just watch how competitors will erode its market share. According to SkyQuest, the AI chipsets market will grow with a 37% CAGR by 2031. AMD’s chances to boost consolidated earnings through its Data Center business are high. On the other hand, AMD will likely be always behind NVDA in this business because NVDA is almost a monopolist in this niche.

Other businesses of AMD do not feel that good. Its Client segment also showed strong revenue growth in Q1 2024, by 85%. This relative growth against the comparative quarter is misleading because if compared to Q1 2022, the segment’s revenue is much lower. Gaming segment’s revenue dynamic since 2022 looks even worse. Embedded has been quite volatile, but the trend is at least positive.

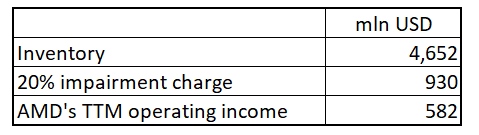

As a result of revenue weakness and volatility in three out of four segments, AMD faced the problem of rapidly growing inventory levels. These segments started struggling due to high inflation and rising interest rates, these developments started unfolding since early 2022. It looks like the management underestimated headwinds for most of its segments because despite revenue growth starting to decelerate two years ago, AMD’s inventory continues to grow. Inventory totaled $4.7 billion as of the end of Q1 2024, which is a big increase compared to early 2022 levels. Having those high inventory levels for the last couple of years increases the probability of recognizing impairment charges to the company’s P&L. This will be a non-cash transaction, but the impact on the company’s EPS will be real. Recognizing even a 20% impairment charge to the current inventory balance will make AMD’s operating income negative.

DT Invest

To wrap up, AMD has strong potential in cementing its position as the number two player in the thriving AI accelerators industry. However, Data Center is only one segment out of four, representing less than a half of the company’s total revenue. Three other segments are cyclical and can drag down AMD’s consolidated performance, especially elevated risks of recognizing inventory impairment charges.

Intrinsic value calculations

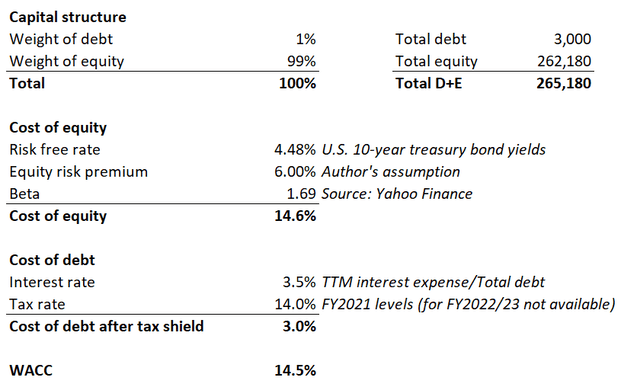

The discount rate for my discounted cash flow (DCF) model will be derived using the CAPM model. The below working demonstrates why AMD’s weighted average cost of capital (WACC) is 14.5%.

I think that using consensus estimates as my revenue assumptions is a prudent choice. AMD’s TTM levered FCF margin is 10.46%, expecting this position to improve with revenue growth is reasonable. Moreover, AMD has a solid record of the EBITDA margin expanding in line with revenue growth. Therefore, expanding the FCF margin by 150 basis points per year looks realistic enough to use this assumption for the DCF.

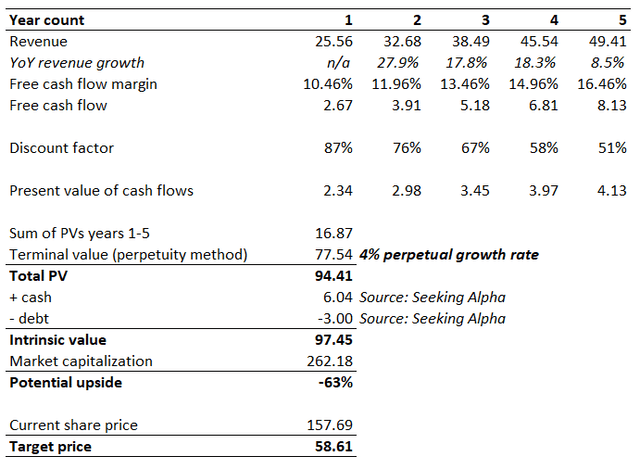

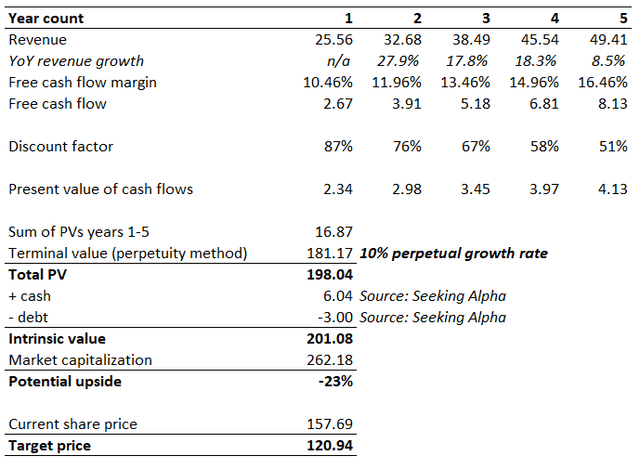

Perpetual growth rate is a crucial assumption, and it significantly affects the intrinsic value. Implementing a 2-3% perpetual growth rate for a semiconductor company looks too low, especially for a company with strong past revenue growth. Therefore, for the first scenario, I will implement a 4% perpetual growth rate.

My first scenario with a 4% perpetual growth rate shows that AMD’s intrinsic value is significantly lower than the current market cap. The overvaluation is so wide that the spreadsheet suggests that there is a 63% downside potential. Moreover, the difference between the intrinsic value and market cap is so big that even upgrading the perpetual growth rate to an unrealistic 10% does not make AMD undervalued.

AMD’s valuation is not attractive. It appears that the market prices have an above 10% perpetual growth rate, which is unrealistically high. AMD’s business is solid, but it is not that solid to price in fantastic growth rates.

What can go wrong with my thesis?

My analysis of AMD’s stock suggests that the business has its flaws, but overall, AMD is a strong player in the thriving semiconductor industry. It has exposure to the booming generative AI market as well. Stocks like AMD can trade with substantial premiums for longer, if the broad stock market’s sentiment is bullish. The market is bullish because the S&P 500 Index (SP500) trades at an all-time high with a 15% rally during the first half of 2024. Bullish environment is favorable for quality growth stocks, and AMD is one of them.

I think that this kind of FOMO factor is the only significant one that can make my pessimistic thesis look wrong in the short term. However, in longer timeframes, intrinsic value and market capitalization are likely to converge at some point in future.

Summary

AMD has solid potential to generate strong revenue growth in Data Center segment due to the increasing demand for AI accelerators. However, it is the only thriving segment out of total four. Other segments are struggling, and their financial performance is less predictable and quite volatile. Almost $5 billion in inventory is a real problem which can lead to massive impairment charges. These negatives offset a significant portion of AMD’s potential in AI, but the stock certainly does not deserve the premium that is has now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.