Summary:

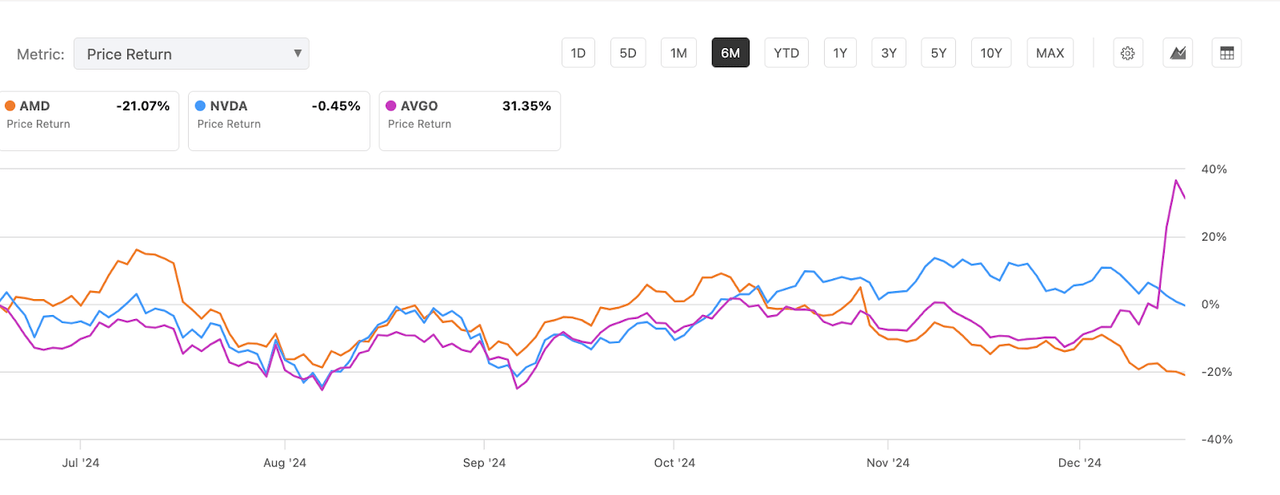

- Advanced Micro Devices, Inc.’s stock has declined over 20% in six months, while other chip stocks have kept on rallying.

- The market may be making a huge mistake by discounting AMD from the AI race.

- AMD’s new chiplet patent could revolutionize AI GPU technology by providing a more cost-effective alternative to Nvidia’s GPUs.

- Despite risks and high expectations, AMD’s proven track record, promising technology, and fair valuation present a compelling investment opportunity.

Mouse-ear

Thesis Summary

Advanced Micro Devices, Inc. (NASDAQ:AMD) has seen its stock price decline over 20% in the past six months. Meanwhile, Broadcom (AVGO) jumped 20% after earnings and is up 100% in the last year.

What’s going on exactly?

While there are some differences between these companies, both are in competition to try to take market share from Nvidia (NVDA) in the AI market.

AMD has, so far, failed to capture much of this market, and investors have been disappointed, while AVGO has shown some promising developments, especially in the last earnings call.

But I believe AMD’s technology and earning potential is being severely underestimated by the market right now.

The company just filed a patent which could revolutionize AI GPU technology, and the stock seems ridiculously undervalued.

Last time, I gave AMD a Buy rating based on its valuation and growth outlook. I’m doubling down now, as the valuation is even more attractive and the outlook, based on these recent developments, is even more promising.

I am upgrading AMD stock to a Strong Buy.

AVGO’s Breakthrough

In the fast-moving world of AI, not every company is rewarded equally and things move quickly. Over the last month, we’ve seen some top chip stocks take very diverse paths.

AMD, AVGO, NVDA performance (SA)

NVDA had a monster rally already, so one might expect some consolidation. But AMD is down over 20% in the past six months, while AVGO has exploded in the last week.

Interestingly, while AMD and NVDA seem quite correlated, they have not rallied at all since AVGO’s earnings, in fact, they have fallen.

Earlier this year, Broadcom bought VMWare, though the market did not react too strongly to this. The market did react strongly to earnings, as AVGO showed a promising outlook for their semiconductors.

In 2027, we believe each of them plans to deploy 1 million XPU clusters across a single fabric. We expect this to represent an AI revenue Serviceable Addressable Market, or SAM, for XPUs and network in the range of $60 billion to $90 billion in fiscal 2027 alone

Source: Earnings Call.

The key thing to understand here is that AVGO is developing more specialized chips, ASICs, together with a lot of Nvidia’s customers. There’s some early evidence that AVGO is already taking market share from Nvidia and I went into depth in this article on why the company’s ASICs could dethrone Nvidia’s GPUs.

Investors May Be Underestimating AMD’s Tech

Broadcom is not trying to beat NVIDIA at its own game, but offering a differentiated alternative, which in some ways at least could prove superior.

Why isn’t AMD doing this too? It turns out they are.

Less than a month ago, the company filed a patent application titled Distributed Geometry

The patent details a fully chiplet approach to GPUs, where the rendering workload is distributed across a collection of chips, rather than having one massive die handling all of the processing

Source: PCGamer.com

Let’s break this down.

GPUs have a central workload processor, which distributes the workload to different parts of the chip. AMD’s new approach would involve doing away with the central processor and replacing this large chunk of silicone with a number of smaller and, to a large extent, “independent” chiplets.

But why would AMD want to do this?

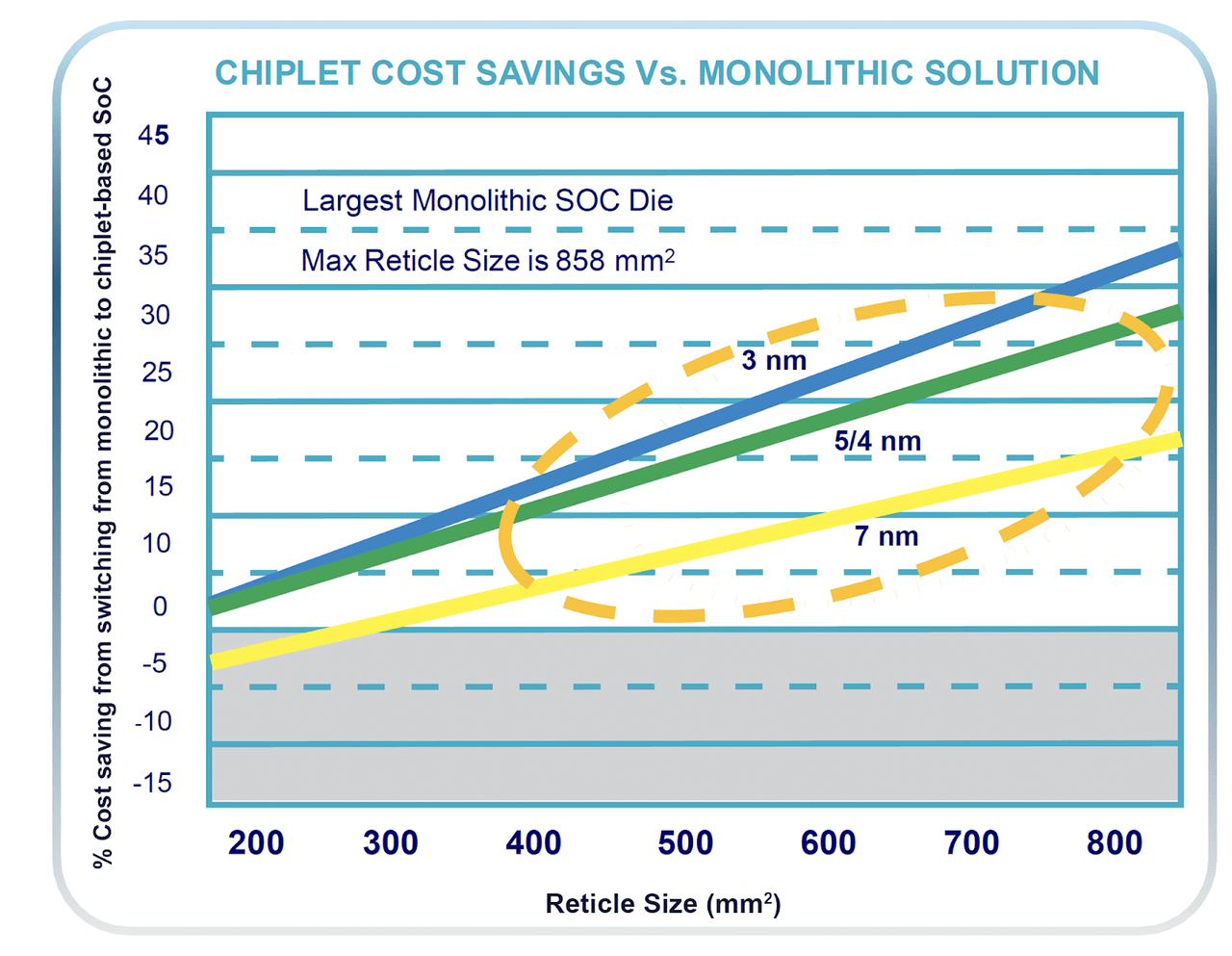

As always, the answer boils down to economics. Large GPUs are less cost-effective to make than smaller units.

And there are also some other advantages to chiplet designs.

Like with ASICs, modular chiplets can be more specialized, reduce total cost and improve data communication, which can be a bottleneck for AI applications.

Chiplet cost savings (Awavesemi)

Larger chips not only cost more, but are more easily defective, one point of failure and reduce yields.

As AI scales, the GPU model’s limitations in cost and power efficiency are becoming increasingly apparent. GPUs will continue to play a pivotal role in AI training, but a shift towards chiplets-based SoCs and AI-dedicated ASICs is already emerging.

Source: Alphawavesemi.

AMD actually showed how chiplets produced much better results in CPUs, and it’s a big reason why the company managed to eventually beat out Intel (INTC).

Will this apply to GPUs too? It’s still early days, but there’s reason to believe so.

However, there are also plenty of challenges. Using interconnected chiplets would require very timely communication and much higher internal memory requirements.

AMD: Cheapest Chip

While it may be early days, AMD could be on the verge of a revolutionary AI breakthrough. At the very least, AMD will begin to offer some viable alternatives to Nvidia’s chips, in the still fast-growing AI market.

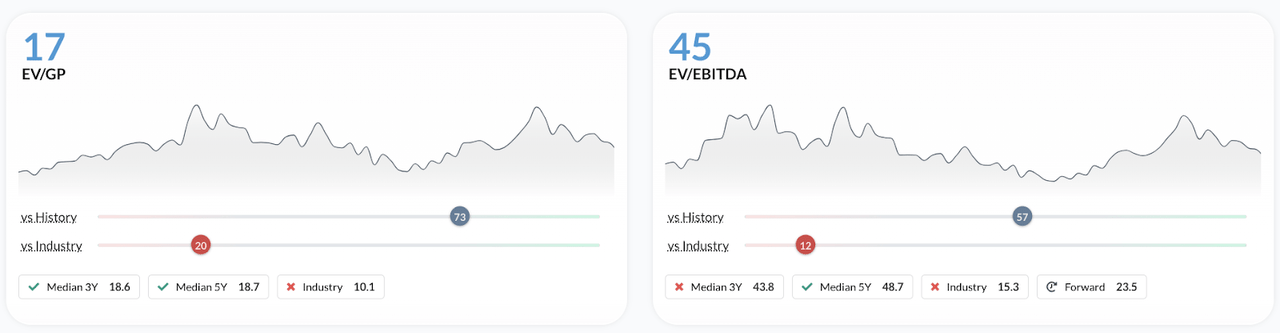

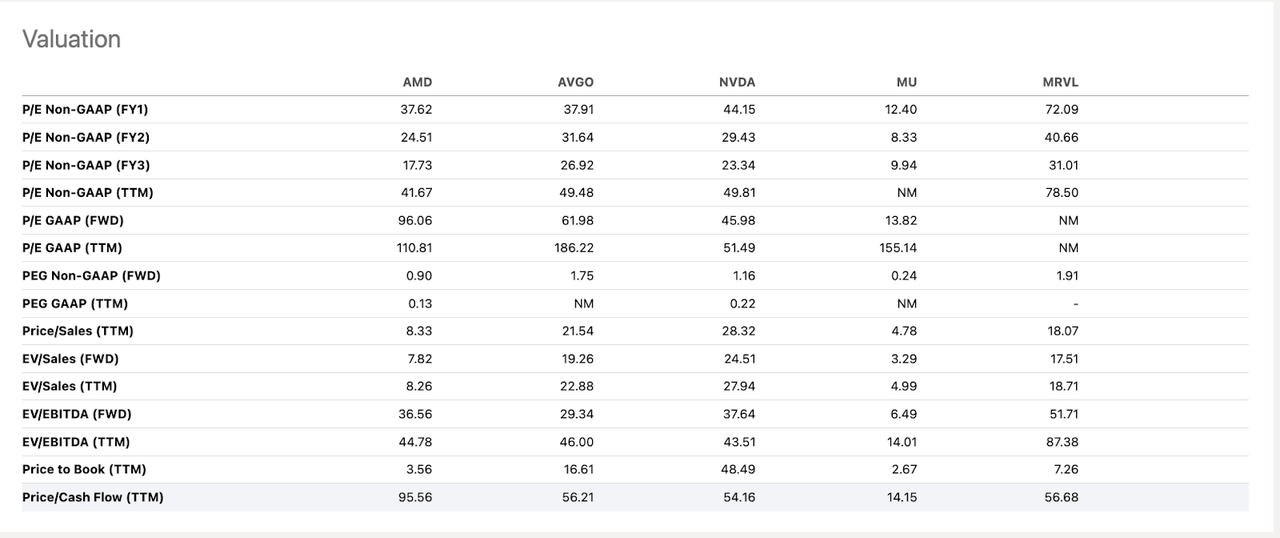

And yet, AMD is priced well below its peers and even below its historical averages.

AMD is cheaper historically if we look at measures like EV/EBITDA and EV/Gross Profit.

Compared to its peers, AMD is also undervalued, especially if we look at PEG and fwd PEG. It is true that AMD carries lower margins than a lot of these stocks above, but this still isn’t enough to explain the disparity.

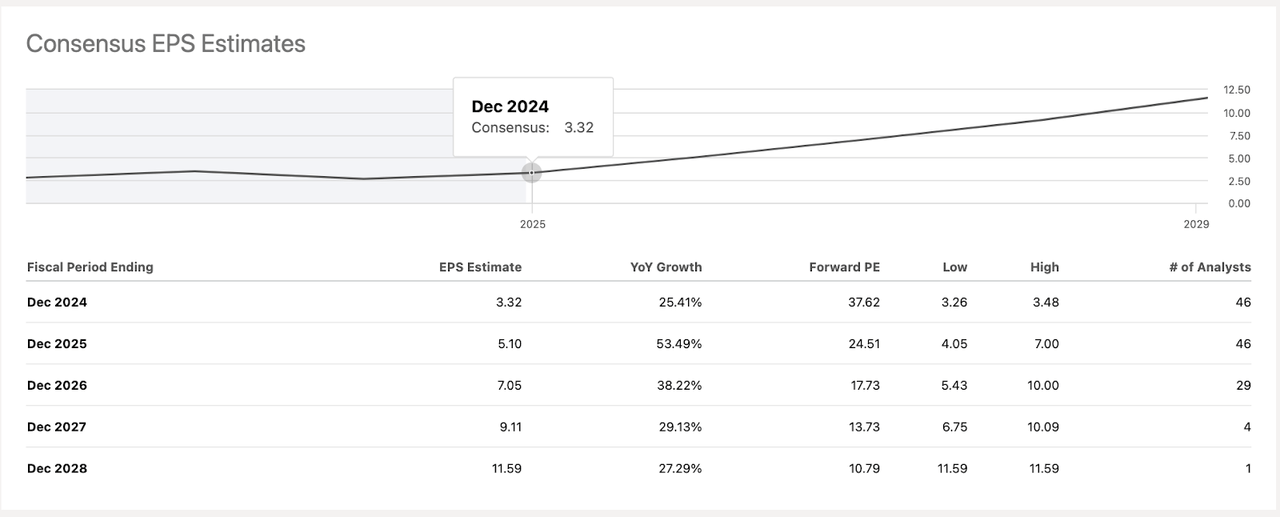

I could understand if AMD was not projected to grow much in the upcoming years, but earnings are projected to double.

And it’s not like AMD is a speculative stock. 2026 estimates are based on a consensus of 29 analysts.

Technical Analysis

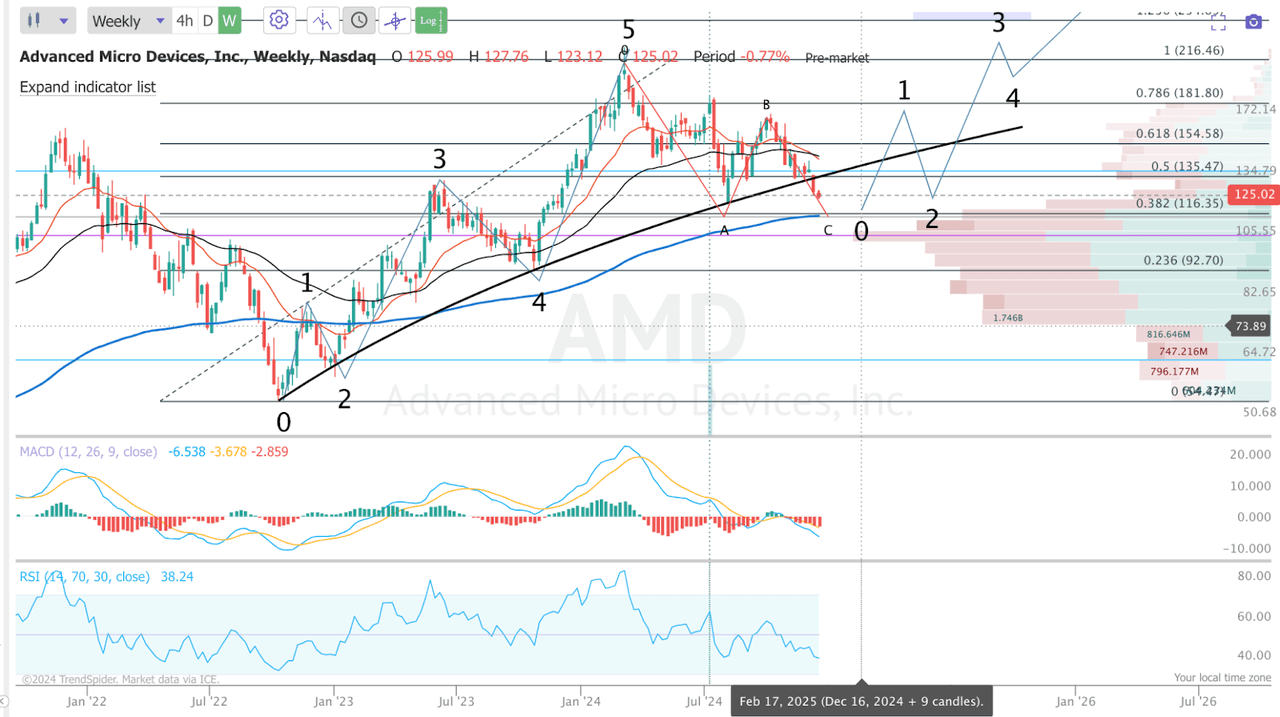

And though this may seem surprising, I also think the technical outlook is great for AMD.

True. Momentum is clearly to the downside, and yes, we have broken below a long-term trend line that I was hoping would hold.

But, we are now approaching a huge area of support where we have a lot of previous volume, the 61.8% retracement and the 200-week EMA.

Set-ups like this don’t come around that often.

Risks

The AI market is disruptive by nature. Nvidia will no doubt continue to dominate, and other companies like AVGO will also keep applying pressure, which will no doubt be a headwind for AMD.

It’s also important to note, that though AMD’s chiplet patent came out recently, it doesn’t seem like there are immediate plans to implement this technology. For now, the company is focusing on its mainstream portfolio.

And, on another note, the high expectations from analysts could actually work against the company in the future. AMD really has to deliver over the next 12 months.

Final Thoughts

I agree that Advanced Micro Devices, Inc. has missed the early AI gravy boat, but that doesn’t justify today’s valuation and negative sentiment.

Fundamentally, this is a company which has proven it can compete with anyone, has very competent leadership, strong products, promising technology and a very fair valuation.

AMD may not dethrone Nvidia, but the risk-reward here seems very much skewed to the upside.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Macro moves markets, and this is what I do at The Pragmatic Investor

Join today and enjoy:

– Weekly Macro Newsletter

– Access to our Portfolio

– Deep dive reports on stocks.

– Regular news updates

Start your free trial right now!