Summary:

- Advanced Micro Devices has a high likelihood of holding recent price lows, with improving fundamentals potentially driving much higher stock prices into 2025.

- The symmetrical triangle pattern on the daily chart suggests a breakout could lead to new highs, with significant upside potential and limited downside risk.

- AMD’s growth is driven by the Data Center segment, with new product development and partnerships, despite weaknesses in the Gaming and Embedded segments.

- AMD’s strong balance sheet and relatively low forward P/E ratio create a favorable risk/reward setup, supporting a Strong Buy rating if the stock holds above $130.

JHVEPhoto

The semiconductors that largely led the enormous rally we saw in 2023/2024 have cooled significantly since the summer months. Except for titan Nvidia (NVDA), the semis as a group are mostly well off their prior highs, as is the case with Advanced Micro Devices, Inc. (NASDAQ:AMD).

It is my belief that AMD has a high likelihood of holding recent price lows made and that the fundamental picture is sufficiently improving next year to drive potentially much higher prices for the stock. As a result, I’m initiating AMD with a Strong Buy rating. Let’s dig in.

Consolidation Complete?

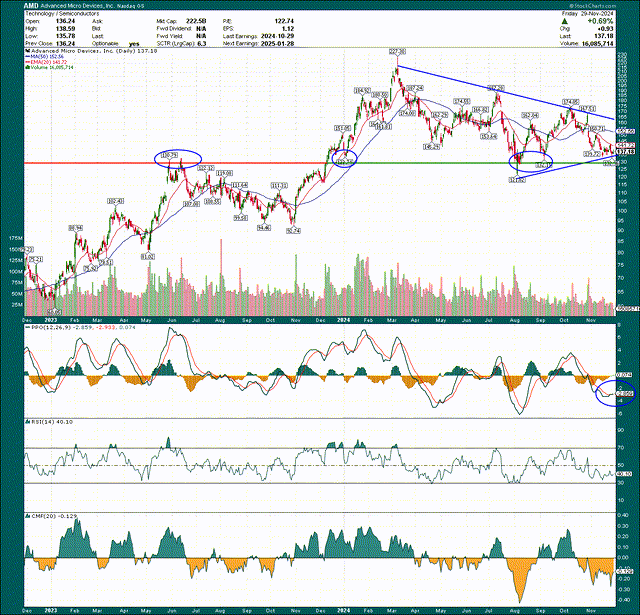

That’s the really big question right now on the daily price chart, as we can see AMD’s enormous rally from $92 to $227 gave way to a series of lower highs in 2024. However, we’ve also got a series of higher lows, forming the symmetrical triangle I’ve drawn below in blue.

If this pattern completes to the upside – marked by a breakout of the downward trending blue line – it could mean new highs for AMD. With the prior high at $227, that leaves considerable potential. The absolute line in the sand is the horizontal line at ~$130, which was the high in the summer of last year, and tested subsequently in December 2023, August 2024, and September 2024. If that level fails, AMD is likely in the midst of a much larger downtrend. However, the risk/reward is excellent here as we’re looking at ~3% of downside risk, and many multiples of that on the upside if I’m right.

The PPO has just made a bullish crossover, albeit in negative territory. The RSI has held 40, which is an improvement over the prior low. The Chaikin Money Flow index has turned sharply higher, although it, like the PPO, is still in negative territory. While the momentum indicators aren’t screaming for us to buy this stock, they are showing marked improvement nonetheless, and given how the price chart itself looks, it appears to be plenty good enough for me.

I think the chart looks great, but let’s dig into the fundamentals to see if there’s fuel for a big rally into 2025.

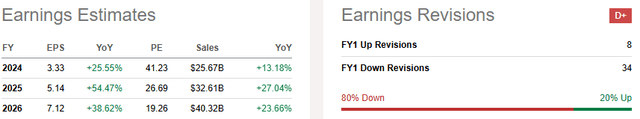

Ugly Revisions = Lower Stock Price

It’s really that simple, and we can see below that AMD has seen a hugely negative revision cycle of late.

EPS estimates are down to just $3.33 for this year but should be off to the races in 2025/2026. Sales are expected to fly higher by mid-20s percentage gains for those two years, which will boost earnings by virtue of revenue being higher, but also by leveraging down costs like R&D and SG&A. The resulting operating leverage should do nicely for EPS estimates, which is why they are slated to grow so much more quickly than revenue. The bull case really is predicated upon this operating leverage being achieved, so as we get into next year, sales growth is crucial to monitor.

As an example, the company’s third quarter saw sales rise 17.5% year-over-year. Operating earnings doubled that rate of change, which is operating leverage in practice. That’s why sales growth is so critical, and that’s what investors need to monitor going forward.

AMD continues to grow gross margins as well, so it’s not all leveraging down of expenses, but it is certainly helping.

Growth is set to come from the Data Center segment, which is both the largest and fastest-growing segment in the company’s portfolio. Revenue in that segment is currently doubling YoY, as are operating margins. New product development – like the Instinct MI325X accelerator – is driving new partnerships, particularly with AI computing. The runway in this market is long, although there are certainly plenty of competitors. AMD continues to see revenue explode higher in this segment, which is wiping out weakness elsewhere.

Speaking of weakness, Gaming and Embedded revenue (and margins) are terrible, but both are small enough that AMD can overcome that weakness with its Data Center and Client segments. The worry is that Gaming and Embedded see enough weakness that consolidated growth and margins weaken, but it seems okay for now.

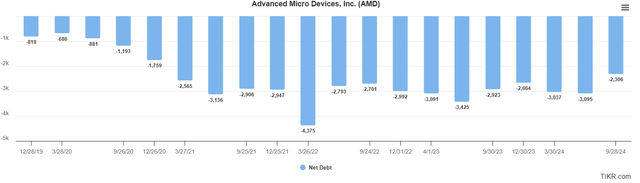

AMD has produced strong earnings and cash flow for years, so its balance sheet is in pristine shape.

Net debt stands at -$2.3 billion, so AMD is free to make acquisitions and invest in R&D as it pleases. This supports the long-term bull case.

Wrapping Up

It is my opinion that AMD looks set for massive upside relative to its downside risk at the moment. Finding asymmetrical risk opportunities in the market is how one puts the odds in their favor, and AMD looks like such a setup today.

There are risks to the bull case, of course, with the primary one being that AMD loses relative market share and doesn’t see revenue rise as quickly as expected. Given that my bull case is predicated upon rapidly rising revenue that drives higher operating margins, this is the biggest risk. I’d also argue the counterpoint that there is upside risk in estimates as well, given the negative cycle AMD has seen of late with analyst revisions. We’ll see in time, but if AMD’s revenue and margins come in lower than expected, the stock will not see new highs.

China is also a risk to AMD, as the ongoing spat between the US and China threatens to take an ever-growing role. AMD’s exposure to China is somewhat limited compared to others in the semi space, but it’s a risk nonetheless.

The thing is that I believe the stock is currently priced for these risks, as we can see below. It doesn’t mitigate the potential for those risks putting the bull case in some jeopardy, but it creates a more favorable risk/reward if the stock can be had at a cheaper valuation.

AMD’s forward P/E is currently as low as it’s been in the past 12 months, and off its three-year average. One could argue that lower estimates should beget a lower multiple, but again, if we’re looking to mitigate risk and put the odds in our favor, wouldn’t you rather buy at 30X forward earnings than 40X or 45X?

So long as AMD holds the line above $130 or so, I think we’ll see it much higher into 2025. Unless the risks I mentioned are quite strong, the odds favor the bulls, and I have AMD at a Strong Buy for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.